Should Investment Firms Outsource their Salesforce Administration?

Compared to hiring an in-house team, managed service providers will almost always generate a more immediate benefit for small and mid-sized firms. These benefits include a reduction of administrative burden, access to a wider breadth of Salesforce expertise, and the implementation of key industry benchmarks.

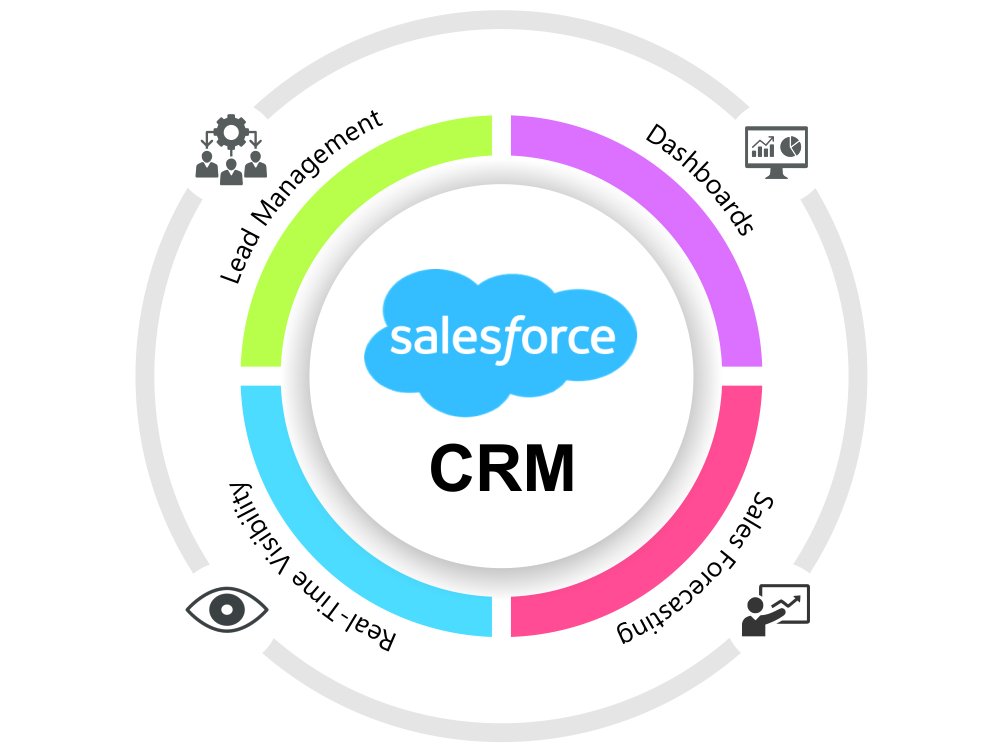

Private equity firms and hedge funds of all sizes should leverage customer relationship management (CRM) software to drive fundraising, maintain investment pipelines, and establish seamless operational processes. Salesforce is the leading and best CRM platform to help you achieve these goals. Each organization that uses Salesforce has its own instance that can be customized in powerful ways to meet its investor relations and operational requirements. Because of Salesforce’s customizable nature, specialized skill sets are required to get the most out of the application. This means that the firm’s size will dictate the resources required to ensure its Salesforce instance is utilized to its full potential.

As smaller firms grow their assets under management (AUM), it often finds that Salesforce will require more customization to meet its growing needs. Additionally, the administrative burden of managing users, data, and the user interface will grow beyond what most small firms can provide without a dedicated Salesforce resource. These firms then find themselves at a crossroads. Do they assemble a team internally to maintain the system, or do they engage with a managed service provider?

This article details the pros and cons of both options and outlines how FinServ’s Salesforce managed service can immediately benefit growing firms.

How to Know When You Are at The Crossroads

A few key indicators often arise when a firm has outgrown its current Salesforce administration process. The factors listed below highlight the most common reasons that firms need to reevaluate their current approach.

Data and Reporting Gaps – Salesforce has a powerful, user-friendly reporting engine that is relatively easy to leverage to gain huge benefits and invaluable business insights. However, the way that your Salesforce data is set up and organized will dictate how much value you will get from your reports. Therefore, it is critical that when first designing your system, you have a specialist who understands alternative investment data as well as Salesforce data modeling. Leveraging a managed service provider like FinServ, a Salesforce partner specializing in alternative asset management, ensures your success at this critical step.

Administrative Burden – New user creation, access management, user deactivation, and user profile customization are just a few of the day-to-day tasks that need to be carried out. Salesforce has one of the most powerful security models in the software marketplace. It allows you to ensure users only have access to the data they require while ensuring compliance with all regulatory agencies. However, with this power comes a level of complexity that requires someone who has been trained in Salesforce’s security model. Trying to use an internal team member without the proper training and expertise could be costly, not just because of compliance issues but also because of the amount of time they will spend trying to configure the system. Using a Salesforce-certified administrator will help to ease this burden at a reasonable cost.

Automating Key Business Processes – Salesforce has an incredibly powerful workflow engine called Flow, which can be used to automate your most important business processes. However, setting up the automation requires specific Salesforce skills and some development-level expertise. In addition, FinServ consultants have the advantage of seeing many other private equity and hedge funds and knowing how they have automated their key business processes. Leveraging best-in-class solutions provides priceless benefits to your firm.

Lack of Integrations – Often internal firm resources will not be aware of other 3rd party applications available through the Salesforce App Exchange that can quickly and easily enhance the power of the Salesforce instance. Since your managed service provider is a Salesforce Partner who spends their time making sure they are up on the best solutions in the Salesforce environment, they are in the best position to recommend cost-effective 3rd party applications to integrate with your Salesforce environment. Integrations with commonly used generic systems like SharePoint Online, or industry systems like Preqin are critical to ensuring your Salesforce instance is operating in the most efficient way possible. If your firm’s Salesforce instance lacks key integrations, engaging a managed service provider like FinServ will provide an immediate benefit.

What Does a Salesforce Managed Service Provide?

In order to compare a managed service provider to in-house resources, the scope of the provider’s services must be outlined. A Salesforce-managed service provider will generally perform the tasks listed below:

| Category | Description |

| Account Maintenance | This category includes responsibilities such as new user setup, access management, account deactivation, and many more day-to-day tasks the firm would typically perform internally. |

| System Configuration | Growing firms often require the creation of new objects, fields, and other metadata within Salesforce’s structure that can be utilized to store and report on data. This can be as simple as a basic object with only a few fields or involve complex structures such as many-to-many mappings and junction objects. |

| Systems Integration | Managed service providers will help your organization integrate Salesforce with other software such as SharePoint Online, Google Cloud, Teams, Preqin, Slack, and many more systems. This service will greatly increase operational efficiency and decrease the time spent switching between software platforms. |

| Data Management and Backups | Proper data management and backups are necessary aspects to ensure your firm has a disaster recovery plan. Managed service providers will ensure your data backups are running properly. Additionally, they will assist with loading data into Salesforce from Excel spreadsheets and other sources. |

| Customization | Customization can entail many aspects, including creating unique dashboards, generating reports utilizing custom objects, developing automation workflows, coding various lightning web components, and much more. However, depending on the scope of the customization, these projects might fall outside of the purview of the managed service agreement. In these scenarios, firms can engage their providers to perform an a la carte project for in-depth customization. |

While many firms without dedicated Salesforce resources can handle their account maintenance and some aspects of their system configuration in-house, most do not have the expertise to deal with the other aspects included in a managed service agreement. Some of the largest firms may choose to hire a dedicated Salesforce resource or build out an entire team. However, hiring dedicated resources is not always a feasible option for firms that are growing rapidly from small to mid-sized. This is the most common scenario in which FinServ’s Salesforce-managed services can provide an immediate benefit.

Overview of Managed Services Compared to In-House

The table below analyzes utilizing a managed services partner compared to developing an in-house team to maintain your Salesforce instance. These are all factors to consider when surveying your potential options.

| Category | Managed Service | In-House Resources |

| Cost | Utilizing a Salesforce-managed service offering will almost always be more cost-effective compared to hiring dedicated resources. This is partially due to the greater flexibility that managed services allow for. | Hiring dedicated resources will lock you into a fixed-cost expense. Generally, this will lead to a higher annual cost and the potential for more wasteful spending. However, if your organization is large enough to have a consistent stream of work, dedicated resources may make more fiscal sense as compared to small or medium-sized firms. |

| Hiring and Selecting |

Managed service firms like FinServ Consulting can provide various Salesforce certifications, qualifications, and case studies to assure your team that they have the necessary skill set and resources to handle all your needs. FinServ, unlike most Salesforce partners, possesses extensive experience in the alternative asset sector and has a deep understanding of the specific Salesforce requirements for that industry. Using a Salesforce partner who does not understand your business is a costly mistake most funds make. |

Hiring internally can be a bit more challenging for various reasons. Candidates should be able to provide their Salesforce certifications; however, it is difficult to attract and vet experienced candidates possessing knowledge of how Salesforce should work within your specific industry and sub-sector. This process will generally take longer than hiring a managed service firm and will involve a training period in which the new hire will not benefit the firm. |

| Expertise |

Managed service firms employ various resources that cover a wide breadth and depth of expertise. This means that your firm will benefit from the diverse pool of knowledge that will be available when they sign up for a managed service agreement. The provider can always assign the most suitable resource to complete the required tasks. |

