Unleashing the Power of Workday R1 2025: Elevating HCM, Finance, and Payroll

The Workday R1 2025 release is more than an update—it’s a comprehensive transformation of enterprise resource management that brings cutting-edge innovations across Human Capital Management (HCM), Finance, and Payroll. This release equips organizations with the tools they need to overcome real-world challenges, drive sustainable growth, and maintain a competitive edge in an increasingly complex global market. Below, we explore the new features in each module with specific examples that illustrate their impact.

Enhanced HCM Capabilities

- Revamped Employee Self-Service Portal: Workday R1 2025 introduces a modern, mobile-first employee self-service portal that streamlines routine HR tasks.

Example: Employees can now update their personal information, manage benefits, and access training materials directly from their smartphones, reducing administrative bottlenecks and enhancing overall engagement.

- Advanced Talent Management Tools: New features within the talent management module offer improved performance review workflows and employee engagement tracking.

Example: The Enhanced Performance Review Workflow automatically schedules review cycles, sends reminders, and consolidates feedback from multiple sources into a centralized dashboard, enabling managers to make more informed development decisions.

- Employee Engagement Dashboard: A new dashboard aggregates real-time feedback and pulse survey data, giving leaders a clear view of employee satisfaction and areas for improvement.

Example: HR teams can quickly identify trends—such as declining engagement in a specific department—and implement targeted interventions to boost morale and productivity.

Financial Management Innovations

- Dynamic Financial Dashboards: The Finance module now features dynamic dashboards that provide real-time insights into key performance indicators and financial health.

Example: A CFO can monitor cash flow, revenue trends, and expense breakdowns in real time, allowing for swift adjustments in response to market fluctuations.

- Enhanced Budgeting and Forecasting: New scenario analysis tools in the budgeting and forecasting modules enable finance teams to simulate various market conditions and their impact on the business.

Example: By modeling potential economic downturns, a finance team can preemptively adjust budgets and resource allocations, thereby reducing risk and improving fiscal resilience.

- Automated Compliance and Audit Trails: Integrated compliance features automate regulatory reporting and monitor financial transactions for adherence to evolving standards.

Example: When a new tax regulation is introduced, the system automatically updates compliance checks and generates audit trails, ensuring the organization remains compliant without manual intervention.

Next-Generation Payroll Enhancements

- Advanced Payroll Automation: The new payroll features leverage automation to handle complex calculations and processing with minimal manual oversight.

Example: The Advanced Tax Compliance Engine automatically incorporates the latest regional tax updates, ensuring accurate deductions and reducing the risk of errors.

- Global Payroll Integration: Workday R1 2025 supports seamless multi-currency processing and localized tax computations, simplifying payroll management for multinational organizations.

Example: A company with employees across different countries can now process payroll in multiple currencies, with the system automatically converting and reconciling local tax liabilities.

- Self-Service Payroll Corrections: A new self-service module empowers employees to resolve payroll discrepancies directly through a guided interface, reducing HR queries and improving satisfaction.

Example: If an employee notices an error in their pay stub, they can initiate a correction request via the portal, which is then routed to the payroll team for swift resolution.

Real-World Impact

The enhancements in Workday R1 2025 address everyday challenges faced by modern enterprises. For instance, the integration of dynamic financial dashboards and enhanced forecasting tools empowers financial leaders to adapt quickly to market changes, while the advanced payroll automation features minimize the administrative burden of managing a global workforce. Moreover, the revamped HCM tools not only improve employee engagement but also foster a culture of continuous improvement and proactive talent management.

For organizations looking to harness these powerful new features, partnering with experts who understand both Workday and industry-specific challenges is key. With Workday R1 2025, companies are better equipped to navigate the complexities of today’s business landscape, ensuring operational excellence and strategic agility well into the future.

To maximize the full potential of these innovations, partner with FinServ—a trusted advisor with deep industry and Workday expertise. FinServ offers operational assessments, release consultations, and strategic implementations to help you get the most out of your Workday investment and seamlessly integrate R1 2025’s capabilities into your organization.

Contact FinServ Consulting today at info@finservconsulting.com or (646) 603-3799 to learn more about how we can support your journey toward a more efficient, responsive, and future-ready enterprise.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Prepare Your Business for Workday 2024 R1

Workday 2024 R1 was released recently and introduced multiple new payrolls and compensated-related capabilities. These features will have a major impact on the client’s Workday environment, and it is critical that the Workday team researches and tests the new updates in the Preview environment to ensure that their systems remain up-to-date.

Workday typically follows a semi-annual release schedule, with updates rolling out approximately twice a year. The spring update was released on the first weekend of March. The release introduced new features, enhancements, and fixes to the Workday platform to improve user experience, functionality, and overall performance.

These updates are important for Workday customers as they ensure that their systems remain up to date with the latest features and improvements, helping them to stay competitive and efficient in their operations. In this article, we specifically review the new Payroll and Compensation updates introduced by the Workday 2024 R1.

Payroll

Prior Period Tax Adjustments

Prior Period Tax Adjustment Calculator to reduce manual effort. PPTA is accessible through the related action icon of an original completed pay result.

- Select Prior Period Tax Adjustment > Run

PPTA Calculator streamlines the process for retro tax authority adjustments. If multiple pay results need to be adjusted, always start with the earliest completed period first.

PPTA can be used anytime users are retroactively adding, changing, or deleting the following for an employee:

- Primary home or work state

- Tax elections for work or home city

- Local other authority

- County local taxes

- Home school district

- Domicile state

The new Prior Period Tax Adjustment (PPTA) calculator will help to calculate tax and wage differences effortlessly due to retro tax authority changes in completed periods. This provides greater efficiency when adjustment for wages or taxes is needed due to retroactive tax authority changes.

