The 4th Industrial Revolution: How FinServ is Helping Clients Take Advantage of the New Tech Paradigm

Coined by Klaus Schwab, the 4th Industrial Revolution promises to develop so quickly that those ahead of the curve today may not be able to keep up with the ripple effect of the changes. At FinServ, we believe it is our job to ensure our clients stay on top of that wave, by providing constant service and insights that take advantage of, the best new technologies.

Why You Should Care About the 4th Industrial Revolution

When we speak to our clients about Industry 4.0, the most common question is, what is it? Why should I care? The term itself does not matter. What does matter is, the name acts as a focal point to enable FinServ to focus our clients on what does really matter.

Whether it is: 1) New technologies embedded in the best industry applications, 2) New agile governance models being put in place, or 3) The core aspects of data privacy that are drastically changing, we believe our client’s need to be ready to adopt and adapt to each of these disruptive forces.

Sears a Cautionary Tale

I was recently watching a piece on how Sears, a company that once was on top of innovation is now going out of business. Each of these anecdotes shows that even the best of funds could end up losing its investors if they do not continue to innovate and take advantage of what technology is offered. There are always hungry new funds, just like Amazon was to Sears that will be more than happy to take your position and your investors if you do not stay on the leading edge.

The Key Challenge

Due to security concerns our industry is a laggard to most new and emerging technologies. While many firms took advantage of the public cloud, a surprisingly high number of our clients are still hesitating to take advantage of this key resource.

We agree with our clients in terms of utilizing the highest standards of protection for their client and investment data, but this should not keep you from adopting technologies in an intelligent manner. It takes extra work and due diligence, but these technologies like public clouds can be safely and securely implemented for any firm. The most critical step is to hire an expert in the technology to ensure it is configured with all the most important safeguards in place.

When you set up a server on Amazon Web Services (“AWS”) you can leave yourself completely open to attack, or you can configure with all the tools AWS provides to be more secure than your own private cloud. It only requires the expertise to know how to complete the configuration.

Speed with Purpose

The terms speed with purpose was something I first came across during my time at KPMG. It was used to describe one of the core values of the firm. I always loved this phrase, because it described something I always believed in, that you should take action and produce outputs and outcomes as quickly as you can. The word purpose added something essential. Purpose highlights that you should not be reckless in your pursuits, and it further suggests that you could act thoughtfully at the same time.

We believe this is exactly how our client base should act towards the technologies and changes that relate to the 4th Industrial Revolution. Our clients should dive into these technologies now, while ensuring that as they implement the changes they are taking the proper precautions, and putting into place the proper controls that will continue to protect their businesses from crucial errors.

Applying the Technologies to our Industry

One key technology Artificial Intelligence (“AI”) is critical to our industry. AI has been a large focus on many funds for several years now.

Whether it be the Investor Relations group using predictive analytics to identify the best investors to pursue, or the front office using prescriptive analytics to draw up specific recommendations in investing you can’t deny the value of these technologies.

Lessons from Data Warehouse Experiences

The biggest barrier to getting on these technologies was the cost and time to set them up. Over the past decade, many clients engaged FinServ in discussions about creating data warehouses. Less than 10% of those clients actually took any real steps to create them, and far fewer ever realized the final goal or benefits.

Thanks to SAAS-based solutions and virtual computing new AI engines are popping up all over the place. These solutions offer a very low-cost entry to powerful AI engines. Microsoft, Salesforce, and SAP just to name a few vendors offering AI platforms that can be acquired and setup in weeks or months.

We strongly suggest before selecting one of these platforms that you do conduct a full vendor selection. Like all system selections ensuring you are picking the right solution that fits your specific requirements is critical. Each of these AI platforms do have their own strengths and weaknesses and aligning those to your business is paramount. As part of this selection process we endorse vetting the security and controls provided by each of these vendors.

One Real World Example

Up to this point we have spoken about why you should adopt new technologies and spoken to most of the reasons firms hesitate to act. Providing an example how a technology today can enhance one common pain point may be the best way to bring people over to adoption.

From the dawn of computerization the dependency of getting users to enter their data into the system has been a large issue. Now with our smartphones we have a device that when combined with AI technology can alleviate that issue. Salesforce introduced Einstein Voice which leverages your voice allowing you to dictate important notes into your smartphone and the AI portion of this solution than intelligently identifies the components of your data and links that to your CRM / sales system as an example to route your information intelligently to those people in your firm who need to act on that data.

Einstein Voice

The Bottom Line

New technologies are arriving at our doorstep with regularity and speed we have never seen before. Knowing which ones to choose and how to safely and effectively implement them can be daunting. You should not let security concerns hold you back from ensuring your fund can compete for investors who are becoming more savvy and discerning about their choices of funds. If anything adopting these new tools will ensure they see you as an innovator worth investing in.

FinServ can help you plan for and implement these technologies in a safe and effective manner with time tested methods and the speed required to have you up and running in the most expedient time possible.

