Optimizing Middle and Back Office Operations: Empowering Hedge Funds for Success

Fund managers understand that it can be difficult to support and scale their operations team; instead, they are moving to outsourced providers to satisfy critical requirements. The right Managed Services Partner will streamline their middle and back-office operations, allowing them to focus on core business activities and capitalize on service level agreements, which include expanded coverage across multiple time zones.

Hedge funds strive to attain strong investor returns through varied investment approaches. They must establish structured fund management, compliance, and reporting systems to accomplish this goal. This is crucial to satisfy investor demands, maintain competitiveness, mitigate risks, adhere to regulations, uphold transparency, improve efficiency, and prevent regulatory issues.

Efficient middle and back-office operations play a critical role in ensuring seamless operations of the fund, and adherence to regulations, resulting in the generation of accurate and reliable reporting. Systematic middle and back-office operations form the backbone of a well-structured and successful hedge fund by managing the operational aspects that underpin the fund’s activities.

Fund managers understand that it can be difficult to support and scale their operations team; instead, they are moving to outsourced providers to satisfy critical requirements. The right Managed Services Partner will streamline their middle and back-office operations, allowing them to focus on core business activities and capitalize on service level agreements, which include expanded coverage across multiple time zones.

This article explains the advantages of outsourcing middle and back-office functions and how it enables fund managers to enhance their operational efficiency and competitiveness in the market.

Expert Middle & Back Office Support

Outsourcing middle and back-office operations provides hedge funds with the benefit of utilizing a team of skilled professionals equipped with specialized knowledge. By harnessing this expertise, fund managers streamline their processes, improve productivity, and enhance risk management practices.

- Optimizing Hedge Fund Efficiency – Hedge funds employ diverse investment strategies to achieve returns surpassing traditional market benchmarks and align with investor expectations. However, the intricate nature of middle and back-office operations can strain a fund’s resources and time, because it requires meticulous attention to tasks such as trade execution, risk assessment, and regulatory compliance. The shift in focus from operational tasks to more investment-focused tasks allows fund managers to make more informed decisions, adapt quickly to market changes, and seize lucrative opportunities.

- Adaptability – Partnering with a service provider with diverse asset class and accounting expertise equips hedge funds for swift adaptation to market shifts and strategies. This seamless flexibility facilitates scaling in trading new asset classes, bolstering the fund’s ability to navigate market fluctuations and make informed decision-making confidently. Fund managers gain reassurance that their daily middle and back-office operations remain unaffected by altering strategies and trade volumes. Expert service providers adeptly accommodate changes, minimizing implementation time and managing the learning curve effectively.

- Advisory – Choosing the right managed service provider is of utmost importance. A reliable service provider surpasses the responsibility of guaranteeing precise daily middle-office and back-office activities. They proactively collaborate with fund managers to enhance workflows and provide advisory support. This approach involves identifying challenges and offering tailored solutions, like incorporating automated swap settlement and reconciliation processes. This is supported by implementing complex tasks like reconciling performance and financing interest against broker files; and adapting tax lot reconciliations to align with specific client preferences, ensuring accurate Profit and Loss (P&L) and General Ledger Providers play a crucial role in delivering valuable expertise and encouraging the adoption of best practices among their clients. This is achieved through a structured series of workflow assessments that are designed to enhance the efficiency and effectiveness of their client’s operations. The provider’s commitment transcends contractual obligations, validating the decision to outsource by delivering extra value. Such dedication reinforces the partnership and cultivates a successful, efficient, and productive relationship with the hedge fund.

- Utilizing Time-Zone Difference – Asset managers collaborating with overseas outsourcing partners gain access to a dedicated and efficient support team available around the clock, spanning pre-market and early trading hours. The time zone disparity enables hedge funds to receive continuous support and real-time aid, even during their non-working hours. With a local presence in the US office, clients enjoy 24/5 coverage. Moreover, the US-based team collaborates closely with fund managers and operations heads, directly streamlining workflows and executing new strategies. This setup ensures rapid issue resolution and seamless operations, minimizing downtime and maximizing productivity. The presence of a dedicated support team empowers hedge funds to tackle operational challenges and sustain uninterrupted functionality. This dynamic contributes to their overall success and competitiveness within the market.

- Customization and Scalability – It is imperative that outsourcing partners recognize the distinctiveness of each hedge fund and understand the importance of catering to their unique requirements. Consequently, the right partner will offer tailored solutions to accommodate individual needs. This necessitates that the outsourced partners possess functional expertise and a technical understanding of the client’s preferred systems and technology. Customization may include curated portfolio reporting, specialized tax lot services, portfolio re-balancing, manual journal entry setups, handling swap and borrow financing adjustments, and other ad-hoc requirements unique to the fund’s operations. This level of personalized service ensures that the outsourcing partner can efficiently address the fund’s individual demands, providing comprehensive and bespoke support that enhances operational efficiency and accuracy. The ability to cater to such diverse and specific requirements further validates the value of outsourcing for hedge funds seeking a highly adaptable and dedicated partner.