Payroll Insights

Real-time smart tool for reviewing payroll results. It has multi-faceted filtering capabilities:

- Once a pay calculation has been run, the Payroll Insights report will pull predictive pay data.

- Allows easier review of historical payroll results to identify what are true abnormalities and what is not.

- Feedback can then be provided on predicted results to improve accuracy over time.

New Tasks:

- Maintain Payroll Insights Configurations

- Maintain Payroll Insights Custom Tags

New Reports:

- Payroll Insights Results Report

- Historical Payroll Insights Results Report

Payroll Insights provides a real-time prediction and evaluation tool to analyze payroll results based on historical payroll result patterns. This feature helps to reduce the amount of time and effort spent manually reviewing and identifying payroll exceptions.

Payroll Third-Party Payments

Generate and Settle Payments for Deduction Recipients of IWO and Court Orders. Workday can now process payments for IWO and Court Orders:

- When a pay calc is run, Workday generates a payable item for the deduction recipient’s line result.

- A new tab is produced on the pay result “Payroll Third-Party Payments.”

- After payroll is completed, the payable will be available to pull into Settlement Run using the new filter “Payroll Third-Party Payments.”

- Payments can be processed electronically via integration or through the print check feature.

Utilizing the normal payroll processing and settlement methods, Workday can now identify, process, and produce payments to deduction recipients. Previously, customers were required to handle these payments manually outside of the payroll process or rely on third-party vendors to complete them. Customers can now produce these payments internally with Check Printing or utilize their existing bank integrations. This feature is a time and cost-saver for clients currently managing the maintenance of their IWOs.

Compensation

Workday Docs for Compensation Statement Layouts. With Workday Docs, users can now create a custom Compensation Review Statement layout within Workday:

- Workday Docs for Layouts is a visual editing tool for designing, creating, and previewing document layouts for use with custom advanced reports in Workday.

- Users can insert data fields and even apply condition rules to any piece of the layout.

As one of the more highly anticipated updates, users can now completely customize the compensation review statements without the need for any outside reporting tools. Once created, users will be able to make updates to the compensation review statements more easily year over year.

Total Rewards Statement Redesign

Design for Increased Customization. Redesigned Layout:

- Users can now configure section groups that will display on the statement as cards.

- Each section group can include lists, tables, and calculated values.

- Users can arrange the cards on the statement in any order they like.

The updated design of Total Rewards Statements will allow users to customize how they show employees their compensation. This will allow employees to understand their compensation more easily and how it is broken into different components.

Percent-Based Calculated Plans

Manage Complex Percent-Based Compensation Plans. Target Percentage or Ceiling Amount:

- Manage complex percent-based compensation plans to configure and report on a target percentage and a ceiling amount for amount-based calculated plans and process them in Payroll.

Calculated plans can now be included in salary-dependent Primary Compensation basis calculations for workers managed by Basis Total. New display text for Calculated Plans with ceiling calculations or percentage calculations.

Dynamic Plan Type Display

Dynamic Compensation Transactions. Propose Compensation Change:

- Workday 2024R1 makes it easier to assign employees compensation during the Propose Compensation Change process by displaying only the relevant plan types for the employee.

By only seeing what is relevant to a specific employee when processing a Change Job or staffing transaction, the processor can decrease manual error while condensing what it sees and maximizing efficiency.

Grid Profiles for Compensation Review

Grid Configuration Profiles. Grid Profiles & Conditional Calculations:

- There is increased flexibility of grid configurations in compensation reviews. Users can now configure multiple grid configurations for the same compensation review process.

Flexibility within the Compensation Review Grid Configuration allows Planners to view fields that are more relevant to the participants in the process.

Conclusion

The Workday release will have a major impact on your current Workday environment, and new features will enable better user adoption for your team. It is critical that your team thoroughly researches and tests the new updates in your Preview environment.

Getting the most out of these features will require a thorough understanding of what you are trying to get out of Workday and how Workday will work within your organization. With FinServ, you have a trusted advisor with experience in both Workday and the industry to help you make informed decisions about what functionality to leverage, ensuring that you make the most out of your Workday investment. FinServ has advised both Workday HCM and Financial clients through Major Semiannual releases. In addition to release consultations, FinServ Consulting offers operational assessments and Workday implementations. FinServ has experienced HR and Finance consultants who have worked with clients on vendor selections and implementations of various HR and Finance platforms.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Make Absence Health Checks a Regular Part of Your Annual Workday Routine

As we near year-end, there are several year-end Workday activities that our Clients must conduct to ensure a smooth transition to the next year. In addition to reviewing pay periods and integration schedules, FinServ recommends conducting an Absence / Time Off Plan health check to ensure the plans and balances are correct, align with employee expectations, and comply with regulatory bodies.

As we near year-end, there are several year-end Workday activities that our clients go through that revolve around extending integration schedules, creating pay periods, and ensuring that Workday is ready for the following year. In addition to these activities, we recommend conducting an Absence / Time Off Plan health check to ensure the plans and balances are correct, align with employee expectations, and comply with regulatory bodies. The following tasks form the basis of the health check:

- Verify unused time off balances.

- Verify that employee time off balances are correct.

- Verify that employee leave statuses are correct.