To learn more about FinServ Consulting’s services, please contact us at info@www.finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How Document Management Systems Help Data Privacy Compliance

GDPR and Data Privacy

Several large Silicon Valley firms have been in the news frequently regarding what data they store about you, what they do with that data and what they tell their consumers. The question becomes what rights do you have in an online world and what standards are applied to these companies that store your data. GDPR (General Data Protection Regulation) aims to answer that. GDPR went into effect on May 2018 and aims to standardize and protect the rights of EU (European Union) citizens in regards to their PII (Personally Identifiable Information) data.

This regulation applies to all EU citizens regardless of location meaning that an investment manager based in the US must abide by these regulations if any of their investors or employees are EU citizens. GDPR may seem a bit draconian but it is the trend (see the Congressional Hearings on the prominent Social Media companies) and other countries will follow the EU’s lead and craft their own PII protection laws.

As an example, the US is considering their own version of General Data Protection Regulation (GDPR):

Click this Link for the Details on US GDPR

Compliance using Document Management Technology

In addition, GDPR will continue to evolve to protect the changing definition of PII data and its usage. For your firm to be able to meet these laws effectively, we recommend using a Document Management System (DMS) such as Microsoft SharePoint Online. Several key DMS technologies will facilitate your regulatory compliance and the ability to pivot rapidly to comply with any new regulations or changes.

- Data Inventory – Regulations such as GDPR place an emphasis on knowing what personally identifiable information (PII) data you store and the ability to extract it on request. In Office 365, Data Loss Prevention (DLP) can identify over 80 common sensitive data types including financial, medical, and PII. EU common sensitive data types are pre-defined and custom sensitive data types can be added to properly categorize current and future definitions of PII data. Furthermore, all Office 365 products (i.e. Outlook, SharePoint, Skype) can be searched through at the same time using Office 365 eDiscovery resulting in a comprehensive PII search

- Data Protection – A common theme of regulations whether it be GDPR or the SEC Safeguards Rule and Identity Theft Red Flags Rule is the safeguarding of data personal and confidential data. Using the Office 365 Security & Compliance Center, you can use DLP to lock down data by preventing internal and/or external sharing of the data. Furthermore, with data on the cloud, you can enable an additional layer of security through Service Encryption with Customer Key which encrypts your data at rest wherever it may reside

- Data Retention / Destruction – Regulations also require Account information and Books and Records to be kept for minimum periods of time (for example Account Information must be kept for 6 years). SharePoint can automate these Document Retention rules using Document Retention Policies eliminating any human error. Retention policies can also be set on a more granular level to govern specific types of documents such as Financial Documents. Once the data is no longer useful or required to be kept, data can also be purged using automated rules and workflows.

For additional information from Microsoft on how they meet GDPR requirements, see:

FinServ Can Help – FinServ is a Microsoft Partner and Integrator. We have done numerous Document Management system implementations for asset managers and approach the project from a policy view. We will help you define your Document Management policies first to meet Compliance and GDPR and other regulatory body requirements. We understand the business and work with you each step of the way to implement the Document Management system on time and on budget.

To learn more about FinServ Consulting’s services, please contact us at info@www.finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How the CLO market has created an opportunity for post-trade technology vendors

If you get a sense of déjà vu when you see the headlines, no one would fault you. In a scene reminiscent of the 2008 subprime mortgage/CDO market, the CLO market has seemingly reached a frothy tipping point. Here’s the New York Times cautioning about the rise in CLO issuances. Here’s a Bloomberg article on AIG, no less, buying a credit manager specializing in CLOs. Here’s another Bloomberg article on a husband/wife-owned Kansas money manager that deals in CLOs. And yet another Bloomberg article on how everyone involved with CLOs gets rich. Even the actors are the same. Greg Lippman, former head of ABS trading at Deutsche Bank has acquired a CLO manager in his current role. And imagine – these links are just from the past two to three months – but you get the idea.

Business case for vendors

In the current low rate environment, investors are chasing yield, but they’re not the only ones. Everyone’s getting a cut of the pie, including CLO managers, structurers, lenders and software firms. This boom has meant an uptick in business for vendors we work with who help operationally manage these loans. This financial technology partner has grown by leaps and bounds in the past 3 years. Their client list reads like a who’s who of the world’s top credit/loan investors.

Vendors, quick to capitalize on a competitive advantage, have made investments into their portfolio management/trading/risk capabilities. Whether it comes from buying out a competitor with a built-in client base (see NEX Group, which started out as ICAP, who bought Traiana, but now lists the following as part of their extensive post-trade offering: Brokertec, TriOptima, Abide and Enso, among others) to investing/growing organically, the post-trade technology market has always been quick to partner with regulators, strategically-inclined to merge with competitors and eager to adopt new technologies in order to provide the best-in-breed offering.

