Selecting the Right IT Managed Service Provider the FinServ Way

Are you happy with your IT MSP? Many funds are not. Selecting the right IT MSP is not something you should keep putting off. Learn how FinServ helps its clients find the right IT provider for their unique needs.

Managing your IT infrastructure touches every team member and can create significant issues if not handled effectively. From extensive downtime to user frustration having an IT team that does not act as a business partner can hurt your whole fund.

FinServ completed an IT MSP Vendor Selection for one of our Private Equity Fund clients experiencing these exact issues. When the head of the fund could not access his systems during the pandemic, and their service provider had let the problem sit for over 24 hours, the fund decided a change had to be made.

The client was already aware of FinServ’s Vendor Selection methodology, as a few months earlier, we helped them select a new Third-Party Fund Administrator.

FinServ’s Vendor Selection methodology ensures that our clients select the right service provider for their unique requirements. Our comprehensive approach includes three stages of selection.

Phase 1 – Initiate

FinServ works with our client to inventory/collect all essential documentation and support for the new vendor culminating in a detailed set of user requirements. FinServ leverages our functions of an IT MSP to reconcile all possible functions to ensure all possible services are covered. Getting from a long list of vendors to a shortlist based on a detailed Request for Information (“RFI”).

Phase 2 – Assess

At the core of our selection approach, we use a 35-Page RFP including over 320 detailed questions. This level of detail ensures that the vendor provides the services and support in a way that meets each client’s requirements. Every client has their own way of doing business, and this approach ensures that the vendor that best fits that model is selected. The key to this stage is FinServ’s team with unparalleled attention to detail combs through the provider’s documentation and answers. It creates a qualitative and quantitative scoring that investors and auditors call world-class.

Phase 3 – Recommend

In the final stage of our selection process, we use scripted demos, which force each vendor to show, not just tell us, how they address the client’s most complex challenges. It is in this step that the right vendor rises to the top. Most salespeople hate this step because they know that often they want to stretch the truth about their systems. The right vendor can show how it is done to seal the win. In our final step, we conduct comprehensive reference checks that often uncover issues that may not disqualify a vendor but help the client with crucial advice as they move forward with the winner. The final step is a recommendation deck that summarizes all the detailed work, including the cost analysis across the finalist vendors supporting the client’s final selection. Many clients have used this document to show potential investors the quality of diligence in selecting a key service provider.

Beyond the Methodology

The process is key to making the right choice, but more important is ensuring that you focus on the essential areas these service providers offer. Technology is constantly evolving, be sure there is a focus on what is needed today and in the near term to meet your firm goals and requirements.

FinServ makes it our business to always stay on top of the latest requirements from regulatory agencies like the SEC and the latest technologies that the best providers are using.

Your IT Managed Service Provider (“MSP”) typically handles 2 to 3 of the most critical aspects of your business:

1) Cyber-Security & Risk Management

2) Monitoring & Management of IT Infrastructure

And for funds that have chosen not to keep IT resources in-house.

3) Service Desk / Desktop Support for Users / Company

1) Cyber-Security & Risk Management

With the war in Ukraine and the increased likelihood of focused cyber-attacks, there has never been a more critical time for a financial institution to ensure that they have the best possible risk management and cyber security coverage possible.

The offerings from the best IT MSPs have changed drastically over the past few years as the technology for cyber security and risk management has been forced to evolve as quickly as the sophistication of attacks.

The Not So Obvious Requirements Matter Most

One of the nuanced aspects of these services is less about your direct protection and more about how communications about potential IT security issues are raised. Our clients desire to limit the noise created by non-critical communications, so only the most critical issues are escalated for review. Some vendors have more advanced issue monitoring and alert systems that use rules and triggers to raise only the most important messages to clients, limiting “boy who cried wolf” scenarios.

The best vendors also proactively provide webinars and training for your employees to stay on top of the latest attack approaches. A knowledgeable team is your best defense against constantly evolving and changing cyber threats.

2) Monitoring & Management of IT Infrastructure

Has your network ever gone down, leaving you unable to work? Have any of your remote employees ever lost access to your network? Has a crucial executive of your firm ever been frustrated by not getting the IT support they need?

If the answer to those questions was yes, you probably don’t have the right service provider with the proper setup and response management systems. The best IT MSPs have formulated approaches that ensure redundancy and backup of essential systems, so you never have downtime during regular business hours. Similarly, they have all created world-class service systems that support intelligent routing of critical issues with complete status transparency. Essential issues are solved in minutes, not hours or days. When they take longer, your support staff can see real-time updates on 1) who is working on the issue, 2) when it will be resolved, and 3) all the latest activity and communications to the key executive.

3) Service Desk / Desktop Support for Users / Company

If a key executive’s camera is suddenly not working and they have a full day of Zoom or Teams calls ahead, not having someone come to their desk immediately to fix the issue can be a significant problem.

Alternative asset management firms often choose not to hire a CTO or desktop support staff. With predominantly SaaS-based applications, the need for in-house physical support has been dramatically reduced. Many smaller funds prefer to rely on an outsourced IT support person along with a part-time Virtual CTOs (“vCTOs”) to focus on complex technology strategy. Separately, while remote desktop support can work for many issues, in-person physical support is still something many funds require. While many IT MSP Vendors have moved away from offering this service, it is still an essential requirement for many funds.

If you are one of these funds, FinServ has you covered. We know which IT MSPs truly champion this type of support and which vendors only give it lip service. Additionally, If you are unhappy with any existing onsite IT support you are receiving today, we can help you move to a vendor that will cover all of your needs.

Conclusion

The IT MSP Vendor space is filled with many sub-par providers that cannot cover the mission-critical services that alternative asset managers require. In a world where one mistake could cost your firm its reputation or paralyze your operations, it seems crazy to leave this essential operational risk under-serviced and exposed.

There is no one-size-fits-all vendor. Many of the best IT MSPs have focused their services in certain areas, so choosing the right partner that fits your firm’s unique requirements is essential. FinServ’s knowledge of the marketplace and our rigorous selection methodology ensure you get the provider and services your fund requires.

To learn more about FinServ Consulting’s services: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Vendor Management Systems Take Center Stage

If the pandemic has taught businesses anything, it is that they need to plan for the unexpected and ensure they have a robust, effective and comprehensive vendor management system. Such a system is not a “nice to have” but the best way to keep track of the myriad of service providers and the detailed work that needs to go into this effort.

No matter the fund or company size, vendor management systems are an integral part of the smooth running of a firm. Recently, FinServ Consulting implemented a vendor management system (VMS) for an alternative asset manager, helping it to customize the system. Based on this experience, FinServ identified six key elements of a top vendor management system.

#6 – Tickler System

Top of the list of “must-haves” is the ability to trigger events automatically. This is at the heart of any VMS and should handle all the rules and actions around contract renewals. Part of this will be automatically sending out vendor risk questionnaires internally to determine if a vendor is performing well and externally to the vendor to ensure its own internal processes, risk assessments, and business continuity plans are robust enough to support the fund. A good VMS will handle all these notices automatically and allow the firm to customize what it needs to do and when.

The best systems provide the functionality to support nested logic, workflow-based action step processes, multiple forms of notification, and automated updates to the data in the system.

Whatever the system, it should ensure the various components can be set up by the end-user with little or no technical expertise through user-friendly user interfaces. The system must also have a dynamic messaging capability, so emails or texts sent to the user and/or vendor provide contextual information needed to understand the details of the alert and be able to act on it in a timely fashion.