Unused Time Off Balances

Looking at each employee’s year-end vacation balances will reveal any outliers or out-of-the-ordinary balances (Hint: Use the Extract Time Off Balances report to view these balances). We’ll want to find any out-of-the-ordinary balances as that can indicate more significant underlying issues that should be addressed sooner rather than later. For example, workers may not have taken any time off, and their full vacation balance will stand out. Having such a sizeable unused balance can indicate issues such as:

- Is this a cultural issue? At many investment firms, front-office employees may not be able to utilize their days, and this may be the accepted norm that requires a more extensive discussion to resolve.

- Is this a process issue? At these same firms, front office / senior management is not inclined to go into Workday to do data input. The discussion would then shift to setting up delegates to enter time off on behalf of select employees or reinforcing the correct time off process with those employees. (Hint: Use the All Worker Time Off report to view all time off requests submitted to see if they are being inputted and approved on a timely basis).

Correct Time Off Balances

Time Off balances are affected by numerous factors such as accrual rates, carryover amount, carryover caps, balance caps, employee tenure, position, office location, manual overrides, etc. The sheer number of dependencies can cause incorrect balances, and it will be essential to catch these scenarios early before the employee notices any discrepancies, uses days they don’t have, or vacation payouts are done on incorrect balances. To identify these situations, verify employee time off balances using future effective dates that are 1-2 years in the future. As the balances span years, any expiration or cap issues will become apparent.

Consider an incorrect carryover cap in Workday for a terminating employee in California. This cap is meant to dictate the maximum number of hours an employee can carry over, and without it, the carryover accumulates to an unexpectedly high amount. This will become an issue if that employee is terminated, as California requires that any unused vacation be paid out.

Confirm Employee Leave Status

Incorporating checks on leaves of absence is highly recommended, as leave status and dates can affect functionality in Workday and possibly have payroll implications. Regardless of whether Leaves are maintained manually or by a third-party leave administrator, leave status needs to be reviewed. Manual updates often get skipped, and leave administration by third parties is not always correct.

Consider the example where an employee was on primary caregiver leave and has returned to work. However, their leave status in Workday was not updated, so their delegation settings were not updated when they returned. This would result in the business process approval not being sent to the correct employee. Furthermore, depending on how the employee is paid while on leave, they can be paid under an incorrect rate if the wrong employee status is sent to the Payroll provider. (Hint: Use the Leave Results for Organization report to get a holistic view of all employees on Leave and their Leave dates).

Conclusion

By making absence a routine focus, you can proactively catch any issues before they happen and become more significant. Once the problem occurs, it becomes more complicated to fix from a Workday configuration perspective and manage employee expectations. For example, an incorrect vacation payout will be much easier to fix before it is paid out. Verifying the health of your Absence setup is good practice and will avoid employee frustrations that happen when pay is affected.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

How Asset Management Firms Can Optimize their Workday Support

When building your support team or enhancing it, it is essential to look for certain key characteristics. These characteristics are attributes of individuals who know Workday in and out and how the industry operates. These attributes are crucial in creating a support team that can efficiently handle any Workday request.

Whether you are implementing Workday for the first time or are an existing Workday user, proper support is needed to ensure your Workday experience is a success. To realize the system’s full potential and adequately support your business users, Workday must be supported by resources capable of taking on many tasks. These tasks can vary from answering how-to questions, troubleshooting issues, administering recurring events, updating calendar/schedule periods, liaising with Workday, and analyzing/deploying Workday release features.

When building your support team or enhancing it, it is essential to look for the following key characteristics. These characteristics are attributes of individuals who know Workday in and out and how the industry operates. These attributes will result in a support team that can efficiently handle any Workday request.

- Resources with Industry Experience – Support personnel with experience in the industry are more efficient than newer resources without the requisite background. In addition, these resources can understand and diagnose issues quickly and accurately as they have been through similar situations before.

- Less Specialization – Resources knowledgeable in multiple Workday modules provide more comprehensive solutions to issues. In addition, cross-module expertise enables these resources to know what components are related, how they impact each other, and what is part of any total solution.

- Documentation Skills – Resources that know how to create well-written documentation provide value beyond configuring Workday. The documentation they produce will be invaluable to retaining institutional and contextual knowledge, mitigate against staff turnover, and provide a knowledge base for others to leverage.

Resources with Industry Experience

It is important not to fixate only on what resources know in Workday. Knowing the ins and outs of the industry is just as valuable. This knowledge is gained only through experience and provides a perspective on how things are supposed to work regardless of the kind of system.

For example, it is quite common for terminating employees at Asset Managers to be subject to a Garden Leave policy where the terminated worker is essentially paid not to work for a set amount of time after their termination. Workday does not come pre-configured with the means to put someone on Garden Leave; it will be up to your firm to configure this. Resources with experience administering and using Garden Leaves will know how to configure it properly. In Workday, the easy part is setting up the Garden Leave itself so that the terminations could go on leave and not terminate until the end of their Leave. However, there are additional considerations to review regarding whether Garden Leave terminations should be included in active headcount, where they should sit in your organization, or whether they should be visible to employees outside of HR. Support resources knowledgeable about Garden Leaves would know how to configure Workday optimally, focusing on the pitfalls to look out for and specific reporting requirements.

This is just one specific example; however, with so many moving pieces for a feature commonly used by Asset Managers, it is critical to vet resources on their knowledge of Workday and how they have applied Workday to meet HR policies at other firms in the same industry.

Less Specialization

Having less specialization in a specific Workday component may seem counterintuitive, but in our experience, it is quite the opposite. Sure, a specialist in a particular Workday module can expertly configure its module. However, this specialization comes at a cost where they cannot configure other modules or realize the more significant impact a request may have on other areas of Workday.

