Make Absence Health Checks a Regular Part of Your Annual Workday Routine

As we near year-end, there are several year-end Workday activities that our Clients must conduct to ensure a smooth transition to the next year. In addition to reviewing pay periods and integration schedules, FinServ recommends conducting an Absence / Time Off Plan health check to ensure the plans and balances are correct, align with employee expectations, and comply with regulatory bodies.

As we near year-end, there are several year-end Workday activities that our clients go through that revolve around extending integration schedules, creating pay periods, and ensuring that Workday is ready for the following year. In addition to these activities, we recommend conducting an Absence / Time Off Plan health check to ensure the plans and balances are correct, align with employee expectations, and comply with regulatory bodies. The following tasks form the basis of the health check:

- Verify unused time off balances.

- Verify that employee time off balances are correct.

- Verify that employee leave statuses are correct.

Unused Time Off Balances

Looking at each employee’s year-end vacation balances will reveal any outliers or out-of-the-ordinary balances (Hint: Use the Extract Time Off Balances report to view these balances). We’ll want to find any out-of-the-ordinary balances as that can indicate more significant underlying issues that should be addressed sooner rather than later. For example, workers may not have taken any time off, and their full vacation balance will stand out. Having such a sizeable unused balance can indicate issues such as:

- Is this a cultural issue? At many investment firms, front-office employees may not be able to utilize their days, and this may be the accepted norm that requires a more extensive discussion to resolve.

- Is this a process issue? At these same firms, front office / senior management is not inclined to go into Workday to do data input. The discussion would then shift to setting up delegates to enter time off on behalf of select employees or reinforcing the correct time off process with those employees. (Hint: Use the All Worker Time Off report to view all time off requests submitted to see if they are being inputted and approved on a timely basis).

Correct Time Off Balances

Time Off balances are affected by numerous factors such as accrual rates, carryover amount, carryover caps, balance caps, employee tenure, position, office location, manual overrides, etc. The sheer number of dependencies can cause incorrect balances, and it will be essential to catch these scenarios early before the employee notices any discrepancies, uses days they don’t have, or vacation payouts are done on incorrect balances. To identify these situations, verify employee time off balances using future effective dates that are 1-2 years in the future. As the balances span years, any expiration or cap issues will become apparent.

Consider an incorrect carryover cap in Workday for a terminating employee in California. This cap is meant to dictate the maximum number of hours an employee can carry over, and without it, the carryover accumulates to an unexpectedly high amount. This will become an issue if that employee is terminated, as California requires that any unused vacation be paid out.

Confirm Employee Leave Status

Incorporating checks on leaves of absence is highly recommended, as leave status and dates can affect functionality in Workday and possibly have payroll implications. Regardless of whether Leaves are maintained manually or by a third-party leave administrator, leave status needs to be reviewed. Manual updates often get skipped, and leave administration by third parties is not always correct.

Consider the example where an employee was on primary caregiver leave and has returned to work. However, their leave status in Workday was not updated, so their delegation settings were not updated when they returned. This would result in the business process approval not being sent to the correct employee. Furthermore, depending on how the employee is paid while on leave, they can be paid under an incorrect rate if the wrong employee status is sent to the Payroll provider. (Hint: Use the Leave Results for Organization report to get a holistic view of all employees on Leave and their Leave dates).

Conclusion

By making absence a routine focus, you can proactively catch any issues before they happen and become more significant. Once the problem occurs, it becomes more complicated to fix from a Workday configuration perspective and manage employee expectations. For example, an incorrect vacation payout will be much easier to fix before it is paid out. Verifying the health of your Absence setup is good practice and will avoid employee frustrations that happen when pay is affected.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

How Asset Managers Can Implement Data Governance in Their Organization

Data governance is the roadmap that guides asset managers towards unlocking the full potential of their firm’s assets. By harnessing the power of data governance, asset managers can confidently ensure compliance, fortify security, and enhance data quality throughout their organization.

Data is the backbone of success for all asset managers. Those who lack data governance policies are at a high risk of facing data breaches, privacy violations, and misuse, each risk capable of deteriorating a firm. Beyond immediate repercussions, longer-term risks can damage the firm’s reputation and can lead to a potential loss of investors. The need for having an effective data governance framework is not merely a choice, but rather an indispensable strategy. Data governance empowers asset managers to uphold data quality, navigate risk threats, and exceed regulatory requirements, all necessary for a robust organization in today’s market.

Data Governance Overview

At its core, data governance is the systematic approach to managing data assets within an organization. The structured framework encompasses policies, processes, and controls to ensure data issues are accurately defined, resolved, and audited to meet the firm’s overall strategy and business goals. By establishing clear lines of data ownership, defining meticulous standards, and rigorously upholding data integrity, data becomes a pathway for organizational growth. In data-dependent industries such as asset management, a robust data governance strategy is not merely an option, but rather a fundamental necessity.

Data governance in asset management firms promotes cross-departmental collaboration, ensuring that data is coordinated and consistent and that all parties are aligned on data understandings and goals. Data within the organization becomes easily accessible and increases accountability, productivity, and trust within the organization. Firms that focus on having a robust data governance framework can better leverage their firm data as an asset, enabling them to improve decision-making and gain a competitive advantage.

Data Governance Amongst Asset Managers

Data governance amongst asset managers is vital due to the complex nature of their business operations, stemming across the trading, operations, IT, compliance, risk, and other firm departments. In the United States, data quality issues cost $3.1 trillion per year across the board (Webinar Care). Furthermore, low data quality and availability can cause employees to spend 36% of their time on non-value-added tasks in Finance (McKinsey & Company). 55% of asset managers have already recognized the benefits of data governance and have taken initiatives to enhance data governance and quality within their organizations (Accenture). Having a dedicated data governance team not only increases data quality but also increases data confidence by 42%. (Webinar Care)

It is crucial for asset managers to recognize the benefits of data governance and focus on it. A lack of focus is costing firms money and decreasing their employees’ productivity. In an industry where it is imperative that each resource is provided with the tools they need in an effective manner, the lack of data governance policies limits this. Not only does a lack of data governance hurt an asset management firm internally, but it also negates its ability to compete within the market. Front-office investment analysis slows down, middle, and back offices face operational delays, and investor data becomes vulnerable. This cannot only have an impact on the firm’s rate of return, but it can also lead to increased regulatory risk and a loss in investor trust.

High-Level Data Governance Framework

Implementing a data governance framework as an asset manager can seem daunting at first; however, following a well-structured and adaptable general framework can make the process seamless and effective. FinServ’s general framework incorporates key learning from previous clients and ensures a comprehensive approach to kick-starting the data governance initiative.

| Phase | Description |

| Assess | During the assessment phase; the firm must review its current policies, processes, and objectives to ensure the proper implementation of the data governance framework. To do this, thorough interviews must be conducted with all key business functions, and all firm documentation must be reviewed to evaluate the state of each business group. As a result, documentation must be produced to gather reporting requirements, pain points, and current business processes. This assessment serves as the critical foundation to resolve a firm’s data governance issues. |

| Inventory | The firm must then create a comprehensive data dictionary to serve as the central repository for all data requirements. Key data elements must be documented, such as the data type, description, source of origin, and other key details. Data lineage must also occur in this step to record the origin, flow, and transformation of the data from initiation to destination. All other relevant business and data process flow diagrams must be created in this phase to ensure a proper understanding of current data flows and definitions. |

| Control | The firm must address all data issues in this step. It is important to review all the current data issues within the firm and establish the necessary controls to ensure data issues are controlled in a systematic and efficient manner. To help facilitate this, support must be obtained from key stakeholders to guarantee the proper execution of control measures and risk mitigation. All data controls will depend on the type of data, current policies in place, and the expected goals for the firm. Data control is a pivotal step in resolving data issues within a firm. |

| Report | Once data issues have been controlled, all key business functions will be responsible for providing finished reports, dashboards, and analytics to the firm. These reports will describe in detail the issues the firm faced, the measures that were taken to control those issues, and the current state of the data. Feedback must be gathered firm-wide, as that will serve as the new basis for evaluating data issues. Once the firm has reviewed the current reports, the process must start again to ensure data governance measures are up to date and issues are mitigated as soon as possible across the firm. |

Conclusion & Suggested Next Steps

Successfully implementing a data governance framework can be challenging for many alternative asset management firms, as there is a need for an objective framework and subject matter expertise. Recognizing, documenting, and strategically resolving key data issues are critical to a firm’s success. Not only does this increase the operational efficiencies within the firm, but it also provides the firm with a competitive advantage. Asset managers can engage with subject matter experts to gather insights into implementing a data governance framework properly, but they must still have the know-how to ensure proper implementation for their firm.