#5 – Business Continuity Plans

The primary focus of a VMS is on the vendors. It should be able to produce a business continuity plan and scrutinize its response to events it can foresee as well as the unknown unknowns. For example, if it is impossible to be physically in the office, the plan should outline the steps needed to ensure the smooth functioning of the fund, including naming key members of the team and what to do it they are incapacitated physically or because of technical problems.

The best vendor management systems have all the key pieces of a rigorous business continuity plan. This means a firm’s plan can be created on the fly each time a new vendor is added, updated, or changed when something significant happens within the business.

It should also provide a detailed system and organization controls (SOC) II level questionnaires and links to detailed analysis of all aspects of a vendor’s risk assessments and pull in details of the vendor’s responses to automated surveys. This allows the operations team and/or the chief information security officer (CISO) if a fund has one to document their own findings and risk mitigation strategies for anything flagged during the risk vetting process.

Capturing incidents in the vendor’s history that may require legal or other actions by operations or compliance teams is another essential related element.

#4 – Managing Costs

A vendor management system is only as good as the quality of the data put into it. If the system uses planned and actual spending from an enterprise resource planning and/or general ledger system, it will give a powerful view of spending by vendor.

One of FinServ’s clients took this a step further by tracking spending by employee for certain subscriptions. This gave a fuller picture of overall spending at the individual employee/trader level. With this data, the financial and operational teams could make decisions quickly on spending allocations in key areas and where spending on vendors was redundant or unnecessary.

A good vendor management system will offer application programming interfaces that make it easier for technology teams to interact with other systems such as the general ledger, customer relationship management, or document management systems. When all these systems talk to each other and automatically pass data back and forth, there is no need to have manual entry. This means a firm can ensure all its data are in sync, avoiding discrepancies.

#3 – Contract Management

Most legal departments are overwhelmed with managing negotiations and deal-related matters. The contract management component of a good VMS allows a legal team to coordinate with other key areas such as the business owner for the vendor, as well as the compliance and finance teams.

Contracts can then pass through risk management and legal processes in a timely and efficient manner. With key inquiries sent to vendors – requests for documents or other information – the vendor management system ensures the contract process goes smoothly. Prior to the end of a contract, the tickler feature automates the notification for vendors and the internal team responsible.

The vendor management system should be able to link to the firm’s enterprise-level document management system to make sure a “golden copy” of each contract is kept in one place only. By linking to the document management system, the firm centralizes the security of these documents, ensuring permissions only for the people who should have rights to see or update these documents. This is where a good vendor management system covers various aspects of the due diligence and overall compliance processes.

#2 – Compliance

Ensuring vendors are compliant with key items such as certificates of insurance, non-disclosure agreements (NDAs) and SOC II is critical for investors, auditors and regulators. The vendor management system should simplify and automate the process of collecting and managing these documents as well as provide integration with other key systems. The system should track not only the receipt of any documents but also expiration dates that require a new document.

One of the more sophisticated and user-friendly features of a system FinServ Consulting implemented for one of its clients was the ability to reveal certain parts of the system only when necessary. For example, only when a vendor required a certificate of insurance would it show the section of the document tab for loading the COI. This made it much clearer and easier for the client’s administrative team to manage the documents it needed to collect from each vendor.

#1 – Onboarding Challenges

How a vendor is onboarded is another area where a vendor management system is essential. It can help streamline processes, identifying who is able to add vendors and what controls, assurances, and guarantees are needed for each type of vendor.

For example, during the vendor onboarding process, the operations due diligence team answered certain key questions through a wizard. The responses determined which document sections would show for the administrators who needed to collect the documents. When all the required documents were collected, it notified the vendor sponsor that its vendor was up to date and ready to go live. The system also notified legal that it should engage the vendor to finalize the contracts while letting all interested parties know that a new vendor was now live in the system without the need for any manual emails or intervention.

Conclusion

Vendor management systems have become an essential system for all alternative asset managers. An effective system must be able to provide a place to store essential data and offer user-friendly support to investor relations, operations, legal, and compliance teams so they enjoy working with the system. When all these pieces are in place, it makes working on due diligence questionnaires and regulatory reviews much easier and enables the firm to avoid last minute panics when trying to meet deadlines.

FinServ Consulting has the systems integration expertise, experience, and depth of knowledge to create vendor management capabilities with nearly any platform including VMS specific systems like Onspring to broader platforms like Salesforce and many others. It understands alternative firms and how a well-designed vendor management system can help limit exposure risks and ensure a firm is prepared for whatever the future may bring.

To learn more about how FinServ Consulting can help your firm build and integrate a new vendor management system, or customize one you already have, contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Create an Investor-Proof Business Continuity Plan in the Post-Pandemic World

Having a robust and automated BCP plan is critical to the post-pandemic DDQ process with Investors. Learn how FinServ has provided this critical service to their clients.

As the world slowly returns to a “new” normal for operational working practices, many funds are reviewing their existing business continuity plans (BCPs) and analyzing how to make them more robust and relevant given lessons learned from the global pandemic.

While many funds moved their technology to cloud-based solutions long before the pandemic began, others still have onsite servers and physical files that constitute a potentially serious business risk, particularly considering the changes (and disruption) to working practices over the past 18 months.

Many alternative funds, including hedge funds and private equity firms, managed to make a timely switch to remote working however many others continue to struggle to implement systems that satisfy their needs while balancing the mistrust of cloud-based environments by some executive team members. Even those that have already made changes will want to look more closely at exactly what systems they are using and if there are better, more effective, and efficient solutions that can be implemented.

Before making any modifications or implementing new business continuity plans, funds should consider several key aspects ranging from calling trees to automating vendor risk analysis. Potential unknowns could disrupt any workplace and its technological solutions. Plans should be formal, detailed, and comprehensive, and account for a variety of different scenarios.

Having a robust continuity plan is essential, particularly as existing, and new investors will look at this closely before making allocation decisions. They will want to see meticulous plans that give them the confidence they need to put (or keep) money into funds.

Futureproofing

No business can future proof itself entirely or plan for black swan events, but it can think about what a new risk or potential disrupter of the future may be. Another pandemic cannot be ruled out, and serious climate events (wildfires, flash flooding, extreme weather, for example) and other unforeseen risks, including political risk, should be factored in.

For example, how robust are communications if there is no mobile network available? What are the alternatives if mobile phone networks are not working? For those working at home, what systems do they need, including equipment and technology, to ensure they can work remotely no matter what the problem? What happens if Wi-Fi stops working or secure networks can no longer be accessed?

Funds also need to look at their service providers and vendors and ensure their vendors’ BCP’s are at the same standard as well as consider how potential disruption to services or systems, whatever the emergency and for varying lengths of time, could be mitigated.

Throughout the pandemic, FinServ has helped clients assess current vendor agreements. A worrying number did not meet the level of detail or required response times firms should reasonably expect – or thought they had agreed on – from providers.

These are real threats to business continuity and performance. For example, quantitative trading funds need a contingency plan in case their trading platforms go down. Can present vendors guarantee little or no disruption to all or only some trades? How quickly can systems be back online or moved to alternative sites? What are the potential costs to the fund?

Enterprise document management systems such as SharePoint Online are far more effective than using the quite common and outdated construct of Network folders. However, relying heavily on document sharing programs such as SharePoint could also be a problem if there is disruption due to remote work. Are agreements in place specifying how long before systems are back online? Are there other, secondary programs that can be used? Does everyone know what to do if disaster strikes and what the alternatives are?

Even smaller scale problems could be a serious disruption to a business. If a key employee is unable to work, who is capable or next in line to handle their duties? Does the replacement employee have the training, permissions, and access needed to continue the work, and while they are being a substitute, who is going to do their work?

