Selecting the Right IT Managed Service Provider the FinServ Way

Are you happy with your IT MSP? Many funds are not. Selecting the right IT MSP is not something you should keep putting off. Learn how FinServ helps its clients find the right IT provider for their unique needs.

Managing your IT infrastructure touches every team member and can create significant issues if not handled effectively. From extensive downtime to user frustration having an IT team that does not act as a business partner can hurt your whole fund.

FinServ completed an IT MSP Vendor Selection for one of our Private Equity Fund clients experiencing these exact issues. When the head of the fund could not access his systems during the pandemic, and their service provider had let the problem sit for over 24 hours, the fund decided a change had to be made.

The client was already aware of FinServ’s Vendor Selection methodology, as a few months earlier, we helped them select a new Third-Party Fund Administrator.

FinServ’s Vendor Selection methodology ensures that our clients select the right service provider for their unique requirements. Our comprehensive approach includes three stages of selection.

Phase 1 – Initiate

FinServ works with our client to inventory/collect all essential documentation and support for the new vendor culminating in a detailed set of user requirements. FinServ leverages our functions of an IT MSP to reconcile all possible functions to ensure all possible services are covered. Getting from a long list of vendors to a shortlist based on a detailed Request for Information (“RFI”).

Phase 2 – Assess

At the core of our selection approach, we use a 35-Page RFP including over 320 detailed questions. This level of detail ensures that the vendor provides the services and support in a way that meets each client’s requirements. Every client has their own way of doing business, and this approach ensures that the vendor that best fits that model is selected. The key to this stage is FinServ’s team with unparalleled attention to detail combs through the provider’s documentation and answers. It creates a qualitative and quantitative scoring that investors and auditors call world-class.

Phase 3 – Recommend

In the final stage of our selection process, we use scripted demos, which force each vendor to show, not just tell us, how they address the client’s most complex challenges. It is in this step that the right vendor rises to the top. Most salespeople hate this step because they know that often they want to stretch the truth about their systems. The right vendor can show how it is done to seal the win. In our final step, we conduct comprehensive reference checks that often uncover issues that may not disqualify a vendor but help the client with crucial advice as they move forward with the winner. The final step is a recommendation deck that summarizes all the detailed work, including the cost analysis across the finalist vendors supporting the client’s final selection. Many clients have used this document to show potential investors the quality of diligence in selecting a key service provider.

Beyond the Methodology

The process is key to making the right choice, but more important is ensuring that you focus on the essential areas these service providers offer. Technology is constantly evolving, be sure there is a focus on what is needed today and in the near term to meet your firm goals and requirements.

FinServ makes it our business to always stay on top of the latest requirements from regulatory agencies like the SEC and the latest technologies that the best providers are using.

Your IT Managed Service Provider (“MSP”) typically handles 2 to 3 of the most critical aspects of your business:

1) Cyber-Security & Risk Management

2) Monitoring & Management of IT Infrastructure

And for funds that have chosen not to keep IT resources in-house.

3) Service Desk / Desktop Support for Users / Company

1) Cyber-Security & Risk Management

With the war in Ukraine and the increased likelihood of focused cyber-attacks, there has never been a more critical time for a financial institution to ensure that they have the best possible risk management and cyber security coverage possible.

The offerings from the best IT MSPs have changed drastically over the past few years as the technology for cyber security and risk management has been forced to evolve as quickly as the sophistication of attacks.

The Not So Obvious Requirements Matter Most

One of the nuanced aspects of these services is less about your direct protection and more about how communications about potential IT security issues are raised. Our clients desire to limit the noise created by non-critical communications, so only the most critical issues are escalated for review. Some vendors have more advanced issue monitoring and alert systems that use rules and triggers to raise only the most important messages to clients, limiting “boy who cried wolf” scenarios.

The best vendors also proactively provide webinars and training for your employees to stay on top of the latest attack approaches. A knowledgeable team is your best defense against constantly evolving and changing cyber threats.

2) Monitoring & Management of IT Infrastructure

Has your network ever gone down, leaving you unable to work? Have any of your remote employees ever lost access to your network? Has a crucial executive of your firm ever been frustrated by not getting the IT support they need?

If the answer to those questions was yes, you probably don’t have the right service provider with the proper setup and response management systems. The best IT MSPs have formulated approaches that ensure redundancy and backup of essential systems, so you never have downtime during regular business hours. Similarly, they have all created world-class service systems that support intelligent routing of critical issues with complete status transparency. Essential issues are solved in minutes, not hours or days. When they take longer, your support staff can see real-time updates on 1) who is working on the issue, 2) when it will be resolved, and 3) all the latest activity and communications to the key executive.

3) Service Desk / Desktop Support for Users / Company

If a key executive’s camera is suddenly not working and they have a full day of Zoom or Teams calls ahead, not having someone come to their desk immediately to fix the issue can be a significant problem.

Alternative asset management firms often choose not to hire a CTO or desktop support staff. With predominantly SaaS-based applications, the need for in-house physical support has been dramatically reduced. Many smaller funds prefer to rely on an outsourced IT support person along with a part-time Virtual CTOs (“vCTOs”) to focus on complex technology strategy. Separately, while remote desktop support can work for many issues, in-person physical support is still something many funds require. While many IT MSP Vendors have moved away from offering this service, it is still an essential requirement for many funds.

If you are one of these funds, FinServ has you covered. We know which IT MSPs truly champion this type of support and which vendors only give it lip service. Additionally, If you are unhappy with any existing onsite IT support you are receiving today, we can help you move to a vendor that will cover all of your needs.

Conclusion

The IT MSP Vendor space is filled with many sub-par providers that cannot cover the mission-critical services that alternative asset managers require. In a world where one mistake could cost your firm its reputation or paralyze your operations, it seems crazy to leave this essential operational risk under-serviced and exposed.

There is no one-size-fits-all vendor. Many of the best IT MSPs have focused their services in certain areas, so choosing the right partner that fits your firm’s unique requirements is essential. FinServ’s knowledge of the marketplace and our rigorous selection methodology ensure you get the provider and services your fund requires.

To learn more about FinServ Consulting’s services: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

What Every HR Department Must Do in Workday to Ensure a Smooth Start to the New Year

There are five main activities that need to be done in Workday at year end / beginning of the year to ensure the smooth running of a business. These simple tasks are often overlooked – particularly by those new to Workday – but can have a negative impact if not done.

There are five critical tasks that Workday companies should undertake around the year-end / new year time frame. Individually, these are simple tasks but can significantly impact your HR operations if not completed in time.

Year-end activities come thick and fast, and it is easy in the last month of the year to forget to undertake some essential tasks. FinServ Consulting has identified five essential tasks that every HR department must complete to guarantee a smooth kick-off to the new year. Lack of action on these tasks could create unnecessary errors or preventable breaks in your operations, causing a lot of unneeded January headaches.

These five areas are:

- Scheduled Processes – (integration, reports, alerts) and Period Schedules (payroll, time off, time tracking) must be reviewed and set up / extended manually. Scheduled processes can be set up in advance up to five instances in a new year. Period schedules can be set up for up to two years in advance.

- Delegation Review – A review of delegation assignments ensures that they are correct and that expiration dates are extended. This will avoid the Workday inboxes of executives filling up with tasks that generally would be delegated.

- Compliance Activities – Review what compliance requirements are pending for the new year, including mandated data purging and verifying employee compliance with company policies.

- Corporate Document Updates – A review of employee documents like the corporate handbook, benefit plan documents, and company policies will ensure that they are updated and properly linked to in Workday.

- Time Off Calendar and Balances – Update the upcoming holiday calendar to ensure that employees can successfully request time off. In addition, review time-off balances that are carrying over to ensure accuracy.

