The Great Debate: Agile or Waterfall Project Management

Effective Project Management

Effectively managing a project and team(s) is a difficult task that faces increased challenges in a remote environment. Obstacles are exacerbated by the lack of in-person collaboration and the inability to stop by a colleagues desk for a quick and informal update. However, selecting the correct project management methodology can help alleviate numerous issues and ensure that your project is completed successfully.

Agile & Waterfall Methodology Overview

No project management technique is best suited for all situations. The most common methodologies are Waterfall and Agile. Although both approaches are popular and have been around for an extended period of time, specific projects are better suited by one or the other.

The Waterfall methodology is the traditional and sequential approach that is best for projects with a well-known scope likely to experience minimal change. Client input takes place at milestones as the project transitions throughout the various phases. In a Waterfall project management strategy, each phase must be completed prior to transitioning to the following phase. These phases are clearly outlined and define clear objectives that must be accomplished before progressing.

As indicated by the name, an Agile methodology is designed to accommodate change. Its iterative nature focuses on completing certain objectives by the end of a specified time period known as a sprint. Agile methodologies are well suited for projects with unclear initial requirements. The methodology prioritizes the most important aspects of a project and relies on continuous client input throughout the engagement. Deliverables are reviewed by the client and other applicable teams after their corresponding sprint.

Advantages of Each Method

The Waterfall approach’s numerous advantages derive from its structured nature. The first of which, is that it clearly defines all aspects of the project and ultimately increases planning accuracy and detail. Consequently, this approach aligns well with fixed price contracts and government entities. Furthermore, progress can be measured through the completion of each phase as opposed to a product backlog that hasn’t been addressed.

It is less reliant on client input because it is predominantly collected at milestones. This allows the client to take a hands off approach and focus on the day-to-day operations of their business. Finally, successful completion of projects managed with a traditional methodology ensures that all items are addressed and eliminates ambiguity.

One of the greatest advantages to the Agile approach is its flexibility. An Agile approach is particularly useful when the project’s timeline is strained because it prioritizes the most important features. The sprint structure aligns with Time & Materials contracts because sprints are predetermined timeframes that specify workload.

Additionally, constant client interaction augments quality via increased feedback, additional testing, and dynamic user requirements that account for evolving needs. The constant nature of client feedback allows for frequent modification of the product backlog. This is particularly useful for a technical client that wants to get a deeper understanding of the solution. They can work through their use cases and determine if their needs will be better served by an alternative route.

Disadvantages of Each Method

Although each method is effective in its own right, they are not without disadvantages. The Waterfall methodology requires a thorough understanding of business requirements prior to beginning. The Project Manager must have a clear sense of all client needs and initially account for them throughout the various phases. Scenarios where the client is unable to provide a comprehensive overview of the requirements may force the PM to “fill in the gaps” – which is far from ideal.

Another disadvantage associated with the Waterfall approach is the risk of a final deliverable that is not in line with client expectations. Given that the client is less involved in the process, they may be surprised by the end result. However, the traditional approach hedges against this with comprehensive requirements and periodic updates.

Agile method drawbacks tend to be associated with one of its strengths, frequent client input. It requires a significant amount of coordination and cooperation across multiple internal and external teams. While this is great in theory, it may be difficult in practice. Clients may not have the resources, interest, or expertise required for the Agile approach’s mandated involvement. This is especially relevant when the client outsources the work as they hired another firm to step away.

The adaptability of the approach leads to many changes in the project’s scope. These changes affect the project’s cost and timeline. Unfortunately, this is not feasible for certain clients and situations. Moreover, low priority items may not get completed within the original time frame due to a focus on high priority items.

Conclusion

In conclusion, both the Waterfall and Agile Project Management methodologies include pros and cons. In an ideal scenario, the project would be completed successfully regardless of the utilized approach. However, certain client types, engagements, and solutions are better suited by one of the two methods. It is critical that you discuss both options with the client and pick the one that they are most comfortable with. Many professionals blend the two techniques to benefit from each’s strengths while minimizing the drawbacks. Recent trends have increased popularity for Agile management, but it is beneficial to gather all available requirements as early as possible.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Securely Share and Work with Files in Salesforce

FinServ has partnered with a firm out of Germany to provide a seamless integration of SharePoint Online right in Salesforce. If you would like to see a demo, please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

The Nightmare Scenario you have to Avoid

Sweat is dripping down your brow and you have a queasy feeling in your stomach, it’s 2 o’clock in the morning and you are desperately trying to reach the person who your Investor Relations team accidentally emailed an investor (NAV) statement with the investor’s social security number in it. If you have shared a sensitive document with the wrong person, you know the sheer terror these moments can bring. We see the most sophisticated financial services companies in the world taken down by these types of mistakes all the time. Even if the email is retrieved the public relations fallout will likely cost you investors or in some extreme instances the shut down of your fund.

Given this risk, it is hard to believe that the majority of funds and other financial services firms are still not integrating their CRM systems with enterprise-level document management systems like SharePoint Online. At FinServ Consulting we work with 40 of the top 100 hedge and private equity funds in the world and very few of these firms currently use enterprise-level document management systems to protect their investor data.

The Quick and Easy way to Use SharePoint Online in Salesforce

Most Salesforce clients abandoned Salesforce Files a long time ago. Due to its lack of user-friendliness and severe limitations, Salesforce Files became one of the least-used features in Salesforce. At the same time, many companies have been moving to cloud-based office suites like Office 365 from Microsoft. With most Office 365 licenses, you get SharePoint Online for free. SharePoint Online is an extremely secure, cloud-based and feature-rich enterprise-level Document Management system.

Has anyone in your firm ever accidentally sent a sensitive document to the wrong client?

SharePoint Online has the ability to stop the recipient from opening that document even if they have already downloaded it onto their computer.

Inserting a Cloud-based Link to a SharePoint Online Document in Email

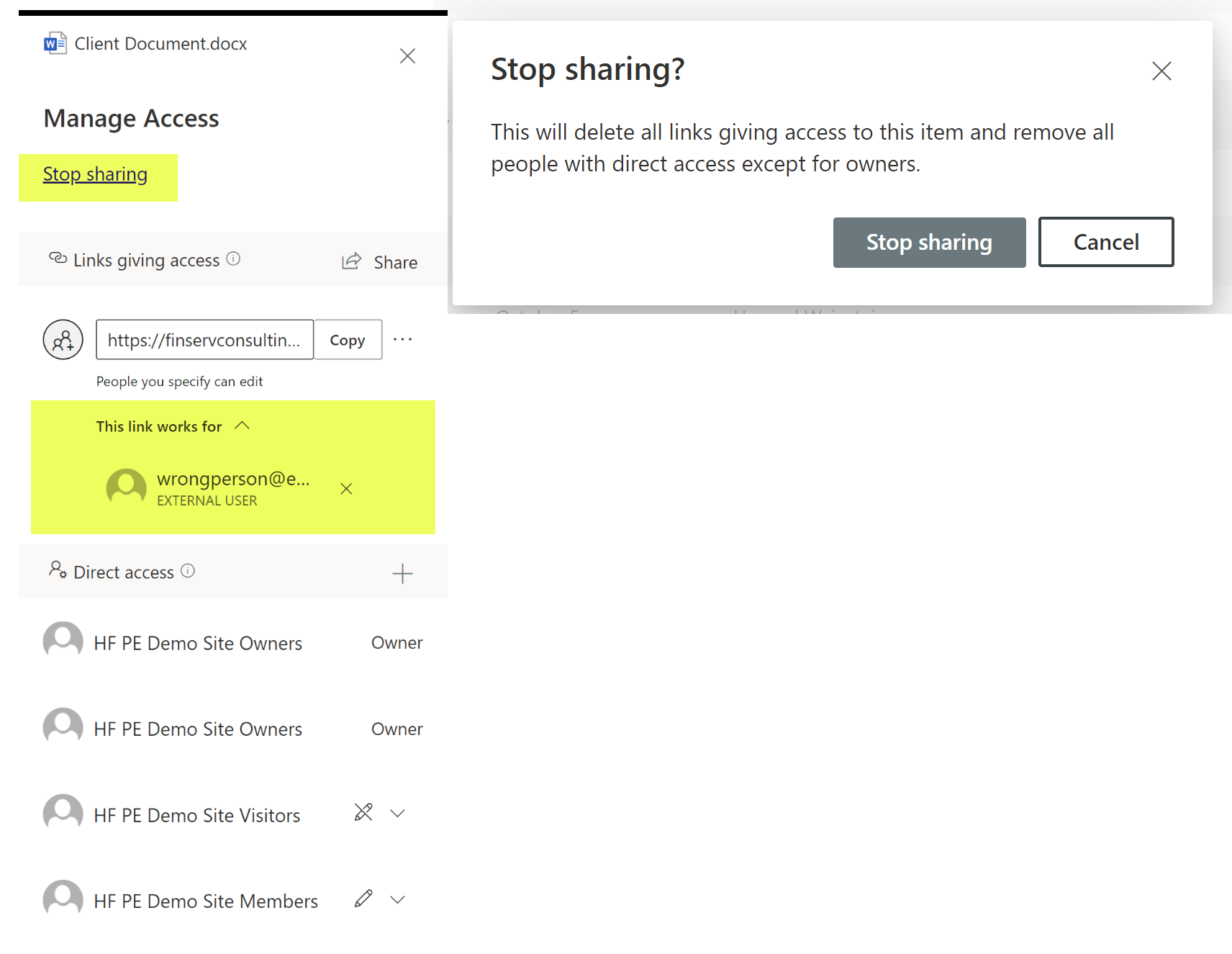

Removing Access Quickly

If you realize you made a mistake, you can stop the person from accessing the document you shared with just a couple of clicks. Even if they downloaded the document onto their hard drive, they will not be able to open the document thanks to Microsoft’s use of dual-key encryption. This means once you take away your side of the key, they can never open the document again.