Potential Solutions for Alternative Investment Firms

FinServ Consulting has helped many alternative investment firms build well-thought-out and fully documented business continuity plans. Some of the areas in which continuity plans should address vendor issues are reassessing vendor agreements and identifying and prioritizing vendors in order of the most critical to the least.

FinServ Consulting can also demine the types of guarantees needed to maintain business continuity, ensure vendors provide those guarantees and review contracts on a regular basis to ensure their own business continuity plans are strong enough not to let you down.

Continuity plans are also needed for employees. FinServ can help identify the priority roles and responsibilities within the firm and create a plan of succession if anyone at any level is unable to work, whatever the reason and length of time. It can help ensure all employees will have the permissions and access needed to take on different or more responsibilities if needed.

To bring this all together, FinServ can also design and implement a communications plan that will ensure everyone is informed and briefed sufficiently on what is happening and to whom whatever the type of disruption.

A vendor management system can play an important role in helping an alternative investment firm with creating and managing a business continuity plan more effectively and efficiently.

To learn more about how FinServ Consulting can help your firm develop and implement a business continuity plan, contact us at info@finservconsulting.com or call us at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Smarter Contracts with Salesforce Blockchain

Smart contracts are the most disruptive enterprise application of blockchain technologies and will continue to create new efficiencies for the financial services industry. They allow for a reliable and enforceable means of aligning multiple parties across a decentralized platform. When Nick Szabo developed the concept of smart contracts in the early 1990’s, blockchains and the subsequent hype surrounding them did not yet exist. Now, the decentralized and trust-based nature of blockchains give smart contracts the necessary platform for reaching more widespread applications in the business environment.

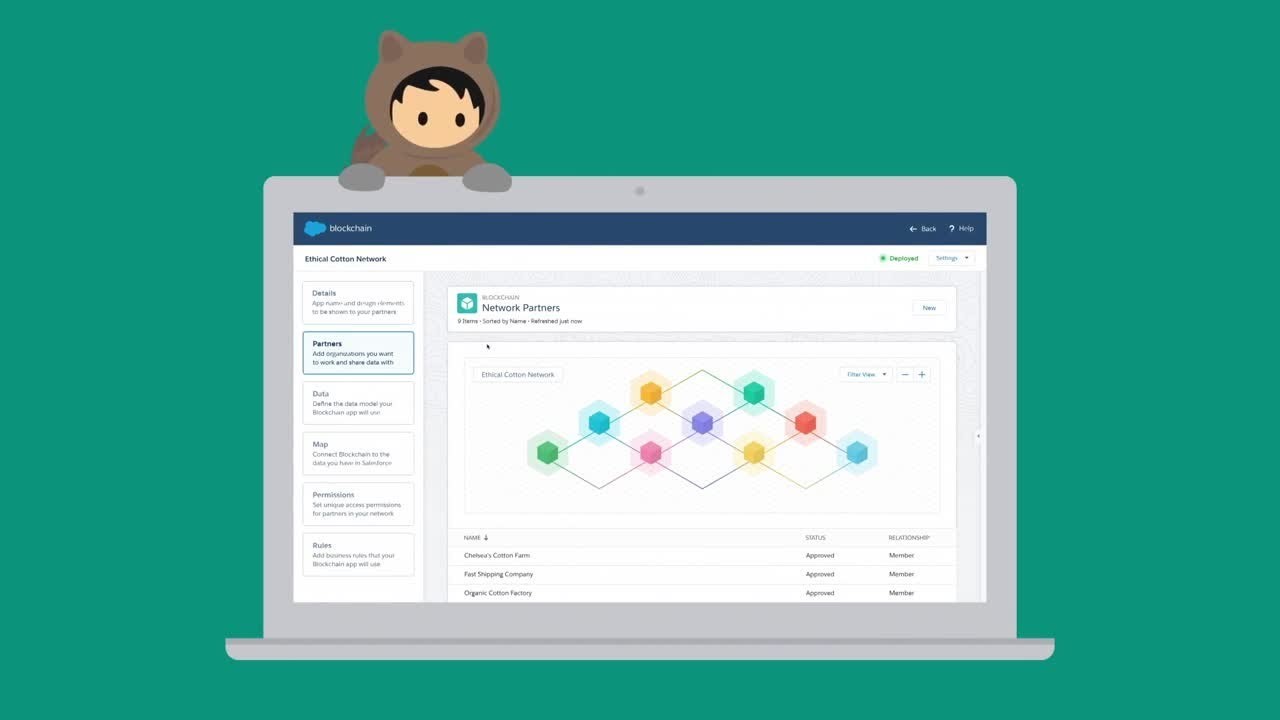

Smart contracts create previously unrealized efficiencies and new opportunities for many business processes; however, the code heavy nature of the technology has historically been a major barrier-to-entry. This has led to a growing need for a scant number of technical developers that not only understand the intricacies of building sophisticated blockchain networks, but also have a deep fundamental understanding of the end user’s business needs. That knowledge scarcity seemed to be the leading factor consistently restraining the enterprise potential of smart contracts. However, Salesforce blockchain eliminates the dependency on building blockchains from lines of code. Instead, users may use the same intuitive drag and drop interface from the world’s leading CRM platform: Salesforce. Smart contracts on the Salesforce blockchain, replace the resource intensive development cycles of other blockchain solutions with easy to use functionality.

What is a “Smart Contract” Anyway?

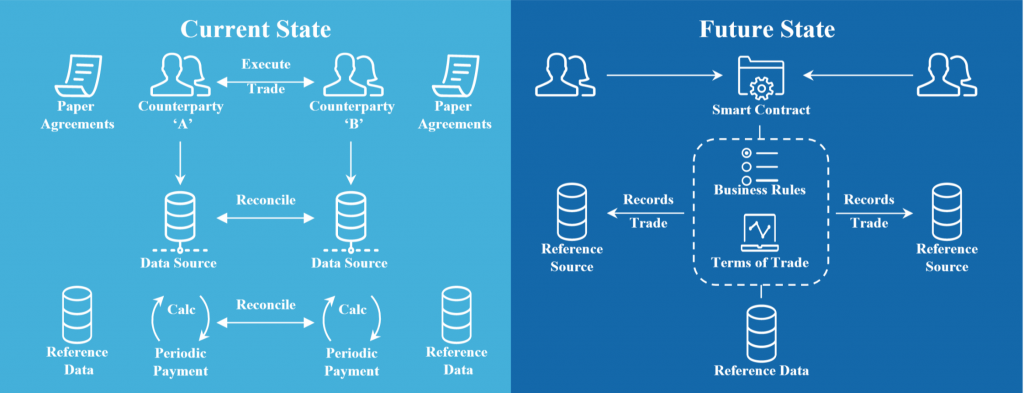

Smart contracts are self-verifiable, self-executable, and tamper proof contracts that exist digitally. At their core, smart contracts are computer programs collectively developed and agreed upon by two or more. This computer code verifies, executes, and enforces the terms of the contract if / when they are met. While this intermediary verification and enforcement role has often been reserved for an individual or institution, smart contracts are a way to remove the resource intensive and error prone third party from the equation. Instead, a secure and trusted decentralized blockchain takes their place as the intermediator that verifies and enforces the agreement both parties previously determined.

Advantages of Smart Contracts on Salesforce Blockchain:

1. Start by defining the trust network, its rules, and permissions. Blockchains are an effective means of uniting participants from different entities under a single network. However, not all of the participants necessarily need the same access to data in the network or the permission to modify that data in the same way. Salesforce blockchains are permissioned, meaning that the network agrees on what sort of information each network participant may view, as well as if / how they are able to modify that information.