The breadth of expertise comes down to the capabilities of the in-house staff. For small or mid-sized firms, their limited in-house teams may not have the expertise to take on some of the more arduous tasks required. Larger firms can more easily employ larger teams and, therefore, diversify their in-house expertise. However, leveraging a diverse team through a managed service provider is much more cost-efficient. |

| Scalability |

The demands of maintaining a fully utilized Salesforce instance are not uniform. There are months when little maintenance is needed other than data backups and user administration. However, there are other periods in which more in-depth services are required. A managed service provider will always be more beneficial in this scenario as contracts can allow for variable hour usage. |

In terms of scalability, in-house resources cannot compete with managed services. Due to their fixed-price nature, firms need to have a consistent stream of work in order to utilize their staff fully. Additionally, when bigger projects with greater requirements materialize, these firms may also need more resources on a short-term basis and may be forced to outsource at that point. |

| Benchmarking |

Due to its expertise in the alternative investment industry, FinServ’s Salesforce managed service offering can help your team determine best practices used by the leading firms in the alternative investment space. FinServ will provide strategic guidance that will enable your processes to run smoothly and allow your firm to enhance the efficiency of those processes. |

The benchmarking provided by your internal resources will be entirely dependent on their individual expertise and past experiences. Typically, in-house benchmarks are less rigorous than those adopted by an experienced Salesforce administrator, potentially compromising the firm’s performance. |

Conclusion

Recognizing when a lack of proper resources is limiting your alternative investment fund is critical. Once the firm has come to this realization, the next step is to engage a managed service provider or build a proper in-house team. Compared to hiring an in-house team, managed service providers will almost always generate a more immediate benefit for small and mid-sized firms. These benefits include a reduction of administrative burden, access to a wider breadth of Salesforce expertise, and the implementation of key industry benchmarks. Additionally, engaging a managed service provider is more cost-effective and allows for greater scalability. Growing firms will have their service grow along with them, which reduces wasteful spending and potential resource chokepoints.

FinServ Consulting is an experienced Salesforce partner and managed service provider who is always available to help growing firms identify their best path forward for Salesforce administration.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

The Great Debate: Agile or Waterfall Project Management

Effective Project Management

Effectively managing a project and team(s) is a difficult task that faces increased challenges in a remote environment. Obstacles are exacerbated by the lack of in-person collaboration and the inability to stop by a colleagues desk for a quick and informal update. However, selecting the correct project management methodology can help alleviate numerous issues and ensure that your project is completed successfully.

Agile & Waterfall Methodology Overview

No project management technique is best suited for all situations. The most common methodologies are Waterfall and Agile. Although both approaches are popular and have been around for an extended period of time, specific projects are better suited by one or the other.

The Waterfall methodology is the traditional and sequential approach that is best for projects with a well-known scope likely to experience minimal change. Client input takes place at milestones as the project transitions throughout the various phases. In a Waterfall project management strategy, each phase must be completed prior to transitioning to the following phase. These phases are clearly outlined and define clear objectives that must be accomplished before progressing.

As indicated by the name, an Agile methodology is designed to accommodate change. Its iterative nature focuses on completing certain objectives by the end of a specified time period known as a sprint. Agile methodologies are well suited for projects with unclear initial requirements. The methodology prioritizes the most important aspects of a project and relies on continuous client input throughout the engagement. Deliverables are reviewed by the client and other applicable teams after their corresponding sprint.

Advantages of Each Method

The Waterfall approach’s numerous advantages derive from its structured nature. The first of which, is that it clearly defines all aspects of the project and ultimately increases planning accuracy and detail. Consequently, this approach aligns well with fixed price contracts and government entities. Furthermore, progress can be measured through the completion of each phase as opposed to a product backlog that hasn’t been addressed.

It is less reliant on client input because it is predominantly collected at milestones. This allows the client to take a hands off approach and focus on the day-to-day operations of their business. Finally, successful completion of projects managed with a traditional methodology ensures that all items are addressed and eliminates ambiguity.

One of the greatest advantages to the Agile approach is its flexibility. An Agile approach is particularly useful when the project’s timeline is strained because it prioritizes the most important features. The sprint structure aligns with Time & Materials contracts because sprints are predetermined timeframes that specify workload.

Additionally, constant client interaction augments quality via increased feedback, additional testing, and dynamic user requirements that account for evolving needs. The constant nature of client feedback allows for frequent modification of the product backlog. This is particularly useful for a technical client that wants to get a deeper understanding of the solution. They can work through their use cases and determine if their needs will be better served by an alternative route.

Disadvantages of Each Method

Although each method is effective in its own right, they are not without disadvantages. The Waterfall methodology requires a thorough understanding of business requirements prior to beginning. The Project Manager must have a clear sense of all client needs and initially account for them throughout the various phases. Scenarios where the client is unable to provide a comprehensive overview of the requirements may force the PM to “fill in the gaps” – which is far from ideal.

Another disadvantage associated with the Waterfall approach is the risk of a final deliverable that is not in line with client expectations. Given that the client is less involved in the process, they may be surprised by the end result. However, the traditional approach hedges against this with comprehensive requirements and periodic updates.

Agile method drawbacks tend to be associated with one of its strengths, frequent client input. It requires a significant amount of coordination and cooperation across multiple internal and external teams. While this is great in theory, it may be difficult in practice. Clients may not have the resources, interest, or expertise required for the Agile approach’s mandated involvement. This is especially relevant when the client outsources the work as they hired another firm to step away.

The adaptability of the approach leads to many changes in the project’s scope. These changes affect the project’s cost and timeline. Unfortunately, this is not feasible for certain clients and situations. Moreover, low priority items may not get completed within the original time frame due to a focus on high priority items.

Conclusion

In conclusion, both the Waterfall and Agile Project Management methodologies include pros and cons. In an ideal scenario, the project would be completed successfully regardless of the utilized approach. However, certain client types, engagements, and solutions are better suited by one of the two methods. It is critical that you discuss both options with the client and pick the one that they are most comfortable with. Many professionals blend the two techniques to benefit from each’s strengths while minimizing the drawbacks. Recent trends have increased popularity for Agile management, but it is beneficial to gather all available requirements as early as possible.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Securely Share and Work with Files in Salesforce

FinServ has partnered with a firm out of Germany to provide a seamless integration of SharePoint Online right in Salesforce. If you would like to see a demo, please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

The Nightmare Scenario you have to Avoid

Sweat is dripping down your brow and you have a queasy feeling in your stomach, it’s 2 o’clock in the morning and you are desperately trying to reach the person who your Investor Relations team accidentally emailed an investor (NAV) statement with the investor’s social security number in it. If you have shared a sensitive document with the wrong person, you know the sheer terror these moments can bring. We see the most sophisticated financial services companies in the world taken down by these types of mistakes all the time. Even if the email is retrieved the public relations fallout will likely cost you investors or in some extreme instances the shut down of your fund.

Given this risk, it is hard to believe that the majority of funds and other financial services firms are still not integrating their CRM systems with enterprise-level document management systems like SharePoint Online. At FinServ Consulting we work with 40 of the top 100 hedge and private equity funds in the world and very few of these firms currently use enterprise-level document management systems to protect their investor data.

The Quick and Easy way to Use SharePoint Online in Salesforce

Most Salesforce clients abandoned Salesforce Files a long time ago. Due to its lack of user-friendliness and severe limitations, Salesforce Files became one of the least-used features in Salesforce. At the same time, many companies have been moving to cloud-based office suites like Office 365 from Microsoft. With most Office 365 licenses, you get SharePoint Online for free. SharePoint Online is an extremely secure, cloud-based and feature-rich enterprise-level Document Management system.

Has anyone in your firm ever accidentally sent a sensitive document to the wrong client?

SharePoint Online has the ability to stop the recipient from opening that document even if they have already downloaded it onto their computer.