The Trading Technology Landscape

Similar to the different flavors of derivatives that exist in the traded market today, the different capabilities needed to service a front office derivatives desk can include any or all of the following:

- Trade Capture

- Market/Reference Data

- Analytics

- Risk, in all its flavors – market, credit, counterparty,

- P&L

- Trade Support/Lifecycle Management

- Limits & Limit Management

- Regulatory – VaR, backtesting, counterparty credit risk, XVA

- Sales – pricing, structuring, MIS

There’s no one vendor that can supply all of this, but that’s not for want of trying. As I stated above, vendors are racing to complete their product suite with most, if not all, of the capabilities listed above. Some try and succeed; others don’t succeed and either get picked up at bargain bin prices or merge with a competitor.

The Bottom Line

The market works in cycles. Yesterday’s ABS/MBS is today’s CLO, which can lead to tomorrow’s next financial-engineered wonder product. Whether it’s a hedge fund looking for alpha on behalf of their investors, to money managers acting in the name of fiduciary responsibility on behalf of a municipality’s pension, they will opt to invest in new products or change their business workflows in response to some regulatory requirement. When that time comes, this will mean delivering technological change or effecting business process improvement. Replacing a new post-trade solution or implementing new workflows using a vendor product can seem daunting, but FinServ can help you efficiently plan for and implement these technologies to suit your unique firm needs. Our expertise in data, systems, and strategic consulting ensures that our clients receive tailored recommendations for the right post-trade solutions they need.

To learn more about FinServ Consulting’s services, please contact us at info@www.finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How A Highly Configurable Solution like Workday Financials is Affected by Regulators

With Workday Financials gaining popularity thanks to its customization capabilities, we expect that organizations who have adopted Workday will have their hands full addressing the growing regulatory requirements, particularly around documentation of system controls.

All your departments are affected

Surely, we expect that Corporate Finance, Accounting, and Internal Audit departments will be pressured from management and regulatory bodies to maintain tight controls and processes in response to the adoption of highly configurable solutions like Workday. This is because Workday customers have full ownership and ability to make changes that have material upstream impacts on financial statement reporting to investors.

However, it’s important to note that this will also affect all your departments that interact with Finance and Accounting functions, including your Shared Services, Information Technology, Legal, Valuation, and third-party administrators, and others.

A digital footprint in Workday

Workday has done extremely well by developing an audit trail of changes to every record, configuration, and policy into its platform. The historical log of changes certainly is one of the system’s core strengths. In fact, you can’t even delete instances within the platform. Simply because wiping your history is just not a concept that exists in the world of Workday. Instead, you would need to correct, inactivate, or adjust the component that you’re looking to change.

Let’s take this example: The bank settlement details for one of your suppliers is incorrect. Rather than deleting this, Workday provides the option to “inactivate” or overwrite the details with the correct data for the existing line item. When that item is changed, Workday retains a record of this change activity: the old value, new value, who changed it, and when.

But what’s missing?

It would be nice if Workday delivered a report that captures the changes to security roles which have the ability to impact financial data. This is an important consideration if you’re familiar with the power of Workday’s security model. A role assignment within the system is not as one-dimensional as providing Sally Hansen the ability to record revenue entries. Such requests should be taken with careful evaluation of the various processes, domains, or functions allowed within that role due to the upstream impacts.

As an example, you may want your payroll processor to post monthly payroll accruals. A seemingly basic function, which is allowed through Workday’s delivered Accountant role to create journal entries. However, you may hesitate before assigning this role as it also allows users to also create cash payments. You can see where things can get complex because someone who has access to both cash and payroll would represent a clear violation of segregation of duties. This would obviously be subject to criticism during an audit as a weakness in the firm’s internal control structure, and required to be remediated to obtain a clean opinion on the financial statements. Therefore, you may want to segment access by creating a new security group with specific access just to post journal entries before deciding to assign roles with core Finance functions.

It goes without saying that the Security Administrator is a very powerful role, one with the ability to change and administer any role within the system without restraint.

So if you don’t have something similar already, it’s worthwhile to create a custom report showing security changes to those key Finance roles. You can hand the report off to senior management, internal and external auditors, and not only will you be addressing a key risk area, but you also gain visibility to what your teams are doing, and you can really manage your people’s roles in a highly configurable platform like Workday.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Salesforce Einstein: A Growing Artificial Intelligence Platform for Financial Services

What is Salesforce Einstein?

Salesforce Einstein is a suite of AI tools embedded into the various Salesforce apps (Sales Cloud, Service Cloud, etc.) packaged into the form of a digital smart assistant. This allows existing Salesforce users to leverage powerful AI capabilities from a platform they already know and love.

The goal of Salesforce Einstein is to make user lives even easier with personalized recommendations, intelligent search results, and task automation. That includes an Amazon Alexa inspired voice assistant called Einstein Voice that can listen, transcribe, and analyze user questions and more importantly, a business intelligence engine to perform the heavy lifting to discover new insights, predict the likelihood of outcomes, recommend strategic actions and automate routing tasks.

Why Should You Care?

A McKinsey & Company study estimates that AI technologies can increase labor productivity by up to 40%. The robot revolution hasn’t started quite yet, but the productivity gains in the next several years could completely reshape the global workforce.