2. Create a low-code data model directly on blockchain. Many of the same fields that would be necessary terms of the smart contract are already common objects and fields within Salesforce. Creating a smart contract and filling in these crucial pieces of information is just as straight forward and foolproof as working through other standard processes in Salesforce.

3. Make blockchain data actionable. Because Salesforce Blockchain is directly linked with the Salesforce Lightning platform, smart contract terms can easily be linked to Salesforce platform events, opportunities, and more to directly reflect the outcomes of the smart contract within the Salesforce environment. No need to go back to Salesforce and manually update the platform based upon the predetermined conditions of the smart contract. This is built into the contract!

4. Easily create apps for all partners and invite them. Entities that are already Salesforce customers have direct insight into the information shared with other participants on the Salesforce blockchain network. Entities that are not Salesforce customers can utilize Heroku or any custom framework to have the same blockchain data be available outside of Salesforce as well. This allows all firms to participate in the efficiency gains of blockchain technology without having to be a Salesforce customer themselves.

Smart Contracts & Derivatives

As with traditional contracts, smart contracts are used when multiple parties need to enforce all participants to adhere to a set of terms. Most often, there are circumstances surrounding these terms that require the participating entities to independently verify each other’s work. Smart contracts are appropriate when:

- More than one entity requires access to the blockchain ledger

- There are potential misalignment issues as to who controls the data

- There is a need for robust data integrity protections and a tamper proof auditable trail for all changes to the data

Smart contracts can be used to create efficiencies in post trade processes by removing the duplicative efforts of each counterparty independently verifying and executing trades. They enable a standardized and predetermined set of terms to create efficiencies in the post-trade processing of over-the-counter derivatives. Smart contracts also enable real-time valuation of positions, allowing for more transparent monitoring and reductions of costly errors. Following the predetermined business rules and terms of trade set by both parties, smart contracts streamline the reconciliation process as well. Salesforce blockchain’s functionality means digitally building secure and executable contracts for sophisticated business processes is an intuitive and efficient way of building enforceable agreements.

Future of Smart Contracts

Smart contracts built on Salesforce Blockchain are poised to disrupt the role intermediaries play across several industries. Individuals are able to manage their digital identity by only enabling the necessary details of their personal identity to be viewed by the required entities. Supply chains are more easily auditable for all parties involved at each stage, allowing for more effective planning and real time insights. Rather than having to wait for an intermediary to update subsequent lines of the supply chain, all participants have a clear understanding of everyone else’s current status. Loan processing and verification will shift from disjointed paper-based forms for verification by an intermediary to easily fillable drop down menus. Transfers of funds or knowledge today that require an intermediary verifying all participating entities can be replaced by the secure, verifiable, and self-executing smart contract on the blockchain.

Summary

Smart contracts on the Salesforce blockchain will revolutionize several business processes relevant to the financial services industry. FinServ has been considering the efficiency gains associated with Salesforce blockchain as well as the usability and process flows of working in the system. As a Salesforce Consulting Partner, FinServ will be joining several other leaders from their respective industries in testing and vetting the Salesforce blockchain platform to ensure that it meets the sophisticated needs of our customers. We are excited to see what benefits Salesforce blockchain and its ability to easily develop smart contracts will soon bring to the financial services industry. If you would like to learn more about the Salesforce blockchain network or other FinServ capabilities, please reach out to us at info@finservconsulting.com or give us a call (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Why Funds Who Want to Grow Must Continue With Their Strategic Projects

As an experienced surfer knows, if you wait until the wave is on top of you, then your chance to ride that wave is already gone. The same can be said about when an alternative asset manager innovates and invests in new technologies and projects during periods of low performance like we have seen recently.

As Klaus Schwab Founder and Executive Chairman of the World Economic Forum (“WEF”) noted, “Typically, first-adopters of technology are the ones with the financial means to secure it, and that technology can catapult their continued success increasing the economic gaps.”

He went on to say, “Additionally, the changes might develop so swiftly, that even those who are ahead of the curve in terms of their knowledge and preparation, might not be able to keep up with the ripple effects of the changes.”

Overview of This Paper

We will look at what companies did during the recession of 2008 to identify historical trends. We will also examine recent surveys that suggest where Investors are focused as they evaluate Hedge, Private Equity and other Alternative Asset managers in 2019 and beyond. Finally, we will highlight information from our own client data to explain how our clients followed these trends and share how those funds performed in terms of their own growth or decline.

Our Thesis

The underlying assumption to our work is that the economy and the market will recover and so will the asset managers who possess strong fundamentals. Given this premise, it would be very hard to argue that putting your strategic projects on hold is a good business decision if you want to stay relevant in an increasingly competitive landscape.

We look at surveys performed by EY and KPMG which back what most fund managers already know. Investors are focused on allocating their money to Innovative Funds who have strong cost management approaches in place, and who are leveraging the latest and greatest technologies.

Finally, we speak to the usage of technologies like AI, Big Data and RDP which are indispensable in the 4th industrial revolution and support the conclusion that funds who have not embraced these technologies will lose out to more innovative managers.

Our Recommendation

Based on this evidence, the only possible course of action is that funds must continue to push forward with their strategic and cost management projects undaunted by current fund performances. This is critical to not just to survive, but thrive and grow in the fast-paced and constantly evolving technical golden age we now live in.

Klaus Schwab who coined the term the 4th Industrial Revolution explained that, “Typically, first-adopters of technology are the ones with the financial means to secure it, and that technology can catapult their continued success increasing the economic gaps. Additionally, the changes might develop so swiftly, that even those who are ahead of the curve in terms of their knowledge and preparation, might not be able to keep up with the ripple effects of the changes.”

We believe in this statement Mr. Schwab accurately warns businesses that a pause in innovation can be very costly to their competitive position in the marketplace.

Why a Reactive Response to Poor Fund Performance Can Amplify its Impact

While it is totally understandable that a prudent CFO, CTO or COO will place all projects on hold during periods of uncertainty and poor fund performances, the loss of momentum is far too costly to allow this to happen. This pause will only multiply the impact on your funds’ future performance by handicapping your investment team from performing their jobs at an optimal level.

There appear to be two basic camps on this question. One side argues that companies should double their innovation efforts in recessionary times. In March 2008, American Express CEO Ken Chenault was quoted in Fortune saying, “A difficult economic environment argues for the need to innovate more, not to pull back.” [1]

What we have seen firsthand at the top performing funds is the exact opposite mentality. The top funds never stop working on the most important strategic projects to their business. In fact, what we have witnessed in most cases is when the markets are in question they double down on their investments, because they want to be able to take advantage of the funds who are too scared to make moves and enhance their market dominance.

They know from experience that when others are cautious and holding back, they can seize on opportunities more easily to extend their dominance.

Historical Support for Investing in Disruptive Innovations During Economic Contraction

Supporting the concepts of the 4th industrial revolution, FinServ believes the pace at which new technologies are being offered to funds in our industry is at a pace that we have never seen before. We believe adopting solutions like AI and RDP without delay is essential to succeed during these down periods in performance.

As we researched historical data to support our thesis, we came across many examples and anecdotes that support the idea that innovation during hard times is the best course of action. Here is one example provided in 2001.

The EY study further backs up the case for innovation supporting the idea that tactical short-term fixes are always important, but it should never be prioritized or replace the long-term, strategic investments that fund managers must continue to focus on in a highly competitive marketplace for investors. We’ll explore a few examples of these innovations as it relates to alternative asset managers later.