Inserting a Cloud-based Link to a SharePoint Online Document in Email

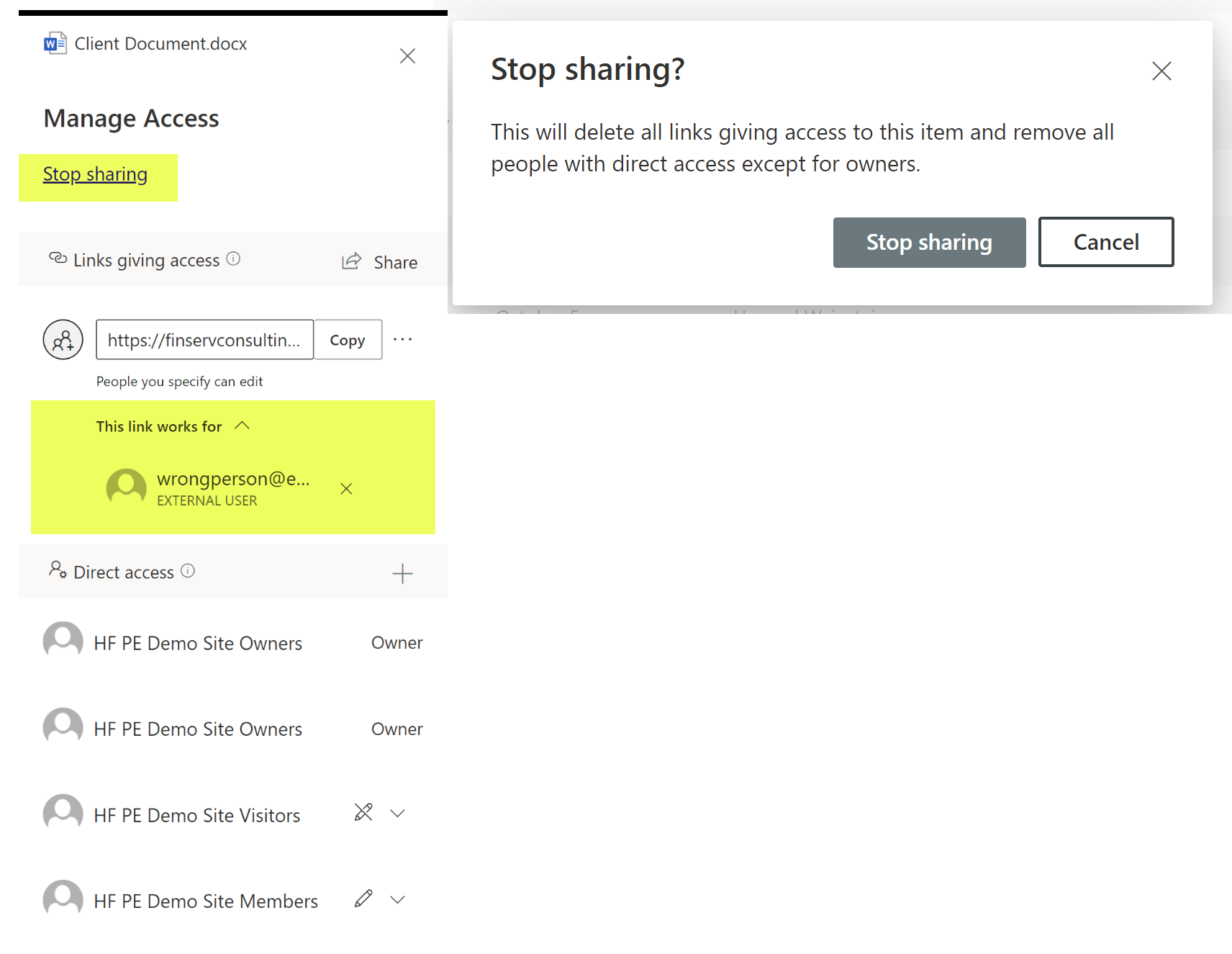

Removing Access Quickly

If you realize you made a mistake, you can stop the person from accessing the document you shared with just a couple of clicks. Even if they downloaded the document onto their hard drive, they will not be able to open the document thanks to Microsoft’s use of dual-key encryption. This means once you take away your side of the key, they can never open the document again.

2 clicks and access to the document is removed

Has anyone in your company ever accidentally or purposely emailed a file to an external recipient with Social Security numbers in it?

SharePoint Online with Outlook / Email integration means that you can stop any email or attachment from being shared if it contains sensitive info with PII (Personally Identifiable Information).

Particularly for highly regulated industries, like Financial Services and Healthcare, the built-in dual-key encryption and information rights management (“IRM”) features that SharePoint Online offers out of the box are “have to have’s”.

Microsoft PII Warning when Sensitive Data is Detected in a Document

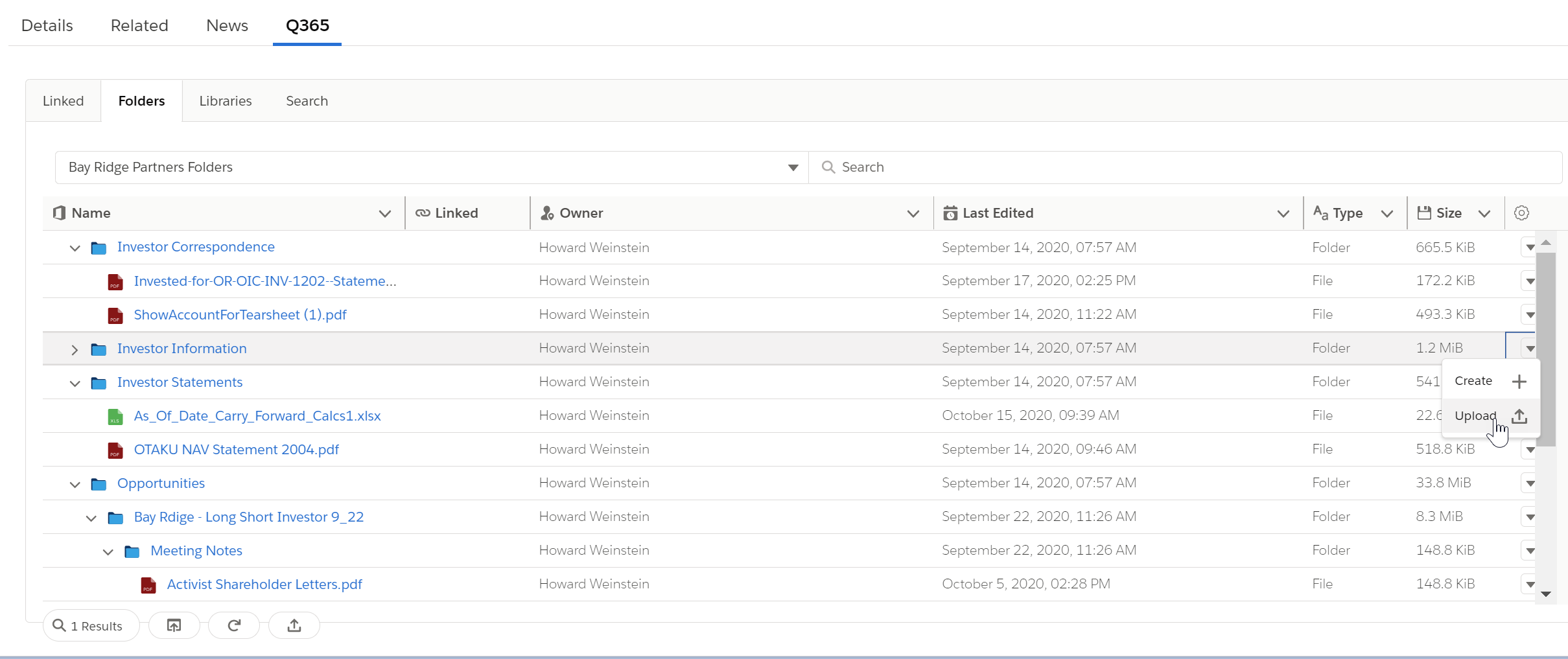

Seamless Integration with our Salesforce App

The application we helped build provides a seamless interface to all of your SharePoint Document Libraries and Files inside the Salesforce Lightning User Interface. The benefits of this application mean that your users will save hundreds of hours they used to spend searching through inconsistent folder structures and names or wading through multiple versions of a file to try to figure out which is the latest version of the file. By automatically linking the Files and Folders to your Salesforce records, you get your data and your files in one combined place to provide optimal efficiency for your team.

Through the application interface you get:

- 1-click to Open just about any kind of file so your team never wastes time with multiple clicks or waiting for a file to download before you can open it

- For Microsoft Office files where you have editor access, it will open up in the Office app in Editor mode

- You can upload files into the document library with 1-click as well

- You can also delete files if you have the correct access with 1-click

- Embedded search available right within the Lightning Component

Investor Relations Use Case

For our Alternative Asset Management clients, we offer the case study of the Investor Relations associate who often spends their day working with investors on questions. The ability to view the investor’s contact record while also looking at the investor’s latest NAV statement or recently updated subscription documents provides a level of efficiency that makes their day-to-day work much easier.

example of Investor Contact record with right sidebar of SharePoint Online Files

How the App Works

Putting the automated component into place is as simple as adding any Lightning Web Component; the interface offers quick and easy checkboxes to turn off and on key features in the application. Once added to any Object Type in Salesforce (standard objects or custom objects are all supported), the interface makes it simple and user-friendly to access your files and folders in seconds.

The quick and easy way to open SharePoint files right in Salesforce!

The application leverages advanced Microsoft technology to provide:

- Automatic creation of preset Folder and Subfolders that are automatically linked to the Salesforce record you just created or updated

- You can use the data in Salesforce to automatically name the Folder; this ensures a consistent naming scheme which will make it easy to find files

- For historical records, we offer automated scripts to create the Folder and Subfolders for all of your existing Salesforce records

Automatically Create a new set of SharePoint Online Folders and Link to your Salesforce Record with no Clicks when you create a New Salesforce Opportunity!

Conclusion

Using an Enterprise-Level Document Management system is a must-have for any company working in a regulated industry like Financial Services or Healthcare. SharePoint Online from Microsoft provides the most cost-effective and robust system in the marketplace. When you combine that with the Salesforce CRM system, you provide your users with a seamless and secure platform to work with customers while ensuring your company’s and your clients documents and data, including PII, remain secure.

The application FinServ has created with our partner provides the level of automation and seamless integration that your users demand and will also ensure they embrace the use of a Document Management system like SharePoint Online.