#1 – Scheduled Processes and Period Schedules

Scheduled processes allow you to automate processes on a schedule (i.e. daily, weekly, monthly), such as an integration with your medical benefits provider or payroll processor. These schedules are typically set up in advance but must be maintained annually. They cannot be scheduled indefinitely and can usually be set for up to five scheduled instances in the following year.

Suppose your payroll file is not sent to your payroll provider because it is no longer automatically scheduled in Workday. In that case, the HR team risks a highly visible and potentially catastrophic mistake.

Period Schedules standardize the sequential periods you use to track absence or payroll. These period schedules also need to be entered and maintained manually and can be entered up to two years in advance.

Not setting your future period schedules can prevent employees from requesting time off or prevent you from processing the next pay run. Like the Scheduled Processes, not maintaining Period Schedules is an easily preventable error.

#2 – Delegation Review

Tasks are often delegated in Workday, usually to assistants of senior executives. Senior executives are generally crucial control points to granting approvals for time off requests from their subordinates or approving high-value expenses and invoices. Executives usually do not have the time or inclination to go into Workday consistently and approve these requests.

Delegating these tasks to assistants allow the tasks to be completed in a timely and consistent manner. These delegations do have expiration dates and need to be reviewed annually. Letting delegation settings expire can result in a senior executive’s Workday inbox being flooded rather than the tasks going to the correct delegated employee for processing. If the executive is not looking at their Workday inbox, critical invoice payments may not be approved, leading to unnecessary late payment penalties. For example, Market Data vendors’ unpaid invoices may lead to unnecessary late fees or, even worse, denial of critical data that the business requires.

As administrative permissions have time limits, it is easy to set them and forget them until something goes horribly wrong.

#3 – Compliance Activities

Data purging and employee compliance are two of the essential resets needed at year-end / beginning of the year. This means verifying that everyone has signed the required employee and corporate policy documents such as the employee handbook, Covid / return to work attestations, restricted trading policy attestations, and other necessary documents.

As these documents are disseminated throughout the year, it is easy to lose track of whether they have been reviewed and signed off on by all employees.

The time surrounding the new year is a natural time to conduct a holistic overview of the status of the firm’s overall policy attestations. For example, employees may be required to attest to understanding the code of ethics or conflicts of interest policies. Ensuring that these policies are enforced and that enforcement is tangible is key to assuaging any concerns of regulators or potential investors.

This time is also an excellent time to review how well the firm is in compliance with data retention and purging regulations. For example, the European Union’s General Data Protection Regulation (GDPR) stipulates that personal data is collected for legitimate reasons and is only kept if needed. Because of these regulations, companies will need to place greater scrutiny on terminated employees and their personal data. The HR or compliance departments must be vigilant in reviewing this data and determining if there is a legitimate reason to continue storing it in Workday.

#4 – Corporate Document Updates

Corporate documents such as employee handbooks, benefit plan documents, and policies can get out of date quickly as policies evolve, such as Diversity and Inclusion and Remote Work policies. In addition, the companies’ benefit providers often change, or the company changes the plan offerings themselves. The document file itself can change from content updates to file name changes or file location changes. Once this happens, the reference link in Workday may no longer work and inevitably lead to errors during any attestation process or during an employee onboarding.

Checking that the latest document versions are set up in the system should be part of any end of year to new year process. Multiple or outdated versions of documents can cause problems; ensuring that only one version – the latest – exists is essential.

Performance review templates are another area to double-check along with offer letters and other templates used throughout the year. These templates can change. Since they impact all employees and prospective hires, it is critical to be consistent and accurate in what is shown. If these templates link to external documents or are set to send information to vendors, it is vital to make sure that the links still work.

#5 – Time Off Calendar and Balances

A simple task that can cause many headaches is ensuring that next year’s calendar includes the correct dates for holidays. Different localities and regions may have special holidays, and observed holidays change from year to year. These are not automatically loaded into Workday; they need to be set up every year manually. This is particularly important for companies with international offices where the holiday dates may differ.

The time around year-end is also a good time to get ahead of nuances in the calendar for the upcoming year to give you more time to be prepared to address any employee concerns. For example, most financial services firms follow the stock market’s holiday schedule. At the end of 2021, the stock market is not observing New Year’s Day 2022 as a holiday since it falls on a Saturday. Usually, the holiday would be observed on the preceding Friday. But, because Friday is a key accounting period (year-end / quarter-end / month-end), the stock market will be open. Try explaining that on New Year’s Eve when this calendar quirk dawns on your employees.

Another critical activity for year-end is to check your employee’s time off balances due to carry over. Carry-over balances should be checked for accuracy; this will ensure that your time off eligibility and carry-over rules are correct and that an unexpected employee type / setup is not breaking the time-off rules. Unused time off that can be paid out will need to be appropriately reviewed and loaded into payroll.

Conclusion

Overall, it is best never to assume that these essential tasks have been completed. Much of what needs to be done annually is common sense, but HR and Operations teams often overlook these additional inputs / actions in the crunch of a busy fourth quarter.

FinServ Consulting has found that many clients outsource support for these activities after they have experienced one of these painful events.

Whether you choose to seek our support or not, we hope these top tips help you avoid any adverse effects on your company’s operations. Getting to grips with these tasks early and on an annual basis will save a lot of time, energy and headaches in the coming year.

To learn more about FinServ Consulting’s services: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Vendor Management Systems Take Center Stage

If the pandemic has taught businesses anything, it is that they need to plan for the unexpected and ensure they have a robust, effective and comprehensive vendor management system. Such a system is not a “nice to have” but the best way to keep track of the myriad of service providers and the detailed work that needs to go into this effort.

No matter the fund or company size, vendor management systems are an integral part of the smooth running of a firm. Recently, FinServ Consulting implemented a vendor management system (VMS) for an alternative asset manager, helping it to customize the system. Based on this experience, FinServ identified six key elements of a top vendor management system.

#6 – Tickler System

Top of the list of “must-haves” is the ability to trigger events automatically. This is at the heart of any VMS and should handle all the rules and actions around contract renewals. Part of this will be automatically sending out vendor risk questionnaires internally to determine if a vendor is performing well and externally to the vendor to ensure its own internal processes, risk assessments, and business continuity plans are robust enough to support the fund. A good VMS will handle all these notices automatically and allow the firm to customize what it needs to do and when.

The best systems provide the functionality to support nested logic, workflow-based action step processes, multiple forms of notification, and automated updates to the data in the system.

Whatever the system, it should ensure the various components can be set up by the end-user with little or no technical expertise through user-friendly user interfaces. The system must also have a dynamic messaging capability, so emails or texts sent to the user and/or vendor provide contextual information needed to understand the details of the alert and be able to act on it in a timely fashion.

#5 – Business Continuity Plans

The primary focus of a VMS is on the vendors. It should be able to produce a business continuity plan and scrutinize its response to events it can foresee as well as the unknown unknowns. For example, if it is impossible to be physically in the office, the plan should outline the steps needed to ensure the smooth functioning of the fund, including naming key members of the team and what to do it they are incapacitated physically or because of technical problems.

The best vendor management systems have all the key pieces of a rigorous business continuity plan. This means a firm’s plan can be created on the fly each time a new vendor is added, updated, or changed when something significant happens within the business.

It should also provide a detailed system and organization controls (SOC) II level questionnaires and links to detailed analysis of all aspects of a vendor’s risk assessments and pull in details of the vendor’s responses to automated surveys. This allows the operations team and/or the chief information security officer (CISO) if a fund has one to document their own findings and risk mitigation strategies for anything flagged during the risk vetting process.

Capturing incidents in the vendor’s history that may require legal or other actions by operations or compliance teams is another essential related element.

#4 – Managing Costs

A vendor management system is only as good as the quality of the data put into it. If the system uses planned and actual spending from an enterprise resource planning and/or general ledger system, it will give a powerful view of spending by vendor.