2 clicks and access to the document is removed

Has anyone in your company ever accidentally or purposely emailed a file to an external recipient with Social Security numbers in it?

SharePoint Online with Outlook / Email integration means that you can stop any email or attachment from being shared if it contains sensitive info with PII (Personally Identifiable Information).

Particularly for highly regulated industries, like Financial Services and Healthcare, the built-in dual-key encryption and information rights management (“IRM”) features that SharePoint Online offers out of the box are “have to have’s”.

Microsoft PII Warning when Sensitive Data is Detected in a Document

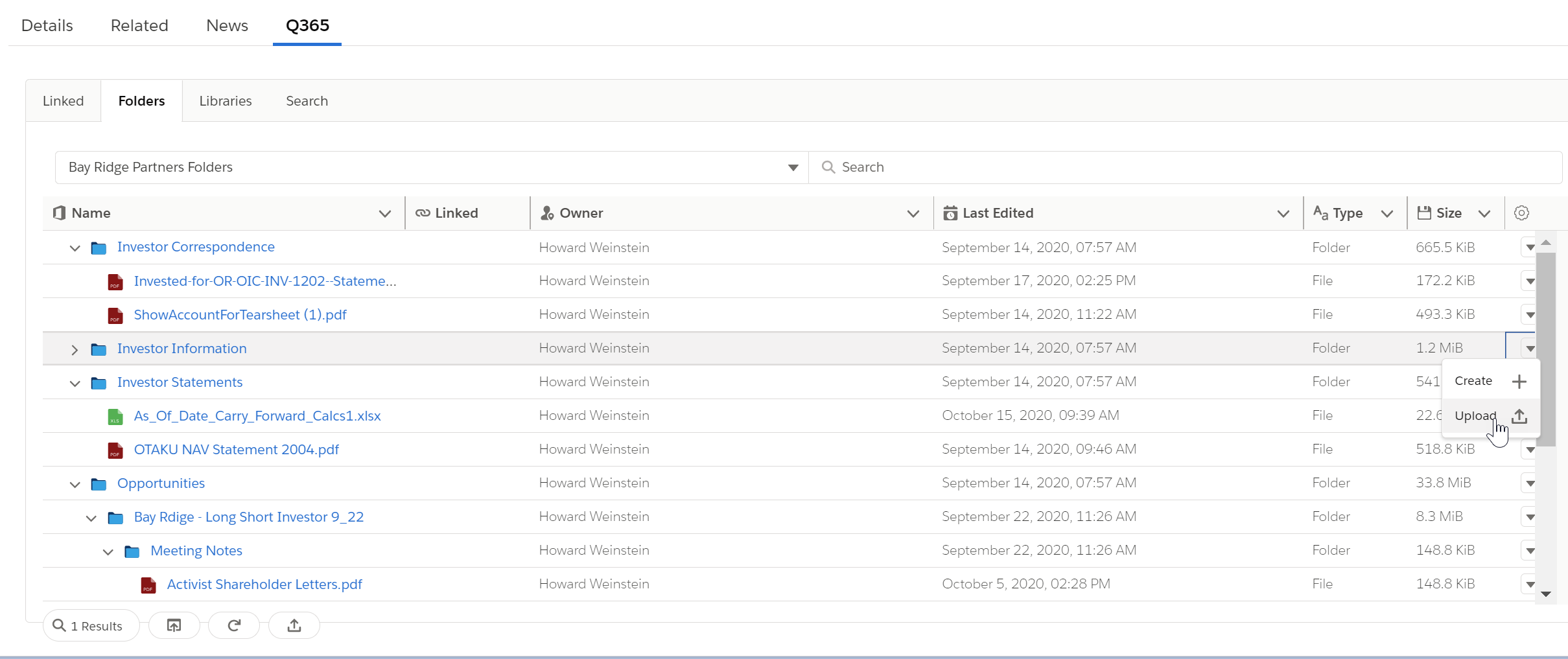

Seamless Integration with our Salesforce App

The application we helped build provides a seamless interface to all of your SharePoint Document Libraries and Files inside the Salesforce Lightning User Interface. The benefits of this application mean that your users will save hundreds of hours they used to spend searching through inconsistent folder structures and names or wading through multiple versions of a file to try to figure out which is the latest version of the file. By automatically linking the Files and Folders to your Salesforce records, you get your data and your files in one combined place to provide optimal efficiency for your team.

Through the application interface you get:

- 1-click to Open just about any kind of file so your team never wastes time with multiple clicks or waiting for a file to download before you can open it

- For Microsoft Office files where you have editor access, it will open up in the Office app in Editor mode

- You can upload files into the document library with 1-click as well

- You can also delete files if you have the correct access with 1-click

- Embedded search available right within the Lightning Component

Investor Relations Use Case

For our Alternative Asset Management clients, we offer the case study of the Investor Relations associate who often spends their day working with investors on questions. The ability to view the investor’s contact record while also looking at the investor’s latest NAV statement or recently updated subscription documents provides a level of efficiency that makes their day-to-day work much easier.

example of Investor Contact record with right sidebar of SharePoint Online Files

How the App Works

Putting the automated component into place is as simple as adding any Lightning Web Component; the interface offers quick and easy checkboxes to turn off and on key features in the application. Once added to any Object Type in Salesforce (standard objects or custom objects are all supported), the interface makes it simple and user-friendly to access your files and folders in seconds.

The quick and easy way to open SharePoint files right in Salesforce!

The application leverages advanced Microsoft technology to provide:

- Automatic creation of preset Folder and Subfolders that are automatically linked to the Salesforce record you just created or updated

- You can use the data in Salesforce to automatically name the Folder; this ensures a consistent naming scheme which will make it easy to find files

- For historical records, we offer automated scripts to create the Folder and Subfolders for all of your existing Salesforce records

Automatically Create a new set of SharePoint Online Folders and Link to your Salesforce Record with no Clicks when you create a New Salesforce Opportunity!

Conclusion

Using an Enterprise-Level Document Management system is a must-have for any company working in a regulated industry like Financial Services or Healthcare. SharePoint Online from Microsoft provides the most cost-effective and robust system in the marketplace. When you combine that with the Salesforce CRM system, you provide your users with a seamless and secure platform to work with customers while ensuring your company’s and your clients documents and data, including PII, remain secure.

The application FinServ has created with our partner provides the level of automation and seamless integration that your users demand and will also ensure they embrace the use of a Document Management system like SharePoint Online.