If you are interested in a demo or would like to purchase the application, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Technology Sets Its Sights on Private Equity

The evolution of technology and its impact across various industries has become widely accepted, particularly for Financial Services. However, Private Equity’s acceptance of new technology has lagged behind other subsectors. Resistance is subsiding as Private Equity Funds are rushing to adopt Client Relationship Management (“CRM”) tools, utilize unstructured data, and transition to the cloud.

Relationship Management

Success within Private Equity is reliant upon strong and enduring relationships that are difficult to manage without the proper infrastructure. Scattered data paired with a lack of centralized oversight can serve as a catalyst for inefficiencies that hinder deal execution and frequency. Efforts to combat the before mentioned issues have given rise to the popularity of CRM systems. Furthermore, numerous CRM solutions can be configured to streamline reporting and eliminate user error.

Although the absence of a CRM system can be detrimental to a firm’s success, a poorly configured system that fails to meet user requirements may be worse. Inadequate systems are generally accompanied by a lacking implementation partner that failed to assess the organization’s needs prior to vendor selection. It is crucial to enlist the services of an experienced implementation partner that has “been there, done that”.

FinServ has successfully implemented CRM solutions for countless Alternative Asset Managers and Financial Institutions. Not only are we a Salesforce Partner, but we also have significant experience with other industry CRMs such as Backstop, Clienteer, and Dynamo. FinServ can walk you through the entirety of the process by gathering business requirements, managing the implementation so you can focus on your business, and tailoring the solution to facilitate your unique procedures.

Data Utilization and Analytics

We are in the golden age of data and organizations are eager to leverage as much of it as possible. Unfortunately, sourcing data from a variety of locations often leads to a lack of uniformity and an assortment of issues. Private Equity firms are implementing robust analytics and data science for Transactional Due Diligence, Post-Investment Value Creation, and more. The application of data science within Transactional Due Diligence is exceptionally groundbreaking as perspective buyers are often subjected to tight timeframes of approximately 6 weeks.

Business Intelligence, Data Science, and Machine Learning allow Private Equity firms to conduct real-time analysis and assess billions of data records in a limited amount of time. Granular post-investment analysis can be attributed to geography, customer type, and more. The segmentation of the data enables a comprehensive understanding of the business. Thus, augmenting the Private Equity firm’s ability to perform the focused improvements that are central to their business model.

Exhaustive analysis of the fund’s overarching portfolio and individual companies hinges upon access to structured data. FinServ has the extensive Business Analysis and Operational Assessment experience that is required for structuring processes and data accordingly. We will partner with your organization to remediate operational issues while integrating innovative technology.

Transitioning to the Cloud

Cloud utilization is rapidly increasing as stigmas against housing data in off-premise locations have eroded. Private Equity firms are realizing the significant benefits provided by transitioning their data to cloud environments, SaaS, and IaaS locations. Migration allows firms to focus on their core competencies rather than hosting data. Cybersecurity is a predominant concern that will be alleviated by outsourcing a portion of the responsibility to an organization that exclusively focuses on housing internal and client data. Safeguarding this sensitive information is required for client safety, firm reputation, and regulations such as GDPR.

One consideration that may be inhibiting your organization’s migration to the cloud is the massive undertaking of doing so. FinServ has honed our data migration expertise through 15+ years of working alongside more than 40 of the world’s top 100 Hedge and Private Equity Funds. Communication is emphasized throughout our engagements and we will partner with your organization to ensure a proper and efficient transition. Furthermore, FinServ will take the opportunity to streamline processes and eliminate bottlenecks that have been hindering your business.

Even though Private Equity has been slower to adopt new technologies than other Alternative Asset Managers, the industry has begun to align with key initiatives offering indisputable benefits. The implementation of superior technologies like CRM systems, Cloud infrastructure, and the utilization of data for advanced analytics supplements competitive advantages and investor returns.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Prepare for the New and Remote Workplace

COVID-19 abruptly forced many financial institutions into a remote staffing model without the slightest inclination of its duration. Barring the infrastructural challenges, many employees have enjoyed the elimination of commuting, comfortable attire, and flexibility. The mandatory adoption of working from home will have significant implications for the daily trips to the office that were once the norm.

An Operational Assessment of your firm’s technology and procedures will identify issues that will be exacerbated by a sustained virtual workplace and provide insight into four verticals: Planning, Security & Controls, Collaboration, and Client Interaction. It is important to perform an exhaustive analysis of your firm’s technology and procedures to identify issues that will be magnified by a remote model.

Planning

The importance of planning is one of the few constants in today’s erratic climate. Many organizations are creating management teams and enlisting the assistance of third-party specialists to navigate these tumultuous times. Creating a specialized team will enable flexibility, establish accountability, guide the implementation of new technologies, and mitigate risks.

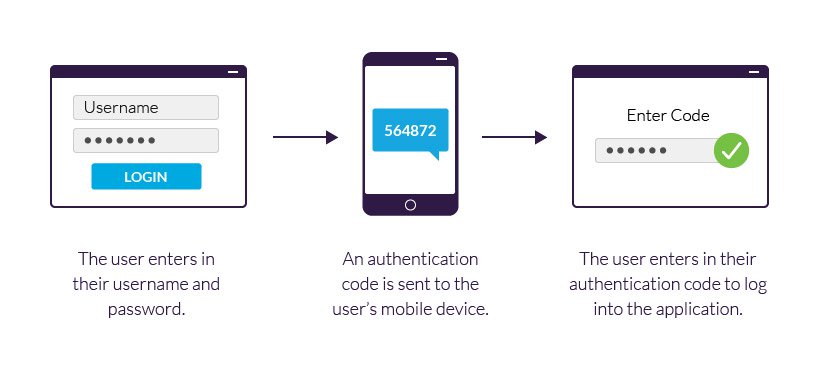

Security

The sensitivity of client data within financial services results in security being a predominant concern. One particular issue is numerous employees accessing company information with wireless networks beyond the organization’s control. The combination of unsecured networks and increased attacks from opportunistic deviants poses significant risk to financial institutions and their clients.

Furthermore, cybersecurity teams’ impeded ability to respond may affect their capacity to remediate issues in a timely fashion. Many teams are accustomed to face-to-face collaboration and/or additional resources that may not be available when working from home. Prevention is the best defense and can be achieved by conducting a detailed assessment of your firms processes and systems.

Establishing procedural controls and maximizing the native features of current technology will enable your company to stop attacks before it is too late. An effective defense for eliminating external access to company information can be as simple as utilizing 2 Factor Authentication or modifying a monthly process.

Collaboration

Collaboration is a major concern that inhibited employer’s from implementing a remote workforce prior to the pandemic. The recent success of remote work has assuaged worries and has even led banking heavyweights such as JPM and Barclays to consider the implementation of remote teams and/or rotational models. Rotational models are particularly attractive because they reduce fixed costs while balancing the benefits of in-person and entirely remote staffing models.

The short-term success of a virtual workplace will not persist if institutions fail to align their technology and operations accordingly. Video conferencing has emerged as the predominant medium for establishing virtual connections but has unfortunately been accompanied by a series of growing pains.

The sheer volume of concurrent employees leveraging the video conferencing system often overloads the solution if it was configured for a lower number of users. Additionally, various teams utilizing different platforms may result in access issues. Mass collaboration can be facilitated through the implementation of a uniform video conferencing system such as Microsoft Teams or a sophisticated document management system like SharePoint.

User error caused by a lack of sufficient training and limited employee access contributes to bottlenecks that can be easily avoided by partnering with an experienced implementation partner. Although the days of side-by-side spreadsheet collaboration may be behind us, teamwork can be augmented with the use of platforms such as Microsoft’s SharePoint. Multiple users can simultaneously work on the same file while SharePoint maintains versioning, audit trails, and an assortment of security features that protect sensitive data.

Client Interaction

Successful client interactions are dependent on thorough and frequent communication. The investment industry has recently experienced a level of volatility and uncertainty that makes communication more important than ever. Asset managers and financial institutions must have the necessary operations and technology to efficiently communicate and protect information that has traditionally been delivered in person.

A popular solution for the mass distribution of content among Salesforce users is Pardot. Pardot is a marketing automation tool offered by Salesforce that boosts communications with potential and current investors. Moreover, it is important to evaluate CRM solutions such as Backstop, Clienteer, Dynamo, or Salesforce to ensure that your team is maximizing their functionality.

The unexpected transition to remote work was a daunting task that will have lasting impacts throughout the financial services industry. Organizations must align their processes and technology if they desire a seamless changeover. Technologies such as Microsoft Teams & SharePoint, an Operational Assessment, and a dedicated Management Team are likely required. FinServ has served as a trusted advisor to the world’s leading Asset Managers & Financial Institutions for more than 15 years and is the ideal partner for facilitating this conversion.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

The Most Impactful Feature of Salesforce’s Summer 20 Release

In FinServ’s opinion, the new Kanban Split View is the most exciting feature of the Salesforce Summer ’20 Release. In this article, we will highlight how Funds and Financial Services companies can take advantage of this new feature to realize maximum benefit and ROI. If you would like more insight into these updates and how to implement them, please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

Expedited Prospect Data Updates with the Kanban Split View

Sales and Marketing teams are constantly working through the list of their top prospects each day. They realize that updating Salesforce with the latest key info is critical to moving the pipeline forward.

