Prepare Your Business for Workday 2024 R1

Workday 2024 R1 was released recently and introduced multiple new payrolls and compensated-related capabilities. These features will have a major impact on the client’s Workday environment, and it is critical that the Workday team researches and tests the new updates in the Preview environment to ensure that their systems remain up-to-date.

Workday typically follows a semi-annual release schedule, with updates rolling out approximately twice a year. The spring update was released on the first weekend of March. The release introduced new features, enhancements, and fixes to the Workday platform to improve user experience, functionality, and overall performance.

These updates are important for Workday customers as they ensure that their systems remain up to date with the latest features and improvements, helping them to stay competitive and efficient in their operations. In this article, we specifically review the new Payroll and Compensation updates introduced by the Workday 2024 R1.

Payroll

Prior Period Tax Adjustments

Prior Period Tax Adjustment Calculator to reduce manual effort. PPTA is accessible through the related action icon of an original completed pay result.

- Select Prior Period Tax Adjustment > Run

PPTA Calculator streamlines the process for retro tax authority adjustments. If multiple pay results need to be adjusted, always start with the earliest completed period first.

PPTA can be used anytime users are retroactively adding, changing, or deleting the following for an employee:

- Primary home or work state

- Tax elections for work or home city

- Local other authority

- County local taxes

- Home school district

- Domicile state

The new Prior Period Tax Adjustment (PPTA) calculator will help to calculate tax and wage differences effortlessly due to retro tax authority changes in completed periods. This provides greater efficiency when adjustment for wages or taxes is needed due to retroactive tax authority changes.

Payroll Insights

Real-time smart tool for reviewing payroll results. It has multi-faceted filtering capabilities:

- Once a pay calculation has been run, the Payroll Insights report will pull predictive pay data.

- Allows easier review of historical payroll results to identify what are true abnormalities and what is not.

- Feedback can then be provided on predicted results to improve accuracy over time.

New Tasks:

- Maintain Payroll Insights Configurations

- Maintain Payroll Insights Custom Tags

New Reports:

- Payroll Insights Results Report

- Historical Payroll Insights Results Report

Payroll Insights provides a real-time prediction and evaluation tool to analyze payroll results based on historical payroll result patterns. This feature helps to reduce the amount of time and effort spent manually reviewing and identifying payroll exceptions.

Payroll Third-Party Payments

Generate and Settle Payments for Deduction Recipients of IWO and Court Orders. Workday can now process payments for IWO and Court Orders:

- When a pay calc is run, Workday generates a payable item for the deduction recipient’s line result.

- A new tab is produced on the pay result “Payroll Third-Party Payments.”

- After payroll is completed, the payable will be available to pull into Settlement Run using the new filter “Payroll Third-Party Payments.”

- Payments can be processed electronically via integration or through the print check feature.

Utilizing the normal payroll processing and settlement methods, Workday can now identify, process, and produce payments to deduction recipients. Previously, customers were required to handle these payments manually outside of the payroll process or rely on third-party vendors to complete them. Customers can now produce these payments internally with Check Printing or utilize their existing bank integrations. This feature is a time and cost-saver for clients currently managing the maintenance of their IWOs.

Compensation

Workday Docs for Compensation Statement Layouts. With Workday Docs, users can now create a custom Compensation Review Statement layout within Workday:

- Workday Docs for Layouts is a visual editing tool for designing, creating, and previewing document layouts for use with custom advanced reports in Workday.

- Users can insert data fields and even apply condition rules to any piece of the layout.

As one of the more highly anticipated updates, users can now completely customize the compensation review statements without the need for any outside reporting tools. Once created, users will be able to make updates to the compensation review statements more easily year over year.

Total Rewards Statement Redesign

Design for Increased Customization. Redesigned Layout:

- Users can now configure section groups that will display on the statement as cards.

- Each section group can include lists, tables, and calculated values.

- Users can arrange the cards on the statement in any order they like.

The updated design of Total Rewards Statements will allow users to customize how they show employees their compensation. This will allow employees to understand their compensation more easily and how it is broken into different components.