One of FinServ’s clients took this a step further by tracking spending by employee for certain subscriptions. This gave a fuller picture of overall spending at the individual employee/trader level. With this data, the financial and operational teams could make decisions quickly on spending allocations in key areas and where spending on vendors was redundant or unnecessary.

A good vendor management system will offer application programming interfaces that make it easier for technology teams to interact with other systems such as the general ledger, customer relationship management, or document management systems. When all these systems talk to each other and automatically pass data back and forth, there is no need to have manual entry. This means a firm can ensure all its data are in sync, avoiding discrepancies.

#3 – Contract Management

Most legal departments are overwhelmed with managing negotiations and deal-related matters. The contract management component of a good VMS allows a legal team to coordinate with other key areas such as the business owner for the vendor, as well as the compliance and finance teams.

Contracts can then pass through risk management and legal processes in a timely and efficient manner. With key inquiries sent to vendors – requests for documents or other information – the vendor management system ensures the contract process goes smoothly. Prior to the end of a contract, the tickler feature automates the notification for vendors and the internal team responsible.

The vendor management system should be able to link to the firm’s enterprise-level document management system to make sure a “golden copy” of each contract is kept in one place only. By linking to the document management system, the firm centralizes the security of these documents, ensuring permissions only for the people who should have rights to see or update these documents. This is where a good vendor management system covers various aspects of the due diligence and overall compliance processes.

#2 – Compliance

Ensuring vendors are compliant with key items such as certificates of insurance, non-disclosure agreements (NDAs) and SOC II is critical for investors, auditors and regulators. The vendor management system should simplify and automate the process of collecting and managing these documents as well as provide integration with other key systems. The system should track not only the receipt of any documents but also expiration dates that require a new document.

One of the more sophisticated and user-friendly features of a system FinServ Consulting implemented for one of its clients was the ability to reveal certain parts of the system only when necessary. For example, only when a vendor required a certificate of insurance would it show the section of the document tab for loading the COI. This made it much clearer and easier for the client’s administrative team to manage the documents it needed to collect from each vendor.

#1 – Onboarding Challenges

How a vendor is onboarded is another area where a vendor management system is essential. It can help streamline processes, identifying who is able to add vendors and what controls, assurances, and guarantees are needed for each type of vendor.

For example, during the vendor onboarding process, the operations due diligence team answered certain key questions through a wizard. The responses determined which document sections would show for the administrators who needed to collect the documents. When all the required documents were collected, it notified the vendor sponsor that its vendor was up to date and ready to go live. The system also notified legal that it should engage the vendor to finalize the contracts while letting all interested parties know that a new vendor was now live in the system without the need for any manual emails or intervention.

Conclusion

Vendor management systems have become an essential system for all alternative asset managers. An effective system must be able to provide a place to store essential data and offer user-friendly support to investor relations, operations, legal, and compliance teams so they enjoy working with the system. When all these pieces are in place, it makes working on due diligence questionnaires and regulatory reviews much easier and enables the firm to avoid last minute panics when trying to meet deadlines.

FinServ Consulting has the systems integration expertise, experience, and depth of knowledge to create vendor management capabilities with nearly any platform including VMS specific systems like Onspring to broader platforms like Salesforce and many others. It understands alternative firms and how a well-designed vendor management system can help limit exposure risks and ensure a firm is prepared for whatever the future may bring.

To learn more about how FinServ Consulting can help your firm build and integrate a new vendor management system, or customize one you already have, contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Create an Investor-Proof Business Continuity Plan in the Post-Pandemic World

Having a robust and automated BCP plan is critical to the post-pandemic DDQ process with Investors. Learn how FinServ has provided this critical service to their clients.

As the world slowly returns to a “new” normal for operational working practices, many funds are reviewing their existing business continuity plans (BCPs) and analyzing how to make them more robust and relevant given lessons learned from the global pandemic.

While many funds moved their technology to cloud-based solutions long before the pandemic began, others still have onsite servers and physical files that constitute a potentially serious business risk, particularly considering the changes (and disruption) to working practices over the past 18 months.

Many alternative funds, including hedge funds and private equity firms, managed to make a timely switch to remote working however many others continue to struggle to implement systems that satisfy their needs while balancing the mistrust of cloud-based environments by some executive team members. Even those that have already made changes will want to look more closely at exactly what systems they are using and if there are better, more effective, and efficient solutions that can be implemented.

Before making any modifications or implementing new business continuity plans, funds should consider several key aspects ranging from calling trees to automating vendor risk analysis. Potential unknowns could disrupt any workplace and its technological solutions. Plans should be formal, detailed, and comprehensive, and account for a variety of different scenarios.

Having a robust continuity plan is essential, particularly as existing, and new investors will look at this closely before making allocation decisions. They will want to see meticulous plans that give them the confidence they need to put (or keep) money into funds.

Futureproofing

No business can future proof itself entirely or plan for black swan events, but it can think about what a new risk or potential disrupter of the future may be. Another pandemic cannot be ruled out, and serious climate events (wildfires, flash flooding, extreme weather, for example) and other unforeseen risks, including political risk, should be factored in.

For example, how robust are communications if there is no mobile network available? What are the alternatives if mobile phone networks are not working? For those working at home, what systems do they need, including equipment and technology, to ensure they can work remotely no matter what the problem? What happens if Wi-Fi stops working or secure networks can no longer be accessed?

Funds also need to look at their service providers and vendors and ensure their vendors’ BCP’s are at the same standard as well as consider how potential disruption to services or systems, whatever the emergency and for varying lengths of time, could be mitigated.

Throughout the pandemic, FinServ has helped clients assess current vendor agreements. A worrying number did not meet the level of detail or required response times firms should reasonably expect – or thought they had agreed on – from providers.

These are real threats to business continuity and performance. For example, quantitative trading funds need a contingency plan in case their trading platforms go down. Can present vendors guarantee little or no disruption to all or only some trades? How quickly can systems be back online or moved to alternative sites? What are the potential costs to the fund?

Enterprise document management systems such as SharePoint Online are far more effective than using the quite common and outdated construct of Network folders. However, relying heavily on document sharing programs such as SharePoint could also be a problem if there is disruption due to remote work. Are agreements in place specifying how long before systems are back online? Are there other, secondary programs that can be used? Does everyone know what to do if disaster strikes and what the alternatives are?

Even smaller scale problems could be a serious disruption to a business. If a key employee is unable to work, who is capable or next in line to handle their duties? Does the replacement employee have the training, permissions, and access needed to continue the work, and while they are being a substitute, who is going to do their work?

Potential Solutions for Alternative Investment Firms

FinServ Consulting has helped many alternative investment firms build well-thought-out and fully documented business continuity plans. Some of the areas in which continuity plans should address vendor issues are reassessing vendor agreements and identifying and prioritizing vendors in order of the most critical to the least.

FinServ Consulting can also demine the types of guarantees needed to maintain business continuity, ensure vendors provide those guarantees and review contracts on a regular basis to ensure their own business continuity plans are strong enough not to let you down.

Continuity plans are also needed for employees. FinServ can help identify the priority roles and responsibilities within the firm and create a plan of succession if anyone at any level is unable to work, whatever the reason and length of time. It can help ensure all employees will have the permissions and access needed to take on different or more responsibilities if needed.

To bring this all together, FinServ can also design and implement a communications plan that will ensure everyone is informed and briefed sufficiently on what is happening and to whom whatever the type of disruption.

A vendor management system can play an important role in helping an alternative investment firm with creating and managing a business continuity plan more effectively and efficiently.