- Risk Mitigation & Better Governance – Efficient outsourcing partners play a pivotal role in assisting hedge funds to navigate risks and enhance governance practices expertly. Their valuable service involves adeptly managing and mitigating operational risks while meticulously monitoring Net Asset Value (NAV) and discrepancies stemming from Fund Administrators’ inputs. This comprehensive process encompasses tasks like calculating dividends, swap accruals, and other non-trading calculations, alongside routine daily and month-end checks. The primary goal is to swiftly identify and rectify potential errors, thus minimizing the chances of financial complexities or regulatory issues emerging during audits. This consistent dedication to compliance and regulatory standards nurtures a deep sense of confidence within hedge funds, highlighting the integrity and professionalism that characterize their partners’ operational approaches.

FinServ Consulting’s Role in the Middle and Back Office Industry

FinServ Consulting’s managed services team provides efficient trade, cash, and position reconciliations, allowing front office and operations teams access to reliable, updated, and error-free information. Accurate positions and NAV data allow portfolio managers and traders to confidently focus on order generation, including sizing and position allocations.

In addition, our service offering includes daily P&L checks, tax lot reporting, swap financing and dividend accrual assistance, hands-on systems entries, and overall guidance with the goal of ensuring efficient month and quarter-end accounting closes. Any discrepancies or differences with fund administrators, prime brokers, and other counterparties are resolved quickly and remediated in real-time.

FinServ Consulting places significant emphasis on five critical service areas, enabling the delivery of quality reconciliations and back-office reporting. This is achievable due to FinServ’s extensive expertise in various aspects of hedge fund operations and a deep understanding of systems and technology.

| Critical Service Areas | Description | Examples |

| Shadow Accounting Essential | Shadow accounting is a vital service deployed to authenticate the accuracy of fund administration books. Maintaining parallel accounts enables thorough monitoring and verification of fund transactions and positions. This approach promptly identifies and addresses potential discrepancies in Profit & Loss (P&L) calculations at month end. Additionally, shadow accounting helps mitigate reconciliation challenges arising from diverse lot liquidation methodologies used by different parties. |

|

| Daily Reconciliation | Managed service providers conduct daily reconciliations of client data against each prime broker, regardless of trade volume. This daily scrutiny is crucial for T+1 settlement, ensuring accurate and timely data. By maintaining consistent reconciliations, FinServ Consulting minimizes discrepancies and offers hedge funds a real-time portfolio view at the start of each trading day, providing a performance advantage. |

|

| Swaps and Borrow Management | Outsourcing swap financing and borrow accrual processes enables thorough validation of swap or borrow agreements with prime brokers, focusing on financing rates and payment frequencies. This ensures robust reconciliations, preventing potential data reconciliation gaps that may arise if solely left to the fund administrator. |

|

| Tax Lot Management | Accurate tax management for share sales requires precise modelling of different lots due to varying tax implications. However, many fund administrators lack the capability for complex tax lot management. Outsourcing to tax experts who understand tax laws and can generate ad hoc reports and tax reconciliations helps avoid issues, especially during a fund administrator change, ensuring data consistency and accurate accounting. |

|

| Cash, Collateral and Margin Management | Accurate cash balance alignment with prime brokers and comprehensive recording of activities involving brokers, ISDA counterparties, and banks is crucial. As these activities are not always recorded in real-time, specialized tools and support are necessary for cash actions. Outsourcing these functions can ensure accurate reconciliations and proper accounting, preventing discrepancies over time and maintaining financial integrity. |

|

Conclusion

Outsourcing middle and back-office operations offers hedge funds a strategic advantage by allowing them to focus on their core business, access to specialized expertise, utilize time zone differences for non-working hours support, receive prompt responses, and benefit from tailored solutions. It enhances risk management practices, improves operational efficiency, and ensures better governance, ultimately supporting hedge funds in their pursuit of excellence in the highly competitive financial landscape.

About FinServ’s Middle & Back-Office Services:

Organizations must leverage tailored solutions to meet their unique requirements in the fast-paced and competitive financial services industry. FinServ Consulting stands out as a trusted partner, offering a comprehensive solution suite that empowers portfolio managers, operations teams, and back-office functions. By aligning technology with industry best practices, FinServ Consulting helps organizations drive efficiency, enhance decision-making, and deliver value across the board. Embrace the power of tailored financial services solutions with FinServ Consulting and unlock your organization’s potential.

To learn more about FinServ Consulting’s customized financial services solutions, visit our website at https://www.finservconsulting.com.

FinServ Opens New India Office with Middle & Back Office Outsourcing Offerings

FinServ Expands Global Presence with India Office.

The New Office Enables Better Service to Fund Clients Amid Increased Demand for Support Services & Solutions.

FinServ is pleased to announce the opening of a new office in Mumbai, India. Shaurin Jobalia, who has worked with leading hedge funds and alternate asset management firms globally, will lead a growing team in India, which has more than two decades of collective middle- and back-office experience in fund accounting. The Indian team includes professionals who have previously worked at industry-leading firms such as Enfusion, SS&C Technologies, GlobeOp, Morgan Stanley Fund Services, and Bank of America.