FinServ has experience researching, developing, and working with clients on their custom-driven data governance requirements. We have extensive knowledge of the different data types, workflows, and processes that exist among leading asset management firms. Our methodologies and frameworks allow us to provide objective and high-quality solutions for our client’s data governance issues. Our technical skillsets and comprehensive project management model ensure the proper resolution of data governance issues. FinServ can help kick-start, support, or lead your unique firm through its complex data governance projects.

To learn more about how we can help and our services, contact info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Should Investment Firms Outsource their Salesforce Administration?

Compared to hiring an in-house team, managed service providers will almost always generate a more immediate benefit for small and mid-sized firms. These benefits include a reduction of administrative burden, access to a wider breadth of Salesforce expertise, and the implementation of key industry benchmarks.

Private equity firms and hedge funds of all sizes should leverage customer relationship management (CRM) software to drive fundraising, maintain investment pipelines, and establish seamless operational processes. Salesforce is the leading and best CRM platform to help you achieve these goals. Each organization that uses Salesforce has its own instance that can be customized in powerful ways to meet its investor relations and operational requirements. Because of Salesforce’s customizable nature, specialized skill sets are required to get the most out of the application. This means that the firm’s size will dictate the resources required to ensure its Salesforce instance is utilized to its full potential.

As smaller firms grow their assets under management (AUM), it often finds that Salesforce will require more customization to meet its growing needs. Additionally, the administrative burden of managing users, data, and the user interface will grow beyond what most small firms can provide without a dedicated Salesforce resource. These firms then find themselves at a crossroads. Do they assemble a team internally to maintain the system, or do they engage with a managed service provider?

This article details the pros and cons of both options and outlines how FinServ’s Salesforce managed service can immediately benefit growing firms.

How to Know When You Are at The Crossroads

A few key indicators often arise when a firm has outgrown its current Salesforce administration process. The factors listed below highlight the most common reasons that firms need to reevaluate their current approach.

Data and Reporting Gaps – Salesforce has a powerful, user-friendly reporting engine that is relatively easy to leverage to gain huge benefits and invaluable business insights. However, the way that your Salesforce data is set up and organized will dictate how much value you will get from your reports. Therefore, it is critical that when first designing your system, you have a specialist who understands alternative investment data as well as Salesforce data modeling. Leveraging a managed service provider like FinServ, a Salesforce partner specializing in alternative asset management, ensures your success at this critical step.

Administrative Burden – New user creation, access management, user deactivation, and user profile customization are just a few of the day-to-day tasks that need to be carried out. Salesforce has one of the most powerful security models in the software marketplace. It allows you to ensure users only have access to the data they require while ensuring compliance with all regulatory agencies. However, with this power comes a level of complexity that requires someone who has been trained in Salesforce’s security model. Trying to use an internal team member without the proper training and expertise could be costly, not just because of compliance issues but also because of the amount of time they will spend trying to configure the system. Using a Salesforce-certified administrator will help to ease this burden at a reasonable cost.

Automating Key Business Processes – Salesforce has an incredibly powerful workflow engine called Flow, which can be used to automate your most important business processes. However, setting up the automation requires specific Salesforce skills and some development-level expertise. In addition, FinServ consultants have the advantage of seeing many other private equity and hedge funds and knowing how they have automated their key business processes. Leveraging best-in-class solutions provides priceless benefits to your firm.

Lack of Integrations – Often internal firm resources will not be aware of other 3rd party applications available through the Salesforce App Exchange that can quickly and easily enhance the power of the Salesforce instance. Since your managed service provider is a Salesforce Partner who spends their time making sure they are up on the best solutions in the Salesforce environment, they are in the best position to recommend cost-effective 3rd party applications to integrate with your Salesforce environment. Integrations with commonly used generic systems like SharePoint Online, or industry systems like Preqin are critical to ensuring your Salesforce instance is operating in the most efficient way possible. If your firm’s Salesforce instance lacks key integrations, engaging a managed service provider like FinServ will provide an immediate benefit.

What Does a Salesforce Managed Service Provide?

In order to compare a managed service provider to in-house resources, the scope of the provider’s services must be outlined. A Salesforce-managed service provider will generally perform the tasks listed below:

| Category | Description |

| Account Maintenance | This category includes responsibilities such as new user setup, access management, account deactivation, and many more day-to-day tasks the firm would typically perform internally. |

| System Configuration | Growing firms often require the creation of new objects, fields, and other metadata within Salesforce’s structure that can be utilized to store and report on data. This can be as simple as a basic object with only a few fields or involve complex structures such as many-to-many mappings and junction objects. |

| Systems Integration | Managed service providers will help your organization integrate Salesforce with other software such as SharePoint Online, Google Cloud, Teams, Preqin, Slack, and many more systems. This service will greatly increase operational efficiency and decrease the time spent switching between software platforms. |

| Data Management and Backups | Proper data management and backups are necessary aspects to ensure your firm has a disaster recovery plan. Managed service providers will ensure your data backups are running properly. Additionally, they will assist with loading data into Salesforce from Excel spreadsheets and other sources. |

| Customization | Customization can entail many aspects, including creating unique dashboards, generating reports utilizing custom objects, developing automation workflows, coding various lightning web components, and much more. However, depending on the scope of the customization, these projects might fall outside of the purview of the managed service agreement. In these scenarios, firms can engage their providers to perform an a la carte project for in-depth customization. |

While many firms without dedicated Salesforce resources can handle their account maintenance and some aspects of their system configuration in-house, most do not have the expertise to deal with the other aspects included in a managed service agreement. Some of the largest firms may choose to hire a dedicated Salesforce resource or build out an entire team. However, hiring dedicated resources is not always a feasible option for firms that are growing rapidly from small to mid-sized. This is the most common scenario in which FinServ’s Salesforce-managed services can provide an immediate benefit.

Overview of Managed Services Compared to In-House

The table below analyzes utilizing a managed services partner compared to developing an in-house team to maintain your Salesforce instance. These are all factors to consider when surveying your potential options.

| Category | Managed Service | In-House Resources |

| Cost | Utilizing a Salesforce-managed service offering will almost always be more cost-effective compared to hiring dedicated resources. This is partially due to the greater flexibility that managed services allow for. | Hiring dedicated resources will lock you into a fixed-cost expense. Generally, this will lead to a higher annual cost and the potential for more wasteful spending. However, if your organization is large enough to have a consistent stream of work, dedicated resources may make more fiscal sense as compared to small or medium-sized firms. |

| Hiring and Selecting |

Managed service firms like FinServ Consulting can provide various Salesforce certifications, qualifications, and case studies to assure your team that they have the necessary skill set and resources to handle all your needs. FinServ, unlike most Salesforce partners, possesses extensive experience in the alternative asset sector and has a deep understanding of the specific Salesforce requirements for that industry. Using a Salesforce partner who does not understand your business is a costly mistake most funds make. |

Hiring internally can be a bit more challenging for various reasons. Candidates should be able to provide their Salesforce certifications; however, it is difficult to attract and vet experienced candidates possessing knowledge of how Salesforce should work within your specific industry and sub-sector. This process will generally take longer than hiring a managed service firm and will involve a training period in which the new hire will not benefit the firm. |

| Expertise |

Managed service firms employ various resources that cover a wide breadth and depth of expertise. This means that your firm will benefit from the diverse pool of knowledge that will be available when they sign up for a managed service agreement. The provider can always assign the most suitable resource to complete the required tasks. |