Strategic, long-term actions are more successful in protecting margins

It feels like an intuitive finding, but the data is clear. Those managers who indicated that they were taking strategic, long-term actions are more likely to report that their margins increased in the past two years.

Only 19% of those managers who indicated they were taking tactical, short-term actions increased margins as compared to 62% who indicated margins decreased. This compares to managers who took strategic actions of whom 32% reported margin increases and only 36% who had margin compression.

Margins are influenced based on both top-line revenue growth as well as cost management, all while making necessary investments to support the overall growth of the business. With resources less abundant for most managers, business leaders need to critically analyze their operations and take actions to best prepare the organization for both the current and future landscape. Acknowledging that the industry is being disrupted and taking advantage of newfound opportunities will best position innovative and forward-looking managers to deal with challenges and competition.

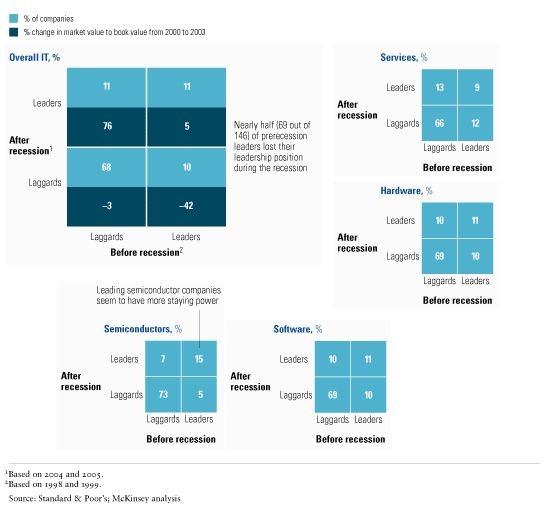

A study performed by McKinsey in the high-tech industry that backs up this point. In their analysis below they reinforce the point made by Klaus Schwab, that if you hesitate you will be left behind, but if you innovate you will surge ahead. The evidence suggests that if you hold back you can very quickly lose your position in the marketplace and go from a leader to a laggard.

“We found, for example, that 69 of the 146 high-tech companies entering the 2000–02 contraction as leaders—47 percent—emerged from it as laggards (Exhibit 3).

Conversely, 13 percent improved their positions during that same period. For example, the last downturn saw several leaders in various subsectors slip, from storage device makers and enterprise software manufacturers to virtualization and consulting-services firms. In contrast, companies such as Foxconn and HCL ascended.

Even companies that remained in the same categories moved to the extremes: Cisco Systems and 3Com, for instance, continued to be a leader and a laggard, respectively, but Cisco’s performance improved while 3Com’s fell further (see sidebar, “Cisco: Exploiting a recession’s dynamics”). With so much change in the sector’s leadership, it’s not surprising that we found that the market-to-book values of leaders and laggards changed significantly—by 40 to 80 percent from prerecession values. The current crisis could exacerbate the sector’s volatility.” [1]

Cisco: Exploiting a recession’s dynamics

While many competitors of Cisco Systems retrenched during the 2000–02 high-tech slide, Cisco invested in the downturn through prudent M&A moves, simultaneously scaling up and streamlining. The company made 16 acquisitions for a total value of almost $15 billion, rounding out its portfolio in areas such as systems design (a large stake in Sigma Systems). It also shed noncore assets, such as a consulting unit in Europe.

Cisco then took decisive steps to increase revenues and cut operating costs. To gain market share, the company reduced prices and shored up customer relationships by allowing deferred payments on purchases. At the same time, it aggressively cut operating expenses by more than $2 billion—in part through redesigning products to use less costly parts and slashing its supplier base by 50 percent to extract bigger discounts from remaining vendors. These actions allowed Cisco to extend its leadership against competitors such as 3Com, which reportedly reduced its headcount by 50 percent (versus Cisco’s 20 percent), froze acquisitions, and divested a valuable asset—Palm—to raise cash. By contrast, Cisco’s cash discipline allowed it to buy back stock even as it stepped up acquisitions. [2]

Another Strong Argument to Invest in Market Downturns

During these market downturns, vendors will offer clients extra incentives to move deals forward, including cost concessions. This is something funds can really leverage, sometimes even locking in long-term preferred rates. Another thing we have seen is when projects are slower at these firms, you are much more likely to get their best talent on your project.

At the end of the day, it is all about supply and demand. If you are brave enough to spend money during shakier times, you will no doubt be able to complete your projects, purchase software and other services at a more advantageous cost than when the rest of the market is buying with you.

FinServ’s Client Experience During Periods of Market Turmoil

As a consulting firm who lived through the 2008 financial crisis, we experienced first-hand how our client base reacted to those catastrophic events. We observed how many of our clients put all projects on hold and pulled back on all work immediately. We witnessed far fewer continue with their most strategic projects undaunted by the potential collapse of the markets.

Of course, the current situation is far from the dynamics of the financial crisis, but we are seeing a general pause on existing projects and slowdown in new projects at many investment firms since the middle of 2018.

Without exception, our clients who chose to continue with their projects during the crisis greatly expanded their businesses and exponentially grew their AUM over the following years. We believe this was because they never stopped their projects and kept the momentum in the innovations. This left them in a much better position to take advantage as the markets rebounded.

This was not only investment in projects or software, but also in new hires and training as well. With many funds cutting back, the number of desirable and experienced candidates in positions like fund accounting had a rare instance of supply far surpassing demand, resulting in many key, valuable hires made during that time.

In an industry where the most knowledgeable resources are so hard to find and hire, this was a rare time when finding qualified candidates was far less challenging.

The Current Alternative Asset Management Environment

Over the past several years, it has become increasingly difficult for funds to compete for new investors and achieve superior returns. As this competition continues to increase, funds are searching for the differentiators that will compel investors to choose their funds.

Based on our own experience, the rigorous due diligence process that most investors put fund managers through today presents challenges in two key areas which is backed up by several studies: technical innovation and cost management.

Technical Innovation – Prospective investors have been clear when performing their due diligence to look for funds who are innovators and utilizing the latest and greatest technologies to achieve superior returns and to effectively manage risk.

The days of investors just providing money without scrutinizing the investment process is gone. The survey by EY substantiates the understanding that although investors may not explain why they require this, it is absolutely critical that the funds who want to continue raising capital must be leveraging technologies like AI, RDP, big data and other innovations.

As a professional with over 25 years in consulting, I have worked through many different economic cycles. Often during the downturns, I have seen clients shift their focus toward compliance-related or non-discretionary projects, and away from more strategic or innovative efforts. In fact, this is the opposite of what funds should do based on investor requirements, and below is great evidence for why.

Continuing to prioritize innovation efforts in recessionary periods requires strong senior leadership. The overwhelming tendency is to slash resources, shut down long-term investments and focus on incremental improvements. Taking the wrong actions can sharply inhibit a company’s ability to reach its long-term strategic objectives. Approaching the problem in the right way can allow companies to do more with less and continue to move forward.”1

As FinServ has worked closely with our clients they have shared many stories of the most common and consistent questions asked during the due diligence process. A few years ago, there was a tremendous focus on risk management and controls in key operational processes and a push to ensure external third parties like third party administrator was validating the funds’ financials. Over the past year or so, there has been a significant shift towards understanding a funds technology stack and what new technologies they are utilizing in their investment process and in their operations to effectively support cost management.

The EY study further supported our experience as well.

“Investors believe advanced technology and data in the front office are important … but few have been able to quantify the benefits.