If you are interested in a demo or would like to purchase the application, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Technology Sets Its Sights on Private Equity

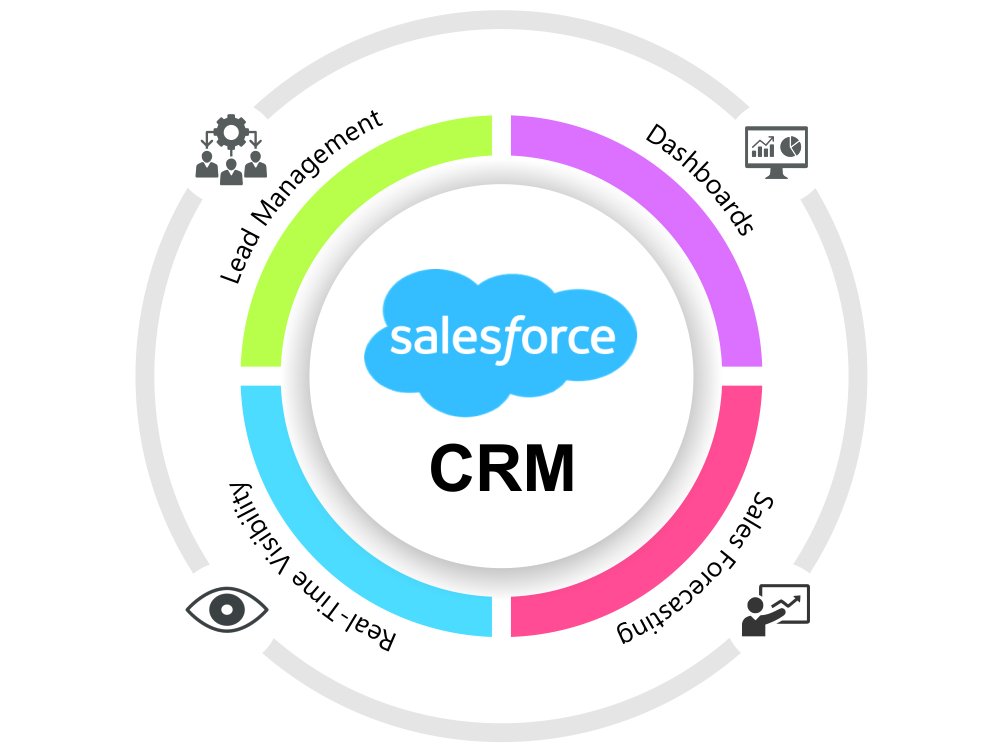

The evolution of technology and its impact across various industries has become widely accepted, particularly for Financial Services. However, Private Equity’s acceptance of new technology has lagged behind other subsectors. Resistance is subsiding as Private Equity Funds are rushing to adopt Client Relationship Management (“CRM”) tools, utilize unstructured data, and transition to the cloud.

Relationship Management

Success within Private Equity is reliant upon strong and enduring relationships that are difficult to manage without the proper infrastructure. Scattered data paired with a lack of centralized oversight can serve as a catalyst for inefficiencies that hinder deal execution and frequency. Efforts to combat the before mentioned issues have given rise to the popularity of CRM systems. Furthermore, numerous CRM solutions can be configured to streamline reporting and eliminate user error.

Although the absence of a CRM system can be detrimental to a firm’s success, a poorly configured system that fails to meet user requirements may be worse. Inadequate systems are generally accompanied by a lacking implementation partner that failed to assess the organization’s needs prior to vendor selection. It is crucial to enlist the services of an experienced implementation partner that has “been there, done that”.

FinServ has successfully implemented CRM solutions for countless Alternative Asset Managers and Financial Institutions. Not only are we a Salesforce Partner, but we also have significant experience with other industry CRMs such as Backstop, Clienteer, and Dynamo. FinServ can walk you through the entirety of the process by gathering business requirements, managing the implementation so you can focus on your business, and tailoring the solution to facilitate your unique procedures.

Data Utilization and Analytics

We are in the golden age of data and organizations are eager to leverage as much of it as possible. Unfortunately, sourcing data from a variety of locations often leads to a lack of uniformity and an assortment of issues. Private Equity firms are implementing robust analytics and data science for Transactional Due Diligence, Post-Investment Value Creation, and more. The application of data science within Transactional Due Diligence is exceptionally groundbreaking as perspective buyers are often subjected to tight timeframes of approximately 6 weeks.

Business Intelligence, Data Science, and Machine Learning allow Private Equity firms to conduct real-time analysis and assess billions of data records in a limited amount of time. Granular post-investment analysis can be attributed to geography, customer type, and more. The segmentation of the data enables a comprehensive understanding of the business. Thus, augmenting the Private Equity firm’s ability to perform the focused improvements that are central to their business model.

Exhaustive analysis of the fund’s overarching portfolio and individual companies hinges upon access to structured data. FinServ has the extensive Business Analysis and Operational Assessment experience that is required for structuring processes and data accordingly. We will partner with your organization to remediate operational issues while integrating innovative technology.

Transitioning to the Cloud

Cloud utilization is rapidly increasing as stigmas against housing data in off-premise locations have eroded. Private Equity firms are realizing the significant benefits provided by transitioning their data to cloud environments, SaaS, and IaaS locations. Migration allows firms to focus on their core competencies rather than hosting data. Cybersecurity is a predominant concern that will be alleviated by outsourcing a portion of the responsibility to an organization that exclusively focuses on housing internal and client data. Safeguarding this sensitive information is required for client safety, firm reputation, and regulations such as GDPR.

One consideration that may be inhibiting your organization’s migration to the cloud is the massive undertaking of doing so. FinServ has honed our data migration expertise through 15+ years of working alongside more than 40 of the world’s top 100 Hedge and Private Equity Funds. Communication is emphasized throughout our engagements and we will partner with your organization to ensure a proper and efficient transition. Furthermore, FinServ will take the opportunity to streamline processes and eliminate bottlenecks that have been hindering your business.

Even though Private Equity has been slower to adopt new technologies than other Alternative Asset Managers, the industry has begun to align with key initiatives offering indisputable benefits. The implementation of superior technologies like CRM systems, Cloud infrastructure, and the utilization of data for advanced analytics supplements competitive advantages and investor returns.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Prepare for the New and Remote Workplace

COVID-19 abruptly forced many financial institutions into a remote staffing model without the slightest inclination of its duration. Barring the infrastructural challenges, many employees have enjoyed the elimination of commuting, comfortable attire, and flexibility. The mandatory adoption of working from home will have significant implications for the daily trips to the office that were once the norm.

An Operational Assessment of your firm’s technology and procedures will identify issues that will be exacerbated by a sustained virtual workplace and provide insight into four verticals: Planning, Security & Controls, Collaboration, and Client Interaction. It is important to perform an exhaustive analysis of your firm’s technology and procedures to identify issues that will be magnified by a remote model.

Planning

The importance of planning is one of the few constants in today’s erratic climate. Many organizations are creating management teams and enlisting the assistance of third-party specialists to navigate these tumultuous times. Creating a specialized team will enable flexibility, establish accountability, guide the implementation of new technologies, and mitigate risks.

Security

The sensitivity of client data within financial services results in security being a predominant concern. One particular issue is numerous employees accessing company information with wireless networks beyond the organization’s control. The combination of unsecured networks and increased attacks from opportunistic deviants poses significant risk to financial institutions and their clients.

Furthermore, cybersecurity teams’ impeded ability to respond may affect their capacity to remediate issues in a timely fashion. Many teams are accustomed to face-to-face collaboration and/or additional resources that may not be available when working from home. Prevention is the best defense and can be achieved by conducting a detailed assessment of your firms processes and systems.

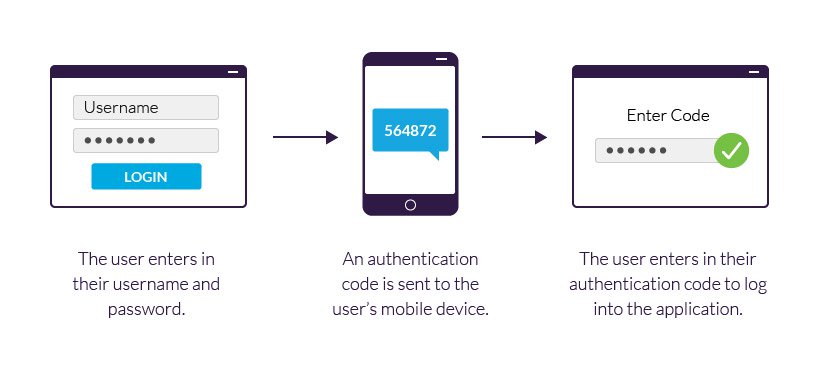

Establishing procedural controls and maximizing the native features of current technology will enable your company to stop attacks before it is too late. An effective defense for eliminating external access to company information can be as simple as utilizing 2 Factor Authentication or modifying a monthly process.

Collaboration

Collaboration is a major concern that inhibited employer’s from implementing a remote workforce prior to the pandemic. The recent success of remote work has assuaged worries and has even led banking heavyweights such as JPM and Barclays to consider the implementation of remote teams and/or rotational models. Rotational models are particularly attractive because they reduce fixed costs while balancing the benefits of in-person and entirely remote staffing models.

The short-term success of a virtual workplace will not persist if institutions fail to align their technology and operations accordingly. Video conferencing has emerged as the predominant medium for establishing virtual connections but has unfortunately been accompanied by a series of growing pains.

The sheer volume of concurrent employees leveraging the video conferencing system often overloads the solution if it was configured for a lower number of users. Additionally, various teams utilizing different platforms may result in access issues. Mass collaboration can be facilitated through the implementation of a uniform video conferencing system such as Microsoft Teams or a sophisticated document management system like SharePoint.

User error caused by a lack of sufficient training and limited employee access contributes to bottlenecks that can be easily avoided by partnering with an experienced implementation partner. Although the days of side-by-side spreadsheet collaboration may be behind us, teamwork can be augmented with the use of platforms such as Microsoft’s SharePoint. Multiple users can simultaneously work on the same file while SharePoint maintains versioning, audit trails, and an assortment of security features that protect sensitive data.