The breadth of expertise comes down to the capabilities of the in-house staff. For small or mid-sized firms, their limited in-house teams may not have the expertise to take on some of the more arduous tasks required. Larger firms can more easily employ larger teams and, therefore, diversify their in-house expertise. However, leveraging a diverse team through a managed service provider is much more cost-efficient. |

| Scalability |

The demands of maintaining a fully utilized Salesforce instance are not uniform. There are months when little maintenance is needed other than data backups and user administration. However, there are other periods in which more in-depth services are required. A managed service provider will always be more beneficial in this scenario as contracts can allow for variable hour usage. |

In terms of scalability, in-house resources cannot compete with managed services. Due to their fixed-price nature, firms need to have a consistent stream of work in order to utilize their staff fully. Additionally, when bigger projects with greater requirements materialize, these firms may also need more resources on a short-term basis and may be forced to outsource at that point. |

| Benchmarking |

Due to its expertise in the alternative investment industry, FinServ’s Salesforce managed service offering can help your team determine best practices used by the leading firms in the alternative investment space. FinServ will provide strategic guidance that will enable your processes to run smoothly and allow your firm to enhance the efficiency of those processes. |

The benchmarking provided by your internal resources will be entirely dependent on their individual expertise and past experiences. Typically, in-house benchmarks are less rigorous than those adopted by an experienced Salesforce administrator, potentially compromising the firm’s performance. |

Conclusion

Recognizing when a lack of proper resources is limiting your alternative investment fund is critical. Once the firm has come to this realization, the next step is to engage a managed service provider or build a proper in-house team. Compared to hiring an in-house team, managed service providers will almost always generate a more immediate benefit for small and mid-sized firms. These benefits include a reduction of administrative burden, access to a wider breadth of Salesforce expertise, and the implementation of key industry benchmarks. Additionally, engaging a managed service provider is more cost-effective and allows for greater scalability. Growing firms will have their service grow along with them, which reduces wasteful spending and potential resource chokepoints.

FinServ Consulting is an experienced Salesforce partner and managed service provider who is always available to help growing firms identify their best path forward for Salesforce administration.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Selecting the Right IT Managed Service Provider the FinServ Way

Are you happy with your IT MSP? Many funds are not. Selecting the right IT MSP is not something you should keep putting off. Learn how FinServ helps its clients find the right IT provider for their unique needs.

Managing your IT infrastructure touches every team member and can create significant issues if not handled effectively. From extensive downtime to user frustration having an IT team that does not act as a business partner can hurt your whole fund.

FinServ completed an IT MSP Vendor Selection for one of our Private Equity Fund clients experiencing these exact issues. When the head of the fund could not access his systems during the pandemic, and their service provider had let the problem sit for over 24 hours, the fund decided a change had to be made.

The client was already aware of FinServ’s Vendor Selection methodology, as a few months earlier, we helped them select a new Third-Party Fund Administrator.

FinServ’s Vendor Selection methodology ensures that our clients select the right service provider for their unique requirements. Our comprehensive approach includes three stages of selection.

Phase 1 – Initiate

FinServ works with our client to inventory/collect all essential documentation and support for the new vendor culminating in a detailed set of user requirements. FinServ leverages our functions of an IT MSP to reconcile all possible functions to ensure all possible services are covered. Getting from a long list of vendors to a shortlist based on a detailed Request for Information (“RFI”).

Phase 2 – Assess

At the core of our selection approach, we use a 35-Page RFP including over 320 detailed questions. This level of detail ensures that the vendor provides the services and support in a way that meets each client’s requirements. Every client has their own way of doing business, and this approach ensures that the vendor that best fits that model is selected. The key to this stage is FinServ’s team with unparalleled attention to detail combs through the provider’s documentation and answers. It creates a qualitative and quantitative scoring that investors and auditors call world-class.

Phase 3 – Recommend

In the final stage of our selection process, we use scripted demos, which force each vendor to show, not just tell us, how they address the client’s most complex challenges. It is in this step that the right vendor rises to the top. Most salespeople hate this step because they know that often they want to stretch the truth about their systems. The right vendor can show how it is done to seal the win. In our final step, we conduct comprehensive reference checks that often uncover issues that may not disqualify a vendor but help the client with crucial advice as they move forward with the winner. The final step is a recommendation deck that summarizes all the detailed work, including the cost analysis across the finalist vendors supporting the client’s final selection. Many clients have used this document to show potential investors the quality of diligence in selecting a key service provider.

Beyond the Methodology

The process is key to making the right choice, but more important is ensuring that you focus on the essential areas these service providers offer. Technology is constantly evolving, be sure there is a focus on what is needed today and in the near term to meet your firm goals and requirements.

FinServ makes it our business to always stay on top of the latest requirements from regulatory agencies like the SEC and the latest technologies that the best providers are using.

Your IT Managed Service Provider (“MSP”) typically handles 2 to 3 of the most critical aspects of your business:

1) Cyber-Security & Risk Management

2) Monitoring & Management of IT Infrastructure

And for funds that have chosen not to keep IT resources in-house.

3) Service Desk / Desktop Support for Users / Company

1) Cyber-Security & Risk Management

With the war in Ukraine and the increased likelihood of focused cyber-attacks, there has never been a more critical time for a financial institution to ensure that they have the best possible risk management and cyber security coverage possible.

The offerings from the best IT MSPs have changed drastically over the past few years as the technology for cyber security and risk management has been forced to evolve as quickly as the sophistication of attacks.

The Not So Obvious Requirements Matter Most

One of the nuanced aspects of these services is less about your direct protection and more about how communications about potential IT security issues are raised. Our clients desire to limit the noise created by non-critical communications, so only the most critical issues are escalated for review. Some vendors have more advanced issue monitoring and alert systems that use rules and triggers to raise only the most important messages to clients, limiting “boy who cried wolf” scenarios.

The best vendors also proactively provide webinars and training for your employees to stay on top of the latest attack approaches. A knowledgeable team is your best defense against constantly evolving and changing cyber threats.

2) Monitoring & Management of IT Infrastructure

Has your network ever gone down, leaving you unable to work? Have any of your remote employees ever lost access to your network? Has a crucial executive of your firm ever been frustrated by not getting the IT support they need?

If the answer to those questions was yes, you probably don’t have the right service provider with the proper setup and response management systems. The best IT MSPs have formulated approaches that ensure redundancy and backup of essential systems, so you never have downtime during regular business hours. Similarly, they have all created world-class service systems that support intelligent routing of critical issues with complete status transparency. Essential issues are solved in minutes, not hours or days. When they take longer, your support staff can see real-time updates on 1) who is working on the issue, 2) when it will be resolved, and 3) all the latest activity and communications to the key executive.

3) Service Desk / Desktop Support for Users / Company

If a key executive’s camera is suddenly not working and they have a full day of Zoom or Teams calls ahead, not having someone come to their desk immediately to fix the issue can be a significant problem.

Alternative asset management firms often choose not to hire a CTO or desktop support staff. With predominantly SaaS-based applications, the need for in-house physical support has been dramatically reduced. Many smaller funds prefer to rely on an outsourced IT support person along with a part-time Virtual CTOs (“vCTOs”) to focus on complex technology strategy. Separately, while remote desktop support can work for many issues, in-person physical support is still something many funds require. While many IT MSP Vendors have moved away from offering this service, it is still an essential requirement for many funds.

If you are one of these funds, FinServ has you covered. We know which IT MSPs truly champion this type of support and which vendors only give it lip service. Additionally, If you are unhappy with any existing onsite IT support you are receiving today, we can help you move to a vendor that will cover all of your needs.

Conclusion

The IT MSP Vendor space is filled with many sub-par providers that cannot cover the mission-critical services that alternative asset managers require. In a world where one mistake could cost your firm its reputation or paralyze your operations, it seems crazy to leave this essential operational risk under-serviced and exposed.