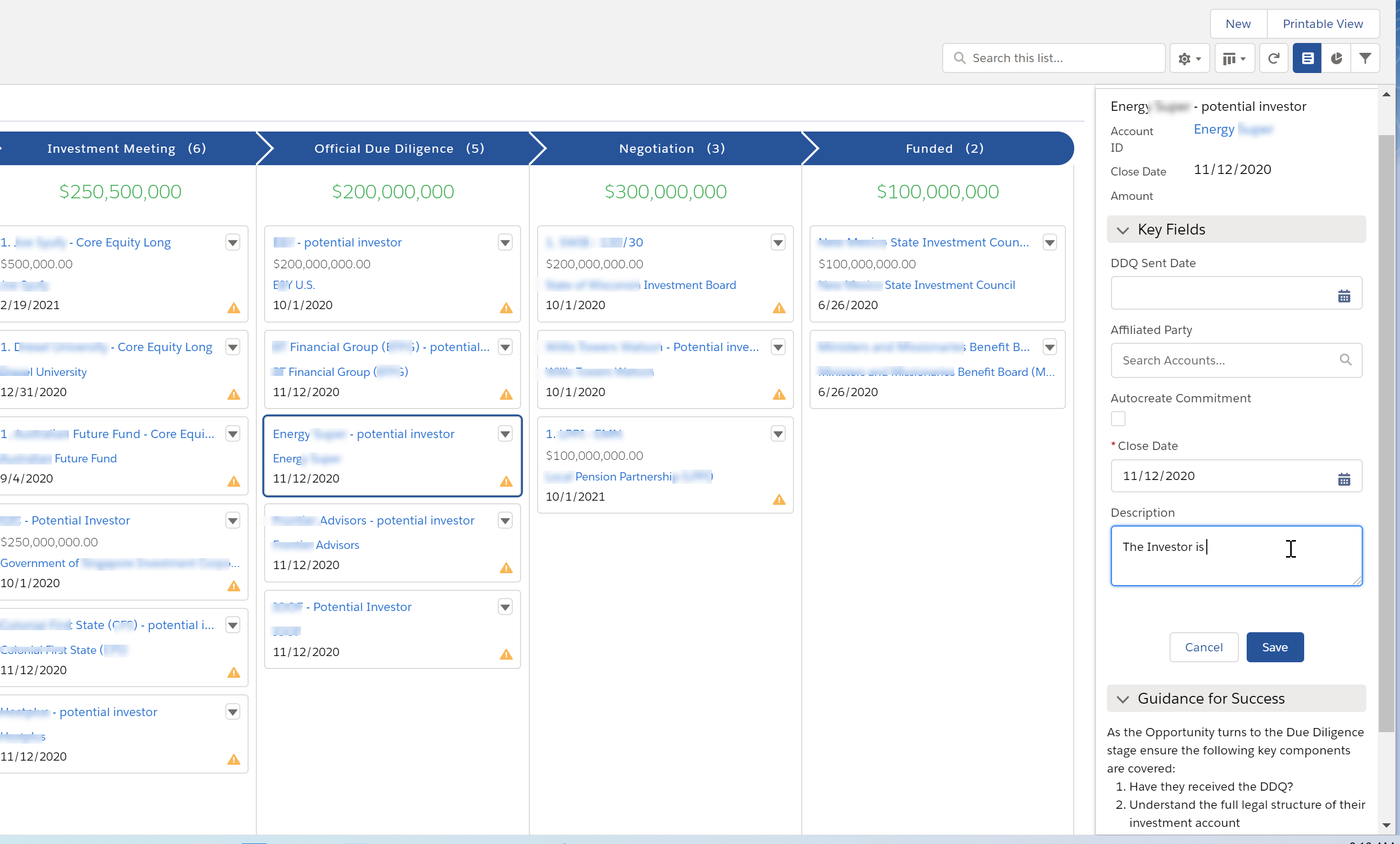

The Kanban view was a huge step forward in previous Salesforce releases. By providing a visual pipeline with the ability to drag and drop items to the next stage, it made pipeline stage updates much more efficient.

Up to this point however, the process of editing these records was a tedious, click-heavy effort of having to go into each record, edit the record, save the record, refresh the screen, and move onto the next record to edit.

With the Salesforce Summer ’20 release, users now have the Split View for Standard Navigation feature. This exciting new feature allows the user to highlight the record they want to edit, right in the Kanban view, and edit the key fields all from the same screen!

Sales and Marketing teams will save hours of time with a level of efficiency previously unattainable in any CRM. By making it easier to update the record, it also promises to improve the quality of the data for the Executive and Investor Relations teams as well.

Split View for Standard Navigation in Kanban View

Key Considerations:

- You must have a Sales Path setup for the Object you want to use this for

- The Sales Path will ask you to select the Key Fields you want to be able to Inline Edit

a. The Key Fields can and should be different for each stage to ensure you are providing your team the quick edit access they require

b. The Key Fields are limited to just 5 per stage, so pick carefully - Provide Guidance in each Stage to ensure your team fully understands what is expected to be filled in and you gain maximum value from the quality data

Salesforce Video on this Exciting New Feature

Conclusion

The Summer ’20 Release is schedule to arrive on July 18th. FinServ Consulting, a top Salesforce Partner with a focus on the Asset Management sector, ensures our clients take advantage of the most important features of each release and maximize their investment in Salesforce.

Over the next few weeks, we will continue to highlight the new features we see as most valuable to our clients, with a unique focus on our industry. Upcoming posts will include exciting new developments to Lightning Flow, which is fast becoming the most useful tool in the Salesforce arsenal for process automation.

If you are interested in any of these features and want help implementing them or just have a question about them, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Sowing a Field to Cultivate: Driving Sales via Contact-Based Leads in Salesforce

One of the recurring challenges new Salesforce clients encounter during their implementations is grappling with how standard Salesforce objects/functions align with their actual business processes. It is one side of the knowledge sharing gap on any new vendor software implementation. The other side of the gap is that technology teams need to get up-to-speed on a client’s business as quickly as possible. This includes a macro understanding of the client’s industry, the specific business processes related to the project, and how any legacy systems work to support client activities today. The faster these gaps close, the better the final solution will be in the end.

The goal of this article is to address the client-side knowledge gap by educating potential Salesforce clients about one of the critical design discussions in any Salesforce implementation: When Should Contacts be Created in Salesforce? To answer that question, the article will provide a quick overview of some core Salesforce basics, along with FinServ’s rationale supporting Contact-Based Leads for Financial Services clients:

- What is the Difference Between a Lead and an Opportunity in Salesforce?

- What are Salesforce Contacts? When are Contacts Created in the Default Salesforce Workflow?

- What is a Contact-Based Lead Approach? Why is it a Better Choice?

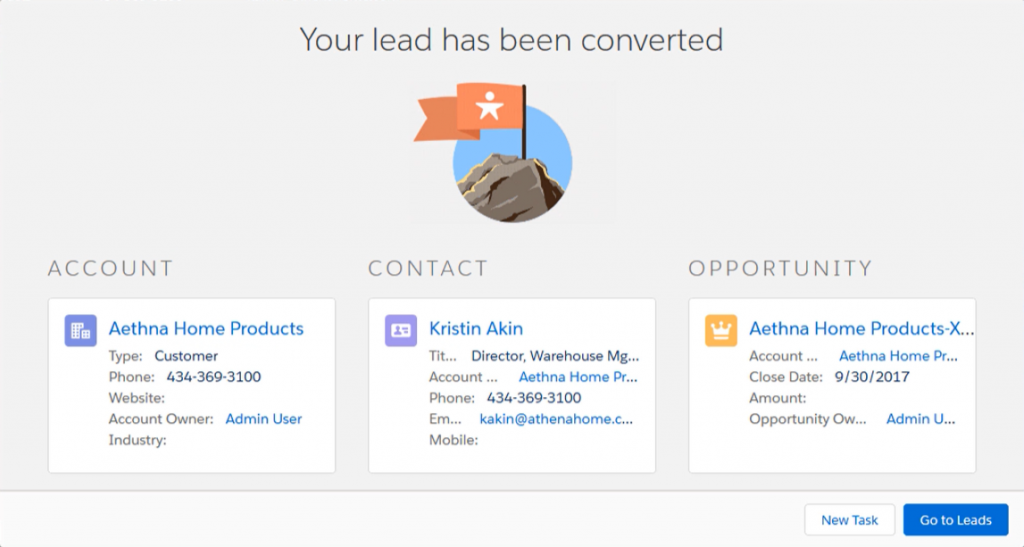

Leads Convert into Opportunities

What is the Difference Between a Lead and an Opportunity in Salesforce?

In Salesforce, Leads represent potential deals that have not been fully vetted or “qualified”; they could also be referred to as “unqualified opportunities”. In this case, qualified refers to confirmed interest from a prospect to buy a specific product/service/offering. Leads can come from a variety of sources, such as real-life interactions like meeting someone at an event or when someone fills out a form on a website requesting more information on a specific product/service.