AI technologies like Salesforce Einstein can help your best employees eliminate repetitive work, giving them more time to work on higher value creative and strategic efforts. Examples of specific Salesforce customer success include:

- 35x increase in lead conversion of top-ranked leads

- 20% increase in sales rep productivity by reducing manual data entry

- 56% increase on open rates on new product emails

Additionally, AI technologies go beyond simple automation or robotic process automation by being able to consume data and derive independent and strategic context. For example,

Salesforce CEO Marc Benioff already uses the Einstein smart assistant in his Monday morning executive meetings:

“We have our top 20 or 30 executives around the table. We talk about different regions, different products, different opportunities. And then I ask one other executive their opinion, and that executive is Einstein.

And I will literally turn to Einstein in the meeting and say, ‘OK, Einstein, you’ve heard all of this, now what do you think?’ And Einstein will give me the over and under on the quarter and show me where we’re strong and where we’re weak, and sometimes it will point out a specific executive, which it has done in the last three quarters, and said that this executive is somebody who needs specific attention during the quarter.

I have the ability to talk to Einstein and ask everything from product areas I should be focusing on, geographies I should be focusing on, the linearity of bookings during the quarter. Every question I could possibly have, I’m able to ask Einstein.”

The above example really opens your eyes to not only the possibilities for AI technologies in the future, but also what they can already achieve today. A few industry specific ideas:

- Fund of Funds Portfolio Manager: Einstein, I am visiting Palo Alto next week to meet ABC Capital for a potential new investment. What are the top fund prospects I should also try to meet while I am there?

- Asset Manager Investor Relations: Einstein, we are launching a new 40-Act fund next year. Who are the investors I should target first?

- Commercial Bank Institutional Relationship Manager: Einstein, I have a monthly client meeting with XYZ Asset Management today. What is the client temperature and key insights?

The Bottom Line

The future of the new digital workforce is deeply intertwined with AI technologies like Salesforce Einstein. We are currently reaching a tipping point where many of these technologies are within reach but understanding how to leverage these tools within your unique organization will be key to maximizing your ROI.

Getting started with an AI platform can seem daunting, but FinServ can help you seamlessly plan for and implement these technologies to suit your unique firm needs. Our expertise in data, systems, and strategic consulting ensures that our clients receive tailored recommendations for the right AI solutions they need.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Enabling the Mobile Workforce in the Alternative Asset Management Industry

It is estimated by the International Data Corporation (IDC) that the number of U.S. mobile workers will rise from 96.2 million in 2015 to 105.4 million in 2020. By the end of 2020, IDC expects mobile workers to account for 72.3% of the total U.S. workforce.

With the technological advancements and proliferation of smartphones and cloud-based applications, the way we work is rapidly changing. The workforce is no longer tethered to the traditional PC or to the confines of a physical office, creating a truly virtual work environment. It is estimated by the International Data Corporation (IDC) that the number of U.S. mobile workers will rise from 96.2 million in 2015 to 105.4 million in 2020. By the end of 2020, IDC expects mobile workers to account for 72.3% of the total U.S. workforce.1

Asset managers are in a great position to take advantage of this trend, as their workforces are especially mobile for several key business reasons. Fund executives and support personnel frequently travel to different financial centers and investor locations to attend investor roadshows, industry events, sales meetings, board meetings, etc. It is critical that these employees have remote access to the firm’s systems, data, and documents in real-time while being updated by coworkers.

The Challenge

While all these leaps in technology are great, the move to the mobile workforce has created a conspicuous weakness in the infrastructure of many of the world’s most influential asset managers. Many funds are only now shifting their focus to cyber security for their mobile devices. As the mobile workforce multiplies, so too will cyber-attacks on the mobile device and on your workforce. With many funds allowing their employees to Bring Their Own Device (“BYOD”) to work, the challenges are even greater.

Cyber criminals target security weak points and the mobile device is a prime target. In 2016 alone, 36,601,939 records were exposed due to a data breach.2 Allowing your team to access your data while working remotely can create a real security issue if your infrastructure is not set up correctly to protect against the most sophisticated hackers. In today’s environment, you need to follow where the work is being done and empower your employees to do so. At the same time, the firm and its investors must be protected at all costs.

Are you willing to risk your fund’s future by putting your investment data, and your client’s data at risk? In 2015, the Global Cost of Cyber Crime was Estimated at $315 billion dollars.3 The monetary damages in the form of actual money stolen or fines levied by the SEC is quantifiable at a point in time and can be managed. The damage to your fund’s reputation is not fully quantifiable, and the fallout would be nearly impossible to manage. Loss of investor faith will cripple your ability to raise new funds and would likely lead to a flood of redemptions. There are two clear opposing issues here:

- The protection of your firm’s data at all costs, and

- The need to ensure that your team can operate as efficiently as possible while they travel.

Consider the scenario where your Head of Investor Relations travels abroad to meet potential investors from a sovereign fund. Is your company secure enough to prevent a data breach or prepared to take action if one of these events occur?

- The employee’s phone with company apps or data is lost or stolen.

- Your company’s email or CRM system is accessed through an insecure or jailbroken phone with a known security vulnerability.