The office will serve funds in a broad range of areas, including:

- Assisting with daily trade positions and cash reconciliations with custodians, prime brokers, and fund administrators.

- Providing break analysis for any issues

- Assisting with corporate actions and swap financing accruals and setup.

- Providing complete shadow NAV with clients’ third-party administrators, including balance sheet and income statement reconciliations.

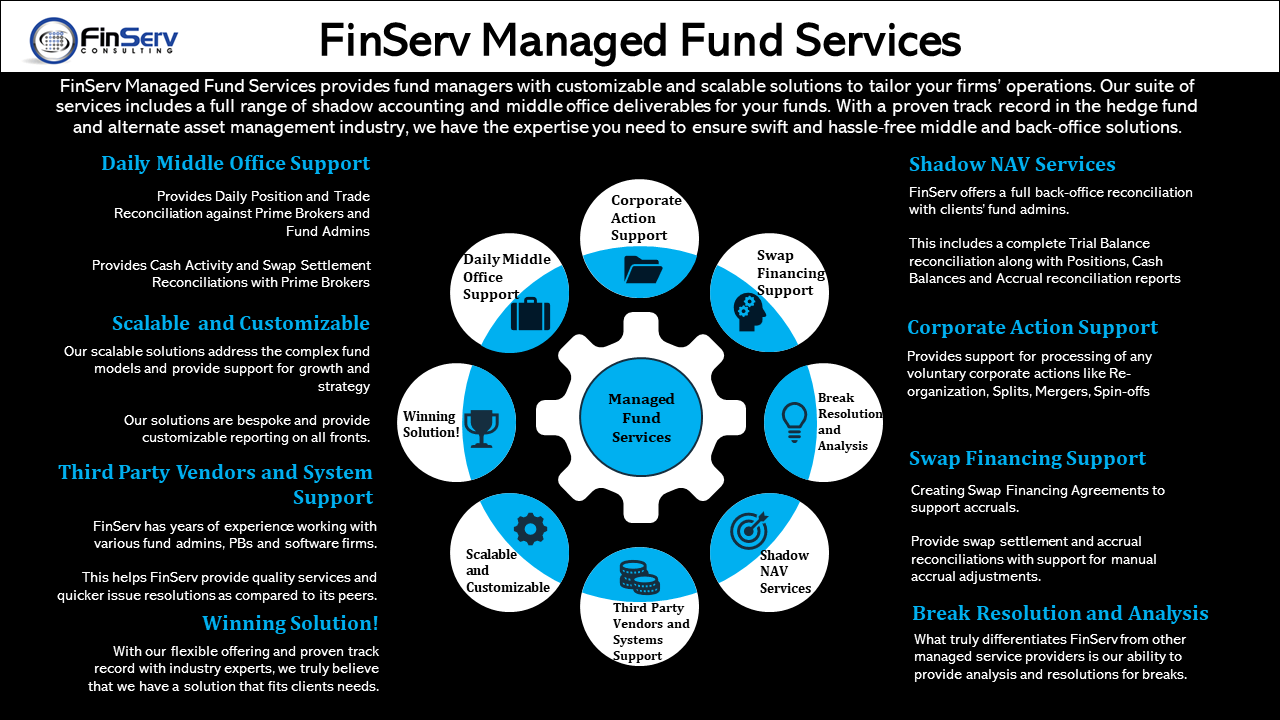

FinServ’s Managed Services aims to provide fund managers with customizable and scalable solutions to tailor their firms’ operations.

The opening comes at a time when two key trends are converging. First, alternative asset managers are under increased pressure to reduce costs. Fees fell to new lows in 2020 according to Hedge Fund Research, as investors pulled roughly $46 billion from funds. Secondly, COVID-19 has disrupted day-to-day operations and provided a new set of challenges for asset managers in keeping their businesses functioning effectively. A silver lining has emerged, however. The global pandemic has accelerated the use and adoption of remote workers among fund managers. With teams working remotely, managers have leaned on service providers and recognized that they can support operations and technology through outsourcing.

With a team in India, FinServ can meet those requirements and deliver new benefits, such as reduced costs and more flexibility. The FinServ team is unique as they bring systems expertise which allows for detailed analysis and problem solving. In addition, the team is staffed by experienced resources that have a deep understanding of different asset classes. If a fund trades equities, credit or privates, the team brings the appropriate knowledge to assist in the processing. By leveraging the team, funds can efficiently scale their operations by eliminating the need to increase headcount for non-core activities, or job functions. The new India office will support FinServ’s core consulting business across specialized middle and back office managed services, software customization and implementations, industry systems integrations, and bespoke systems development.

At a time when funds are accustomed to receiving what has historically been a commoditized service, FinServ’s team takes it a step further. The teams are well-versed in each client’s unique needs and deliver on those requirements through both a hands-on and customized approach.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.