Percent-Based Calculated Plans

Manage Complex Percent-Based Compensation Plans. Target Percentage or Ceiling Amount:

- Manage complex percent-based compensation plans to configure and report on a target percentage and a ceiling amount for amount-based calculated plans and process them in Payroll.

Calculated plans can now be included in salary-dependent Primary Compensation basis calculations for workers managed by Basis Total. New display text for Calculated Plans with ceiling calculations or percentage calculations.

Dynamic Plan Type Display

Dynamic Compensation Transactions. Propose Compensation Change:

- Workday 2024R1 makes it easier to assign employees compensation during the Propose Compensation Change process by displaying only the relevant plan types for the employee.

By only seeing what is relevant to a specific employee when processing a Change Job or staffing transaction, the processor can decrease manual error while condensing what it sees and maximizing efficiency.

Grid Profiles for Compensation Review

Grid Configuration Profiles. Grid Profiles & Conditional Calculations:

- There is increased flexibility of grid configurations in compensation reviews. Users can now configure multiple grid configurations for the same compensation review process.

Flexibility within the Compensation Review Grid Configuration allows Planners to view fields that are more relevant to the participants in the process.

Conclusion

The Workday release will have a major impact on your current Workday environment, and new features will enable better user adoption for your team. It is critical that your team thoroughly researches and tests the new updates in your Preview environment.

Getting the most out of these features will require a thorough understanding of what you are trying to get out of Workday and how Workday will work within your organization. With FinServ, you have a trusted advisor with experience in both Workday and the industry to help you make informed decisions about what functionality to leverage, ensuring that you make the most out of your Workday investment. FinServ has advised both Workday HCM and Financial clients through Major Semiannual releases. In addition to release consultations, FinServ Consulting offers operational assessments and Workday implementations. FinServ has experienced HR and Finance consultants who have worked with clients on vendor selections and implementations of various HR and Finance platforms.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Mastering Data Migration: Strategies, Solutions, and Success

Data migration remains a critical process for alternative asset managers aiming to stay competitive, enhance operational efficiency, and achieve their strategic objectives. In the dynamic world of finance, where data is fundamental for informed decision-making, achieving seamless data migration is essential for alternative asset managers.

In the dynamic world of finance, where data is fundamental for informed decision-making, seamless and accurate data migration is essential for organizations like hedge funds, private equity firms, asset managers, and fund administrators aiming to transition their systems and workflows. With technology progressing rapidly and industry dynamics constantly evolving, the importance of robust systems and workflows cannot be overstated. Data migration emerges as a complex challenge in such a landscape, especially for entities handling intricate financial instruments, detailed investor allocations, and diverse portfolios. Successfully navigating this challenge demands strategic planning and meticulous execution to achieve desired outcomes.

This comprehensive blog post explores the intricacies of data migration tailored for financial firms, specifically hedge funds and fund administrators. Focusing on these firms’ unique landscape, we delve into their challenges, explore best practices for successful migrations, and propose potential solutions to navigate the complexities of transferring financial data seamlessly.

FinServ Consulting draws upon its extensive experience and cultivated expertise forged through partnerships with similar funds and entities. This strategic approach allows the company to successfully support its clients in the dynamic realm of data migration projects.

Challenges in the Data Migration Process:

Data migration is riddled with numerous challenges, especially when grappling with substantial data volumes or transitioning to a new system. This segment will delve into the complex hurdles faced by financial firms during data migration, addressing issues ranging from maintaining data integrity and managing compatibility disparities between source and target systems to mitigating the risks of downtime and disruption.

Data Quality Issues:

The importance of data quality cannot be emphasized enough, considering the significant consequences of incomplete or inaccurate data, duplicate entries, and improperly formatted information.

Accomplishing precise Net Asset Value (NAV) and investor allocations, the primary goals in every data migration project, depends significantly on the completeness and accuracy of the source data. This involves meticulously examining various data components, including trade and open lot files, non-trading and cash activity reports, and financial statements. FinServ Consulting highlights the crucial need to validate data samples for accuracy before migration, emphasizing a proactive approach to identify and rectify any inconsistencies. This ensures the preservation of data integrity throughout the entire migration process.