As a result, a specialist may not be able to implement a comprehensive solution. Or, their lack of knowledge of other Workday components would introduce complexities when handoff and coordination are required between multiple resources.

For example, in Workday Financials, you can set up a Punchout where Workday integrates with a vendor allowing you to purchase items (like office supplies or computer hardware) directly from the vendor, and the order information would flow directly into Financials. Setting this up would involve creating a Purchase Order, matching the invoice, capitalizing the asset (if applicable), and setting up a depreciation schedule. Again, a resource that was knowledgeable in multiple Workday components would be able to advise you on what to watch out for and the best path to implement the solution.

Documentation Skills

The most overlooked attribute when evaluating Workday resources is the mindset and ability to document everything and do it well. Documentation is critical as resolving Workday issues is often an involved process involving researching the subject, implementing the solution, and testing multiple scenarios. Furthermore, many types of problems and projects repeat themselves (i.e., an employee thinks their Time Off Balance is incorrect, Performance Cycles happen twice a year, annual Open Enrollment, and new time off plans). Documentation can prevent having to research and resolve the same issues more than once.

Proper and well-written documentation will preserve the work done, allowing you to retain institutional knowledge, lessen the impact of any resource turnover, and enable work to be done more efficiently. The team will spend less time re-examining common issues, attempting to understand past decisions, and more time resolving the actual problem.

Retaining knowledge of your existing setup is particularly relevant across the alternative investment client base, where firms often devise complex allocation rules to determine the true profitability of each business line. These rules result in a ‘fully-loaded’ P&L by business line and can be used in some cases to determine the compensation of portfolio managers, traders, or other essential employees associated with the business. In some cases, firms will want access to this P&L but not have it truly posted in the general ledger and instead use it for reporting purposes. This necessitates customized reporting that may exclude or include these allocations depending upon the view of the person running the report. When troubleshooting or modifying these reports, it may take a resource that is unfamiliar with the setup much longer and may lead them to recommend modifications that are not appropriate. It may also require lengthy explanations from the business that is not the best use of time and could otherwise be avoided.

Conclusion

Successfully supporting Workday is not easy, as there are many types of users to deal with and a wide array of issues to resolve. Therefore, selecting the proper staff to support Workday is in your best interest. Your support personnel must be capable of working with multiple Workday components, documenting solutions and decisions well, and having knowledge of the business to create solutions that fit within the industry. By recognizing and evaluating resources against these critical traits, you will be well-positioned to field the right Workday support team for your organization.

FinServ’s long history servicing the world’s top Alternative Asset Managers, combined with our deep Workday expertise, make us a natural option to help you find a world-class Workday support team.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

What Every HR Department Must Do in Workday to Ensure a Smooth Start to the New Year

There are five main activities that need to be done in Workday at year end / beginning of the year to ensure the smooth running of a business. These simple tasks are often overlooked – particularly by those new to Workday – but can have a negative impact if not done.

There are five critical tasks that Workday companies should undertake around the year-end / new year time frame. Individually, these are simple tasks but can significantly impact your HR operations if not completed in time.

Year-end activities come thick and fast, and it is easy in the last month of the year to forget to undertake some essential tasks. FinServ Consulting has identified five essential tasks that every HR department must complete to guarantee a smooth kick-off to the new year. Lack of action on these tasks could create unnecessary errors or preventable breaks in your operations, causing a lot of unneeded January headaches.

These five areas are:

- Scheduled Processes – (integration, reports, alerts) and Period Schedules (payroll, time off, time tracking) must be reviewed and set up / extended manually. Scheduled processes can be set up in advance up to five instances in a new year. Period schedules can be set up for up to two years in advance.

- Delegation Review – A review of delegation assignments ensures that they are correct and that expiration dates are extended. This will avoid the Workday inboxes of executives filling up with tasks that generally would be delegated.

- Compliance Activities – Review what compliance requirements are pending for the new year, including mandated data purging and verifying employee compliance with company policies.

- Corporate Document Updates – A review of employee documents like the corporate handbook, benefit plan documents, and company policies will ensure that they are updated and properly linked to in Workday.

- Time Off Calendar and Balances – Update the upcoming holiday calendar to ensure that employees can successfully request time off. In addition, review time-off balances that are carrying over to ensure accuracy.

#1 – Scheduled Processes and Period Schedules

Scheduled processes allow you to automate processes on a schedule (i.e. daily, weekly, monthly), such as an integration with your medical benefits provider or payroll processor. These schedules are typically set up in advance but must be maintained annually. They cannot be scheduled indefinitely and can usually be set for up to five scheduled instances in the following year.

Suppose your payroll file is not sent to your payroll provider because it is no longer automatically scheduled in Workday. In that case, the HR team risks a highly visible and potentially catastrophic mistake.

Period Schedules standardize the sequential periods you use to track absence or payroll. These period schedules also need to be entered and maintained manually and can be entered up to two years in advance.

Not setting your future period schedules can prevent employees from requesting time off or prevent you from processing the next pay run. Like the Scheduled Processes, not maintaining Period Schedules is an easily preventable error.

#2 – Delegation Review

Tasks are often delegated in Workday, usually to assistants of senior executives. Senior executives are generally crucial control points to granting approvals for time off requests from their subordinates or approving high-value expenses and invoices. Executives usually do not have the time or inclination to go into Workday consistently and approve these requests.