What separates Leads and Opportunities is how realistic the deal is based on confirmed client interest. Opportunities are real, active deals with confirmed, measurable interest from a prospect. When that hurdle is met, Leads are considered qualified and they are “converted” into Salesforce Opportunities. Opportunities are the sales and pending deals that need to be tracked. By creating Opportunities, a “pipeline” of deals is formed, which may be tied to sales forecasting and advanced pipeline reports.

What are Salesforce Contacts? When are Contacts Created in the Default Salesforce Workflow?

Contacts are the golden source of all data related to a person/individual. The set of Contacts in Salesforce is simply a modern-day rolodex. Out-of-the-box Salesforce includes basic datapoints for Contacts one would expect like phone numbers, email addresses, and mailing addresses. When you convert a Lead in Salesforce, the system guides you through the creation of new Accounts, Contacts, and Opportunities, while connecting that data with the information already on the platform.

This default Lead-to-Contact process flow makes sense for a lot of Salesforce clients that are dealing with a high volume of low-quality Leads. An example of this would be a web-based retail store; lots of potential customers might show up through various channel source that need to be filtered and cultivated. Keeping your Leads and Contacts separate help to reduce tracking bad person/individual data from Leads in Salesforce Contacts. The problem with this approach is that Leads are never associated with a Contact until the Lead is qualified and the actual Lead conversion process occurs, which means you lose prospect history. This affects a couple key areas for most of FinServ’s financial services clients:

- Cross-Selling New Products/Services to Existing Clients: Valuable historical information from past interactions on a Contact are never associated with new Leads for the same person/individual. That includes the basics like simple contact information to important details like preferred market strategies and potential commitment amounts for a hedge fund client.

- Re-engaging Old Leads: Even if Leads don’t convert in an isolated sales cycle, most FinServ clients are not dealing with high volume, low-quality. The Leads available are usually curated through existing relationships or through industry service like capital introduction. It is important to curate all this information whenever new Leads are created to avoid face losing valuable details.

What is a Contact-Based Lead Approach? Why is it a Better Choice?

The simple solution to all these issues with vanilla Salesforce is simply to adopt a Contact-Based Lead Approach. This means that users may create Leads from existing Contacts and relate Lead records to Contacts before the Lead conversion process occurs. It’s that easy and it facilitates the ability to handle the above limitations with standard Salesforce, while also supporting common business activities like the ability to track multiple Leads for the same Contact.

The Bottom Line

Adopting Contact-Based Leads is quick solution to solve some of the major limitations of vanilla Salesforce to align the platform with financial services businesses; however, it is a major design decision that is easier to enforce for new implementations. It is always better to measure twice and cut once. FinServ Consulting’s industry expertise and unparalleled track record for financial services clients makes us the right partner to help you make the best decisions to support your business.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Cybersecurity Protection with Salesforce Shield

Salesforce recently introduced a cybersecurity focused offering that builds on the already formidable security capabilities of the world’s leading customer relationship management platform. With Salesforce Shield, organizations can institute better internal cybersecurity practices by developing clearer oversight of employee’s daily activities and stronger protection of their valuable data. Salesforce Shield expands on the class leading security infrastructure of Salesforce across the three key service areas of:

- Platform Encryption

- Event Monitoring

- Field Auditing

Salesforce Shields’s focus on these three services allows for a more nuanced utilization of privacy functionalities and clearer oversight into the firm’s cyber activities. Of course, administrators of standard Salesforce environments could always customize their firm wide security settings through a variety of restrictions, permissions, and requirements across the platform. However, with Salesforce Shield, administrators have exponentially deeper control and granularity when establishing and maintaining their firm’s online security. This article will provide an overview of each Salesforce Shield’s services, as well as the key factors management should consider when implementing the technology.

Platform Encryption

A standard Salesforce subscription only allows for the encryption of custom fields that are less than 175 characters, which is likely insufficient for many firms that maintain large amounts of customer data. For the first time, Salesforce Shield brings encryption to a wider range of custom and standard fields, including sensitive information such as Account Names, Addresses, Phone Numbers, and Emails. Platform Encryption with Shield allows users to natively encrypt their most sensitive data such as personally identifiable information (PII), confidential, or proprietary data, while meeting internal and external compliance regulations. Salesforce Shield also allows users to adopt the latest encryption innovations, such as Bring Your Own Keys (BYOK), which allow users to provide their own tenant secret, generate their own Hardware Security Module (HSM), and ultimately increase their control over the encryption processes.

Implementation Considerations:

1) Identify Encryption Needs

-

- Firms need to first identify their unique encryption needs. Encrypting every piece of data that a firm has online would slowdown workflows, leading to inefficiencies that provide little returned value. Firms should identify and evaluate the potential channels and methods of attack they face, while also classify the data types that they would like to protect. At the same time, firms can specify which fields are the truly “must encrypt” elements and evaluate the business functionality changes that may come with encrypting this information.

2) Apply Field Level Encryption

-

- Because encryption can be assigned at the field level across different users, firms need to decide which fields would be accessible by different users. Shield allows firms to grant permissions to certain fields only for authorized users, while also applying encryption to these fields for an added level of security. Once these capabilities have been properly vetted, users can begin testing how their business processes would work with this newly encrypted data.

3) Define Key Management Strategy

-

- Shield enables firms to take on greater ownership over their encryption key management strategy. For an effective implementation of Salesforce Shield, firms should identify who can manage the encryption keys and define the protocols for backing up, rotating, and archiving keys.

4) Maintain Organization’s Encryption Policy

-

- Platform encryption requires strong policy and procedure documentation to guarantee its effectiveness. Establishing the lifecycle of keys and periodic data backups ensures that the data your firm has today is securely maintained in the future as well. Meanwhile, periodic reviews of encryption protocols ensure that these established policies remain effective as data grows and new fields are added. Regular reviews of data encryption protocols are a critical aspect of continued data security and data effectiveness with Salesforce Shield.

Event Monitoring

Salesforce Shield allows firms to have even clearer oversight of critical business performance and user behavior data. Firms using Salesforce Shield have a deeper understanding of the underlying performance, security, and individual usage of data stored in their Salesforce ecosystem. With Event Monitoring, managers can drill deeper into their event log files in order to visualize time relevant performance and security metrics. This allows managers to understand employee behavior within Salesforce, ensuring that they are securely utilizing the platform to its fullest potential, and overseeing the storage of their sensitive data. Managers would find these capabilities especially valuable during audits, when regulators can easily drill down to see what changes were made within Salesforce, by which users, at what time. Shield allows for this Event Monitoring capability on over 40 different event types across different user activities, all of which can be displayed across 16 pre-built dashboards.

Implementation Considerations:

1) Capture Read-Only Event Log Files

-

- With more than 40 event types able to be captured using Salesforce Shield, firms should first review the current list to see which would bring value to their organization. Event logs can store the granular details of how specific users are utilizing the firm’s data, as well as the corresponding timing and location of these action. Therefore, understanding what data to be capturing as well as the means of capturing this data is critical part of a successful Salesforce Shield implementation.

2) Visualize the Data to Identify Critical Insights

-

- The ability to directly transfer Salesforce insights into any business intelligence or data visualization tool, such as PowerBI (click here for an earlier FinServ post on Power BI), allows managers to quickly visualize trends and develop actionable strategies. Users can also build Data Loss Prevention or Adoption & Performance dashboards with Einstein Analytics or bring this data into any of the 16 prebuilt dashboards with the Einstein Event Monitoring Analytics tool included with Shield. Additional visualizations capabilities can also be found in pre-built apps via Salesforce’s AppExchange and data can still be exported to CSV files for additional analysis and visualization methods.

3) Take Action

-

- Identifying gaps in security policies and procedures, modifying governance policies, and setting up access controls as well as transaction security measure are all early management considerations for an effective implementation of the Event Monitoring service. This will support firms in driving initiatives to increase user adoption, automating workflows, and improving the overall performance of their Salesforce environment.

Field Audit Trail

As companies continue to generate and track massive quantities of data, having an effective IT governance strategy in place becomes more and more critical. Salesforce Shield Audit Trail allows users to track the history of various data fields in their Salesforce ecosystem in a far more robust manner. While the field history feature included with a standard Salesforce subscription allows users to track 20 fields for 18 months, Salesforce Shield Audit Trail allows users to track 60 fields per object for 10 years. This is a significant asset for firms operating in highly regulated industries such as financial services. Shield allows firms to extend the utilization of their audit trails while remaining compliant with data retention and audit granularity requirements.

Implementation Considerations:

1) Consult Business Units to Understand Retention and Audit Period / Depth

-

- Firms should first identify their data retention and audit period on a per object basis to understand exactly where and how Audit Trails may benefit their business processes. While the maximum possibility is for 10 years and 60 objects, firms should find the ideal balance between complete oversight and operational efficiency. Additionally, firms should consider the unique regulatory guidelines they must adhere to while customizing the service to fit their needs.

2) Set Retention Policies

-

- Firms should determine which fields and objects should be retained for audit purposes. Additionally, identifying when and how long this information should be archived is a crucial step in a successful implementation of Field Audit Trail.

3) Identify Practices for Retrieving and Auditing Data

-

- Finally, firms should develop best practices for obtaining, maintaining, and auditing this data. Steps such as setting up audit dashboards, defining standardized queries, and providing access to auditors in the permissions settings should be taken to ensure consistent and accurate reporting of Field Audit Trails in the future as well.