There is no one-size-fits-all vendor. Many of the best IT MSPs have focused their services in certain areas, so choosing the right partner that fits your firm’s unique requirements is essential. FinServ’s knowledge of the marketplace and our rigorous selection methodology ensure you get the provider and services your fund requires.

To learn more about FinServ Consulting’s services: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

What Every HR Department Must Do in Workday to Ensure a Smooth Start to the New Year

There are five main activities that need to be done in Workday at year end / beginning of the year to ensure the smooth running of a business. These simple tasks are often overlooked – particularly by those new to Workday – but can have a negative impact if not done.

There are five critical tasks that Workday companies should undertake around the year-end / new year time frame. Individually, these are simple tasks but can significantly impact your HR operations if not completed in time.

Year-end activities come thick and fast, and it is easy in the last month of the year to forget to undertake some essential tasks. FinServ Consulting has identified five essential tasks that every HR department must complete to guarantee a smooth kick-off to the new year. Lack of action on these tasks could create unnecessary errors or preventable breaks in your operations, causing a lot of unneeded January headaches.

These five areas are:

- Scheduled Processes – (integration, reports, alerts) and Period Schedules (payroll, time off, time tracking) must be reviewed and set up / extended manually. Scheduled processes can be set up in advance up to five instances in a new year. Period schedules can be set up for up to two years in advance.

- Delegation Review – A review of delegation assignments ensures that they are correct and that expiration dates are extended. This will avoid the Workday inboxes of executives filling up with tasks that generally would be delegated.

- Compliance Activities – Review what compliance requirements are pending for the new year, including mandated data purging and verifying employee compliance with company policies.

- Corporate Document Updates – A review of employee documents like the corporate handbook, benefit plan documents, and company policies will ensure that they are updated and properly linked to in Workday.

- Time Off Calendar and Balances – Update the upcoming holiday calendar to ensure that employees can successfully request time off. In addition, review time-off balances that are carrying over to ensure accuracy.

#1 – Scheduled Processes and Period Schedules

Scheduled processes allow you to automate processes on a schedule (i.e. daily, weekly, monthly), such as an integration with your medical benefits provider or payroll processor. These schedules are typically set up in advance but must be maintained annually. They cannot be scheduled indefinitely and can usually be set for up to five scheduled instances in the following year.

Suppose your payroll file is not sent to your payroll provider because it is no longer automatically scheduled in Workday. In that case, the HR team risks a highly visible and potentially catastrophic mistake.

Period Schedules standardize the sequential periods you use to track absence or payroll. These period schedules also need to be entered and maintained manually and can be entered up to two years in advance.

Not setting your future period schedules can prevent employees from requesting time off or prevent you from processing the next pay run. Like the Scheduled Processes, not maintaining Period Schedules is an easily preventable error.

#2 – Delegation Review

Tasks are often delegated in Workday, usually to assistants of senior executives. Senior executives are generally crucial control points to granting approvals for time off requests from their subordinates or approving high-value expenses and invoices. Executives usually do not have the time or inclination to go into Workday consistently and approve these requests.

Delegating these tasks to assistants allow the tasks to be completed in a timely and consistent manner. These delegations do have expiration dates and need to be reviewed annually. Letting delegation settings expire can result in a senior executive’s Workday inbox being flooded rather than the tasks going to the correct delegated employee for processing. If the executive is not looking at their Workday inbox, critical invoice payments may not be approved, leading to unnecessary late payment penalties. For example, Market Data vendors’ unpaid invoices may lead to unnecessary late fees or, even worse, denial of critical data that the business requires.

As administrative permissions have time limits, it is easy to set them and forget them until something goes horribly wrong.

#3 – Compliance Activities

Data purging and employee compliance are two of the essential resets needed at year-end / beginning of the year. This means verifying that everyone has signed the required employee and corporate policy documents such as the employee handbook, Covid / return to work attestations, restricted trading policy attestations, and other necessary documents.

As these documents are disseminated throughout the year, it is easy to lose track of whether they have been reviewed and signed off on by all employees.

The time surrounding the new year is a natural time to conduct a holistic overview of the status of the firm’s overall policy attestations. For example, employees may be required to attest to understanding the code of ethics or conflicts of interest policies. Ensuring that these policies are enforced and that enforcement is tangible is key to assuaging any concerns of regulators or potential investors.

This time is also an excellent time to review how well the firm is in compliance with data retention and purging regulations. For example, the European Union’s General Data Protection Regulation (GDPR) stipulates that personal data is collected for legitimate reasons and is only kept if needed. Because of these regulations, companies will need to place greater scrutiny on terminated employees and their personal data. The HR or compliance departments must be vigilant in reviewing this data and determining if there is a legitimate reason to continue storing it in Workday.

#4 – Corporate Document Updates

Corporate documents such as employee handbooks, benefit plan documents, and policies can get out of date quickly as policies evolve, such as Diversity and Inclusion and Remote Work policies. In addition, the companies’ benefit providers often change, or the company changes the plan offerings themselves. The document file itself can change from content updates to file name changes or file location changes. Once this happens, the reference link in Workday may no longer work and inevitably lead to errors during any attestation process or during an employee onboarding.

Checking that the latest document versions are set up in the system should be part of any end of year to new year process. Multiple or outdated versions of documents can cause problems; ensuring that only one version – the latest – exists is essential.

Performance review templates are another area to double-check along with offer letters and other templates used throughout the year. These templates can change. Since they impact all employees and prospective hires, it is critical to be consistent and accurate in what is shown. If these templates link to external documents or are set to send information to vendors, it is vital to make sure that the links still work.

#5 – Time Off Calendar and Balances

A simple task that can cause many headaches is ensuring that next year’s calendar includes the correct dates for holidays. Different localities and regions may have special holidays, and observed holidays change from year to year. These are not automatically loaded into Workday; they need to be set up every year manually. This is particularly important for companies with international offices where the holiday dates may differ.

The time around year-end is also a good time to get ahead of nuances in the calendar for the upcoming year to give you more time to be prepared to address any employee concerns. For example, most financial services firms follow the stock market’s holiday schedule. At the end of 2021, the stock market is not observing New Year’s Day 2022 as a holiday since it falls on a Saturday. Usually, the holiday would be observed on the preceding Friday. But, because Friday is a key accounting period (year-end / quarter-end / month-end), the stock market will be open. Try explaining that on New Year’s Eve when this calendar quirk dawns on your employees.

Another critical activity for year-end is to check your employee’s time off balances due to carry over. Carry-over balances should be checked for accuracy; this will ensure that your time off eligibility and carry-over rules are correct and that an unexpected employee type / setup is not breaking the time-off rules. Unused time off that can be paid out will need to be appropriately reviewed and loaded into payroll.

Conclusion

Overall, it is best never to assume that these essential tasks have been completed. Much of what needs to be done annually is common sense, but HR and Operations teams often overlook these additional inputs / actions in the crunch of a busy fourth quarter.

FinServ Consulting has found that many clients outsource support for these activities after they have experienced one of these painful events.

Whether you choose to seek our support or not, we hope these top tips help you avoid any adverse effects on your company’s operations. Getting to grips with these tasks early and on an annual basis will save a lot of time, energy and headaches in the coming year.

To learn more about FinServ Consulting’s services: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Vendor Management Systems Take Center Stage

If the pandemic has taught businesses anything, it is that they need to plan for the unexpected and ensure they have a robust, effective and comprehensive vendor management system. Such a system is not a “nice to have” but the best way to keep track of the myriad of service providers and the detailed work that needs to go into this effort.

No matter the fund or company size, vendor management systems are an integral part of the smooth running of a firm. Recently, FinServ Consulting implemented a vendor management system (VMS) for an alternative asset manager, helping it to customize the system. Based on this experience, FinServ identified six key elements of a top vendor management system.

#6 – Tickler System

Top of the list of “must-haves” is the ability to trigger events automatically. This is at the heart of any VMS and should handle all the rules and actions around contract renewals. Part of this will be automatically sending out vendor risk questionnaires internally to determine if a vendor is performing well and externally to the vendor to ensure its own internal processes, risk assessments, and business continuity plans are robust enough to support the fund. A good VMS will handle all these notices automatically and allow the firm to customize what it needs to do and when.