Delegating these tasks to assistants allow the tasks to be completed in a timely and consistent manner. These delegations do have expiration dates and need to be reviewed annually. Letting delegation settings expire can result in a senior executive’s Workday inbox being flooded rather than the tasks going to the correct delegated employee for processing. If the executive is not looking at their Workday inbox, critical invoice payments may not be approved, leading to unnecessary late payment penalties. For example, Market Data vendors’ unpaid invoices may lead to unnecessary late fees or, even worse, denial of critical data that the business requires.

As administrative permissions have time limits, it is easy to set them and forget them until something goes horribly wrong.

#3 – Compliance Activities

Data purging and employee compliance are two of the essential resets needed at year-end / beginning of the year. This means verifying that everyone has signed the required employee and corporate policy documents such as the employee handbook, Covid / return to work attestations, restricted trading policy attestations, and other necessary documents.

As these documents are disseminated throughout the year, it is easy to lose track of whether they have been reviewed and signed off on by all employees.

The time surrounding the new year is a natural time to conduct a holistic overview of the status of the firm’s overall policy attestations. For example, employees may be required to attest to understanding the code of ethics or conflicts of interest policies. Ensuring that these policies are enforced and that enforcement is tangible is key to assuaging any concerns of regulators or potential investors.

This time is also an excellent time to review how well the firm is in compliance with data retention and purging regulations. For example, the European Union’s General Data Protection Regulation (GDPR) stipulates that personal data is collected for legitimate reasons and is only kept if needed. Because of these regulations, companies will need to place greater scrutiny on terminated employees and their personal data. The HR or compliance departments must be vigilant in reviewing this data and determining if there is a legitimate reason to continue storing it in Workday.

#4 – Corporate Document Updates

Corporate documents such as employee handbooks, benefit plan documents, and policies can get out of date quickly as policies evolve, such as Diversity and Inclusion and Remote Work policies. In addition, the companies’ benefit providers often change, or the company changes the plan offerings themselves. The document file itself can change from content updates to file name changes or file location changes. Once this happens, the reference link in Workday may no longer work and inevitably lead to errors during any attestation process or during an employee onboarding.

Checking that the latest document versions are set up in the system should be part of any end of year to new year process. Multiple or outdated versions of documents can cause problems; ensuring that only one version – the latest – exists is essential.

Performance review templates are another area to double-check along with offer letters and other templates used throughout the year. These templates can change. Since they impact all employees and prospective hires, it is critical to be consistent and accurate in what is shown. If these templates link to external documents or are set to send information to vendors, it is vital to make sure that the links still work.

#5 – Time Off Calendar and Balances

A simple task that can cause many headaches is ensuring that next year’s calendar includes the correct dates for holidays. Different localities and regions may have special holidays, and observed holidays change from year to year. These are not automatically loaded into Workday; they need to be set up every year manually. This is particularly important for companies with international offices where the holiday dates may differ.

The time around year-end is also a good time to get ahead of nuances in the calendar for the upcoming year to give you more time to be prepared to address any employee concerns. For example, most financial services firms follow the stock market’s holiday schedule. At the end of 2021, the stock market is not observing New Year’s Day 2022 as a holiday since it falls on a Saturday. Usually, the holiday would be observed on the preceding Friday. But, because Friday is a key accounting period (year-end / quarter-end / month-end), the stock market will be open. Try explaining that on New Year’s Eve when this calendar quirk dawns on your employees.

Another critical activity for year-end is to check your employee’s time off balances due to carry over. Carry-over balances should be checked for accuracy; this will ensure that your time off eligibility and carry-over rules are correct and that an unexpected employee type / setup is not breaking the time-off rules. Unused time off that can be paid out will need to be appropriately reviewed and loaded into payroll.

Conclusion

Overall, it is best never to assume that these essential tasks have been completed. Much of what needs to be done annually is common sense, but HR and Operations teams often overlook these additional inputs / actions in the crunch of a busy fourth quarter.

FinServ Consulting has found that many clients outsource support for these activities after they have experienced one of these painful events.

Whether you choose to seek our support or not, we hope these top tips help you avoid any adverse effects on your company’s operations. Getting to grips with these tasks early and on an annual basis will save a lot of time, energy and headaches in the coming year.

To learn more about FinServ Consulting’s services: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

HCM for Asset Managers: Find the Right Solution for Your Firm

An HCM solution is an integrated system that automates HR functions combined with finance, planning, and analytics and allows for employee self-service capabilities, thereby reducing labor costs, optimizing business processes, and increasing efficiency. Companies that transition from manual processes and disparate legacy systems to modern, cohesive digital workforce management technologies can realize up to 15-25% cost savings related to HR and IT spend.

Most current HCM solutions are offered as a cloud-based, SaaS delivery model and include modules for payroll, HR, time and labor management, and recruitment. This type of solution does not require an expensive hardware investment and constantly updates software to the latest version while maintaining secure backups. These systems are monitored at all times and provide the utmost reliability. An added plus for asset managers is that the solutions can be customized to suit the size of any company and grow as the organization grows.

At FinServ Consulting, we have experience working with firms of various sizes in the alternative asset management industry to select, implement, and/or upgrade their HCM systems. While there are numerous benefits of having one comprehensive, integrated HCM, there are other options available on the market such as lite solutions that meet basic needs without all the added features that may not be necessary for some firms, as well as point solutions that cater to the industry’s unique needs, like complicated compensation structures. FinServ can help assess your company’s specific requirements to identify what to be aware of in terms of missing features, implementation issues, and cost-benefit analysis of different HCM options.