Security Benefits Over Standard Salesforce

The Platform Encryption, Event Monitoring and Field Audit benefits that Salesforce Shield brings to users, beyond the basic platform capabilities, offer an effective means of protection against a wide range of cybersecurity threats. Firms can now encrypt large amounts of information in standard objects, track and visuzalize a variety of events in pre-built dashboards, and maintain an audit history of dozens of objects for a decade. Salesforce has recognized that as the cybersecurity landscape continues to evolve, robust and innovative solutions are needed to keep their customers ahead of criminal attacks.

FinServ’s Capabilities

When securing your firm’s sensitive data from increasingly sophisticated attacks, it is crucial to partner with industry experts that understand the most effective solutions available. While Salesforce Shield brings a deeper level of sophistication over classic Salesforce security capabilities, sophisticated technology is only part of the complex cybersecurity equation. FinServ can gather the development requirements and implement the detailed policies and procedures to protect your firm for years to come. An effectively led implementation of Salesforce Shield is the best way to ensure that there is lasting security for your organization as cybercrimes grow more sophisticated and prevalent.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Robust Integration with Salesforce

Integrating external data feeds from your Administrator can facilitate operations and eliminate many of the daily bottlenecks faced by employees. Investor Relations teams may struggle to adequately communicate key performance and investment data to investors if they are simultaneously juggling numerous information sources. Directly feeding Administrator data into Salesforce will allow them to navigate a singular system while answering critical questions. Moreover, you can finally eliminate your countless excel files and the associated processes that mandate excessive manipulation.

Salesforce boasts impressive reporting and data visualization functionality that will enable your firm to draw deeper insights. The amalgamation of Salesforce Reports, Dashboards, and real time data will allow your organization to create visualizations highlighting key investor and performance metrics. Thus, augmenting personnel’s ability to anticipate client needs and answer their questions. FinServ has developed an assortment of pre-built reports and dashboards that isolate data pertaining to investment strategy, region, fee structure, performance, and more.

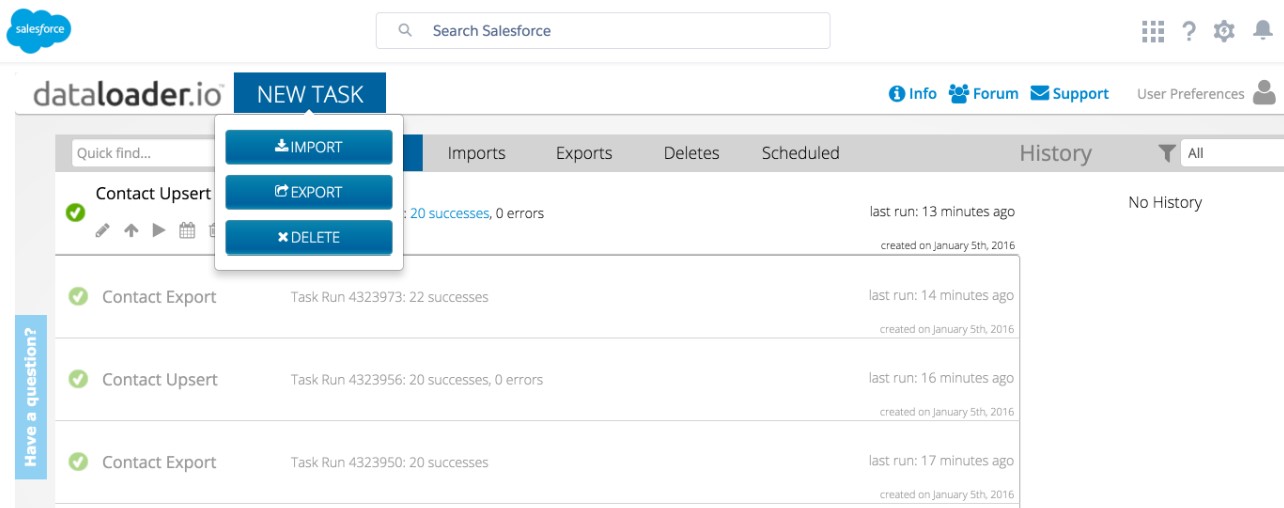

How to Integrate Your Data

Salesforce offers three primary tools for uploading data into Salesforce: Data Import Wizard, Data Loader, and dataloader.io. Each tool is applicable in its own right with differing use cases and functionality. The Data Import Wizard does not require installation and can easily be found by performing a quick search within Setup. Once you open the Data Import Wizard, it is as simple as selecting your CSV file and mapping the fields via the Salesforce Interface. Although the Data Import Wizard is a useful tool for basic uploads, it’s record count is limited to 50,000 and it cannot export data. The Data Import Wizard can be leveraged for both Custom Objects and Standard Objects such as Accounts, Contacts, Campaign Members, Leads, and Solutions.

Data Loader is a more robust data integration solution than Data Import Wizard. It is an external client application and therefore requires installation. The Data Loader facilitates the importation of 5,000 to 5 million records and is inclusive of both data exportation and deletion functionality. Users can specify configurations with the user interface or command-line interface. More advanced users can use the command-line interface to automate their data processing needs. However, the command-line interface is limited to Windows users and uses the Salesforce Object Query Language.

The final and most developed option is the cloud based MuleSoft solution known as dataloader.io. Similar to Data Loader, dataloader.io boasts importing, exporting, deleting, and scheduling capabilities. However, it can pull data from a variety of sources such as Box, Dropbox, FTP and SFTP repositories. Data Loader’s functionality is dependent on the package offering (Pricing Information) and has 3 editions that are priced at $0, $99, or $299 per month per user. The number of records, file size, and related objects ranges from 10,000, 10MB, and 1,000 to Unlimited, 100MB, and 100,000 per month.

How FinServ Can Help

FinServ’s completion of hundreds of projects spanning the Back, Middle and Front Offices for more than 40 of the top 100 Alternative Asset Mangers has enabled an expertise in industry processes, technological solutions, database management, and more. Additionally, FinServ has a deep understanding of the granular details associated with constructing a customized data model that fulfills your funds operational needs. FinServ is an accomplished integration partner due to countless experiences with Administrators and other Third-Party Data Sources.

Identifying the correct data may appear intuitive, but it is a common pain point throughout the industry. FinServ will host sessions with your various teams to identify and document their requirements. Thus, enabling the structured categorization of necessary and superfluous data. Directly integrating data into Salesforce allows for the elimination of unnecessary calculations that often mandate reconciliation. Subsequently reducing strain on your infrastructure and employees to allow for concentration on value rather than performing endless maintenance.

FinServ’s role extends well beyond the traditional tasks associated with integrating your data feeds. Business processes optimization and the identification of enhancements will originate from more than 15 years of experience within the Alternative Asset Management industry. FinServ will consolidate systems, document procedures, ensure successful implementations, and redesign processes to construct a simple and efficient approach that supports both your business and personnel.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Salesforce Spring 20 – The Top 5 Features to Deploy in your Company Today

As with most Salesforce releases, the Spring 20 release which came out for most Salesforce users last week is full of some great new enhancements and features to the system. In this article we will highlight a few of the items we think will be most useful to Asset Managers and Financial Services companies. If you would like more insight into these updates and how to implement them please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