To learn more about how FinServ Consulting can help your firm develop and implement a business continuity plan, contact us at info@finservconsulting.com or call us at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Cybersecurity Protection with Salesforce Shield

Salesforce recently introduced a cybersecurity focused offering that builds on the already formidable security capabilities of the world’s leading customer relationship management platform. With Salesforce Shield, organizations can institute better internal cybersecurity practices by developing clearer oversight of employee’s daily activities and stronger protection of their valuable data. Salesforce Shield expands on the class leading security infrastructure of Salesforce across the three key service areas of:

- Platform Encryption

- Event Monitoring

- Field Auditing

Salesforce Shields’s focus on these three services allows for a more nuanced utilization of privacy functionalities and clearer oversight into the firm’s cyber activities. Of course, administrators of standard Salesforce environments could always customize their firm wide security settings through a variety of restrictions, permissions, and requirements across the platform. However, with Salesforce Shield, administrators have exponentially deeper control and granularity when establishing and maintaining their firm’s online security. This article will provide an overview of each Salesforce Shield’s services, as well as the key factors management should consider when implementing the technology.

Platform Encryption

A standard Salesforce subscription only allows for the encryption of custom fields that are less than 175 characters, which is likely insufficient for many firms that maintain large amounts of customer data. For the first time, Salesforce Shield brings encryption to a wider range of custom and standard fields, including sensitive information such as Account Names, Addresses, Phone Numbers, and Emails. Platform Encryption with Shield allows users to natively encrypt their most sensitive data such as personally identifiable information (PII), confidential, or proprietary data, while meeting internal and external compliance regulations. Salesforce Shield also allows users to adopt the latest encryption innovations, such as Bring Your Own Keys (BYOK), which allow users to provide their own tenant secret, generate their own Hardware Security Module (HSM), and ultimately increase their control over the encryption processes.

Implementation Considerations:

1) Identify Encryption Needs

-

- Firms need to first identify their unique encryption needs. Encrypting every piece of data that a firm has online would slowdown workflows, leading to inefficiencies that provide little returned value. Firms should identify and evaluate the potential channels and methods of attack they face, while also classify the data types that they would like to protect. At the same time, firms can specify which fields are the truly “must encrypt” elements and evaluate the business functionality changes that may come with encrypting this information.

2) Apply Field Level Encryption

-

- Because encryption can be assigned at the field level across different users, firms need to decide which fields would be accessible by different users. Shield allows firms to grant permissions to certain fields only for authorized users, while also applying encryption to these fields for an added level of security. Once these capabilities have been properly vetted, users can begin testing how their business processes would work with this newly encrypted data.

3) Define Key Management Strategy

-

- Shield enables firms to take on greater ownership over their encryption key management strategy. For an effective implementation of Salesforce Shield, firms should identify who can manage the encryption keys and define the protocols for backing up, rotating, and archiving keys.

4) Maintain Organization’s Encryption Policy

-

- Platform encryption requires strong policy and procedure documentation to guarantee its effectiveness. Establishing the lifecycle of keys and periodic data backups ensures that the data your firm has today is securely maintained in the future as well. Meanwhile, periodic reviews of encryption protocols ensure that these established policies remain effective as data grows and new fields are added. Regular reviews of data encryption protocols are a critical aspect of continued data security and data effectiveness with Salesforce Shield.

Event Monitoring

Salesforce Shield allows firms to have even clearer oversight of critical business performance and user behavior data. Firms using Salesforce Shield have a deeper understanding of the underlying performance, security, and individual usage of data stored in their Salesforce ecosystem. With Event Monitoring, managers can drill deeper into their event log files in order to visualize time relevant performance and security metrics. This allows managers to understand employee behavior within Salesforce, ensuring that they are securely utilizing the platform to its fullest potential, and overseeing the storage of their sensitive data. Managers would find these capabilities especially valuable during audits, when regulators can easily drill down to see what changes were made within Salesforce, by which users, at what time. Shield allows for this Event Monitoring capability on over 40 different event types across different user activities, all of which can be displayed across 16 pre-built dashboards.

Implementation Considerations:

1) Capture Read-Only Event Log Files

-

- With more than 40 event types able to be captured using Salesforce Shield, firms should first review the current list to see which would bring value to their organization. Event logs can store the granular details of how specific users are utilizing the firm’s data, as well as the corresponding timing and location of these action. Therefore, understanding what data to be capturing as well as the means of capturing this data is critical part of a successful Salesforce Shield implementation.

2) Visualize the Data to Identify Critical Insights

-

- The ability to directly transfer Salesforce insights into any business intelligence or data visualization tool, such as PowerBI (click here for an earlier FinServ post on Power BI), allows managers to quickly visualize trends and develop actionable strategies. Users can also build Data Loss Prevention or Adoption & Performance dashboards with Einstein Analytics or bring this data into any of the 16 prebuilt dashboards with the Einstein Event Monitoring Analytics tool included with Shield. Additional visualizations capabilities can also be found in pre-built apps via Salesforce’s AppExchange and data can still be exported to CSV files for additional analysis and visualization methods.

3) Take Action

-

- Identifying gaps in security policies and procedures, modifying governance policies, and setting up access controls as well as transaction security measure are all early management considerations for an effective implementation of the Event Monitoring service. This will support firms in driving initiatives to increase user adoption, automating workflows, and improving the overall performance of their Salesforce environment.

Field Audit Trail

As companies continue to generate and track massive quantities of data, having an effective IT governance strategy in place becomes more and more critical. Salesforce Shield Audit Trail allows users to track the history of various data fields in their Salesforce ecosystem in a far more robust manner. While the field history feature included with a standard Salesforce subscription allows users to track 20 fields for 18 months, Salesforce Shield Audit Trail allows users to track 60 fields per object for 10 years. This is a significant asset for firms operating in highly regulated industries such as financial services. Shield allows firms to extend the utilization of their audit trails while remaining compliant with data retention and audit granularity requirements.

Implementation Considerations:

1) Consult Business Units to Understand Retention and Audit Period / Depth

-

- Firms should first identify their data retention and audit period on a per object basis to understand exactly where and how Audit Trails may benefit their business processes. While the maximum possibility is for 10 years and 60 objects, firms should find the ideal balance between complete oversight and operational efficiency. Additionally, firms should consider the unique regulatory guidelines they must adhere to while customizing the service to fit their needs.

2) Set Retention Policies

-

- Firms should determine which fields and objects should be retained for audit purposes. Additionally, identifying when and how long this information should be archived is a crucial step in a successful implementation of Field Audit Trail.

3) Identify Practices for Retrieving and Auditing Data

-

- Finally, firms should develop best practices for obtaining, maintaining, and auditing this data. Steps such as setting up audit dashboards, defining standardized queries, and providing access to auditors in the permissions settings should be taken to ensure consistent and accurate reporting of Field Audit Trails in the future as well.

Security Benefits Over Standard Salesforce

The Platform Encryption, Event Monitoring and Field Audit benefits that Salesforce Shield brings to users, beyond the basic platform capabilities, offer an effective means of protection against a wide range of cybersecurity threats. Firms can now encrypt large amounts of information in standard objects, track and visuzalize a variety of events in pre-built dashboards, and maintain an audit history of dozens of objects for a decade. Salesforce has recognized that as the cybersecurity landscape continues to evolve, robust and innovative solutions are needed to keep their customers ahead of criminal attacks.

FinServ’s Capabilities

When securing your firm’s sensitive data from increasingly sophisticated attacks, it is crucial to partner with industry experts that understand the most effective solutions available. While Salesforce Shield brings a deeper level of sophistication over classic Salesforce security capabilities, sophisticated technology is only part of the complex cybersecurity equation. FinServ can gather the development requirements and implement the detailed policies and procedures to protect your firm for years to come. An effectively led implementation of Salesforce Shield is the best way to ensure that there is lasting security for your organization as cybercrimes grow more sophisticated and prevalent.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Leverage Document Intelligence to Expedite LIBOR Contract Renegotiations

As previously discussed in SOFR is the New LIBOR, one of the key issues regarding the transition of $35 trillion in USD LIBOR assets to an alternative reference rate is the lack of sufficient fallback language. Inadequate fallback language gives rise to an assortment of complications when attempting to analyze contracts using traditional technologies. Fallback language is the contractual provisions that outline the procedure for transitioning to a new reference rate.