Disparity between Source and Target Systems:

A critical challenge during data migration arises from compatibility issues between the source and target systems. These systems may operate on distinct platforms or employ diverse data formats, creating obstacles to seamless data transfer.

For example, in the source system, certain asset classes like Collateralized Loan Obligations (CLOs), Loans, and Collateralized Mortgage Obligations (CMOs) might be uniformly treated as Notes or Bonds due to system limitations. However, the target system may support these distinct asset classes, requiring a thoughtful transition that accommodates these variations. In another scenario, the source system might lack an automated method for handling complex investor allocations, resorting to manual management through Excel spreadsheets. Conversely, the target system may feature a sophisticated calculation engine designed for these intricate allocations.

FinServ Consulting excels in crafting migration plans, which include testing and validation of these variations, ensuring a smooth transition that not only addresses system limitations but also effectively leverages the capabilities of the new environment. This tailored approach is essential for mitigating issues arising from differences in asset treatment, automation capabilities, and overall system functionality.

Downtime and Disruption:

Data migration often introduces downtime and disruptions to regular business operations. Throughout the process, systems may experience offline periods, and access to real-time and live data could be restricted, potentially impacting business operations and customer service. Mismanagement of the migration process can exacerbate downtime, leading to errors and potential data loss.

To counter the challenges of potential downtime and disruptions during data migration, FinServ Consulting adopts strategic measures. This includes scheduling migrations during less busy periods, conducting migrations in Quality Assurance (QA) environments, or implementing controlled setups with dummy entities in live production environments. FinServ emphasizes the importance of maintaining regular communication and updates for stakeholders throughout the entire process. This commitment to transparency and collaboration contributes to a smoother and less disruptive data migration experience for financial firms.

FinServ Consulting Recommended Best Practices for Successful Data Migration

FinServ Consulting’s recommended best practices serve as a comprehensive guide for financial firms undertaking data migration. By incorporating these practices into their migration strategy, businesses can navigate the complexities of the process with confidence and achieve successful outcomes.

Creating a Comprehensive Data Migration Strategy:

Formulating a well-defined data migration strategy is crucial for ensuring success in financial firms. This strategy encompasses various elements such as a detailed project timeline, a comprehensive list of deliverables, key milestones, roles and responsibilities, effective communication channels, and contingency measures to address unexpected challenges during the migration.

This involves conducting detailed sessions with the head of operations and accounting to understand how to achieve the end goal effectively. There are several approaches to data migration, each with its advantages and considerations:

- Migrating historical open lots and journal entries true up for all other entities, including cash and non-trading items, up to an agreed-upon Cut-Off Date. This method is the quickest and most cost-efficient solution. However, it may result in the loss of historical Realized P&L or journal entries.

- Migrating granular data, including all trades, cash activity, and journal entries. This approach provides a comprehensive solution with access to all historical P&L and ledger entries. However, it can be extremely time-consuming and expensive.

- Migrating open lots while maintaining granularity on cash and non-trading data. This option strikes a balance between the first two approaches. It is less expensive than option 2 and provides more historical data than option 1. Additionally, it can be cost-efficient and significantly quicker than option 2.

By carefully considering these options and aligning them with the organization’s goals and resources, financial firms can devise an effective data migration strategy tailored to their specific needs and objectives.

Ensuring Data Integrity and Systems Compatibility:

Data integrity is a critical consideration in achieving a successful data migration. This involves identifying discrepancies like missing or inaccurate data and creating a comprehensive plan for resolution. Utilizing data profiling tools is advantageous in detecting inconsistencies and determining effective approaches for resolution.

Additionally, verifying compatibility between source and target systems is essential for a seamless migration process. Given potential differences in data structures, formats, and standards, this involves mapping source data to align with the target system, identifying necessary data transformations, and validating data format accuracy.

Leveraging Automated Tools:

Automated tools play a pivotal role in enhancing the efficiency of the data migration process while simultaneously reducing the likelihood of errors. These tools encompass a spectrum of solutions, ranging from quick VBA scripts for data transformation to more comprehensive system-supported tools. Their primary objective is to automate key tasks such as data extraction, transformation, and loading.