Client Interaction

Successful client interactions are dependent on thorough and frequent communication. The investment industry has recently experienced a level of volatility and uncertainty that makes communication more important than ever. Asset managers and financial institutions must have the necessary operations and technology to efficiently communicate and protect information that has traditionally been delivered in person.

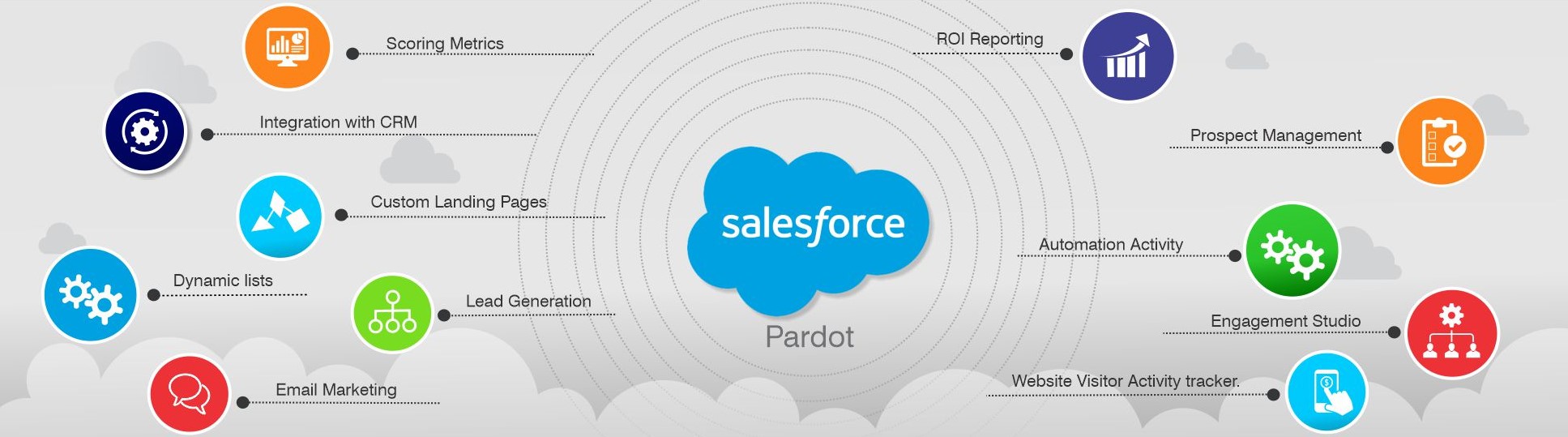

A popular solution for the mass distribution of content among Salesforce users is Pardot. Pardot is a marketing automation tool offered by Salesforce that boosts communications with potential and current investors. Moreover, it is important to evaluate CRM solutions such as Backstop, Clienteer, Dynamo, or Salesforce to ensure that your team is maximizing their functionality.

The unexpected transition to remote work was a daunting task that will have lasting impacts throughout the financial services industry. Organizations must align their processes and technology if they desire a seamless changeover. Technologies such as Microsoft Teams & SharePoint, an Operational Assessment, and a dedicated Management Team are likely required. FinServ has served as a trusted advisor to the world’s leading Asset Managers & Financial Institutions for more than 15 years and is the ideal partner for facilitating this conversion.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Intelligent Business with Power BI

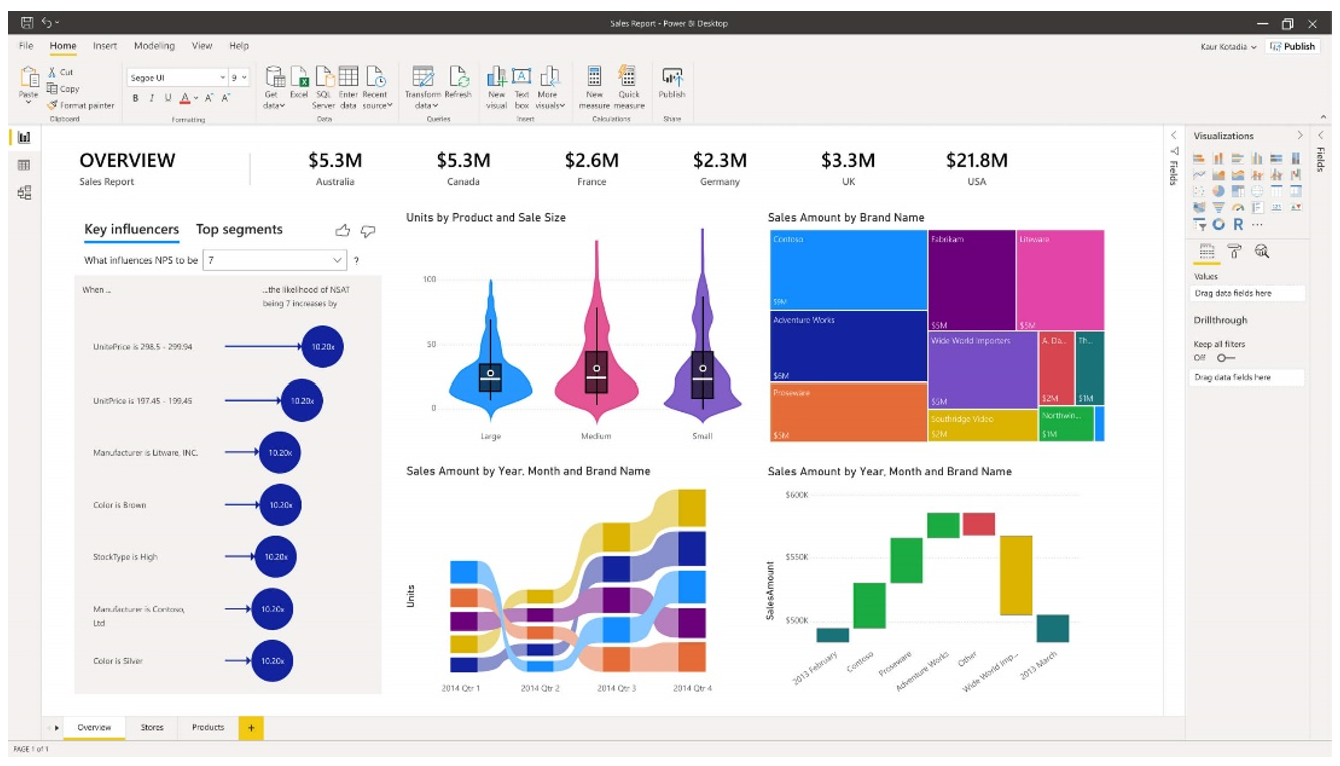

In order to understand the capabilities of Power BI, it is best to start with the fundamentals of Analytics & Business Intelligence (“ABI”) and data visualization. The combination of ABI and data visualization allows Power BI to articulate information in a digestible manner that is supportive of intelligent decision making.

ABI tools are user-friendly data management platforms that emphasize self-service and provide analytical functionality ranging from data preparation to insight generation. Business Intelligence (“BI”) leverages historical information while analytics employs modeling and statistics to anticipate future events. Generally speaking, BI is focused on what happened, and analytics is focused on why it happened.

Data visualization is the presentation of information through graphical mediums like charts, diagrams, dashboards, and more. Dashboards are an amalgamation of components designed to inform stakeholders in an aesthetically pleasing manner like the sales dashboard below. The goal is to provide an informative platform that is far easier to comprehend than traditional resources such as a spreadsheet with thousands of rows.

Power BI and Its Key Features

Power BI is a business intelligence solution that enables companies to draw organizational insights by using data visualizations, performing analytics, connecting to hundreds of data sources, and embedding content into external applications & websites. An additional benefit enjoyed by users on the Windows platform is its seamless integration with the Microsoft suite. In summation, Power BI allows users to connect, prepare, model, and visualize data.

Power BI incorporates numerous features (illustrated above) that assist in the analysis and comprehension of a business. Three particularly impressive features included in Power BI’s repertoire are Natural Language Generation (“NLG”), Automated Insights, and Advanced Analytics. NLG uses artificial intelligence to automatically produce rich text descriptions detailing outputs. Automated Insights are conceived from advanced algorithms and are a great way to initiate analysis on large data sets. While the initial analysis generated from Power BI can provide direction for additional research and evaluation, other factors may be sufficiently analyzed within Power BI without the need for further investigation. Advanced Analytics can be performed with Power BI’s internal ABI platform and/or by integrating with external models. Azure Machine Learning Studio’s drag and drop interface can be combined with SQL and R to conduct predictive analytics on data sets.