Benefits of a Consolidated HCM

Attract and Grow Talent

Recruiting top talent and keeping them engaged is no longer just HR’s responsibility—talent objectives can have a significant financial impact on growing a financial services business. Implementing a new HCM system can help enhance performance management processes to eliminate bureaucracy and encourage meaningful conversations between managers and employees focused on performance improvement. In addition, better compensation data and visibility of top talent allow managers to make more well-informed decisions regarding performance and rewards.

Some clients in the alternative asset management space that FinServ has previously worked with used manual spreadsheets to manage staff performance, as well as recruiting and other functions in some cases. However, by opting for a consolidated HCM system, these organizations were able to use more sophisticated workflows to provide employees with more meaningful feedback. Also, they could track and monitor operational outcomes and staff development across the company to ensure a payback from their HCM investment.

Make Better Informed Decisions

Asset management firms in the current environment face increasing regulatory scrutiny, such as GDPR, AIFMD, and Form PF, and constantly evolving standards. In order to meet the new generation of demands, these companies need to make well-informed investment decisions with visibility into all business lines. However, this is a difficult task when the data required to deliver these insights is housed in disparate legacy systems with varying formats and level of detail. This is where having consolidated HCM comes in—a single system for finance, HR, planning, and analytics can offer the necessary foundation to gain better insights, save time on data aggregation, and proactively solve business problems. A digital solution of this type can help improve business margins, provide competitive differentiation, attract and retain customers, and identify lucrative areas for growth.

Harness the Power of Modern Data

Today’s financial companies have an unprecedented amount of valuable data across their organization. However, many are still not able to access this data due to isolated, unorganized, and inaccurate legacy systems. The data warehouses that are typically accessed by business intelligence tools to create reports or perform financial analyses hold data that was accurate at the time it was loaded and refreshed from legacy systems, resulting in a high likelihood that it is out-of-date and unreliable. As a result, financial services firms often turn to add-on custom software solutions to try and achieve real-time data extraction, but these products often produce further challenges because they require continuous maintenance to keep up with the changing needs of the business.

Implementing a contemporary, consolidated HCM system allows firms nimble access to the real-time data that is necessary for constantly changing business needs. These solutions include technologies, such as cloud computing, open APIs, artificial intelligence, and machine learning, that make insights transparent and accessible across lines of business.

Build Organizational Agility

Being agile is key to an asset manager’s long-term success and there are several factors at play in building organizational agility:

- Adaptable: A flexible technology foundation is essential to be able to change organizational structures and processes in response to regularly shifting business needs.

- Skilled: Financial services firms, among others, face a widening skill gap and must find ways to upskill their workforce.

- Empowered: In order to perform at the highest potential to meet evolving consumer expectations and drive success, employees need full access to data to make business decisions.

- In Control: The need for measurement and control goes hand in hand with agility and speed. Asset managers must measure more relevant KPIs to learn from what works and what doesn’t when it comes to new digital revenue streams.

There are common obstacles that firms must overcome to meet the guidelines above, including inflexible legacy technologies, bureaucratic organizational culture, and a lack of relevant employee skills. By using a comprehensive HCM solution to add intelligence to business tasks, financial firms can move past these challenges and employ integrated, real-time planning in order to build organizational agility and realize their digital growth aspirations.

Choose the Right Solution

As mentioned previously, there are many HCM offerings available on the market and it is important to select the right one to meet your firm’s unique needs. There are several factors to consider, such as the needs and priorities of the business, size of the firm, and desired metrics and reporting abilities. FinServ Consulting has experience working with asset management firms to identify and implement a suitable HCM solution. We can help you make the right decision and take full advantage of the capabilities and rewards that the new solution will provide.

Summary

If you are interested in establishing or improving your firm’s HCM platform, FinServ Consulting is the right partner to help you reach your firm’s strategic objectives. Throughout our 15 years of existence, we have proven that our deep industry knowledge combined with our project management and overall best practice methodologies can be an asset to your organization. To further continue the conversation or to discuss more of FinServ’s capabilities, please contact us at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Implementing Workday – What Your IT Staff Can Expect

If you are considering implementing Workday for your Human Capital Management (HCM) and / or Financial system needs, then you are likely aware that Workday is a Software as a Service (SaaS) application – centrally hosted and consumed over the Internet as a Service. The SaaS model will save your organization time and money on the maintenance tasks typically associated with an on-premise software installation. What it won’t do is absolve your IT staff from all Workday responsibilities, rather your team’s responsibilities will shift. Depending on your organizational structure, this role can stay solely within IT or it can be split between IT and the Business.

Let’s review the traditional on-premise software model and how your staff supported it.

| On-Premise Software Support Responsibilities |

|

|

|

|

|

|

|

|

|

|

With Workday, your IT Staff largely pivots away from the infrastructure maintenance to an application maintenance and integrations focus. Your staff would support Workday’s “Delivered Value” as defined in the Workday Technology Illustration below.

Let’s examine each “Delivered Value” item to determine how they translate into responsibilities for you and your staff.

Web Familiar Experience

Workday’s main user interface is through the Web Browser and will be how your users primarily interact with Workday (there is also an App).

Enabling your users to access Workday will be dependent on your staff and this can include the following application Maintenance and Support tasks.

- Adding and configuring New Users in Workday including Single Sign-On (SSO) set up

- Disabling Terminated Users

- Setting login and password expiration settings

- Monitoring New Releases and reviewing their corresponding System Release Notes

- Using Business Analysis to plan and manage projects for Enhancements and Additional Component Activation

- Keeping abreast of major functionality changes that will benefit your firm such as Workday Prism Analytics

- Configuring and Testing System Changes

- Troubleshooting User Issues and Managing the Issues to Resolution

- Administering your Workday environments (tenants) – Production and Staging to manage system refreshes and upgrades

Enterprise Reporting

Workday will become the Golden Source for your firm’s Human Resources and Financial data. Naturally, your users will want to take advantage of this and will want a comprehensive set of reports. Building these reports will require your staff to understand how Workday stores the data and how to extract the data using specific report types.