For instance, consider a hedge fund with a substantial trading volume leading to a vast history of open lots and transactions. Once the source data formats are established, creating quick Excel macros can significantly expedite the loading process. This automation minimizes the need for manual intervention, resulting in notable time and cost savings while concurrently reducing the risk of errors.

Risk Mitigation and Contingency Planning:

Identifying potential challenges is crucial in data migration, and employing strategies to mitigate risks is essential. Developing comprehensive contingency plans ensures a swift response to unforeseen issues, safeguarding smooth project execution. This involves proactive risk assessment, ongoing monitoring, and agile responses to emerging challenges, all aimed at preserving project success.

It is crucial to have rollback options and restore points established during the data migration process to ensure that the previous accurate version is restored in case of unforeseen issues.

Documentation and Knowledge Transfer:

Creating thorough documentation is pivotal for future reference and ensuring effective knowledge transfer within the organization. This practice guarantees that insights gained during the data migration process are well-documented, facilitating seamless continuity and providing a valuable resource for future efforts.

Post Migration Support:

Establishing feedback loops is crucial for ongoing improvements after data migration. Continuous monitoring for post-migration issues allows for the identification of potential challenges, enabling the organization to address them swiftly. This involves creating mechanisms for gathering feedback to inform iterative enhancements and maintaining vigilant oversight to ensure a successful post-migration phase.

Conclusion

In conclusion, data migration remains a critical process for businesses aiming to stay competitive, enhance operational efficiency, and achieve their strategic objectives. While it presents inherent complexities and challenges, these hurdles can be overcome with the right strategies and considerations. By proactively addressing potential obstacles such as data quality issues and system incompatibility and adhering to best practices like meticulous planning, thorough testing, and vigilant monitoring, businesses can ensure a smooth and successful transition.

At FinServ, we understand the nuances of data migration, particularly within the realm of the asset management industry. Leveraging our deep expertise in diverse data types, workflows, and processes, we provide tailored solutions to meet each client’s unique data migration needs. Our methodologies and frameworks, supported by technical proficiency and a robust project management model, guarantee effective resolutions for data migration challenges. Whether you require a push-start, ongoing support, or leadership in complex migration projects, FinServ stands ready to assist your firm at every stage of the journey. With our assistance, you can confidently navigate the complexities of data migration, ensuring that your migration aligns seamlessly with your objectives and contributes to your overall success.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Unlocking the Power of Data: Why Hedge and Private Equity Funds Should Embrace Snowflake

Traditional on-premises data warehouses often struggle with handling large datasets, hindering optimal decision-making. By embracing Snowflake, funds can gain a competitive edge by driving superior investment outcomes while keeping their data infrastructure secure.

In today’s rapidly evolving financial landscape, data has become the lifeblood of decision-making for hedge and private equity funds. As the volume, velocity, and variety of data continue to increase, so does the need for a modern, scalable, and agile data management solution. Enter Snowflake – a cloud data platform revolutionizing how organizations manage and analyze their data. In this blog post, we’ll explore why hedge and private equity funds should consider leveraging Snowflake to stay ahead of the curve and drive better investment outcomes. In this post, we have focused on the front-office-related aspects of a fund’s data. Still, the same advantages apply to the investor relations/business development, HR, and middle and back-office operations of your fund.

Scalability and Performance:

Hedge and private equity funds deal with massive amounts of data, from market trends and economic indicators to company financials and portfolio performance. Traditional on-premises data warehouses struggle to handle the scale and complexity of this data, leading to performance bottlenecks and scalability challenges. Snowflake’s cloud-native architecture allows funds to scale their data infrastructure on-demand, ensuring fast and reliable access to critical insights, even as data volumes grow.

Agility and Flexibility:

In today’s fast-paced financial markets, agility is key to seizing new opportunities and adapting to changing conditions. Snowflake’s decoupled storage and compute architecture enables hedge and private equity funds to decouple their data storage from compute resources, allowing them to independently scale and optimize each component based on their needs. This flexibility enables funds to quickly spin up new analytics workloads, experiment with new data sources, and iterate on investment strategies without being constrained by their underlying infrastructure.