Subscription Options and Functionality

The three versions of Power BI are Desktop, Pro, and Premium. Desktop, the lowest-tiered option, can be downloaded from the Microsoft Store for free. It includes the core data visualization and analysis features; data preparation, reports, dashboards, connection to over 50 data sources, and the ability to export in various formats.

Pro includes all of Desktop’s functionality and can be purchased as a standalone product for an annual subscription of $10 per user license per month or as part of the Microsoft Office 365 Enterprise E5 suite. The enhancements differentiating Pro primarily fall under collaboration and the distribution of content. For example, users can share their insights by embedding visuals within applications such as SharePoint and MS Teams. Furthermore, users can leverage peer-to-peer sharing to distribute their work to external stakeholders with Power BI Pro licenses.

Premium, the most advanced offering, comes at a hefty annual subscription that breaks down to a monthly price of $4,995 per dedicated cloud compute and storage resource. Some distinguishing characteristics that amplify data analysis include enterprise level BI, cloud & on-premise reporting, dedicated cloud computing, and big data analytics. Other features that are included in Power BI Premium are increased storage, higher refresh rates, and a larger data capacity. Premium grants enterprise-wide access and is best suited for large organizations with significant business intelligence requirements.

Implementing Power BI in Financial Services

Power BI has countless applications for alternative asset managers and other financial services companies that span the front, middle, and back office. One of Power BI’s most popular functions is financial management and reporting. QuickBooks Online customers can utilize a preconfigured Content Pack that allows them to quickly construct financial statement dashboards. Users are immediately provided with functionality that comprises customer rankings, profitability trends, and various financial ratios.

Implementing and tracking KPI’s with Power BI allows investment managers to accurately evaluate operations. Best practice is to have KPIs spanning the front, middle, and back office because an unidentified issue in any of the three areas can be detrimental. A few prevalent KPIs are Investment Management Fee Revenue as a Percentage of AUM, Trade Settlements per Back Office Employee, Subscriptions vs. Redemptions, and Trade Error Rate by Asset Class.

Business intelligence can be applied to portfolio management by connecting Power BI to the underlying data sources detailing investments. For instance, asset allocation reports and dashboards allow fund managers to interpret the distribution of funds relatively easily. Another prominent application of Power BI is treasury & liquidity management because data visualizations can be developed to provide detailed breakdowns of cash management, FX hedge balances, and more.

Conclusion

Power BI is a powerful ABI platform that augments a business’s ability to consume data through the creation of interactive reports and dashboards. Business intelligence can be constructed to support any business function with enough data. More importantly, it can be configured to the firm’s unique needs and has the ability to adapt with dynamic business requirements.

FinServ has acquired deep industry and technological expertise through the completion of over 600 engagements at more than 40 of the top 100 Hedge and Private Equity Funds. FinServ can configure Power BI to accurately monitor operations, identify the correct KPIs, properly document business processes, and seamlessly integrate new technologies with existing infrastructure.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Enabling the Mobile Workforce in the Alternative Asset Management Industry

It is estimated by the International Data Corporation (IDC) that the number of U.S. mobile workers will rise from 96.2 million in 2015 to 105.4 million in 2020. By the end of 2020, IDC expects mobile workers to account for 72.3% of the total U.S. workforce.

With the technological advancements and proliferation of smartphones and cloud-based applications, the way we work is rapidly changing. The workforce is no longer tethered to the traditional PC or to the confines of a physical office, creating a truly virtual work environment. It is estimated by the International Data Corporation (IDC) that the number of U.S. mobile workers will rise from 96.2 million in 2015 to 105.4 million in 2020. By the end of 2020, IDC expects mobile workers to account for 72.3% of the total U.S. workforce.1

Asset managers are in a great position to take advantage of this trend, as their workforces are especially mobile for several key business reasons. Fund executives and support personnel frequently travel to different financial centers and investor locations to attend investor roadshows, industry events, sales meetings, board meetings, etc. It is critical that these employees have remote access to the firm’s systems, data, and documents in real-time while being updated by coworkers.

The Challenge

While all these leaps in technology are great, the move to the mobile workforce has created a conspicuous weakness in the infrastructure of many of the world’s most influential asset managers. Many funds are only now shifting their focus to cyber security for their mobile devices. As the mobile workforce multiplies, so too will cyber-attacks on the mobile device and on your workforce. With many funds allowing their employees to Bring Their Own Device (“BYOD”) to work, the challenges are even greater.

Cyber criminals target security weak points and the mobile device is a prime target. In 2016 alone, 36,601,939 records were exposed due to a data breach.2 Allowing your team to access your data while working remotely can create a real security issue if your infrastructure is not set up correctly to protect against the most sophisticated hackers. In today’s environment, you need to follow where the work is being done and empower your employees to do so. At the same time, the firm and its investors must be protected at all costs.

Are you willing to risk your fund’s future by putting your investment data, and your client’s data at risk? In 2015, the Global Cost of Cyber Crime was Estimated at $315 billion dollars.3 The monetary damages in the form of actual money stolen or fines levied by the SEC is quantifiable at a point in time and can be managed. The damage to your fund’s reputation is not fully quantifiable, and the fallout would be nearly impossible to manage. Loss of investor faith will cripple your ability to raise new funds and would likely lead to a flood of redemptions. There are two clear opposing issues here:

- The protection of your firm’s data at all costs, and

- The need to ensure that your team can operate as efficiently as possible while they travel.

Consider the scenario where your Head of Investor Relations travels abroad to meet potential investors from a sovereign fund. Is your company secure enough to prevent a data breach or prepared to take action if one of these events occur?

- The employee’s phone with company apps or data is lost or stolen.

- Your company’s email or CRM system is accessed through an insecure or jailbroken phone with a known security vulnerability.

- The employee saves a file attachment received via company email to the hard drive of a PC at a hotel business center and does not delete it.

- The employee accesses company data over public Wi-Fi that is inherently not secure.

Many firms are limiting what their travelling executives can access while they are on the road, or requiring them to remote in through limited access protocols like VPN or Citrix. The main question is, can any fund afford to limit what their Head of Investor Relations can access while they are on the road, at meetings with key investors? Maintaining this productivity could be the difference in securing a new Investor for your fund.

The Solution

The good news is that these and many other threats can be handled with the right security package and many are available in the marketplace. In Gartner’s 2016 Magic Quadrant for Enterprise Mobility Management Suites report, these security packages are recognized as Enterprise Mobility Management (“EMM”) products. EMM products provide a comprehensive security package that secures your firm on all data entry points while enabling employee work mobility.

Microsoft Enterprise Mobility Suite

FinServ Consulting has found that Asset Managers are primarily Microsoft-centric in that their infrastructure is Windows based, their productivity suite is Microsoft Office, and their email is on Outlook. With the core systems using Microsoft products, Microsoft’s Enterprise Mobility Suite (“EMS”) security package is a natural fit for these organizations.

Microsoft’s EMS product consists of several components acting together to leverage Microsoft technologies to form a more comprehensive framework (as shown below) to protect your organization’s data while providing employee mobility.4

| Microsoft Solution | Key Features | Description |

| Azure Active Directory Premium |

|

Microsoft’s Mobile Identity Service, with Single Sign-On (SSO) enabled will require you to sign in only once. Once you log into your Windows account, you will be authenticated through to the rest of your applications such as Office, Salesforce, and Dropbox. Remembering or having to create multiple passwords with varying security requirements — like special characters, uppercase letters, numbers, password length — is replaced with 1 secure password to remember. |

| Intune – MDM |

|

Intune Mobile Device Management (MDM) enables your mobile device to work on your company’s network without the need for VPN, Citrix, or other cumbersome remote technologies. MDM ensures that your mobile device is authorized and meets security requirements (e.g. device has not been jail-broken). MDM ensures that if your device is lost or stolen, the device can be wiped (data and applications erased remotely). If a person has left the firm, the wipe can be selective, erasing only company data and leaving personal data (such as personal emails or photos) intact. |

| Intune – MAM | Secure Office Apps on Your Phone or Tablet |

Working on your mobile device will most likely entail needing access to your Microfost Office apps such as Outlook, Word, or Excel. Microsoft’s Intune Mobile Application Management (MAM) is currently the only service that can manage and enable mobile access to Microsoft Office applications. |

| Azure Rights Management Premium |

Secure File Content Information Rights Management (IRM) |

Microsoft’s Information Protection SErvice provide Mobile ocntent management functinonality tha twill protect you and the firm by protecting the files on your divce. |

Conclusion

Microsoft offers a full EMM security platform that will support your organization today and tomorrow. As the mobile workforce continues to transform the way your employees work and interact with your firm’s data, it is critical to keep the mobile workforce productive and secure your firm data. Microsoft’s EMS is a comprehensive security package that offers a tight integration with the Microsoft family of products that competitors cannot match. FinServ is a Microsoft certified partner. To learn more about FinServ Consulting’s Microsoft and Enterprise Mobility Suite expertise, please contact us at info@finservconsulting.com or (646) 603-3799.