- The employee saves a file attachment received via company email to the hard drive of a PC at a hotel business center and does not delete it.

- The employee accesses company data over public Wi-Fi that is inherently not secure.

Many firms are limiting what their travelling executives can access while they are on the road, or requiring them to remote in through limited access protocols like VPN or Citrix. The main question is, can any fund afford to limit what their Head of Investor Relations can access while they are on the road, at meetings with key investors? Maintaining this productivity could be the difference in securing a new Investor for your fund.

The Solution

The good news is that these and many other threats can be handled with the right security package and many are available in the marketplace. In Gartner’s 2016 Magic Quadrant for Enterprise Mobility Management Suites report, these security packages are recognized as Enterprise Mobility Management (“EMM”) products. EMM products provide a comprehensive security package that secures your firm on all data entry points while enabling employee work mobility.

Microsoft Enterprise Mobility Suite

FinServ Consulting has found that Asset Managers are primarily Microsoft-centric in that their infrastructure is Windows based, their productivity suite is Microsoft Office, and their email is on Outlook. With the core systems using Microsoft products, Microsoft’s Enterprise Mobility Suite (“EMS”) security package is a natural fit for these organizations.

Microsoft’s EMS product consists of several components acting together to leverage Microsoft technologies to form a more comprehensive framework (as shown below) to protect your organization’s data while providing employee mobility.4

| Microsoft Solution | Key Features | Description |

| Azure Active Directory Premium |

|

Microsoft’s Mobile Identity Service, with Single Sign-On (SSO) enabled will require you to sign in only once. Once you log into your Windows account, you will be authenticated through to the rest of your applications such as Office, Salesforce, and Dropbox. Remembering or having to create multiple passwords with varying security requirements — like special characters, uppercase letters, numbers, password length — is replaced with 1 secure password to remember. |

| Intune – MDM |

|

Intune Mobile Device Management (MDM) enables your mobile device to work on your company’s network without the need for VPN, Citrix, or other cumbersome remote technologies. MDM ensures that your mobile device is authorized and meets security requirements (e.g. device has not been jail-broken). MDM ensures that if your device is lost or stolen, the device can be wiped (data and applications erased remotely). If a person has left the firm, the wipe can be selective, erasing only company data and leaving personal data (such as personal emails or photos) intact. |

| Intune – MAM | Secure Office Apps on Your Phone or Tablet |

Working on your mobile device will most likely entail needing access to your Microfost Office apps such as Outlook, Word, or Excel. Microsoft’s Intune Mobile Application Management (MAM) is currently the only service that can manage and enable mobile access to Microsoft Office applications. |

| Azure Rights Management Premium |

Secure File Content Information Rights Management (IRM) |

Microsoft’s Information Protection SErvice provide Mobile ocntent management functinonality tha twill protect you and the firm by protecting the files on your divce. |

Conclusion

Microsoft offers a full EMM security platform that will support your organization today and tomorrow. As the mobile workforce continues to transform the way your employees work and interact with your firm’s data, it is critical to keep the mobile workforce productive and secure your firm data. Microsoft’s EMS is a comprehensive security package that offers a tight integration with the Microsoft family of products that competitors cannot match. FinServ is a Microsoft certified partner. To learn more about FinServ Consulting’s Microsoft and Enterprise Mobility Suite expertise, please contact us at info@finservconsulting.com or (646) 603-3799.

References

(1) IDC Forecasts: U.S. Mobile Worker Population to Surpass 105 Million by 2020

(2) Identity Theft Resource Center: Working to Prevent Internal Data Breaches

(3) Financial Times: Asia hacking: Cashing in on cyber crime – Attacks cost Asian companies $81bn last year. The region is even more vulnerable to new scams

(4) Microsoft: Enabling mobile productivity for iOS, OS X, and Android devices at Microsoft