Fallback Language Elements:

Issues with Fallback Language

Numerous issues arise when analyzing the fallback language of assets tied to USD LIBOR. Contracts often fail to designate a benchmark replacement rate and therefore leave managers without a clear resolution plan in the occurrence of a fallback trigger event. Most of the language was designed to alleviate temporary gaps in benchmark rate reporting rather than the permanent termination of LIBOR. Consequently, the appropriate benchmark replacement is unclear.

Compounding the lack of clarity is the absence of a standardized contract structure across various derivatives and cash products. Moreover, many contracts lack the existence of fallback language altogether. The involvement of multiple parties further complicates fallback language negotiations due to a misalignment of priorities. The amalgamation of these issues has hindered firms from storing asset contracts in a sophisticated document repository with search capabilities and often warrants the manual review of individual contracts.

Addressing the Situation

Changes to the structure of a fund’s holdings and operations command careful planning and execution. Amendments deriving from the termination of LIBOR mandate the construction of meticulous roadmaps and the design of new business procedures. Their creation is impossible without the knowledge of USD LIBOR assets and processes. It is vital to take a detailed inventory of all holdings, systems, and operations that are subject to change. Consolidating contracts into one or more defined document repositories augments the renegotiation process by facilitating the application of targeted remediation strategies.

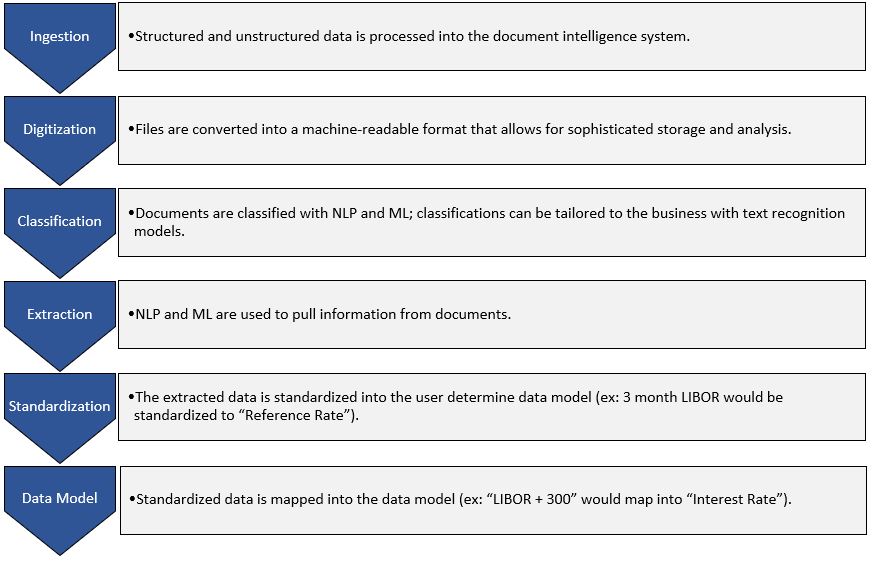

Following the familiarization of contracts and their storage, the application of document intelligence solutions can greatly enhance the navigation of fallback language with tools such as natural language processing (“NLP”) and optical character recognition (“OCR”). Document intelligence has shown the ability to decrease cost by 80% and processing time by 90%; while increasing accuracy and consistency by 25% and 50%, respectively. The classification and normalization of data augments your contract review team’s ability to analyze contracts. Additionally, NLP and machine learning (“ML”) technology enable access to vital information that was formerly lost in traditional document repositories.

How Document Intelligence Works:

More on Document Intelligence Systems

Document intelligence solutions automate the ingestion of contracts, extract and structure key data, and automate contract repapering. Repositories frequently lack the advanced search capabilities required for evaluating fallback language. The implementation of a document intelligence system that automates the ingestion of structured and unstructured contracts can fill this gap and streamline your firm’s technological infrastructure.

Document Intelligence solutions transform key contract data into structured data models that allow for advanced search capabilities. Next, the solution automates various components of the contract repapering process such as generating the proposed amendments. Contract repapering functions can be paired with workflow tools to further streamline the process. The assortment of features offered by a document intelligence solution result in significant time and costs savings while boosting accuracy.

FinServ Can Help

Why tackle this arduous task alone when industry experts are eager to help? FinServ’s project management and industry expertise can provide value through the various stages of negotiating fallback language. FinServ can lead the implementation of your desired document intelligence solution, construct a comprehensive inventory of your firm’s contracts, and manage the integration of existing infrastructure with your new system.

We can produce a detailed overview of the document intelligence solution, it’s interdependence with various internal and external systems, and design the procedures associated with its use. FinServ understands that proper documentation is essential for mitigating regulatory risks, validating business procedures, and streamlining training.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

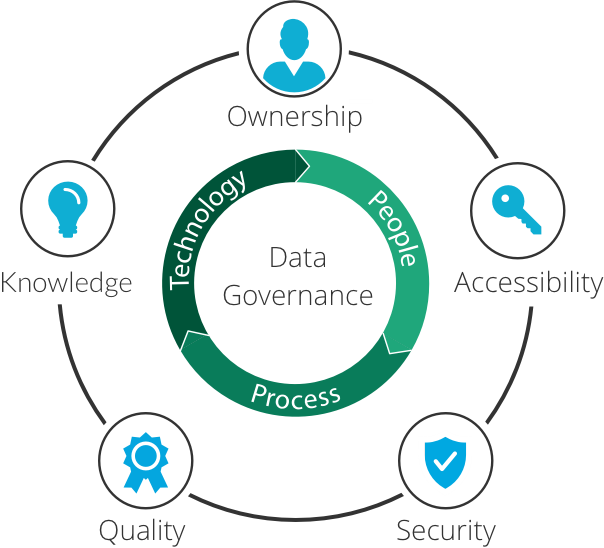

Discipline is Freedom: How Data Governance Generates Alpha for Asset Managers

In today’s increasingly digital, data-centric corporate environment, a strong data governance approach is of utmost importance. Data governance defines who does what in data management. It cannot be solved in one corner of the organization; it requires consistent collaboration between IT and business to manage data as a real asset. A robust data governance program defines who makes the decisions and who is accountable for each data management activity in the company. Defining these roles is necessary to improve data integrity, power key business initiatives, and ensure regulatory compliance.

Companies with unclear or non-existent responsibilities related to their data lack an effective data governance methodology and usually face the following situations:

- Lack of clarity around who is responsible for key data objects and their quality

- Poor data quality (e.g. missing values, outdated information)

- Data management and stewardship activities are performed in an unstructured manner and without proper documentation and controls

These issues can have severe consequences for an asset management firm from the front to back office. For example, poor data quality and lack of responsibility for key data objects can lead to problems in reporting, such as incorrect or missing data items for PnL reporting. Asset managers are in need of enhanced analytics that improve operations. In order to build out a target operating model or other highly scalable platform, asset managers must focus on being a data-first company.

Clearly, there can be substantial functional and tactical obstacles to establishing a data governance framework. However, the benefits and overall payoff are well worth the investment. Especially within the asset management domain, there are several advantages of implementing an effective data governance strategy.

Prepare for Regulatory Scrutiny

The financial services industry has recently faced increasing pressure to comply with new financial data reporting regulations such as AIFMD, Form PF, GDPR, CCAR, and DFAST. Most firms were not adequately prepared; they had to scramble to find the necessary data, map its lineage and usage, and verify its accuracy in order to satisfy these requirements.