As the industry becomes more familiar with the use cases of artificial intelligence and alternative data, investors are increasingly coming to expect that asset managers will leverage it. Many view these tools as attractive complements to the manager’s existing investment process which can lead to alpha generation … although few investors can actually prove it.

Investors reported that 30% of their 2018 allocations are to managers using next-generation investment tools or data with an expectation that these allocations will grow to over 40% in the next two years. Investors are continuing to trend in the direction of expecting AI or alternative data to be used, and where it is not, managers may need to justify the rationale.

Those managers who are not embracing these techniques need to ask if they and their investors are comfortable with the status quo or if there are potential benefits.” [1]

3 At the tipping point: Disruption and the pace of change in the alternative asset management industry, 2018 Global Alternative Fund Survey

https://www.ey.com/us/en/industries/financial-services/asset-management/ey-2018-global-alternative-fund-survey

- Cost Management – At the same time, investors continue to add pressures to funds to be much more effective at managing their own operating costs. Investors want assurance from the funds that their operations are efficient. Again, investors are being more intrusive in this area, insisting that funds demonstrate a focus in technologies like AI, Robotic Process Automation (“RPA”) to meet this expectation.

The McKinsey study backed up this same focus on investment in the business operations:

“The companies in our study managed their sales, general, and administrative (SG&A) expenses in a much different way than anything else we investigated. Controlling operating expenses is critical for all companies, but leading ones that maintained their positions in the 2000–02 recession actually increased their SG&A costs by 6 percent more, in absolute dollar terms, than leaders that lost their positions (Exhibit 4). Some leaders that maintained their leadership also raised overall headcounts by 2 percent; fallen leaders cut them by 8 percent. The growth in SG&A expenses and employees took place even as sales for most leaders declined by 5 percent. A leading software firm, for instance, increased its advertising expenditures from $1.23 billion in 2000 to $1.36 billion in 2001 as the market softened. And SAP ramped up sales and marketing spending by 19 percent in 2001, although it cut administrative expenses by 8 percent. In contrast, a software competitor that slipped somewhat cut approximately 2,000 sales and marketing employees.” [1]

Who is Implementing These New Technologies

As a consulting firm that services the Hedge and Private Equity Fund markets, we have seen that the two alternative asset management approaches have different levels of systems requirements, as well as experience levels of investing in technologies.

Hedge funds tend to have far more complex needs, demonstrating a propensity to invest in and adopt new technologies well ahead of most private equity firms. However, we have seen over the past several years that many of our private equity clients are beginning to push into the newer technologies like AI and big data at an increasing rate.

The Private Equity Story

A KPMG paper which focused mostly on digitization technologies correctly points out that while Private Equity firms have been slow to adopting new technologies, they do have just as much, if not more to gain from investing in them.

This is because Private Equity firms can not only apply the solutions to their own investment process, but also to their portfolio companies, thus offering a huge return in terms of efficiency by leveraging the same technologies. Applying these technologies to their portfolio company reporting requirements also aids in the transparency for their investors. Investors preferred private equity firms who utilized advanced technologies to report performance on their investments as they saw this as evidence of a strong set of fund operations and effective controls. Additionally, investors looked very favorably on fund managers who brought the latest technologies to their investment portfolio to enhance their investments value and efficiency as well.

KPMG’s analysis corroborates this finding with the following charts.

As suggested by KPMG, innovation should not be limited to the front office and the investing process in general, but instead should be spread out across the front, middle, and the back office as the chart below depicts.

This backs up the point we made earlier that potential investors are also very interested in cost containment and want to see evidence that the funds are using technology to make their operations as cost effective and efficient as possible.

Private equity firms are applying technologies to the onboarding of new portfolio companies, which makes the processing of the portfolio company’s financials more efficient and antiquates a manually intensive process that was often subject to data entry errors.

The Hedge Fund Story

A survey by EY reveals that the most innovative hedge funds have already been delving into artificial intelligence and big data for some time now.

“Artificial intelligence and machine learning are more often being used by managers across asset classes and investment strategies to make actual investment decisions. Automation of various facets of the investment process is being embraced, and managers who are able to complement their operations with these tools are gaining significant competitive advantages.” 2

The impact of artificial intelligence on front-office models is significant

In the past year, we saw 300% growth in the use of artificial intelligence (AI) in the front office among hedge fund managers and 100% growth in the proportion that expect to use AI in the near future. Quantitative managers have been on the forefront of this technology for years, but managers of all strategies have been building capabilities and taking advantage of next generation trading systems and tools.

Hedge funds have embraced these capabilities more quickly as their investment strategy of analyzing large volumes of securities and economic data lends itself more to leveraging software and machine learning as part of the trade analysis and execution process. Further, hedge fund managers are more likely to have been further along on the technology continuum. Over their life cycle, most were able to forgo basic tools such as spreadsheets Excel and have been using off-the-shelf and proprietary technology.

Use of big data continues to proliferate

The majority of hedge funds either use or are evaluating “next-gen” data for use cases in their investing — a material increase from two years ago. During 2018, only 30% of hedge fund managers did not expect to use next-gen data in their investment process, a decline from almost 50% who made that statement just two years ago. The explosion in the volume of data that is available and the number of market participants utilizing it have begun to change how many hedge funds think of this information. For many firms in the industry, what next-gen data was a few years ago is now just data.

As a consulting firm with very deep expertise in ERP systems and business expertise in fund accounting and other back office areas, we have been helping our clients from our inception to implement the latest applications and technologies to automate manual, recurring and error prone processes.

The speed at which new technologies have been introduced and adopted by the hedge fund industry in just the past two to three years has been astounding. This is in no small part due to key players like Workday who have begun to dominate the ERP / Financials marketplace with a SAAS-based solution that many hedge funds are implementing.

Now that Workday and other vendors are linking their applications to AI offerings, the cost and effort required for even small fund managers to leverage these technologies in areas of their business other than the front office is even more compelling. This is further backed up by the EY survey:

Hedge fund managers lead in using robotics and AI in the middle and back office.

There has been significant growth in the proportion of hedge fund managers that leverage robotics to perform routine, repetitive tasks in the middle and back office. In 2017, just 10% of hedge fund managers reported that they had invest in robotics or AI. This year a third of hedge managers have implemented robotics and 1 in 10 is utilizing AI.

The benefits are significant. Technology is able to confirm trades, reconcile positions, automate regulatory reporting filings, etc. Once implemented, the tools can work continuously and limit the amount of manual, low-value work performed by people at the manager, freeing these individuals up to perform more value-add activities. The tools and technology are no longer the “wave of the future” so much as the current reality and one of the most impactful means in which managers can scale their operations to support growth and product diversification.

A Warning to Laggard Private Equity Managers

The EY study found some alarming observations in the likelihood of PE funds embracing these new technologies overall. Given the historical use of systems by PE funds, this is not surprising. However, given the increased competition for investors it is shocking that most PE funds seem determined to keep their heads stuck in the sand when it comes to AI.

74% of private equity managers do not expect to use AI. But only 40% of hedge fund managers still hold that expectation.

Conclusion

It seems clear that despite many experiencing weaker performance over the past year, there is only one option for any fund who wants to continue to not only survive, but thrive in the ever more competitive alternative asset management marketplace.

The evidence we have provided in this analysis compels managers to avoid any hesitation on moving forward with key strategic projects. Doing so will inevitably position them at a distinct disadvantage compared to other funds who will be only too happy to take their investors.

Investors are far more savvy and demanding than ever in our industry’s history, and that trend shows no signs of abatement. In fact, we expect that the demands for funds to be more transparent and efficient through technological innovations will only grow exponentially as the 4th industrial revolution takes hold.