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

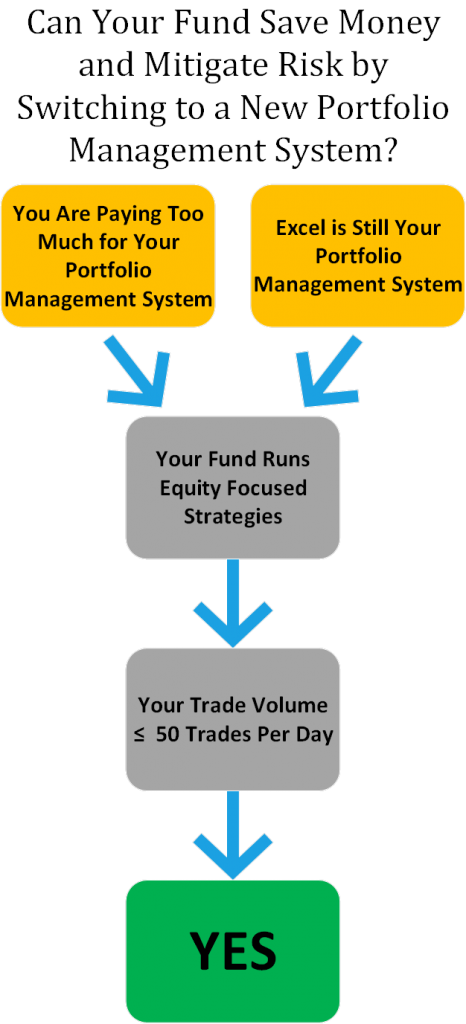

Now Is the Time to Get an Affordable Trading Platform for your Fund

A new set of enterprise level trading systems has been added to the marketplace with much more reasonable price points. Funds that have been holding off on implementing an enterprise-level system to manage their Execution Management (“EMS”), Order Management (“OMS”), Portfolio Management (“PMS”), Fund Accounting and lite Risk requirements should consider re-examining the market for the best options. Despite the lower price point, these applications offer robust core functionality for funds with moderate trade volumes. These systems also offer true straight through processing (“STP”) for many types of equity focused funds. FinServ is seeing an increase in its client base of hedge funds looking towards more cost-effective Portfolio Management platforms.

The majority of these offerings are coming from new software firms in the marketplace. Historically, the biggest challenges of implementing software from startups, or relatively new firms has been a lack of maturity, or the inability to cover certain asset classes. Since many systems were built for one specific fund’s assets or business approach, it often proved far too challenging to take the software that worked well for that one fund and extend its functionality to cover the multiple asset classes and potentially higher volumes that a more complex or larger fund would have. While some of these challenges still exist, and you have to assess each new product independently, many of the latest offerings have passed FinServ’s intensive vendor selection reviews.

Our clients are finding that the cost savings are compelling enough to choose an up and coming software provider over the old stalwart trading platforms that come with a very high price point and here are some typical price point differences we are seeing:

The majority of FinServ’s clients that have a long/short strategy or are lower volume shops, are a good fit for these new solutions. The following topics highlight key areas that will indicate if your fund is a good fit for these systems:

Product Mix – Historically, derivative and hedging, or more exotic asset class support were missing in the newer software choices. Now, the asset class and derivative coverage exist from the majority of these vendors. It is important to note that, as these companies mature, there is some flexibility and patience required, as the asset types are expanded. However, for many of our clients, the cost savings are worth the investment and time required as new functionality is built out.

Trade Volumes – High trading volume shops are not a good fit for these systems because these newer systems cannot currently support the performance demands of the very high transaction flows. However, for funds with trade volumes between 10 and 200+ trades on a weekly basis, who do not trade exotic asset classes, these funds are a good fit for the newer systems in the marketplace.

What is Driving Funds to Require a Portfolio Management System

A number of our clients are anxious to move off Excel, as they see Excel-based systems as a major operational risk. The move is being driven by funds who don’t like to rely on their administrator for reporting that is critical and urgent to their day to day operations. Historically, funds with anything but a very simple mix of asset types did not have many options besides the high cost of systems like SS&C’s Geneva. Now, these funds can choose from a handful of well architected and efficient platforms that can support: Execution Management, Order Management, Portfolio Management, Fund Accounting, lightweight Risk Management & Compliance, as well as Reconciliation functions all under one application.

| Topic | Historical | Current |

| Desire for Real Time Reporting |

|

Even our smaller clients are moving to shadow accounting for multiple reasons:

|

| Meeting Regulatory Requirements |

|

Investor Demands

|

| Reducing Operational Risk |

|

Leveraging a portfolio accounting platform to reduce operational risk by interfacing directly with market data providers, brokers and counterparties

|

| Simplifying Operations & Technical Infrastructure |

|

The new software companies are offering a true straight through processing (“STP”) experience that allows a fund to go from the front to back office with one system. Support true Portfolio Management System capabilities including tagging at the trade and security level for P&L and exposure reporting Pre and Post trade compliance capabilities are now an out of the box feature of most of these systems Key Advantages of 1 system – Front to Back

|

In the following case study FinServ highlights one of our most recent clients who made the move to a new system:

| Case Study – How One Fund Added Shadow Accounting & Automated Reconciliations |