Firms learned that a data governance program would alleviate much of the compliance pressure and avoid endless meetings, emails, Excel spreadsheets, and Visio diagrams. The best way to end that cycle of ad hoc documentation, which produces data that nearly instantly becomes stale, is through the use of technology and analytics. Asset managers can benefit from proactively implementing a data governance plan that will be useful when the regulators come knocking.

In addition, there has been increasing regulatory emphasis on data security and protection, including cybersecurity, preventing data leaks. Data governance is the clear solution here for asset managers to prove the reliability of their data to authorities and ensure that they have protected the data against potential breaches.

Consistent Standards for Data Quality, Validity, and Transparency

The process of acquiring data, especially from external, third-party vendors, is an expensive one for asset managers. On top of that, the data may not have been properly validated and therefore presents quality issues. A centralized data governance system can streamline data procurement and validation so the firm can negotiate favorable rates with vendors, mitigate data-related risk, and reduce operational costs of scrubbing the data.

Once the data is within the organization, quality can still be an issue for different users. A data governance program facilitates commitment to firm-wide data quality standards, which increases transparency and trust among business users that the data has been thoroughly validated.

Additionally, business terms and definitions often have an entirely different meaning in one group versus another, which leads to issues in the case of firm-wide initiatives and projects that require multiple teams to collaborate. This is where data governance comes in to help centralize the function and create a set of business definitions (a “data dictionary”) and business usage rules. Having a centralized governance process is very useful when it comes to large-scale data transformations for mitigating risk through increased control and oversight of complex data projects.

Increase the Value of Data

The vast amount of data that is available today can be extremely valuable to asset managers for many purposes, from discovering valuable investment opportunities to gaining insight on potential investors. Implementing data governance contributes to increasing data’s value even further. If it is not used properly, data has little to no value. Governance ensures that any data issues can be quickly resolved, and that data is ready for use in increasing efficiency of business processes as well as decision-making and business models.

Implementing Data Governance

FinServ Consulting specializes in offering a wide variety of business services to asset management firms; we can help define a data governance framework that will realize the benefits discussed and more. FinServ can provide hands-on business analysts to support clients looking to create a specific set of reports of dashboards, those looking to stand-up a formal data governance program, and those looking to implement a more complex master data management system to handle growing complexity of hybrid on-premise and cloud system ecosystems. We are well versed in the established guidelines and proven approach for setting up data governance:

- Define who does what. Who owns specific data management activities within the organization? Is the function centralized or decentralized?

- Set mandates and decision-making rights. Set the mandate and decision-making rights for the people defining and monitoring the governance policies and standards.

- Define an implementation plan. Training, communication and change management activities should be included.

- Identify resources. Determine how many people are needed and select the right individuals to run data governance.

- Select technology. Select the appropriate technology solutions to create a best-in-class platform.

Summary

If you are interested in establishing or improving your firm’s data governance platform, FinServ Consulting is the right partner to help you reach your firm’s strategic data objectives. Throughout our 15 years of existence, we have proven that our deep industry knowledge combined with our project management and overall best practice methodologies can be an asset to your organization. To further continue the conversation or to discuss more of FinServ’s capabilities, please contact us at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

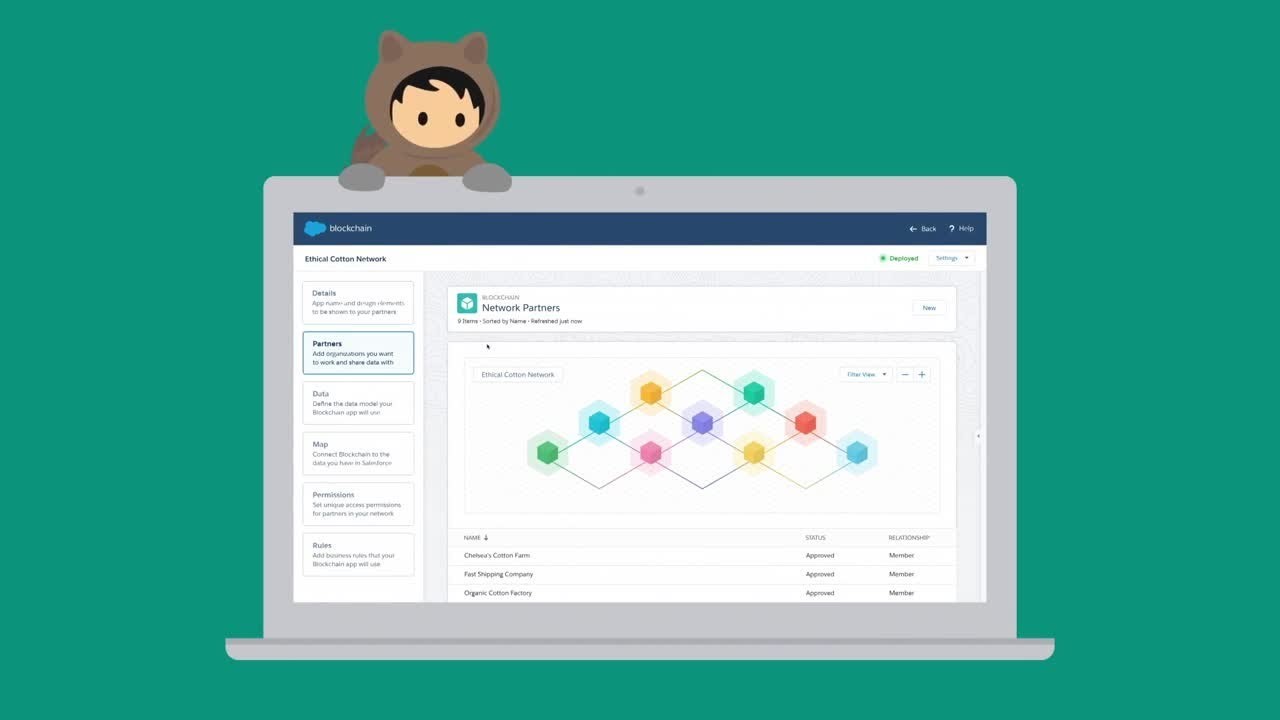

Smarter Contracts with Salesforce Blockchain

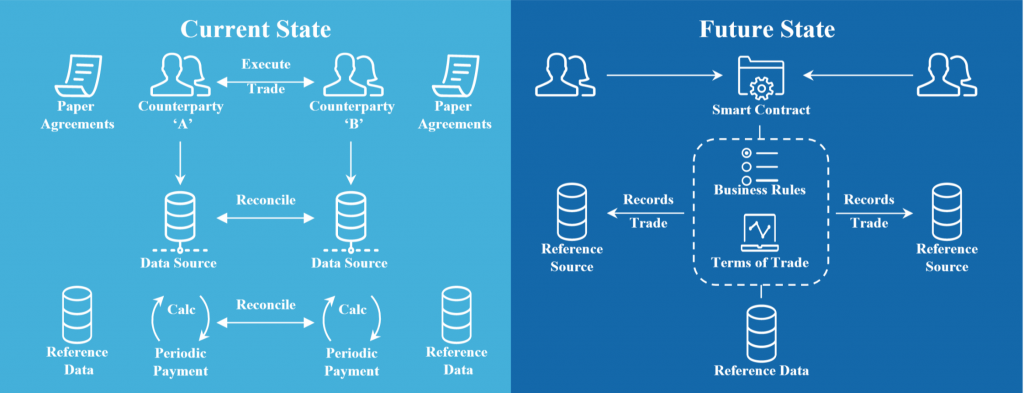

Smart contracts are the most disruptive enterprise application of blockchain technologies and will continue to create new efficiencies for the financial services industry. They allow for a reliable and enforceable means of aligning multiple parties across a decentralized platform. When Nick Szabo developed the concept of smart contracts in the early 1990’s, blockchains and the subsequent hype surrounding them did not yet exist. Now, the decentralized and trust-based nature of blockchains give smart contracts the necessary platform for reaching more widespread applications in the business environment.