The best systems provide the functionality to support nested logic, workflow-based action step processes, multiple forms of notification, and automated updates to the data in the system.

Whatever the system, it should ensure the various components can be set up by the end-user with little or no technical expertise through user-friendly user interfaces. The system must also have a dynamic messaging capability, so emails or texts sent to the user and/or vendor provide contextual information needed to understand the details of the alert and be able to act on it in a timely fashion.

#5 – Business Continuity Plans

The primary focus of a VMS is on the vendors. It should be able to produce a business continuity plan and scrutinize its response to events it can foresee as well as the unknown unknowns. For example, if it is impossible to be physically in the office, the plan should outline the steps needed to ensure the smooth functioning of the fund, including naming key members of the team and what to do it they are incapacitated physically or because of technical problems.

The best vendor management systems have all the key pieces of a rigorous business continuity plan. This means a firm’s plan can be created on the fly each time a new vendor is added, updated, or changed when something significant happens within the business.

It should also provide a detailed system and organization controls (SOC) II level questionnaires and links to detailed analysis of all aspects of a vendor’s risk assessments and pull in details of the vendor’s responses to automated surveys. This allows the operations team and/or the chief information security officer (CISO) if a fund has one to document their own findings and risk mitigation strategies for anything flagged during the risk vetting process.

Capturing incidents in the vendor’s history that may require legal or other actions by operations or compliance teams is another essential related element.

#4 – Managing Costs

A vendor management system is only as good as the quality of the data put into it. If the system uses planned and actual spending from an enterprise resource planning and/or general ledger system, it will give a powerful view of spending by vendor.

One of FinServ’s clients took this a step further by tracking spending by employee for certain subscriptions. This gave a fuller picture of overall spending at the individual employee/trader level. With this data, the financial and operational teams could make decisions quickly on spending allocations in key areas and where spending on vendors was redundant or unnecessary.

A good vendor management system will offer application programming interfaces that make it easier for technology teams to interact with other systems such as the general ledger, customer relationship management, or document management systems. When all these systems talk to each other and automatically pass data back and forth, there is no need to have manual entry. This means a firm can ensure all its data are in sync, avoiding discrepancies.

#3 – Contract Management

Most legal departments are overwhelmed with managing negotiations and deal-related matters. The contract management component of a good VMS allows a legal team to coordinate with other key areas such as the business owner for the vendor, as well as the compliance and finance teams.

Contracts can then pass through risk management and legal processes in a timely and efficient manner. With key inquiries sent to vendors – requests for documents or other information – the vendor management system ensures the contract process goes smoothly. Prior to the end of a contract, the tickler feature automates the notification for vendors and the internal team responsible.

The vendor management system should be able to link to the firm’s enterprise-level document management system to make sure a “golden copy” of each contract is kept in one place only. By linking to the document management system, the firm centralizes the security of these documents, ensuring permissions only for the people who should have rights to see or update these documents. This is where a good vendor management system covers various aspects of the due diligence and overall compliance processes.

#2 – Compliance

Ensuring vendors are compliant with key items such as certificates of insurance, non-disclosure agreements (NDAs) and SOC II is critical for investors, auditors and regulators. The vendor management system should simplify and automate the process of collecting and managing these documents as well as provide integration with other key systems. The system should track not only the receipt of any documents but also expiration dates that require a new document.

One of the more sophisticated and user-friendly features of a system FinServ Consulting implemented for one of its clients was the ability to reveal certain parts of the system only when necessary. For example, only when a vendor required a certificate of insurance would it show the section of the document tab for loading the COI. This made it much clearer and easier for the client’s administrative team to manage the documents it needed to collect from each vendor.

#1 – Onboarding Challenges

How a vendor is onboarded is another area where a vendor management system is essential. It can help streamline processes, identifying who is able to add vendors and what controls, assurances, and guarantees are needed for each type of vendor.

For example, during the vendor onboarding process, the operations due diligence team answered certain key questions through a wizard. The responses determined which document sections would show for the administrators who needed to collect the documents. When all the required documents were collected, it notified the vendor sponsor that its vendor was up to date and ready to go live. The system also notified legal that it should engage the vendor to finalize the contracts while letting all interested parties know that a new vendor was now live in the system without the need for any manual emails or intervention.

Conclusion

Vendor management systems have become an essential system for all alternative asset managers. An effective system must be able to provide a place to store essential data and offer user-friendly support to investor relations, operations, legal, and compliance teams so they enjoy working with the system. When all these pieces are in place, it makes working on due diligence questionnaires and regulatory reviews much easier and enables the firm to avoid last minute panics when trying to meet deadlines.

FinServ Consulting has the systems integration expertise, experience, and depth of knowledge to create vendor management capabilities with nearly any platform including VMS specific systems like Onspring to broader platforms like Salesforce and many others. It understands alternative firms and how a well-designed vendor management system can help limit exposure risks and ensure a firm is prepared for whatever the future may bring.

To learn more about how FinServ Consulting can help your firm build and integrate a new vendor management system, or customize one you already have, contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

The Great Debate: Agile or Waterfall Project Management

Effective Project Management

Effectively managing a project and team(s) is a difficult task that faces increased challenges in a remote environment. Obstacles are exacerbated by the lack of in-person collaboration and the inability to stop by a colleagues desk for a quick and informal update. However, selecting the correct project management methodology can help alleviate numerous issues and ensure that your project is completed successfully.

Agile & Waterfall Methodology Overview

No project management technique is best suited for all situations. The most common methodologies are Waterfall and Agile. Although both approaches are popular and have been around for an extended period of time, specific projects are better suited by one or the other.

The Waterfall methodology is the traditional and sequential approach that is best for projects with a well-known scope likely to experience minimal change. Client input takes place at milestones as the project transitions throughout the various phases. In a Waterfall project management strategy, each phase must be completed prior to transitioning to the following phase. These phases are clearly outlined and define clear objectives that must be accomplished before progressing.

As indicated by the name, an Agile methodology is designed to accommodate change. Its iterative nature focuses on completing certain objectives by the end of a specified time period known as a sprint. Agile methodologies are well suited for projects with unclear initial requirements. The methodology prioritizes the most important aspects of a project and relies on continuous client input throughout the engagement. Deliverables are reviewed by the client and other applicable teams after their corresponding sprint.

Advantages of Each Method

The Waterfall approach’s numerous advantages derive from its structured nature. The first of which, is that it clearly defines all aspects of the project and ultimately increases planning accuracy and detail. Consequently, this approach aligns well with fixed price contracts and government entities. Furthermore, progress can be measured through the completion of each phase as opposed to a product backlog that hasn’t been addressed.

It is less reliant on client input because it is predominantly collected at milestones. This allows the client to take a hands off approach and focus on the day-to-day operations of their business. Finally, successful completion of projects managed with a traditional methodology ensures that all items are addressed and eliminates ambiguity.

One of the greatest advantages to the Agile approach is its flexibility. An Agile approach is particularly useful when the project’s timeline is strained because it prioritizes the most important features. The sprint structure aligns with Time & Materials contracts because sprints are predetermined timeframes that specify workload.

Additionally, constant client interaction augments quality via increased feedback, additional testing, and dynamic user requirements that account for evolving needs. The constant nature of client feedback allows for frequent modification of the product backlog. This is particularly useful for a technical client that wants to get a deeper understanding of the solution. They can work through their use cases and determine if their needs will be better served by an alternative route.

Disadvantages of Each Method

Although each method is effective in its own right, they are not without disadvantages. The Waterfall methodology requires a thorough understanding of business requirements prior to beginning. The Project Manager must have a clear sense of all client needs and initially account for them throughout the various phases. Scenarios where the client is unable to provide a comprehensive overview of the requirements may force the PM to “fill in the gaps” – which is far from ideal.

Another disadvantage associated with the Waterfall approach is the risk of a final deliverable that is not in line with client expectations. Given that the client is less involved in the process, they may be surprised by the end result. However, the traditional approach hedges against this with comprehensive requirements and periodic updates.