|

A Long / Short Equity shop with over $2B AUM was looking for a shadow accounting solution that would allow for daily reconciliations with its Third Party Administrator’s (“Admin’s”), Prime Broker’s (“PB’s”), and Counterparties and would provide day T+0 reporting to assist with portfolio exposure analysis and same day P/L analytics. The existing process included manual daily reconciliations consisting of logging on to websites, manually transcribing position, market value, and cash balances and comparing these records to the Admin, the street and internal records. This process was error prone, time-consuming and placed a huge reliance on their fund administrator. If new counterparties were added, it compounded the issue and placed an undue burden on the fund accounting and operations staff. The fund began looking for an in-house portfolio accounting solution that would not only allow for a full shadow, but could assist with the reconciliations and reporting requirements. The fund contracted FinServ to assist with the selection. The requirements called for a solution that could be hosted to reduce the burden on the limited internal IT support staff. The system also needed to be capable of supporting asset classes including CDS, CMBX, TRS and several Fixed Income products. In addition, the fund anticipates expanding its asset class to include Bank Debt and other Credit positions in the near future. The system also needed to be integrated with their existing OMS, downstream reporting software and potentially a future treasury, data warehouse and risk application. FinServ documented the existing infrastructure and created future state diagrams depicting the optimal end state. FinServ conducted multiple interviews with the fund operations and accounting staff to understand the key user requirements and current pain points. After a thorough selection, which included a detailed cost analysis, the fund and FinServ selected Enfusion’s Integrata Fund Accounting solution. FinServ and Enfusion took the lead to setup the fund’s structure, load opening balances and connect with the Order Management System (“OMS”). The fund’s admin, prime broker and several counterparties were interfaced directly in the system and reconciliation functionality was established to highlight differences with cash, market value and position data. Financing agreements were established for each unique Swap to automate the daily financing accrual. In addition, Bond interest, Dividend and other automated interest entries were established. An interface with Bloomberg Data License was put in place so prices could be snapped throughout the day. Positions and Cash balances were reconciled with the Fund Admin’s NAV packs. Trade data received from the OMS is reconciled daily. Reconciliation activities which used to take hours each day are now automated. Breaks are identified immediately and remediated. Reporting is now available the same day and includes daily calculations that were previously only accessible at month end. In addition, wash sales and other tax lot reporting is more accessible and allows for more informed trading decisions. Future phases will see Enfusion feeding the OMS with start of day positions and feeding downstream reporting applications which are currently fed by the administrator. Enfusion was the right choice for this fund which is enjoying greater flexibility, increased accuracy and quicker access to data.

|

How FinServ Can Help

An experienced integrator can make a huge difference in your implementation. Pointing out areas like where you can save significant costs with your software provider is just one key area where the right partner will make a massive difference to the success and ultimate cost of your implementation. A partner like FinServ will also make sure you consider all aspects of your business. It is important to not only consider existing needs but also understand where the firm may be headed in the future.

Our clients have found significant benefits in both cost savings and overall operational efficiencies through implementing many of the new Trading Platforms. Even smaller funds now require in-house systems and have a strong desire to eliminate external reporting dependencies. The greatest barrier against undertaking a project of this size and complexity is often the availability of key staff. FinServ has the capability to provide investment fund best practices, subject matter expertise, and a hands-on approach, to ensure your project can be implemented successfully without jeopardizing the daily and monthly responsibilities of key staff.

Strong project management and a tried and true systems integration methodology are also critical to a successful systems implementation. In the past 12 years, FinServ Consulting has saved our client’s millions of dollars by delivering each project we perform, on time and on budget. While the new software companies have strong technologists and architects, they still lack a focus and expertise in core project management and often get distracted trying to manage too many clients at one time. Our clients usually run very lean and having a member of their firm shift all their responsibility to a full-time project is not feasible. By having a consultant who is dedicated to the project and stays on top of all open items including managing the software vendor, we find that projects are completed in a fraction of the time of other implementations where no dedicated consultant is utilized.

Our team can help you determine if you are a good fit for one of these systems and help to estimate the costs and time for your implementation. For more information, please feel free to contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Top 6 Lessons Learned From Clients Who Have Been Through an SEC Audit

In line with our new tag line, “Don’t be a Target”, FinServ would like to provide some insight we have gained from our clients who have had the unfortunate experience to go through an SEC Audit. In many conversations we have had with our clients over the past year the concern of an audit has been on the top of many of their minds. Many have gone thru mock exams or SAS 70 Type II testing. Here is what we hope is a list of helpful hints if you have to go through this process.

1. Resist the temptation to educate the audit staff – The auditing staff just like any audit team will undoubtedly be staffed by a group of very junior inexperience yet intelligent team of staffers. However you should resist the maternal or paternal instinct to educate these individuals. Remember they have a job to do which is to uncover issues in your financials or trade history. You should answer specific questions that the staff has about the information you provide them but resist elaborating or providing lectures on various tangential topics.

2. Educate your employees – A large part of the audit will focus on your policy and procedures and whether the team actually follows them. It is critical that in advance of the audit you ensure that your policy and procedures are up to date and that all employees have reviewed them and are familiar with the policies and procedures that apply to their area.

3. Accept the fact that they will be with you for a while – You should avoid trying to take steps to attempt to rush the auditors. You must remember first and foremost that these workers likely have no specific deadline for finishing your audit and they are not overly motivated to work extra hours so expect them to work 9 to 5 each day and be with you for a while. The best tact you can take to getting them out as quickly as possible is to provide the information they request in a quick and well organized manner. Again only providing exactly what they ask for. Having systems that can provide custom reports is critical so you are not spending hours on end attempting to modify excel files. Reports that come from a specific data source will appear much more reliable than you providing them with excel files as well.

4. Plan now for a major drain on your key staff members – If you don’t have a fully automated set of systems that can produce all the

possible requests at a moment’s notice (and very few people do) you need to plan ahead so you can keep the lights on with your critical operations as the auditors drain your team’s time.