Size is no longer a guarantee of leadership in the future, as our historical analysis has shown. It is quite easy to go from a leader to a laggard in increasingly shorter periods of time as the speed of innovation outpaces companies’ ability to adapt.

The words of Klaus Schwab should be a constant reminder to innovate at all costs:

“It used to be that the big used to eat the small, now it is the fast eat the slow and I’m seeing it everyday.”

[1] Innovating During A Recession, By Scott D. Anthony and Leslie Feinzaig, July 8, 2008

https://www.forbes.com/2008/07/08/recession-innovation-retailing_leadership_clayton_in_sa_0708claytonchristensen_inl.html#3b48f53d4757

[2] Article McKinsey Quarterly March 2009 High tech: Finding opportunity in the downturn, By Andrew Cheung, Eric Kutcher, and Dilip Wagle

https://www.mckinsey.com/business-functions/organization/our-insights/high-tech-finding-opportunity-in-the-downturn

[3] At the tipping point: Disruption and the pace of change in the alternative asset management industry, 2018 Global Alternative Fund Survey

https://www.ey.com/us/en/industries/financial-services/asset-management/ey-2018-global-alternative-fund-survey

[4] The Digital Transformation Imperative – Why Private Equity Firms Must Digitally Transform to Compete, By Gavin Geminder, and Jeff Kollin

https://assets.kpmg/content/dam/kpmg/us/pdf/2018/05/737580-nss-pe-digital-transformation-whitepaper-v18.pdf

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

FinServ can help you plan for and optimally implement a long term strategy and roadmap to embrace the new technologies of the 4th Industrial Revolution.

Here Comes Flow Builder in Salesforce Spring 2019 – What You Need to Know

In the Spring ’19 Release of Salesforce, Flow Builder will be replacing Cloud Flow Designer. On the surface, this may seem like a minor change, but it has major implications. Here are some key changes that you need to be aware of if you use any Flows in Salesforce.

Flow Designer Brings a Major Change to Salesforce Process Automation

Salesforce is providing a new default application for workflow automation called Flow Builder. Similar to many other Lightning tools, this new component has the promise of a far superior User Interface (“UI”) and a user-friendly and familiar canvas approach (very similar to Lightning page designer). The new tool certainly provides a much more modern and user-friendly look and feel, but the rest of this new tool has a long way to go in terms of delivering on some key items that Salesforce has been promising for workflow automation. In this article we will explore the pros and cons of the current version of the tool and provide a recommendation for any organization that uses or plans to use workflow automation in Salesforce.

(The same Flow side by side – On the left is the old Cloud Flow Designer, On the right is the new Lightning Flow Builder)

A Familiar User Interface

As we noted in the intro, Salesforce has done a great job of providing the very familiar UI canvas, with the components on the left-side panel and the properties on the right-side panel. Certainly, this consistent approach to how Salesforce’s Lightning tools work will make it easy for people creating the flows to quickly adapt to the new tool.

(The new user-friendly Flow Builder Canvas)

Uses of Flow

Workflow automation in Salesforce isn’t new, and people who have been using Salesforce Flows know it is an incredibly useful tool. At FinServ, we have used previous iterations of the Salesforce Flow tools for the automation of key approval processes, such as travel expenses. We have also used Flow to kick off key Conversions of Job Candidates to Employees in our Salesforce Recruiting system and Converting Opportunities to Projects in our Sales Pipeline.

In all these instances, we use the Flow tool to make interaction and updates to key fields, related lists, and attachments to Salesforce Objects highly efficient and more user-friendly, ensuring our team provides all the critical data that our firm needs to act on. Since incomplete data and users providing insufficient information is one of the biggest challenges our clients often ask us to solve, we believe tools like Salesforce Flows are a big part of the answer to having better data. In a world where data is becoming an increasingly important aspect of all businesses, particularly with machine learning and artificial intelligence, it is critical to make it as easy as possible for your users to provide the best data possible.

With Flow Builder, Salesforce is promising to make certain commonly used Flow functions far more efficient. For instance, with the addition of the Phone data type, the validation and masks for a phone number are now built into the properties of the data type so that you no longer need to create your own extensive validation scripts, custom masks, or formatting—which is a huge time saver. Salesforce has also added the Address data type which now consolidates the street, city, state, and postal code components of any address into one streamlined data type.

What Big Issues Exist in the New Tool

It feels like Salesforce is rushing out the new Flow Builder. Overall, the application seems a bit half-baked in our opinion. Our opinion is in large part due to the fact that certain basic tools are missing from this first version of Flow Builder:

- Support for Rich Text Editing – Yes, this is correct and not a typo. The Rich Text Editor that existed in the old Cloud Flow Designer does not exist in Flow Builder. In fact, look at the screenshot below to see how messy your Rich Text will appear in the new Flow Builder. This is because they left support for Rich Text by allowing HTML tags. This is the main reason why I am saying this was rushed. It just does not seem like a commercially viable product with such an open issue.

- No Ability to Copy & Paste – Yes, again this is not a typo. The tool does not support Copy / Paste and Undo / Redo functions that exist in the core tool. Again, it is hard to believe Salesforce would release a tool without what everyone now feels is the most core, basic capabilities any tool has to have.

One of the best features is really the elimination of a huge dependency on Adobe Flash (which is going away by the end of 2020). We suspect this is the main reason why Salesforce is rushing this new tool out.

(Below shows what use of Rich Text in the previous version looks like in the new Flow Builder – an HTML mess!)

What’s New / The Benefits of the Flow Builder

So this new tool is not all bad; in fact, it offers some new and incredibly powerful capabilities. Most exciting are some really powerful data types that people have been looking forward to for a long time, such as:

- Address – Consolidates the different components of any address

- Display Image – Easy way to work with image types

- Email – A mask that is set up to auto-validate and accept email addresses

- File Upload – A built-in way to upload files and link to your Salesforce objects

- Name – Pre-built data type to work with the Contact Object

- Phone – A mask that is set up to auto-validate and accept phone numbers

A Whole New Way to Test your Flows

One of the best innovations in the Flow Builder is the addition of a Debugging Tool that allows you to trace through the progression of your Flow as you make entries into your forms. This is especially handy in flows where you may have created multiple decision points, or where you may have created complex formulas to calculate or assign certain values to fields in your objects. Previously, you more or less had to guess how this was occurring. Now with the debugger, you get an amazingly detailed screen on the right-hand side that tells you what element in the flow has executed and the reason why, and also shows you the value of each of your variables in that step.

(Sample screens of the new Debugger Screens to support testing your flows)

Other Benefits

The Flow Builder has also streamlined some of the Data Elements which were very confusing. There is no longer a need to pick between things like a Record Lookup or a Fast Lookup, as these have been combined so that the system will handle it for you. A summary of these related updates is below:

Data Elements

- Record Lookup / Fast Lookup = Get Records

- Record Create / Fast Create = Create Records

- Record Update / Fast Update = Update Records

- Record Delete / Fast Delete = Delete Records

Resources

- sObject data type = Record

- Dynamic Record Choice = Record Choice Set

- Picklist Choice = Picklist Choice Set

Variables

- sObject Variable = Variable, where Data Type is set to Record

- Collection Variable = Variable, where Allow multiple values is selected

- sObject Collection Variable = Variable, where Data Type is set to Record and Allow multiple values is selected

Actions – reduced to just Action Types

- For example, send an email after contact records are created

- Static Action, such as post to Chatter, submit for Approval, or Send Email = Core Action

- Local Action = Core Action

- Quick Action = Core Action

- Apex = Apex Action

- Apex Plug-In = Apex Action (Legacy) – Going away

Logic

- Wait = Pause

Here’s the Catch and Our Recommendation

As we have highlighted in this post, there are many core items that are missing from this initial version of the Flow Builder tool. Some of these omissions can cause major issues if you update your flows with this new tool.