Agile method drawbacks tend to be associated with one of its strengths, frequent client input. It requires a significant amount of coordination and cooperation across multiple internal and external teams. While this is great in theory, it may be difficult in practice. Clients may not have the resources, interest, or expertise required for the Agile approach’s mandated involvement. This is especially relevant when the client outsources the work as they hired another firm to step away.

The adaptability of the approach leads to many changes in the project’s scope. These changes affect the project’s cost and timeline. Unfortunately, this is not feasible for certain clients and situations. Moreover, low priority items may not get completed within the original time frame due to a focus on high priority items.

Conclusion

In conclusion, both the Waterfall and Agile Project Management methodologies include pros and cons. In an ideal scenario, the project would be completed successfully regardless of the utilized approach. However, certain client types, engagements, and solutions are better suited by one of the two methods. It is critical that you discuss both options with the client and pick the one that they are most comfortable with. Many professionals blend the two techniques to benefit from each’s strengths while minimizing the drawbacks. Recent trends have increased popularity for Agile management, but it is beneficial to gather all available requirements as early as possible.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Securely Share and Work with Files in Salesforce

FinServ has partnered with a firm out of Germany to provide a seamless integration of SharePoint Online right in Salesforce. If you would like to see a demo, please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

The Nightmare Scenario you have to Avoid

Sweat is dripping down your brow and you have a queasy feeling in your stomach, it’s 2 o’clock in the morning and you are desperately trying to reach the person who your Investor Relations team accidentally emailed an investor (NAV) statement with the investor’s social security number in it. If you have shared a sensitive document with the wrong person, you know the sheer terror these moments can bring. We see the most sophisticated financial services companies in the world taken down by these types of mistakes all the time. Even if the email is retrieved the public relations fallout will likely cost you investors or in some extreme instances the shut down of your fund.

Given this risk, it is hard to believe that the majority of funds and other financial services firms are still not integrating their CRM systems with enterprise-level document management systems like SharePoint Online. At FinServ Consulting we work with 40 of the top 100 hedge and private equity funds in the world and very few of these firms currently use enterprise-level document management systems to protect their investor data.

The Quick and Easy way to Use SharePoint Online in Salesforce

Most Salesforce clients abandoned Salesforce Files a long time ago. Due to its lack of user-friendliness and severe limitations, Salesforce Files became one of the least-used features in Salesforce. At the same time, many companies have been moving to cloud-based office suites like Office 365 from Microsoft. With most Office 365 licenses, you get SharePoint Online for free. SharePoint Online is an extremely secure, cloud-based and feature-rich enterprise-level Document Management system.

Has anyone in your firm ever accidentally sent a sensitive document to the wrong client?

SharePoint Online has the ability to stop the recipient from opening that document even if they have already downloaded it onto their computer.

Inserting a Cloud-based Link to a SharePoint Online Document in Email

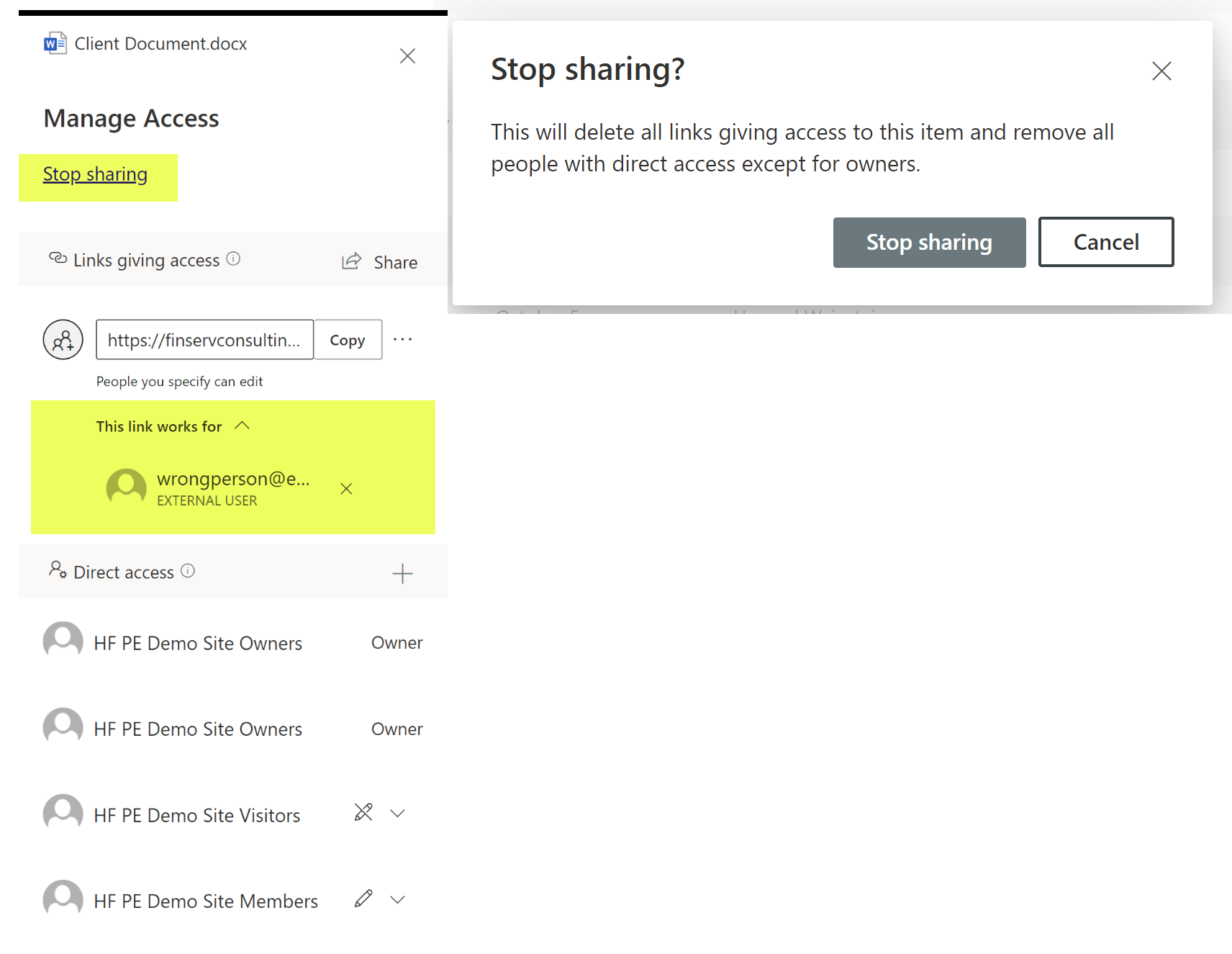

Removing Access Quickly

If you realize you made a mistake, you can stop the person from accessing the document you shared with just a couple of clicks. Even if they downloaded the document onto their hard drive, they will not be able to open the document thanks to Microsoft’s use of dual-key encryption. This means once you take away your side of the key, they can never open the document again.

2 clicks and access to the document is removed

Has anyone in your company ever accidentally or purposely emailed a file to an external recipient with Social Security numbers in it?

SharePoint Online with Outlook / Email integration means that you can stop any email or attachment from being shared if it contains sensitive info with PII (Personally Identifiable Information).

Particularly for highly regulated industries, like Financial Services and Healthcare, the built-in dual-key encryption and information rights management (“IRM”) features that SharePoint Online offers out of the box are “have to have’s”.