Furthermore, you will also need to think beyond Workday to consider how HR and Financials data in Workday can augment and complement the data in other areas of your firm. At many of our clients, the strategic vision in consolidating all of the firm’s data involves another tool, usually a Data Warehouse.

- Building Matrix Reports

- Building Advanced Reports

- Building Composite Reports

- Understanding the available set of pre-configured reports

- Planning how Workday data can be used throughout your firm

Integration On-Demand

Central to Workday’s functionality is the ability to communicate your data with both internal and external parties. Internally, you may want to have Workday interact with your internal CRM system such as Salesforce (typically for deal pipeline or other customer management). Externally, you will want to have Workday interact with your various Vendors for Procurement Punch-Outs, Banking Transactions, Benefits and Payroll. This data flow is done via Integrations / API Calls that were initially set up during the initial Workday deployment by the Workday Integrators.

Maintaining the Integrations, API Calls and related File Transfer Infrastructure will fall on your staff and the responsibilities include the following:

- Mapping out both internal applications and external vendors that will interact with Workday

- Monitoring Integration Runs and Troubleshooting Errors

- Collaborating with Vendor Contacts to determine the root cause and resolve

- Building custom Integrations in Workday Studio (if standard integrations do not meet requirements)

- Configuring and maintaining a File Transfer Server (if necessary) with secure file protocols such as SFTP, SSL, SSH, etc.

- Supporting file encryption with keys such as PGP keys

- Configuring the Firewall to white list Vendor IPs to allow the Vendor to connect to your File Transfer Server

Configurable Business Processes

Business Processes allow you to define and create your firm’s workflow in Workday. For example, to hire a new employee, each firm will have their own steps to initiate the hire process, enter data, run background checks, obtain approvals, etc. This process is taken from your firm and then re-created in Workday.

Your staff will need to develop their Business Process skills to support the business in the following manner.

- Investigating and Resolving Business Process Issues

- Creating and / or modifying Business Processes

- Tracking approvals given for Business Process changes through the Request Framework or other internal tool

- Reviewing and Analyzing the Business Process for risks due to Key Man Dependency, Separation of Duties, Improper Access Granted, etc.

Summary

Implementing Workday will require your IT staff to be fully committed and involved in the implementation from the beginning. This is critical for a successful implementation and a seamless operational support transition. Your IT staff will not be as focused on Physical Infrastructure but rather on Workday and the systems / components related to Workday. IT’s role is critical for segregation of responsibilities and allows your firm to successfully address audit points and regulatory concerns. This post is designed to guide and instruct you on the changes to come to you and your staff. FinServ has advised multiple clients on supporting their Workday implementation, augmenting their support staff and improving upon existing processes. FinServ is an experienced Workday integrator with the deep industry expertise needed to configure Workday optimally for your firm. For help in implementing or enhancing Workday, contact FinServ at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Artificial Intelligence for Human Resources

Artificial Intelligence – The Next Internet

Today, the term Artificial Intelligence (AI) has gone main stream and has become the focus for the next stage of technological evolution. In 1996, Bill Gates said about the Internet:

“The Internet is a revolution in communications that will change the world significantly. The Internet opens a whole new way to communicate with your friends and find and share information of all types. Microsoft is betting that the Internet will continue to grow in popularity until it is as mainstream as the telephone is today.” –Bill Gates (Time, 16 September 1996).

This sounds awfully familiar to how AI is being described today as to how it will reshape our lives. In the Business.com article “3 Reasons Why AI is Beneficial to Business“, AI is described as:

“Artificial intelligence (AI) is regarded as one of the most impactful technologies in the word today. It is transforming the way the world works by spurring innovation in every sphere of the planet. There are many advantages of AI, from the capability of making any function work faster to improving how the world runs.”

Much like how the Internet was described in its genesis, AI is being described in a similar grandiose fashion where I am not being told anything specific in terms of benefits nor am I being told of the practical usage of AI. For example, how is AI going to exactly make me and my clients work more effectively? Specifically, how will this make the HR space function more efficiently? How can HR utilize AI to add value to their work and to their firm?

Think Small

To identify the areas where AI can help HR immediately, it helps to think small. Find smaller ways to improve your work processes that you can implement with minimal change. Changes that affect multiple groups and the whole organization will run into stiff cultural resistance and incur greater risk. For example, AI has been a trending topic recently in how it can improve the Recruiting process from scheduling to follow ups to candidate interaction. However, we have seen that Recruiting processes can be difficult to change due to ingrained processes, legacy systems, multiple internal and external involved parties, etc. Furthermore, if AI is not implemented correctly for Recruiting, it can potentially lead to employment law violations.

In a notable misstep for AI, Amazon recently disclosed that they abandoned an internal effort to have AI review and process candidate resumes as the AI learned gender bias and showed preference toward male resumes. Reuters reported that:

In effect, Amazon’s system taught itself that male candidates were preferable. It penalized resumes that included the word “women’s,” as in “women’s chess club captain.” (Reuters, Amazon scraps secret AI recruiting tool that showed bias against women)

Effective AI should be thought of as an “add-on” that can enhance your work by taking on mundane tasks, guiding you through tasks, offering advanced data analysis to complement your work, etc. We have selected 3 areas where an AI “add-on” can have a big impact to HR and be implemented quickly.