References

(1) IDC Forecasts: U.S. Mobile Worker Population to Surpass 105 Million by 2020

(2) Identity Theft Resource Center: Working to Prevent Internal Data Breaches

(3) Financial Times: Asia hacking: Cashing in on cyber crime – Attacks cost Asian companies $81bn last year. The region is even more vulnerable to new scams

(4) Microsoft: Enabling mobile productivity for iOS, OS X, and Android devices at Microsoft

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Use Microsoft’s Power BI to Create Powerful Reports & Dashboards with Little or No IT Support

Business users often struggle to produce reports and conduct analysis without the dependency on their IT team. One of the main reasons is because the users depend on IT to provide the data from many different sources or transform the data in a way that makes it easy to use. Most clients we talk to, say they spend a lot of time waiting for reports from their IT team and this can be frustrating at times. The delays are usually because the IT team has an endless list of user requests and systems projects and often understaffed. The end result is that asset manager’s ability to produce timely reports for key operational purposes or investor inquiries is poor. Leveraging Business Intelligence tools is the way to break this ugly cycle, and enhance your fund’s responsiveness to information requests while also enhancing your reporting with rich and powerful analytics, with little or no IT support.

Microsoft saw the marketplace of Business Intelligence, as a natural extension of their ubiquitous office suite and industry leading SQL Server and Access databases. Microsoft’s entry known as Power BI is one of their latest tools they have rolled out in alignment with Office 365, their cloud-based set of office applications. Power BI has both, a cloud-based and desktop version to support business users in producing powerful visual reports and dashboards from just about any type of data source. The real value of Power BI is that it makes 1) Extracting, 2) Transforming, and 3) Visualizing / Sharing Data something that a business user can accomplish with, little or no support from their own IT team

Extracting Data

Power BI has pre-built connectors to highly popular data sources Salesforce.com, Google Analytics, SharePoint, Facebook and many other cloud-based systems. These connectors make pulling data from these sources as easy as running through a set of intuitive wizards. In addition, Power BI allows users to pull data from the world’s number one data application, Excel. In addition to Excel, Power BI can also pull data from just about any standard file type like txt, csv, and xml just to name a few. Power BI can also pull from more traditional data sources like Microsoft Access, SQL Server, MySQL, Oracle, Sybase and many other databases. If Power BI does not have a connector you can always download your data from your source into any of those file types and you are off to the races!

One of the biggest challenges in excel is the limitations related to more than one person using an excel spreadsheet at one time. A common scenario is, that Finance is preparing the Net Asset Value (“NAV”) pack for the investors from data they have received from the administrator. At the same time, Investor Relations is responding to an investor inquiry based on that same data. Historically, one user would have to wait until the other user is out of the excel file if they want to update that spreadsheet causing delays and frustration. Power BI facilitates multiple teams simultaneously using the same data for different purposes while ensuring the integrity of that data remains intact and solves this issue by allowing each team to access the same data at the same time. It does this by allowing each group to perform their own transformations on the underlying data without affecting the underlying source of the data (the feed from the administrator).

Once your data source is established and your data changes, you simply click the refresh button on Power BI’s Main Menu Ribbon and your data is automatically refreshed

Transforming Data

The real magic of Power BI is in its Transformation Capabilities. Just like Excel, Power BI offers the user a very familiar and user-friendly way to update your data. However, the key difference between the way most people use Excel, and how Power BI works, is that when you modify your Data in Power BI, it never forgets what you did or loses the linkage to your original data source. It does this magic by memorizing the steps you took to change your data and each time you update the data from your data source, you simply press refresh and it repeats those same updates you made to the new data. Just like that, you have all your data just how you need it without having to repeat and potentially make a mistake with your modifications.

To illustrate some of the most common data manipulations capable in Power BI, we will work through an example of a typical way, a user would need to modify some data from Excel. In our before picture below, we have a typical pivot table in excel, which may be great for your accountant who only cares about numbers, but your head of Investor Relations, for instance, is likely to need the same information in a much more visual manner. Many of FinServ’s client projects over the years have focused on how accounting and IR can share the same data for different purposes. In Power BI, with just a few commands in a matter of minutes, any novice user can transform Excel-based tabular information into a report-friendly data set that lends itself perfectly to visual reports and analysis. You can see in our after picture below, how Power BI has transformed the data while recording each step that was taken to organize the data:

- The first command we used was the Transpose Table command which is familiar to many excel users it simply flips the columns and rows in a table

- We then used a simple menu choice, Use First Row As Headers on the Power BI Ribbon to make the first row of data the Field Names for our data

- Next, we simply took the 2 Fields that did not have names and used the

- We then used the Fill Down command, another familiar excel command to simply take the values that were in the data to fill in each rows relative value

- Finally, we used one of the cooler Power BI commands to take the Yearly data that was in columns and convert it to a relational data format, with the Unpivot Columns command

Visualizing / Sharing Data

Visualization in Power BI is, taking the dataset you created and applying Powerful Graphics & Charts to make the Information Come Alive with Insights and Meaning. Power BI provides a rich set of options, including various ways to view and interact with your data. The options go from the basic bar and pie charts to cooler and more sophisticated options like Scatter, Geography-based, or even KPI (Key Performance Indicator) charts. Because all the work was done in the transformation step, the Visualization step is a simple matter of dragging the fields onto your chart and the Power BI Engine does the work of creating your charts for you. In fact, if you drag certain types of data onto the Power BI canvas, Power BI in many instances will pick the best chart type for you.

Conclusion

We have really only scratched the surface of what is possible in Power BI. We have not even spoken about all the great integration capabilities Power BI has with the rest of the Office 365 suite such as: Planner, One Drive, SharePoint Online and many more. In future articles, we will go into more industry specific topics and show how specific alternative asset management data can best be leveraged in Power BI. We will also explain how more sophisticated data extractions and visuals can be created all without any programming required.

The bottom line is, with Power BI Microsoft has put a powerful Reporting & Visualization tool in the hands of business users, and given them the ability to Access Data and Transform it into Stunning and Deeply useful Visualizations in a Collaborative environment, greatly reducing the reliance on their IT teams while addressing many of the limitations of Excel spreadsheets.

How FinServ Can Help

FinServ is a Microsoft Cloud Solutions Partner with deep expertise in Power BI . Our team can help you formulate a Power BI project to transform how your organization views and consumes data. For more information, feel free to contact us at info@finservconsulting.com or (646) 603-3799. You can also access this link to fill out your information and we will follow-up with you immediately.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Investing in an Enterprise Content Management System to Simplify your Documentation Process

Companies are realizing that there is a significant amount of actionable business information in their unstructured data. Consolidating, accessing, and analyzing unstructured data is increasingly becoming an important factor in optimizing and analyzing business processes.

Are your firm’s deal documents simplifying or complicating the due diligence process? Imagine having the ability to seamlessly compile information from different sources, gain top level perspective from your firm’s combined intelligence, and ensure your process for managing knowledge and intellectual property is streamlined, enforced, and compliant. An Enterprise Content Management (“ECM”) system can give your firm the ability to gather, synthesize, and analyze information in real-time while helping to reduce complexity and increase productivity across your organization.

FinServ has found that many Alternative Asset Managers struggle to properly manage their deal documents. Managing information can be a difficult endeavor, especially when a team spans across different functions and locations, or when deal teams are frequently traveling and working remotely. An unstructured document management process frequently causes inefficiencies throughout an organization and can result in missed opportunities or poor decisions. Some of the most common issues we see at our clients include:

- Version control issues, due to multiple iterations and a high number of authors or collaborators

- An inability to identify and analyze key data trends across your deal documentation

- Issues retrieving past due diligence documents, for reference in future deals

- Compliance/Audit issues resulting from unorganized folders and unclear document management structures

- Security issues related to managing remote or mobile access to documents

- A loss of documentation due to an employee’s departure from the firm

Enterprise Content Management systems are becoming increasingly prevalent in the Alternatives industry and a strong document management process can be a major competitive advantage for a growing Asset Management firm.

A 2016 study of ECM applications by Nucleus Research found that investing in an ECM system has an average return of 750%; however, FinServ’s experience indicates that the potential return is even higher for Alternative Asset Managers.

An ECM system can simplify your process for managing documentation and ensure the right people are viewing the right files at the right time. Automating document management processes enables your firm to more effectively allocate resources and manage productivity. Many asset management firms are already leveraging ECM systems to improve their operations, chiefly through the creation of integrated workflows, customized dashboards, and enhanced reporting capabilities.