Smart contracts create previously unrealized efficiencies and new opportunities for many business processes; however, the code heavy nature of the technology has historically been a major barrier-to-entry. This has led to a growing need for a scant number of technical developers that not only understand the intricacies of building sophisticated blockchain networks, but also have a deep fundamental understanding of the end user’s business needs. That knowledge scarcity seemed to be the leading factor consistently restraining the enterprise potential of smart contracts. However, Salesforce blockchain eliminates the dependency on building blockchains from lines of code. Instead, users may use the same intuitive drag and drop interface from the world’s leading CRM platform: Salesforce. Smart contracts on the Salesforce blockchain, replace the resource intensive development cycles of other blockchain solutions with easy to use functionality.

What is a “Smart Contract” Anyway?

Smart contracts are self-verifiable, self-executable, and tamper proof contracts that exist digitally. At their core, smart contracts are computer programs collectively developed and agreed upon by two or more. This computer code verifies, executes, and enforces the terms of the contract if / when they are met. While this intermediary verification and enforcement role has often been reserved for an individual or institution, smart contracts are a way to remove the resource intensive and error prone third party from the equation. Instead, a secure and trusted decentralized blockchain takes their place as the intermediator that verifies and enforces the agreement both parties previously determined.

Advantages of Smart Contracts on Salesforce Blockchain:

1. Start by defining the trust network, its rules, and permissions. Blockchains are an effective means of uniting participants from different entities under a single network. However, not all of the participants necessarily need the same access to data in the network or the permission to modify that data in the same way. Salesforce blockchains are permissioned, meaning that the network agrees on what sort of information each network participant may view, as well as if / how they are able to modify that information.

2. Create a low-code data model directly on blockchain. Many of the same fields that would be necessary terms of the smart contract are already common objects and fields within Salesforce. Creating a smart contract and filling in these crucial pieces of information is just as straight forward and foolproof as working through other standard processes in Salesforce.

3. Make blockchain data actionable. Because Salesforce Blockchain is directly linked with the Salesforce Lightning platform, smart contract terms can easily be linked to Salesforce platform events, opportunities, and more to directly reflect the outcomes of the smart contract within the Salesforce environment. No need to go back to Salesforce and manually update the platform based upon the predetermined conditions of the smart contract. This is built into the contract!

4. Easily create apps for all partners and invite them. Entities that are already Salesforce customers have direct insight into the information shared with other participants on the Salesforce blockchain network. Entities that are not Salesforce customers can utilize Heroku or any custom framework to have the same blockchain data be available outside of Salesforce as well. This allows all firms to participate in the efficiency gains of blockchain technology without having to be a Salesforce customer themselves.

Smart Contracts & Derivatives

As with traditional contracts, smart contracts are used when multiple parties need to enforce all participants to adhere to a set of terms. Most often, there are circumstances surrounding these terms that require the participating entities to independently verify each other’s work. Smart contracts are appropriate when:

- More than one entity requires access to the blockchain ledger

- There are potential misalignment issues as to who controls the data

- There is a need for robust data integrity protections and a tamper proof auditable trail for all changes to the data

Smart contracts can be used to create efficiencies in post trade processes by removing the duplicative efforts of each counterparty independently verifying and executing trades. They enable a standardized and predetermined set of terms to create efficiencies in the post-trade processing of over-the-counter derivatives. Smart contracts also enable real-time valuation of positions, allowing for more transparent monitoring and reductions of costly errors. Following the predetermined business rules and terms of trade set by both parties, smart contracts streamline the reconciliation process as well. Salesforce blockchain’s functionality means digitally building secure and executable contracts for sophisticated business processes is an intuitive and efficient way of building enforceable agreements.

Future of Smart Contracts

Smart contracts built on Salesforce Blockchain are poised to disrupt the role intermediaries play across several industries. Individuals are able to manage their digital identity by only enabling the necessary details of their personal identity to be viewed by the required entities. Supply chains are more easily auditable for all parties involved at each stage, allowing for more effective planning and real time insights. Rather than having to wait for an intermediary to update subsequent lines of the supply chain, all participants have a clear understanding of everyone else’s current status. Loan processing and verification will shift from disjointed paper-based forms for verification by an intermediary to easily fillable drop down menus. Transfers of funds or knowledge today that require an intermediary verifying all participating entities can be replaced by the secure, verifiable, and self-executing smart contract on the blockchain.

Summary

Smart contracts on the Salesforce blockchain will revolutionize several business processes relevant to the financial services industry. FinServ has been considering the efficiency gains associated with Salesforce blockchain as well as the usability and process flows of working in the system. As a Salesforce Consulting Partner, FinServ will be joining several other leaders from their respective industries in testing and vetting the Salesforce blockchain platform to ensure that it meets the sophisticated needs of our customers. We are excited to see what benefits Salesforce blockchain and its ability to easily develop smart contracts will soon bring to the financial services industry. If you would like to learn more about the Salesforce blockchain network or other FinServ capabilities, please reach out to us at info@finservconsulting.com or give us a call (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

SOFR is the New LIBOR

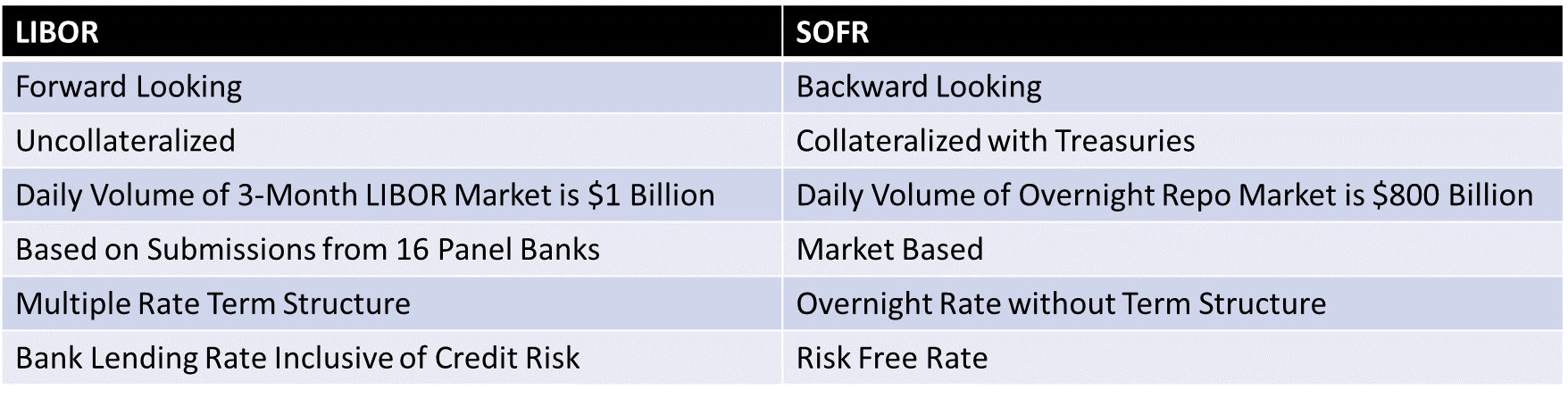

Transition from the once world-renowned London Interbank Offer Rate (LIBOR) to an Alternative Reference Rate (ARR) is slated for completion by year-end 2021. The push to guide the world economy from LIBOR to the Secured Overnight Financing Rate (SOFR) was triggered by a series of scandals that highlighted LIBOR’s reliance on “Expert Judgement” rather than market transactions. LIBOR serves as the benchmark rate for more than $350 trillion financial products worldwide with $200 trillion in assets tied to USD LIBOR alone.