- Chatbots

- System Training

- Retaining Talent

Chatbots

Chances are that you have already encountered many of these Chatbots on your daily websites from shopping sites to your utility provider’s site. The Chatbot AI prompts you to ask questions which they then answer without an actual representative interacting with you. Well, this is coming to the workplace as well and HR is in a prime position to benefit.

On the popular collaboration and messaging app, Slack, the add-on, Niles, can listen and learn from your questions. For example, you can ask Niles, how much would it cost to switch from the Low to High Medical plans or how many vacation days can I carry over? Niles can answer these questions freeing up your time for more complex tasks. And what if Niles does not know the answer? Well, you would have to give Niles the right answer and Niles would learn from this.

System Training

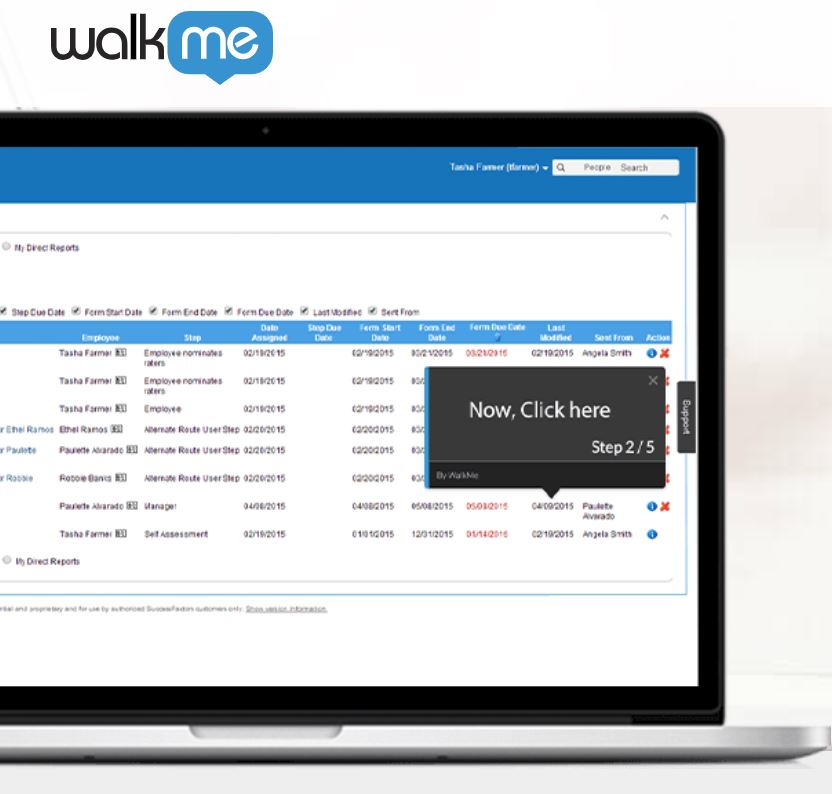

As more and more HR departments implement HCM systems, there comes a learning curve to learn how to use the system. For the most part, users have been trained through on-site sessions and user guides. But how much knowledge does the user really retain after the training is complete – not enough to complete the task seamlessly. User guides have issues as well in terms of finding and using the correct guide and their overall static nature. You can always ask your HRIS Administrator for help but that depends on if they are available and it may take time away from their other tasks as well. AI in System Training is designed to overlay on top of the system for a seamless experience and interact with you as you do your task. This on-screen experience is on demand and contextual.

WalkMe, a digital adoption platform, offers AI training that sits on top of the Workday UI. It can guide you step by step to complete your tasks and this becomes really powerful when taking the context into account. For example, you are no longer following just the steps to transfer an employee from the New York office to the London office. WalkMe would recognize the context that you are performing the office move task in – the employee is transferring, not just moving. You could be prompted to perform related tasks such as updating a home address, converting salary to the local UK salary or updating the retirement benefits. And if you have never done these steps or forgot how to do them? WalkMe has got you covered..

Retaining Talent

When employees leave, it causes strain on the organization’s employees and the organization itself. Employee morale can suffer. The organization can encounter the adverse effects from lost industry and institutional knowledge and the necessity to kick off recruiting a replacement. Recruiting itself is arduous and time consuming and there is no guarantee that the replacement is a good fit for the organization. But what if you could potentially prevent this or at least be prepared when someone inevitably leaves? AI can scan and analyze employee behavior and cues and identify those at risk for leaving. With this knowledge, potential issues can addressed before they become issues and the transition plan becomes a proactive exercise rather than a reactive exercise.

Veriato, a user behavior analytics and employee monitoring software company, offers AI platforms designed to identify employees that may be leaving. By tracking the employee’s behavior from their computer activity, tone in emails, keystrokes, internet browsing, etc., a baseline is created for that employee. The AI can monitor and detect deviations to the baseline that would indicate if an employee might be leaving. For example, the AI may detect a change in tone to a negative tone regarding the company in emails or disengagement from work through reduced work activity.

Summary

AI is being touted as the next great solution much like the Internet was in its early days. To take advantage of AI now, start small and practical. Small improvements can be implemented quickly with less organizational resistance and risk. The benefits of AI will be realized quicker and will help you present tangible benefits as supporting arguments for implementing AI with a larger organizational impact. FinServ has helped many of our clients evaluate their current processes, implement process efficiencies and select technology that best fits the organization. For help in evaluating where AI can benefit you and implementing it, contact FinServ at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.