Integrated Workflows

Developing defined workflows around key document processes can help improve data retention by automating tasks and increasing standardization across your firm. Unfortunately, most funds rely on email, and unorganized folders to manage their documentation which leads to significant issues with data quality. A recent report from The Association for Information and Image Management found that 28% of organizations have been criticized in the last 3 years by their auditors for poor records. An ECM system can help your firm secure the underlying processes around managing your data by creating workflows that define the entire process from end to end.

A strong workflow allows firms to manage any documentation received and determine who will need to review which pieces. This can be accomplished by creating permission-based roles, as well as folder and subfolders for different types of documents. Defined workflows can alert staff members when specific documents require their attention and ensure that nothing gets through the cracks. Other features of a strong integrated workflow include:

- Check-in/check-out and document locking, to coordinate the simultaneous editing of a document

- Version control, so users can see how the current document came to be, and how it differs from the versions that came before it

- Roll-back, to “activate” a prior version in case of an error or issue

- Audit trail, to permit the reconstruction of who did what to a document during the course of its life in the system

Creating a strong document management workflow can help improve efficiency across your organization. However, implementing a workflow requires a change of behavior across your organization. FinServ has found that the most effective way to introduce a new ECM tool is on a business process basis. When you target key processes first it enhances adoption and also creates a large ROI. Some key processes that can be targeted first are:

- Collecting data from portfolio companies and deal teams

- Deal tracking and origination

- Expediting Investor Reporting processes (generating quarterly reports, K-1s, and other mailings)

- Building regulatory/audit workflows (FAS 157, reviewing financing agreements, sourcing agreements and other commercial contracts)

- Fundraising and marketing

- Other complex multistep processes.

Luckily, creating integrated workflows does not involve training your people on new technology: most ECM systems can integrate with the Microsoft Office suite for an intuitive user experience, and to help ensure higher compliance rates with the new workflows. ECM systems facilitate the creation of key business process workflows that can help your firm save time and money.

Dashboards

Documentation is becoming increasingly difficult to manage as content is no longer limited to Excel spreadsheets and Word documents. In the 2016 Magic Quadrant Report for Enterprise Content Management, Gartner predicted that:

By 2019, 70% of all business content will be non-textual, which will require organizations to invest more widely in analytics as part of their content management efforts.

The case for investing in analytics is even stronger for Alternative Asset Management firms, as key transaction documents often combine textual and non-textual information like site plans, photos of real estate, manufacturing specifications or even interviews with your portfolio company’s management team. It is hard to amalgamate unstructured data in a traditional document management workflow, but a major advantage of an ECM system is that it consolidates unstructured data – like spreadsheets, Word documents, emails, and other documents from multiple applications and file systems. Gartner Group estimates that:

80% of business is conducted on unstructured information.

Companies are realizing that there is a significant amount of actionable business information in their unstructured data. Consolidating, accessing, and analyzing unstructured data is increasingly becoming an important factor in optimizing and analyzing business processes. ECM systems are now integrating with Business Intelligence tools to provide integrated dashboards for your team to manage key aspects of their daily work from a single place. Configurable dashboards give each user a tailored real-time view into metrics and trends surrounding deal flow, target company information, and other key business processes. Dashboards allow your management team to pick up on trends before they happen and provide greater transparency into deal pipeline, displaying status, last update, key contacts, and next steps.

ECM systems can also allow your team to customize dashboards to track your deals through various stages from origination to due-diligence and commitment. These dashboards can be customized so Compliance, Investor Relations, and the Investment Team can all monitor the information that is important to them.

However, the real power of Dashboards is to visualize your raw data and supplement your numbers with more qualitative information like commentary from the Portfolio Company Management or key highlights from due diligence reports. In Aug 2016, Harvard Business Review released an article entitled: Private Equity’s New Phase, where Dave Ulrich and Justin Allen discussed a New Phase of Private Equity in which firms utilize non textual data to facilitate organizational change. They found that:

50% of the value of a firm cannot be explained by its financials and that new measures should be used to assess firm value. These measures will include intangibles like strategic clarity, customer connection, brand leverage, and R&D impact and leadership capital around competencies of individual leaders and capabilities of the organization as a whole like culture, talent, accountability, collaboration, and information. PE firms aimed at benefiting from a phase three strategy need to expand their data sources and deepen their ability to sift through both structured and unstructured data in order to find more predictive variables.

A strong ECM system can give your team the ability to sift through large amounts of company data and find these types of actionable insights. Your firm’s data is a competitive advantage, and implementing an ECM system can help you better leverage it.

Reporting Tools

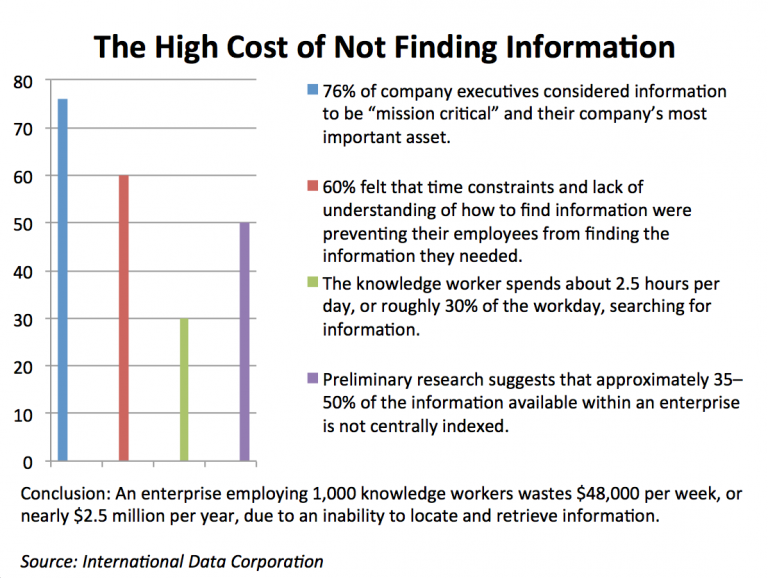

Another advantage of ECM systems is that customized reports can put your data at your employee’s fingertips. A 2013 Report from the International Data Corporation, found that:

“The average knowledge worker spends 2.5 hours per day or 30% of their work week looking for information.”

A robust ECM system provides easy access to on-demand reports that allows raw data to be transformed into key business processes. No more searching for information from different sources. Document management systems can streamline the business process by creating access to the required document when needed. Dynamic reporting capabilities support organizations in making faster and more accurate business decisions by leveraging key features such as:

- Data merged from different sources into one report

- Scheduled report delivery to support key business processes (like presenting performance results or portfolio company updates.)

- Integration with 3rd party reporting tools such as Power BI or Tableau

- Policy based reporting (Form PF, FATCA)

Robust reporting functionality can also be used to create on-demand reports customized to particular business challenges. A great example of the power of reporting is in identifying trends in portfolio companies. If your fund wanted to identify international exposure trends across your Portfolio Companies would you be able to automatically pull this information without manually searching through all your due diligence reports? A powerful ECM system would allow your team to quickly search through all your due diligence documentation to identify a list of all countries where your portfolio companies are doing business. The final results can be exported to Excel, or even represented in a presentation-quality report that is linked directly to the inquiry. An ECM system will use reporting to support key business processes and allow your team to better leverage all of your fund’s data. This leads to your employees making more informed decisions and doing so more efficiently.

Conclusion

The market for ECM systems is rapidly growing: Gartner Group estimates the market to grow from USD 28.10 Billion in 2016 to USD 66.27 Billion by 2021. There are many options available and selecting the right option for your organization can be difficult. FinServ has extensive experience navigating these challenges while vetting the marketplace to identify the most appropriate solution for your firm’s unique needs. The greatest challenge to undertaking a vendor selection project is often the availability of key staff. FinServ can provide investment fund best practices, subject matter expertise on the software industry, and the necessary hands-on skillset to ensure the project is implemented successfully without jeopardizing the responsibilities of key staff.

To learn more about FinServ Consulting’s Enterprise Content Management and Document Management expertise, please contact us at info@finservconsulting.com or (646) 603-3799.

References

- “Hybrid ECM: The Future of Enterprise Content Management.” Oracle. N.p., Apr. 2015. Web.

- “Enterprise Content Management Delivers $7.50 for Every Dollar Spent, Up from $6.12 Two Years Ago, Nucleus Research Finds.” Nucleus Research | Return On Investment (ROI). Nucleus Research, n.d. Sep. 2014.

- “Records Management Strategies.” AAIM Market Intelligence, n.d. Web.

- “SMB: Everything You Need to Know about ECM.” AAIM Market Intelligence, 2016. Web.

- Hobart, Karen A., Gavin Tay, and Joe Mariano. “Magic Quadrant for Enterprise Content Management.” Gartner, Oct. 2016. Web.

- “Benefits of a Virtual Data Room for Private Equity Deals.” Benefits of a Virtual Data Room for Private Equity Deals. Secure Docs, June 2015. Web.