5. Be well-prepared – When you receive the notice that you will be audited you should be as prepared as possible for the team arrival. Hopefully you have the systems in place to produce the data they management system). However if you don’t the best thing to do is start dedicating your internal team’s time to getting this data well organized and together as quickly as possible. No one ever said I wish I wasn’t so prepared, but plenty of people have said I wish I was more prepared.

6. Don’t give them a closet to work in – Avoid the temptation to try to place your auditors in the most uncomfortable location possible. While this may seem like a great idea and you may think this will motivate them to leave as soon as possible. The reality is, as noted earlier, they are with you for a specific purpose and cannot leave before that job is done. Below is a sample SEC Exam Documentation Request List to give an idea of what type of questions will be asked, most of which our clients mentioned : Sample SEC Request List

- Trade Data

- Operational Data – Valuation & Supporting Workpapers

- Reconciliations & Controls

- Separation of Functions

- Independence from your third party administrator (TPA)

- Brokerage Data

- Proof of Best Execution

- Client Info (Value added, conflicts)

- Corporate Record

- List of Service Providers Paid

- Confidential Agreement with Service providers

- Political Donations

For more insights and industry best practices, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

The Slippery Slope of Hedge Fund Regulation and Enforcement

With respect to accounts for calendar year 2009 and earlier, U.S. investors don’t have to report large holdings (exceeding $10,000) in offshore hedge funds and private-equity firms this year under disclosure rules designed to detect offshore tax evasion and money laundering.

In a recent Feb 26th Bloomberg article titled ‘Hedge-Fund Assets Offshore Exempt from Reporting Rule’, the Internal Revenue Service said “with respect to accounts for calendar year 2009 and earlier, U.S. investors don’t have to report large holdings (exceeding $10,000) in offshore hedge funds and private-equity firms this year under disclosure rules designed to detect offshore tax evasion and money laundering.” (more…)

Tighter Restrictions on Banks – Will Hedge Funds and Private Equity Funds Benefit?

Restrictions on big banks could boost possible benefits for hedge funds and private equity funds. The Regulatory Reform package and other bills such as the “Volcker rule” could push investors from big banks towards their funds instead. The Volcker rule is a plan to ban proprietary trading. Another key element in the rule is to limit banks involvement with hedge funds and private equity funds. The current Administration is not making sufficient efforts to limit the size and risk profiles of banks. A goal is to stop Wall Street banks from gambling in markets with subsidized deposits. This is good news for hedge funds and private equity funds.

Hedge Funds and Private Equity funds will definitely have a chance to absorb former bank investors when tighter restrictions are levied against the big banks. Current bank investors will either get spooked from the new regulations or will be forced to seek other options because of new regulations. This now gives hedge funds and private equity funds more potential investors and ultimately more power. These investors will not hesitate to move to hedge funds and private equity shops outside of the big banks. An investor’s main interest is to make money and are they willing to take the risks inherent with these types of firms.

The main impact will be proprietary trading. Markets will become less liquid which in turn means wider spreads and higher costs for investors. This may be something some investors feel is worth paying for – a safer banking system. What will most likely happen are proprietary traders will move to hedge funds.

If hedge funds do not already have proprietary trading strategies, it would be wise for them to start getting into that business or increase their current proprietary trading desks. Fund subscriptions are likely to increase. Private Equity funds will also be able to take advantage if big banks are forced to dissolve or separate their private equity arms. Private equity funds will most likely see an increase of investors to their funds. Therefore, more money will start to flow into these funds that are leaving the banks.

The larger funds will get bigger and other small to medium sized funds will start to adapt and create new strategies in order to accommodate new investors and new positions.

During President Obama’s State of the Union address, he made a remark about how the bank bail-out was “as popular as a root canal.” He vowed to take on lobbyists who are trying to stifle financial reform and that it is a fight he is willing to have. For President Obama, bank bashing is good politics for him now especially after the bruising he has taken on Health Care reform.

Previous financial reforms have had some unintended results. Regulation Q was a reform that restricted the interest rate that banks could pay on deposits. Many investors ended up in the Euromarket and with money-market funds where dollars were then accumulating outside of the US. Enforcement of the Basel Rules was another example. This was an incentive for banks to hold AAA rated securities which required less capital to be held against them. Eventually, there was a shortage of AAA rated bonds. The financial gurus then devised complex securities called collateralized debt obligations (CDO’s) based on sub-prime mortgages. CDO’s did not have a happy ending.

In conclusion, big bank reform will have benefits for hedge funds and private equity funds. When investors move away from big banks, hedge funds and private equity funds will be sure to grow. Investors will invest more in these funds where regulation is not as stringent yet. This leaves one final question for the readers. Will the unregulated hedge funds and private equity funds pose a financial systemic risk in the future that will cause regulatory authorities to second guess themselves if another financial crisis occurs in the future? Only time will tell. For the near term, hedge funds and private equity funds will be sure to capitalize on bank reform. To learn more about how FinServ Consulting can assist your firm amidst these industry reforms, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.