What is LIBOR, and How is it Used?

LIBOR is published daily by the Intercontinental Exchange (NYSE: ICE) and denominated in five currencies across the world. It is the benchmark interest rate for major global banks extending short-term loans to one another on the international interbank market while serving as the benchmark rate for variable lending assets such as adjustable rate mortgages and other consumer loans. In addition to loans, it is used as the base rate for FRNs (floating rate notes) that use “LIBOR + X” to determine yield. Other financial instruments that frequently use LIBOR as the underlying rate include forward rate agreements, interest rate swaps, CDs, syndicated loans, and various collateralized obligations.

LIBOR’s Shortcomings

The primary shortcoming exhibited by LIBOR is its dependence on “Expert Judgement” rather than an active market. The rate submitted by each of the 16 panel banks is the cost at which the bank believes it could finance itself. LIBOR’s significantly low trading volume is illustrated by its most active tenure’s (3-month) daily transaction value of approximately $1 billion. Consequently, less than 30% of LIBOR rate submissions are derived from actual transactions.

What is SOFR, and How will it Alleviate LIBOR’s Issues?

SOFR is the cost of borrowing overnight cash collateralized by Treasuries. It is the proposed Alternative Reference Rate for USD LIBOR and is posted each business day by the New York Fed around 8:00am. SOFR is dictated by the daily exchange of $800 billion in overnight Treasury repo transactions. This greatly reduces its susceptibility to manipulation as the rate is determined by market activity rather than the submissions from the 16 panel banks.

SOFR’s Shortcomings

Although ARRC has deemed SOFR as the USD LIBOR replacement, it is not a flawless solution. SOFR lacks LIBOR’s credit component and termed structure. LIBOR is produced for multiple time periods (3-month, 6-month, etc.) and SOFR is a single overnight rate; thus, posing an issue when borrowing funds at various time intervals. SOFR’s volatility is another predominant issue that was illustrated by a spike in September of 2019 when it jumped to 5.25% while some individual transactions reached as high as 10%. The issue was severe enough to warrant Fed intervention.

Managing the Move – FinServ Can Ensure Success

$35 trillion of the $200 trillion in assets tied to USD LIBOR are scheduled to expire after 2021. These legacy assets with varying fallback language present complexities when analyzing the impact of the transition and extracting LIBOR terms from ISDA contracts. Exposure to LIBOR assets can be identified through the utilization of technological systems such as Natural Language Processing (NLP) or a manual process; but it will likely prove ineffective to solely allocate human resources to the task. FinServ can spearhead the combined application of NLP technology and manual oversight to restructure legacy assets referencing LIBOR.

Regulators advise the appointment of a Senior Manager in conjunction with the establishment of a steering committee to oversee the changeover. The transition is a laborious process that will require the complete dedication of numerous individuals and a detailed roadmap for measuring progress. FinServ can oversee interactions with internal and external stakeholders while providing onsite white glove service tailored towards walking your company through this vital transformation.

FinServ’s comprehensive project management approach is inclusive of issue management, scope management, executive level presentations, and comprehensive weekly status reports. A mere 20% of financial institutions have a mature LIBOR transition plan for the impending 2021 year-end deadline. It is critical to create a thorough LIBOR Roadmap and begin immediately.

An extensive review of your business is vital for the identification of LIBOR dependent practices. Additionally, an in-depth analysis of your current state will likely identify opportunities for enhancement. Formal documentation of modified and/or new processes is crucial for training personnel while simultaneously serving as a resource for resolving issues faced in day-to-day operations. Allow FinServ to apply our business and technological expertise to create documentation that employees lack the time to adequately produce.

Summary

It is not necessary to embark on the journey from LIBOR to SOFR alone. Nor is it always feasible to allocate employees with various other responsibilities to this initiative. The move from LIBOR to SOFR is quickly approaching and it is best to make the necessary adjustments sooner rather than later. FinServ is an industry leader that has the expertise, experience, and resources required for a successful transition. To further continue the conversation or to discuss more of FinServ’s capabilities, please contact FinServ at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Opportunity Zone Investments

Hedge Funds and Opportunity Zones

Opportunity Zones have recently been cited in the news as new opportunities for investors looking for tax-deferred long-term gains. What is an Opportunity Zone? According to the IRS, an Opportunity Zone is an economically-distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as Opportunity Zones if they have been nominated for that designation by the state and that nomination has been certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service. In order to be eligible for this program, specific state census tracts must have a 20% poverty rate or have a median family income of less than 80% of the surrounding area. Governors then selected 25% of the eligible tracts for the program.

These Zones were added by the Tax Cuts and Jobs Act in 2017 as a way of spurring investment in economically distressed cities. As a result of this new law, many asset managers have been raising new funds to invest in these Zones. The value proposition in these Zones is such that taxes can be deferred on any gains invested in these Funds as late as the end of 2026. In addition, if the investment is held for longer than 5 years, an additional 10% is excluded on the gain. If the investment is held for longer than 7 years, the exclusion becomes 15%. Furthermore, if the investment is held for at least 10 years, the investor is able to be exempt from all capital gains taxes.

Not surprisingly, many funds have been eager to defer capital gains by selling investments that have appreciated and reinvesting the gains in the new funds within six months. According to the rules, the sale of stocks, real estate or businesses can be sold and their proceeds can be reinvested in these Funds. The principal and capital gains can both be invested, but only the capital gains portion is exempt from taxes. There is also no requirement to invest in a like-kind asset in order to defer the gain (which is a requirement in a 1031-exchange).

Funds Investing in Opportunity Zones

One of the more famous (infamous?) funds that has started an Opportunity Fund is Skybridge Capital, whose Co-Founder is Anthony Scaramucci, the former White House communications director for President Trump. Skybridge intends to raise $3 billion for their Opportunity Fund. Another is EJF Capital. They manage almost $7 billion in assets and recently started fundraising for a $500M fund in September 2018.

Skybridge and EJF Capital had announced plans for a joint $3 billion fund, but recently ended the venture after there were concerns about EJF’s experience in managing real estate funds.

While the traditional hedge funds are open to individual investors (many have minimums of $50K to $100K, and in many cases, substantially higher), there are other opportunities for individual investors.

These include crowdsourced investment vehicles like Fundrise, which allow retail investors to invest as little as $500 into a pooled investment vehicle, which then invests in an Opportunity Zone fund.

Benefits of Opportunity Zones

The benefits of these Opportunity Zones are multi-faceted. One is tax deferral for investors. Another is the hope of rebuilding depressed American cities.

From an investor point of view, the tax deferred benefits of such a program are the biggest benefit. The ability to take capital gains from a current investment and invest it in a new one that can defer taxes for up to 10 years can be attractive to long-term investors. In addition to the tax benefits, by increasing the benefits to an investor the longer they invest their money, it ensures that the investor is financially aligned with the Opportunity Zone and ensures they have skin in the game.

The largest social benefit is spurring economic investment. Recall the old saying ‘a rising tide lifts all boats.’ This program has the potential to revive smaller cities and towns that historically, have not had much outside investment. By providing incentives and access to private money, this new law can turn around once-forgotten cities in the Midwest and Rust Belt that have not been able to attract development and investment like the coastal cities of San Francisco and New York.

Risks and Downsides of Opportunity Zones

Like any speculative investments, the potential risks are not suited for the faint of heart. Aside from the lock-up period needed to realize the potential tax benefits, there is no lengthy track record by which an investor can gauge performance. In addition, one needs to question why some of the depressed areas have not had organic investments on their own and rather, require the specter of deferred tax benefits to attract investors.