Microsoft PII Warning when Sensitive Data is Detected in a Document

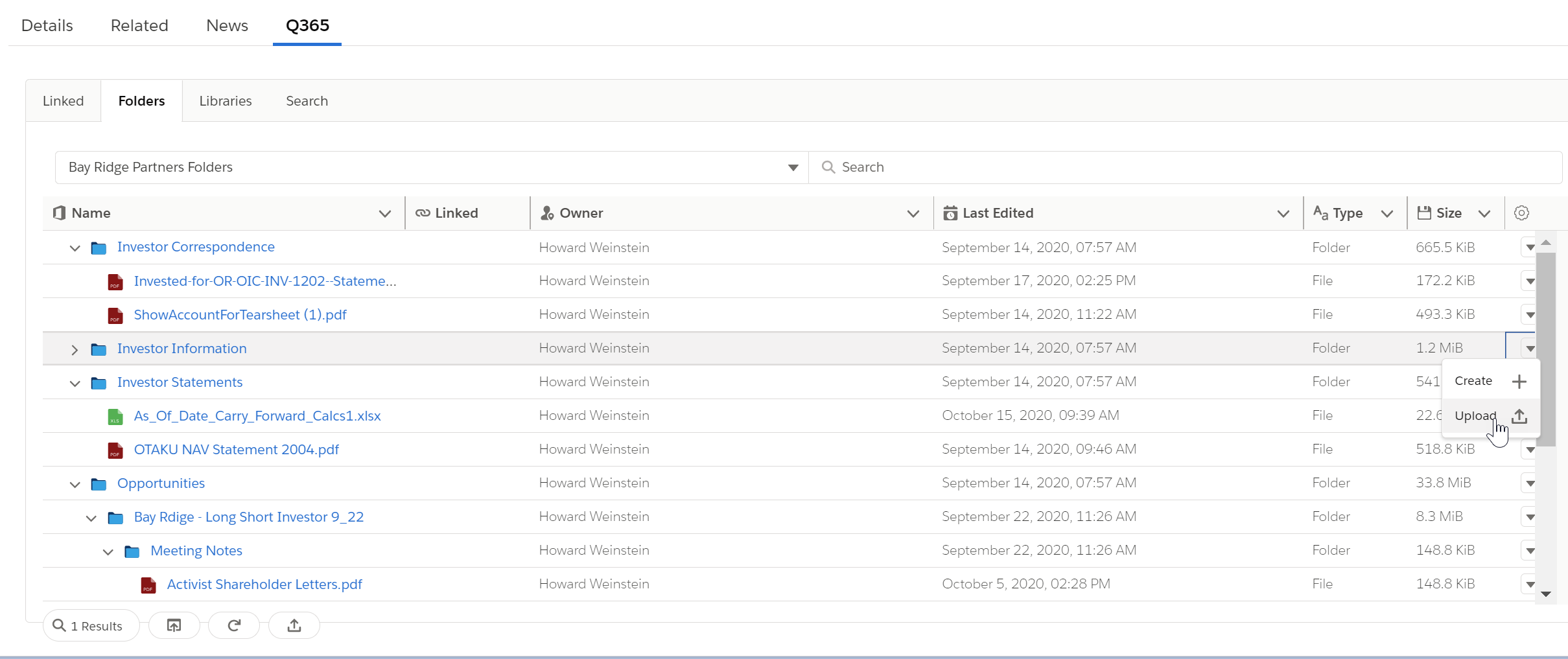

Seamless Integration with our Salesforce App

The application we helped build provides a seamless interface to all of your SharePoint Document Libraries and Files inside the Salesforce Lightning User Interface. The benefits of this application mean that your users will save hundreds of hours they used to spend searching through inconsistent folder structures and names or wading through multiple versions of a file to try to figure out which is the latest version of the file. By automatically linking the Files and Folders to your Salesforce records, you get your data and your files in one combined place to provide optimal efficiency for your team.

Through the application interface you get:

- 1-click to Open just about any kind of file so your team never wastes time with multiple clicks or waiting for a file to download before you can open it

- For Microsoft Office files where you have editor access, it will open up in the Office app in Editor mode

- You can upload files into the document library with 1-click as well

- You can also delete files if you have the correct access with 1-click

- Embedded search available right within the Lightning Component

Investor Relations Use Case

For our Alternative Asset Management clients, we offer the case study of the Investor Relations associate who often spends their day working with investors on questions. The ability to view the investor’s contact record while also looking at the investor’s latest NAV statement or recently updated subscription documents provides a level of efficiency that makes their day-to-day work much easier.

example of Investor Contact record with right sidebar of SharePoint Online Files

How the App Works

Putting the automated component into place is as simple as adding any Lightning Web Component; the interface offers quick and easy checkboxes to turn off and on key features in the application. Once added to any Object Type in Salesforce (standard objects or custom objects are all supported), the interface makes it simple and user-friendly to access your files and folders in seconds.

The quick and easy way to open SharePoint files right in Salesforce!

The application leverages advanced Microsoft technology to provide:

- Automatic creation of preset Folder and Subfolders that are automatically linked to the Salesforce record you just created or updated

- You can use the data in Salesforce to automatically name the Folder; this ensures a consistent naming scheme which will make it easy to find files

- For historical records, we offer automated scripts to create the Folder and Subfolders for all of your existing Salesforce records

Automatically Create a new set of SharePoint Online Folders and Link to your Salesforce Record with no Clicks when you create a New Salesforce Opportunity!

Conclusion

Using an Enterprise-Level Document Management system is a must-have for any company working in a regulated industry like Financial Services or Healthcare. SharePoint Online from Microsoft provides the most cost-effective and robust system in the marketplace. When you combine that with the Salesforce CRM system, you provide your users with a seamless and secure platform to work with customers while ensuring your company’s and your clients documents and data, including PII, remain secure.

The application FinServ has created with our partner provides the level of automation and seamless integration that your users demand and will also ensure they embrace the use of a Document Management system like SharePoint Online.

If you are interested in a demo or would like to purchase the application, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

The Most Impactful Feature of Salesforce’s Summer 20 Release

In FinServ’s opinion, the new Kanban Split View is the most exciting feature of the Salesforce Summer ’20 Release. In this article, we will highlight how Funds and Financial Services companies can take advantage of this new feature to realize maximum benefit and ROI. If you would like more insight into these updates and how to implement them, please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