- Mulcahy, Ryan. “Business Intelligence Definition and Solutions.” CIO. CIO, Mar. 2007. Web.

- “Street of Walls.” Private Equity New Investment Process. Private Equity Training, n.d. Web.

- Ulrich, David, and Justen Allen. “Private Equity’s New Phase.” Harvard Business Review, Aug. 2016. Web.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Some Helpful Warnings for the Next Generation Sync Client from Microsoft

As our company has continued down the path of extending our own usage of Office 365 we recently decided to implement Mobile Device Management for Office 365. Since all of our clients have very keen interest in security we figured it only made sense to implement as many of the security features in Office 365 that our clients would also be focused on.

As we noted in our recent post, How to Keep your Company Files from Walking Out the Door, MDM is a very valuable component of your security policy as it relates to your employee’s mobile devices. It provides 2 really key features that all companies will find incredibly valuable:

- The ability to keep your employee from connecting to your corporate IP with any mobile device that has been jailbroken since these devices leave themselves and ultimately your company open to the considerable threat of external attacks.

- The ability to either process a full wipe or a selective wipe of any device that is under your firm’s MDM management. This means that if a mobile device is lost or stolen you can immediately remove all your company’s IP from the device which again is key to security. The full wipe which your employee may prefer in the lost or stolen scenario will also ensure none of their personal info is available to the person who has their device.

As we progressed beyond MDM to start experimenting with the combination of MDM with other Office 365 applications like One Drive / SharePoint Online we started to discover some significant changes that Microsoft has made to how their file storage and sharing system is setup. In the latest version of One Drive Microsoft has now eliminated any differentiation between One Drive and One Drive for Business as well as SharePoint. The Next Generation Sync client now syncs all of the files related to your Microsoft Account regardless of which platform the files are from. Ultimately this strategy makes complete sense. You still have the ability to selectively decide which files you want to synchronize or not, but now you have the key advantage of not having to maintain separate versions of the sync client for your personal one drive versus your business one drive assuming they are registered under the same Microsoft User Account. Of course with any Microsoft update, some pain must also be incurred. In this case, Microsoft has no easy way to allow you to migrate the folders that were previously synced to SharePoint Sites with the New OneDrive folder setup. What this means is that you will need to repeat the process of setting up the sync client for all the folders you want to sync locally and you will also need to disconnect the old SahrePoint folders and then delete them once you have setup the new sync folders with the Next Generation Sync Client.

In the latest version of One Drive Microsoft has now eliminated any differentiation between One Drive and One Drive for Business as well as SharePoint. The Next Generation Sync Client now syncs all of the files related to your Microsoft Account regardless of which platform the files are from. Ultimately this strategy makes complete sense. You still have the ability to selectively decide which files you want to synchronize or not, but now you have the key advantage of not having to maintain separate versions of the sync client for your personal OneDrive versus your business OneDrive assuming they are registered under the same Microsoft user account. Of course with any Microsoft update, some pain must also be incurred. In this case, Microsoft has no easy way to allow you to migrate the folders that were previously synced to SharePoint Sites with the New OneDrive folder setup. What this means is that you will need to repeat the process of setting up the sync client for all the folders you want to sync locally and you will also need to disconnect the old SharePoint folders and then delete them once you have setup the new sync folders with the Next Generation Sync Client.

Of course with any Microsoft update, some pain must also be incurred. In this case, Microsoft has no easy way to allow you to migrate the folders that were previously synced to SharePoint Sites with the New OneDrive folder setup. What this means is that you will need to repeat the process of setting up the sync client for all the folders you want to sync locally and you will also need to disconnect the old SahrePoint folders and then delete them once you have setup the new sync folders with the Next Generation Sync Client.

It is important to note that the sync client like the previous version is still a bit buggy and will crash from time to time. However, it seems to restart itself and resume working correctly whenever it does go down. In addition, this new sync client does appear to work much more quickly which is probably the best part of the new sync client.

In summary, the Next Generation Sync Client from Microsoft does appear to be a major enhancement to Microsoft’s overall push to take over the File Storage marketplace from vendors like Box.com and Dropbox, or your old school network drives. The ease of use and efficiency of the application is certainly superior to the prior versions. However, you must go into this update with the understanding that these key steps must be taken:

- You will need to manually disconnect your old SharePoint sites and delete those folders if you had this already setup.

- You will need to manually setup on the Next generation Sync Client all the folders and files you want to sync again.

To learn more about FinServ Consulting’s Office 365 and Microsoft related services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Keep your Company Files from Walking Out the Door

In one of the more infamous data breaches, the Department of Veteran Affairs exposed 26.5 million PII (Personally Identifiable Information) records of its military veterans and personnel when a laptop containing this data was stolen from the home of an employee. Imagine if this situation occurred at your fund, where your employee’s mobile device containing your investor list was stolen. Not only would there be potential monetary damage, the reputational damage and loss of trust would be immeasurable.

With the proliferation and rapid technological advancement of mobile devices today, it is only becoming more difficult to secure your data. Having a robust Mobile Device Management (“MDM”) toolset that integrates seamlessly with your productivity files (i.e. emails, spreadsheets, presentations, etc.) and meets your organizational needs is a key step to begin securing your data. Microsoft has been rapidly catching up in providing solutions to key areas of concern for CTO’s. In many cases where only 3rd party vendor solutions covered the gaps Microsoft has now either built or acquired and integrated key solutions that provide the key security requirements for the financial services industry. Office 365, Microsoft’s cloud version of their ubiquitous Office suite, offers built-in MDM functionality (MDM for Office 365) that is included with any commercial Office 365 subscription (Enterprise, Business, Education, and Government).

The Microsoft Office suite continues to be the dominant player for desktop productivity tools. With the continued rise of cloud based services, Office 365 offers the path of least resistance for adoption in moving Office to the cloud. Furthermore, as the MDM tools are embedded into Office 365, this results in a tight and seamless integration with your firm’s Office productivity files. This cloud based tight integration offers the robust MDM functionality evidenced in the following scenarios.

Authorized Devices – Before an employee can access your firm’s Office files such as the company financials in Excel, the device must be authorized to access Office 365. Authorization is applied on multiple levels from the device type itself (Android, iPhone, etc.) to properly configured device security settings (your company domain) to having the device enrolled in MDM for Office 365. The best part is this can now be achieved without the costly and labor intensive solutions like VPN.

At-Risk Device Detection – The BYOD (Bring Your Own Device) environment is here to stay and employees will continue to want to use their own devices to access company related information. Before allowing your research analyst to access proprietary research files on their personal device, it is critical to ensure that their device has not been “jailbroken” (factory operating system settings edited). “Jailbroken” devices are at risk as there is a greater chance of such a device being compromised. These devices can be identified and prevented from accessing Office 365.

Remote Device Wiping – Device wiping can be done as a full wipe or a selective wipe. Should your CEO lose their device, the device can be wiped completely resulting in a device that has been restored back to its original factory state. For terminated employees, selective wipes can be applied to their devices to ensure that all corporate information is removed from the device.

On the vendor level, Office 365 MDM offers several compelling factors as follows:

Vendor Reputation – Microsoft is a premier vendor with a history of excellence and stability. They are not going away anytime soon

Product Cost – Office 365 MDM is offered free as part of the Commercial Level subscription to Office 365

Employee Adoption / Comfort Level – Office 365 MDM is tightly integrated with Office and Office is the productivity suite that your employees are familiar with

Technological Fit – Office 365 MDM is cloud based and is reflective of the trend towards cloud based services. With cloud based services, you will gain advantages in not having to maintain hardware and software upgrades

Scalability – As your firm continues to grow and has additional security needs, Microsoft also offers more robust MDM features through its Intune product. MDM for Office 365 is a subset of the Intune product and as such, any upgrade to Intune will be seamless and allow you to maintain a single vendor relationship

As a free product offered with its Office 365 product, Microsoft offers a truly compelling MDM solution that will protect your firm’s data. The tight integration with Office 365 files results in greater data security for both the data itself and your employee’s mobile devices. Office 365 MDM is a subset of their full MDM product, Microsoft Intune. Intune offers additional capabilities such as managing Windows PC’s and application deployment to devices. Intune itself is the MDM component of Microsoft’s EMS (Enterprise Mobility Suite) product which also offers document encryption, identity management and threat detection. Microsoft EMS has been recognized by Gartner as a Visionary in their Magic Quadrant for EMM Suites report. In future posts, we will go over the added benefits of using Intune in connection with your Office 365 platform.

FinServ is dedicated to researching how funds can benefit from cloud based technologies. Using our extensive industry knowledge in combination with a partnership with Microsoft, we continue to vet how these solutions are secure enough for funds to meet their stringent security and regulatory requirements.

To learn more about FinServ Consulting’s Office 365 and Microsoft related services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.