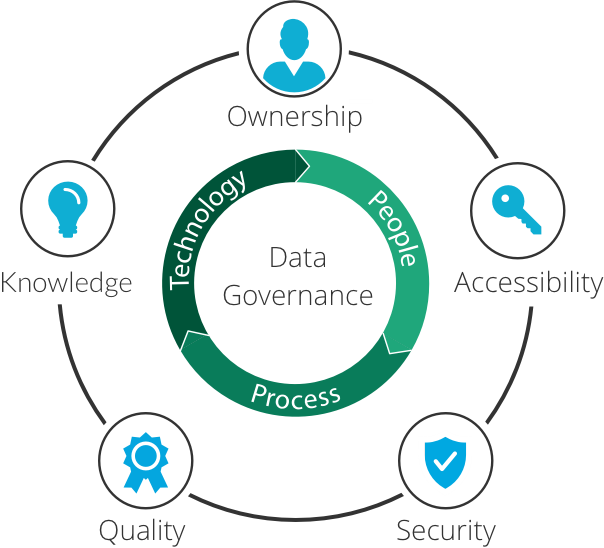

In today’s increasingly digital, data-centric corporate environment, a strong data governance approach is of utmost importance. Data governance defines who does what in data management. It cannot be solved in one corner of the organization; it requires consistent collaboration between IT and business to manage data as a real asset. A robust data governance program defines who makes the decisions and who is accountable for each data management activity in the company. Defining these roles is necessary to improve data integrity, power key business initiatives, and ensure regulatory compliance.

Companies with unclear or non-existent responsibilities related to their data lack an effective data governance methodology and usually face the following situations:

- Lack of clarity around who is responsible for key data objects and their quality

- Poor data quality (e.g. missing values, outdated information)

- Data management and stewardship activities are performed in an unstructured manner and without proper documentation and controls

These issues can have severe consequences for an asset management firm from the front to back office. For example, poor data quality and lack of responsibility for key data objects can lead to problems in reporting, such as incorrect or missing data items for PnL reporting. Asset managers are in need of enhanced analytics that improve operations. In order to build out a target operating model or other highly scalable platform, asset managers must focus on being a data-first company.

Clearly, there can be substantial functional and tactical obstacles to establishing a data governance framework. However, the benefits and overall payoff are well worth the investment. Especially within the asset management domain, there are several advantages of implementing an effective data governance strategy.

Prepare for Regulatory Scrutiny

The financial services industry has recently faced increasing pressure to comply with new financial data reporting regulations such as AIFMD, Form PF, GDPR, CCAR, and DFAST. Most firms were not adequately prepared; they had to scramble to find the necessary data, map its lineage and usage, and verify its accuracy in order to satisfy these requirements.

Firms learned that a data governance program would alleviate much of the compliance pressure and avoid endless meetings, emails, Excel spreadsheets, and Visio diagrams. The best way to end that cycle of ad hoc documentation, which produces data that nearly instantly becomes stale, is through the use of technology and analytics. Asset managers can benefit from proactively implementing a data governance plan that will be useful when the regulators come knocking.

In addition, there has been increasing regulatory emphasis on data security and protection, including cybersecurity, preventing data leaks. Data governance is the clear solution here for asset managers to prove the reliability of their data to authorities and ensure that they have protected the data against potential breaches.

Consistent Standards for Data Quality, Validity, and Transparency

The process of acquiring data, especially from external, third-party vendors, is an expensive one for asset managers. On top of that, the data may not have been properly validated and therefore presents quality issues. A centralized data governance system can streamline data procurement and validation so the firm can negotiate favorable rates with vendors, mitigate data-related risk, and reduce operational costs of scrubbing the data.

Once the data is within the organization, quality can still be an issue for different users. A data governance program facilitates commitment to firm-wide data quality standards, which increases transparency and trust among business users that the data has been thoroughly validated.

Additionally, business terms and definitions often have an entirely different meaning in one group versus another, which leads to issues in the case of firm-wide initiatives and projects that require multiple teams to collaborate. This is where data governance comes in to help centralize the function and create a set of business definitions (a “data dictionary”) and business usage rules. Having a centralized governance process is very useful when it comes to large-scale data transformations for mitigating risk through increased control and oversight of complex data projects.

Increase the Value of Data

The vast amount of data that is available today can be extremely valuable to asset managers for many purposes, from discovering valuable investment opportunities to gaining insight on potential investors. Implementing data governance contributes to increasing data’s value even further. If it is not used properly, data has little to no value. Governance ensures that any data issues can be quickly resolved, and that data is ready for use in increasing efficiency of business processes as well as decision-making and business models.

Implementing Data Governance

FinServ Consulting specializes in offering a wide variety of business services to asset management firms; we can help define a data governance framework that will realize the benefits discussed and more. FinServ can provide hands-on business analysts to support clients looking to create a specific set of reports of dashboards, those looking to stand-up a formal data governance program, and those looking to implement a more complex master data management system to handle growing complexity of hybrid on-premise and cloud system ecosystems. We are well versed in the established guidelines and proven approach for setting up data governance:

- Define who does what. Who owns specific data management activities within the organization? Is the function centralized or decentralized?

- Set mandates and decision-making rights. Set the mandate and decision-making rights for the people defining and monitoring the governance policies and standards.

- Define an implementation plan. Training, communication and change management activities should be included.

- Identify resources. Determine how many people are needed and select the right individuals to run data governance.

- Select technology. Select the appropriate technology solutions to create a best-in-class platform.

Summary

If you are interested in establishing or improving your firm’s data governance platform, FinServ Consulting is the right partner to help you reach your firm’s strategic data objectives. Throughout our 15 years of existence, we have proven that our deep industry knowledge combined with our project management and overall best practice methodologies can be an asset to your organization. To further continue the conversation or to discuss more of FinServ’s capabilities, please contact us at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.