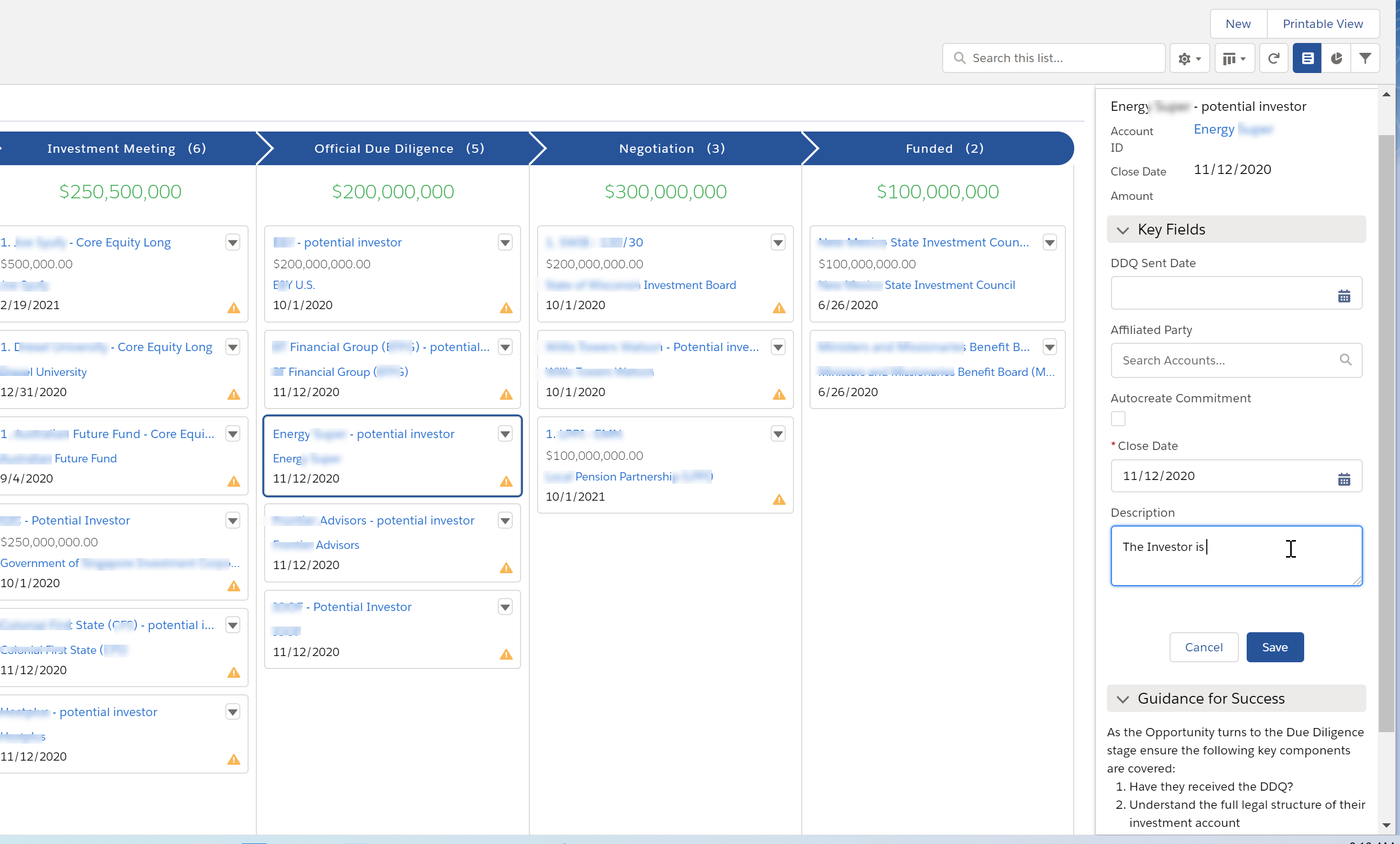

Expedited Prospect Data Updates with the Kanban Split View

Sales and Marketing teams are constantly working through the list of their top prospects each day. They realize that updating Salesforce with the latest key info is critical to moving the pipeline forward.

The Kanban view was a huge step forward in previous Salesforce releases. By providing a visual pipeline with the ability to drag and drop items to the next stage, it made pipeline stage updates much more efficient.

Up to this point however, the process of editing these records was a tedious, click-heavy effort of having to go into each record, edit the record, save the record, refresh the screen, and move onto the next record to edit.

With the Salesforce Summer ’20 release, users now have the Split View for Standard Navigation feature. This exciting new feature allows the user to highlight the record they want to edit, right in the Kanban view, and edit the key fields all from the same screen!

Sales and Marketing teams will save hours of time with a level of efficiency previously unattainable in any CRM. By making it easier to update the record, it also promises to improve the quality of the data for the Executive and Investor Relations teams as well.

Split View for Standard Navigation in Kanban View

Key Considerations:

- You must have a Sales Path setup for the Object you want to use this for

- The Sales Path will ask you to select the Key Fields you want to be able to Inline Edit

a. The Key Fields can and should be different for each stage to ensure you are providing your team the quick edit access they require

b. The Key Fields are limited to just 5 per stage, so pick carefully - Provide Guidance in each Stage to ensure your team fully understands what is expected to be filled in and you gain maximum value from the quality data

Salesforce Video on this Exciting New Feature

Conclusion

The Summer ’20 Release is schedule to arrive on July 18th. FinServ Consulting, a top Salesforce Partner with a focus on the Asset Management sector, ensures our clients take advantage of the most important features of each release and maximize their investment in Salesforce.

Over the next few weeks, we will continue to highlight the new features we see as most valuable to our clients, with a unique focus on our industry. Upcoming posts will include exciting new developments to Lightning Flow, which is fast becoming the most useful tool in the Salesforce arsenal for process automation.

If you are interested in any of these features and want help implementing them or just have a question about them, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

What You Need To Consider When Choosing A New OMS

Undergoing technological change or implementing a new system is not something to be taken lightly in ordinary market environments, much less during a time of extreme or abnormal market volatility. If your fund or organization is planning to implement a new OMS or replace a legacy OMS, there are several things you should consider.

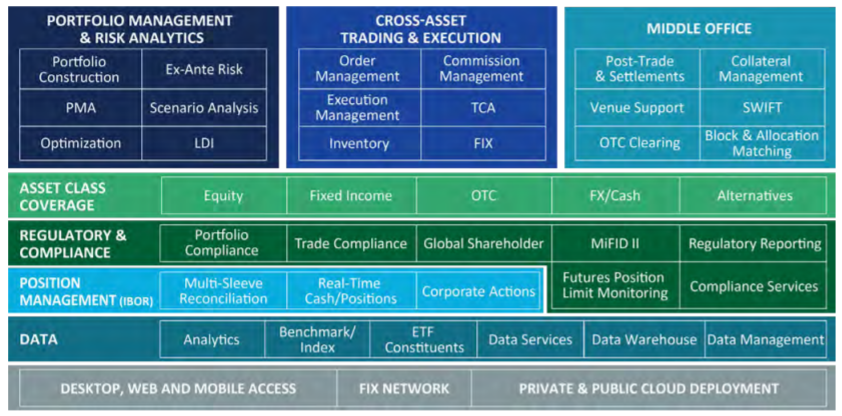

From a business and investment standpoint, there are the usual key considerations, including: the need for integrated OMS/EMS functionality, whether ease of use important, ability to customize workflows and if there is a desire for extensive client/marketplace connectivity. From an operational perspective, one must also consider other non-functional items like data migration (and how easy it is to implement), the software support model, modularity and future expandability.

The aforementioned list only touches the surface; the overarching themes involve automation, workflows, analytics and decision-support tools. In fact, in a recent Refinitiv/Greenwich Associates paper, traders ranked an EMS as the most impactful technology in the short-term.

OMS vs EMS

In general, hedge funds treat the Portfolio Manager (PM) and Trader workflows as a single unit, whereas traditional asset managers may have additional bifurcation between roles and responsibilities. At a hedge fund where the PM sends orders via email/chat/voice to a trader to execute, they may want a single, integrated OEMS. On the other hand, an asset manager often has multiple PMs who route orders to a centralized trading desk. In this case, the institution may want a solution with specific standalone OMS and EMS functionality, in order to access best-of-breed functionality.

The trend in the marketplace for a while has been OMS vendors integrating additional trading functionality by buying or building EMS solutions. This results in the ability to capture and allocate client orders while also capturing execution details to help the firms comply with regulatory requirements. Additionally, this allows them to market themselves as an all-in-one solution and would insulate the client from having to integrate yet another vendor into their technology stack.

Source: Charles River Development

Ease of Use

Being able to get your operations, back office and front office users onboarded and using the software as quickly as possible can be a heady concern for most clients. In theory, this sounds simple, but many legacy OMS were designed with a single asset class in mind. If your client is now multi-asset, multi-strategy and trading a variety of instruments in volume, it’s even more imperative that a system be easy to use and operate as one cohesive platform.

A modern interface with intuitive workflows can be a competitive advantage especially if the fund’s current OMS platform is antiquated and requires, in a worst case scenario, dual entry or swivel-chairing in order to execute and fill an order. (Swivel chairing involves a PM creating orders/allocations in an OMS and then sending them over to trader for execution in an EMS).

Ease of Customization

A vendor’s product team always has to find the right balance of customization and the notion of a standard offering for the client. However, in this day and age where customizability is king, most vendors are client-driven and willing to bend over backwards for their clients. Enfusion Systems, whose product features weekly upgrades, has marketed their product as being easily customized. In a recent implementation with an asset manager, Enfusion agreed on development of specific functionalities within their platform that would position them well for the changing OEMS marketplace. The client agreed on an OMS implementation, while also using Enfusion’s Services team for reconciliations (the client still kept some functionality in-house, like collateral management).

Client/Marketplace Connectivity

Most multi-strategy funds that trade a wide breadth of products across different asset classes and venues will always be excited at the prospect of having a vendor whose product comes pre-packaged with existing API connectivity to brokers, venues and marketplaces. Many clients have a baseline expectation of connectivity with a full suite of partners across the spectrum of asset classes. If this is not currently in the vendor’s repertoire, the expectation is that connecting to new trading venues and brokers would be trivial.

Data Migration