The good news is that if you do nothing and do not touch your Flows, they will work just as they always have. Even better news is you can still have access to the old Cloud Flow Designer by simply going to Setup->Process Automation->Process Automation Settings and you will find a checkbox that says Disable access to Cloud Flow Designer (this is checked by default) and you can simply uncheck the box to get access to the old Cloud Flow Designer.

After a deep dive on the new tool, we suggest to most users that you not update any of your existing flows with the new Flow Builder.

Instead, we recommend that if you are willing to work with a true beta product, you should create new flows or copies of your current flows to experiment with the new Flow Builder (preferably in your Sandbox environment). Start to assess which of the new features you will incorporate once Salesforce releases a more complete version of the tool.

Longer Term View

The new Flow Builder is the future of Process Automation in Salesforce, and the tool will evolve quickly as we saw with the Lightning Platform to become a very valuable addition to the Salesforce arsenal. Unfortunately, in today’s incarnation we can only recommend that you use it in Sandbox, and plan for the new features that will be added in the Summer ’19 release when we expect most of the major shortfalls will be addressed.

FinServ can help you plan for and optimally implement many of the Lightning based technologies and other Salesforce modules like Marketing Cloud and Einstein Analytics.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How Hedge Funds are Saving Time and Money by Automating their Financial Statements

In 2017, CFA Institute reported that automating financial statements reduced the cost of producing these documents by 30%. Manually crafting financial statements is a difficult and cumbersome process, and the Hedge Fund industry is quickly moving to a more efficient automated model. Many of FinServ’s clients are automating their financial statements production and are reaping other benefits in addition to the cost savings. Fund Accounting groups that are still manually preparing financial statements should seriously consider implementing an automated solution. FinServ’s clients are investing automated financial statement systems for the following key reasons.

(1) There is a large number of capable systems available in the marketplace.

- Command Financial CAPS, Donnelley Financial Solutions ArcReporting, IBM Disclosure Management, and Workiva Wdesk are financial statement automation tools.

- These solutions originated from early EDGAR and XBRL filing requirements; however, there is growing adoption amongst more complex hedge fund managers for financial statement preparation.

(2) Automated solutions transform a time-consuming process that is prone to human error.

- Financial statement automation tools provide a cost-effective way for hedge funds to improve their operational controls and streamline the financial statement production process.

- In a typical manual production cycle, Microsoft Excel workbooks are used to generate financial workpapers, while Word templates are populated using calculated numbers.

- Each manual step is an opportunity to introduce errors into the process and risk is controlled by extensive reviews by internal accounting teams and external audit reviewers.

- Automation of financial reporting frees your accounting team to perform more value-added work like insightful reporting and dashboarding.

(3) Automated solutions facilitate the standardization of your data at the source.

- With these solutions, firms must adhere to a well-controlled data-driven set of processes designed to send structured data through standardized financial statement templates.

- This reduces the amount of time required by users to review, approve, and publish final documents.

- External auditors advocate in favor of automated solutions as proven solutions that save time and improve overall financial statement consistency.

Key Financial Statement Automation Product Benefits

Financial reporting software can help Hedge Funds to become more efficient, reliable and better equipped to handle future growth. The automation of financial reporting allows your team to focus on strategic value-added activities like evaluating new disclosure requirements, or preparing for specialized notes for new entity launches/liquidations. The marketplace for automated financial reporting solutions is rapidly evolving and the right solution for your fund is dependent on your unique requirements. There are few areas of benefit with these applications that every Hedge Fund should consider:

| Features | Core Benefits |

| Standardized Notes to Financial Text Libraries |

|

| Shared Document Output Templates & Calculations |

|

| Collaboration & Controls |

|

Different Approaches to Consider

An in-house vendor implementation is not the only option for an alternative asset manager to take advantage of a financial statement automation product. Some fund Third Party Administrators (“TPAs”) offer financial statement preparation services using an automated software product; however, these services only make sense for managers with a low number of reporting fund entities (due to cost models of the TPAs for this service) and/or those who favor an outsourced back-office operating model. The graphic below provides a useful perspective based on cost preference and risk tolerance as to what solution your firm may be more likely to benefit from today.

| Features | Core Benefits |

| Standardized Notes to Financial Text Libraries |

|

| Shared Document Output Templates & Calculations |

|

| Collaboration & Controls |

|

Different Approaches to Consider

An in-house vendor implementation is not the only option for an alternative asset manager to take advantage of a financial statement automation product. Some fund Third Party Administrators (“TPAs”) offer financial statement preparation services using an automated software product; however, these services only make sense for managers with a low number of reporting fund entities (due to cost models of the TPAs for this service) and/or those who favor an outsourced back-office operating model. The graphic below provides a useful perspective based on cost preference and risk tolerance as to what solution your firm may be more likely to benefit from today.

Conclusion

Automated financial statement preparation tools provide compelling cost and time savings while greatly enhancing data integrity in financial statements preparation processes. Fund managers looking to streamline their quarterly/annual production cycles must consider the automation options as soon as possible. Implementing a financial statement automation tool is a complex project that includes:

- Gathering/normalizing data from fund administrators

- Standardizing fund accounting business processes, and

- Managing vendor team resources.

Systems integration expertise is critical to the success of your financial statement tool implementation to maximize your funds overall ROI. To learn more about FinServ Consulting’s Systems Integration expertise and strong track record for delivering projects on-time and on-budget, please contact us at: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

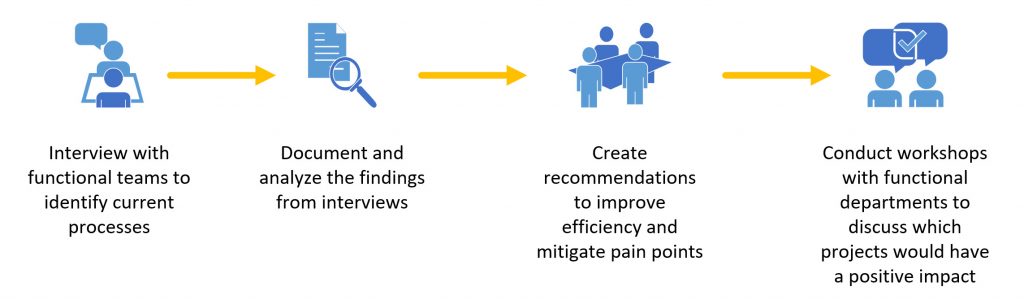

Case Study – Getting the Most Out of Your Software through an Operational Assessment

The Client

Our Client, an emerging healthcare firm was experiencing rapid growth which was stressing their existing processes. The issue had gotten to the point where management felt the current processes were no longer acceptable because of the number of manual workflows and department inefficiencies leading to worker burnout and turnover. It became apparent to senior management that they needed to focus on streamlining the functions that were heavily affected by these issues: Corporate Accounting, Financial Planning & Analysis, and Human Resources. In order to accomplish this goal, the firm decided to implement an end-to-end Enterprise Resource Planning (“ERP”) application with the intention of integrating the system with its Human Capital Management (“HCM”) and Financial processes.

The Dilemma

The first phase of the implementation included, basic general ledger, accounts payable and reporting functionality. The second phase of the implementation was combining the recruiting, onboarding and payroll departments into the system to streamline these processes into a single-user experience.