# – 1. Lightning Extensions for Google Chrome Browser

Click here to access extension for Google Chrome

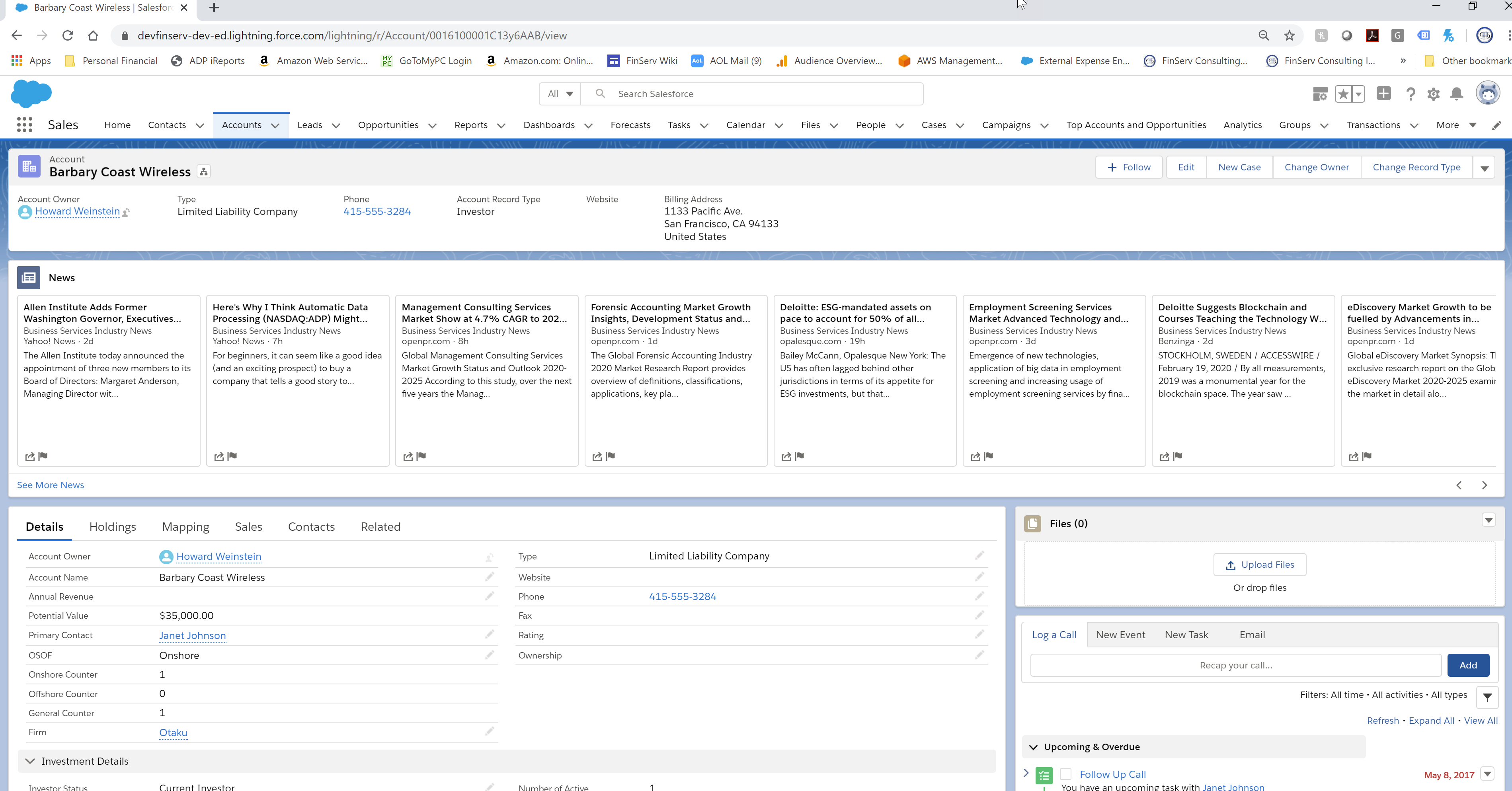

This first feature applies to anyone who uses the Google Chrome Browser only. Now you can install a Google Extension called the Lightning Extension that provides 3 new features. The most useful of these new features is the Component Customization feature which will allow your users to toggle on and off sections of their Page Layout. If there is a section that is never used or if the user wants a streamlined view, they can now quickly make any section invisible on their screen and can toggle it back on if needed.

A great example is in the Account Barbary Coast Wireless — we often want to see the latest activity with the client but the File section is taking up the screen so the user can’t quickly see that section right away.

Account Page before enabling new Component Customization

By quickly using the new feature, you see which sections will be hidden (see how its done below)

When you click on the Component Icon the screen will grey out and you will see the components and you can select as shown in the screenshots which ones you have chosen to hide

There are two other less impactful features in this release. One is Dark Mode which is meant to be easier on the eyes when working at night, for instance, and renders the background black. The second is Linkgrabber, which opens every single link you click on in a single browser tab, similar to how the Sales Console works for people who like that feature.

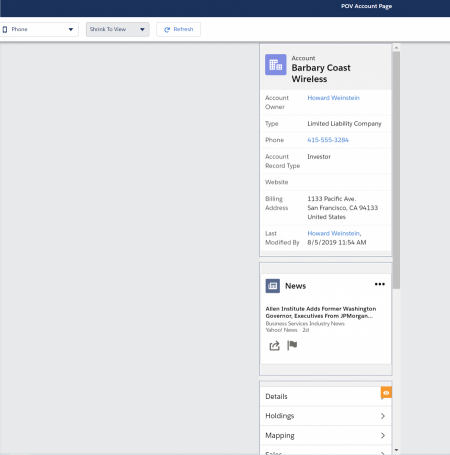

#2 – Lightning App Builder for Mobile

Salesforce has started to push out a real difference maker with their Mobile application, which is increasing the functionality gap between Salesforce and other industry CRM’s like Backstop and Clienteer. For those who have become used to the Lightning Page Builder for the desktop, you will be overjoyed to know that the Page Builder for the Mobile Device has now become General Availability. You can now drag and drop and setup the layout of your pages for your Mobile Device as easy as you would on a desktop. The cherry on top with this feature is the ability to differentiate the layout by device so for smartphones with limited space you can intelligently decide which layouts and features are included in your page setup.

The familiar App Builder with the New Form factor Option to Customize the Layout for any Smart Phone

With the new Phone view you get to see the dynamic layout that the user sees on their smartphone.

You can see that the layout is automatically adapted to your phone screen’s dimensions providing a fully responsive experience that Backstop and Clienteer can’t even dream about.

The Filter by Device lets you decide not to show certain components like graphs that may be too big to effectively be viewed on a mobile device.

The below screenshot shows the intuitive and easy to use filter to exclude large components from the phone options

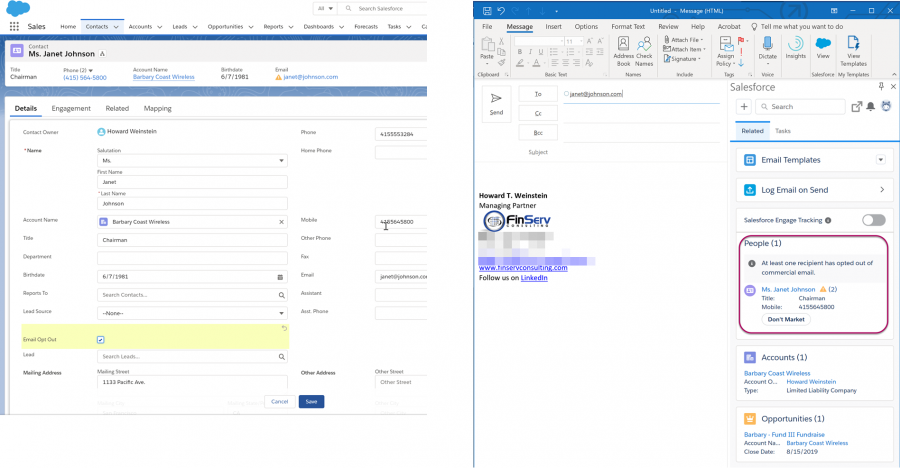

#3 – Email Integration / Opt Out Shown Right in Sidebar

For those who are extensive users of the Lightning Salesforce plugin for Outlook and Gmail, you will love the new feature which highlights when a contact has opted out of emails right in the Salesforce Outlook sidebar.

In the before screenshot below you see Janet Johnson’s contact info showing under People

The first screenshot below shows Janet’s contact record which is updated in Salesforce to indicate that she has opted out of email. You can see in the 2nd screen shot the resulting clear warning — anyone who tries to write Janet an email will see that she has opted out of email. This keeps sensitive investors and investor representatives from getting upset with your sales and marketing teams!

#4 – Report Filtering by Other Fields on the Report

The Spring 20 release has several new features in Reporting. Once of the most useful additions is the ability to add filters to the report that compares other fields on the report.

For example, this can come in very handy if you wanted to compare an Investor’s NAV in an older fund vs. their NAV in a current fund. In my example, the fund has 3 funds and I filtered on the Investor’s whose NAV in Fund III is greater than their NAV in Fund I. The original report had 17 Records but this filtered report just shows the 11 Investors who meet the refined criteria.

The screenshot below shows the user friendly filter screen with the new option to choose the filter type of Field instead of a literal value

#5 – URL Links with Prepopulated Values (not for mobile app)

This next item is one of those features advanced users loved in Classic that was lost in Lightning during the transition. Thankfully, Salesforce has been working diligently to bring back the most popular features to Lightning as Classic is very close to its end of life.

This feature allows you to create a URL link that includes prepopulated values for any field in the object, which will save time when creating a new record. For instance, if your Sales and Marketing teams are at an Investor roadshow and they are meeting new Investors, they will want to create new Contacts quickly since there are often many fields that are always the same entry in a Contact. By creating a clickable URL link to start the new Contact from the Account Page for the Investor, the new Contact can be prepopulated with as many of the fields as you want. Some of these may be placeholder values, while others are real values that never change but previously had to be manually entered or selected.

The syntax to set this up is a bit tricky so we recommend you seek help from us or your IT department if you are not experienced in HTML as you need to create a query string and place the field name and the value you want entered separated by a comma. You use lightning/pageReferenceUtils module to build navigation links that prepopulate a records’ create page with default field values. Prepopulated values can accelerate data entry, improve data consistency, and otherwise make the process of creating a record easier.

How: To construct a custom button or link that launches a new record with prepopulated field values, use this sample formula:

/lightning/o/Account/new?defaultFieldValues=

Name={!URLENCODE(Account.Name)},

OwnerId={!Account.OwnerId},

AccountNumber={!Account.AccountNumber},

NumberOfEmployees=35000,

CustomCheckbox__c={!IF(Account.SomeCheckbox__c, true, false)}

Link to New URL Link Description

Conclusion

As you see there are many exciting features included in Salesforce’s Spring 20 release. FinServ Consulting, a top Salesforce Partner with a focus on the Asset Management sector, ensures our clients take advantage of the most important features and maximize their investment in Salesforce.

If you are interested in any of these features and want help implementing them or just have a question about them, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.