Security and Compliance:

Data security and compliance are top priorities for hedge and private equity funds, given the sensitive nature of the information they handle. Snowflake provides industry-leading security features, including end-to-end encryption, role-based access controls, and data masking, to protect sensitive data and ensure compliance with regulations such as GDPR, CCPA, and SEC Rule 17a-4. Additionally, Snowflake’s built-in audit trail and governance capabilities provide funds with full visibility into data access and usage, helping them maintain trust and transparency with investors and regulators.

Advanced Analytics and Insights:

In the competitive world of finance, the ability to extract actionable insights from data can be the difference between success and failure. Snowflake’s integration with leading analytics and machine learning tools, such as Tableau, Looker, and DataRobot, empowers hedge and private equity funds to uncover hidden patterns, identify investment opportunities, and optimize portfolio performance. By leveraging Snowflake’s scalable compute resources and support for diverse data types, funds can perform complex analytics tasks, such as risk modeling, scenario analysis, and predictive modeling, with ease.

Cost-Efficiency:

Traditional data warehousing solutions often require significant upfront investment in hardware, software, and maintenance, making them cost-prohibitive for many hedge and private equity funds. In contrast, Snowflake’s pay-as-you-go pricing model allows funds to pay only for the resources they consume, eliminating the need for costly infrastructure investments and providing greater cost predictability and transparency. Additionally, Snowflake’s automatic scaling and resource optimization capabilities help funds minimize wasted resources and optimize their cloud spend, further driving cost-efficiency and ROI.

Conclusion

In conclusion, Snowflake offers hedge and private equity funds a modern, scalable, and agile data platform that can unlock the full potential of their data assets. By embracing Snowflake, funds can gain a competitive edge in the market, drive better investment outcomes, and future-proof their data infrastructure for the challenges ahead. It’s time for hedge and private equity funds to harness the power of Snowflake and take their data capabilities to the next level.

How FinServ Can Help

With close to twenty years of working with the top 100 Hedge and Private Equity funds, FinServ is uniquely positioned to understand the data requirements of your fund from Front to Back-Office and everywhere in between. Our consultants possess the technical skills and industry expertise to help you design and implement an effective Snowflake strategy. Our familiarity with all the other systems you will need to integrate your Snowflake data into makes FinServ the ideal Snowflake Partner to help you unlock the Power of their platform today.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Preparing for Salesforce Blockchain

Salesforce Blockchain was only announced in May 2019 and at Dreamforce 2019, it was announced that Lamborghini, the premier maker of exotic super cars, was using Salesforce Blockchain to authenticate its previously owned (aka heritage) cars. Lamborghini represents yet another major early adopter of Salesforce Blockchain in a short amount of time since its release. Salesforce Blockchain will not be available to the general public until 2020 and it already has been rapidly implemented by early adopters such as Arizona State University, IQVIA, S&P Global Ratings and now, Lamborghini to gather and share massive amounts of data with an expanding and increasingly complex network of partners and third parties.

What is Salesforce Blockchain?

To define Salesforce Blockchain properly, we must look at what Blockchain is overall and its underlying components. Blockchain is a distributed decentralized digital ledger spread across a network of computers securely storing transactional data. Core features include:

- Distributed Decentralized Digital Ledger – the digital ledger stores transactions such as the transfer of funds across a network of computers rather than a central source

- Peer to Peer Network – the network is comprised of a partner network (only accessible to members) who all save and maintain the transactional data

- Data Verification – data is verified using cryptography and digital signatures to authenticate identities and transactions

Salesforce Blockchain takes all of the interconnected and complex components of Blockchain and makes it accessible to the general users. It is a low code platform built on Lightning and open source Blockchain technology from Hyperledger Sawtooth. It is designed to make building and managing trusted partner networks, workflows and contracts possible with clicks and not code.

“Blockchain is changing the way companies approach trust and transparency,” said Adam Caplan, SVP, Emerging Technology, Salesforce. “Lamborghini is a perfect example of this—we’re excited to see how such an iconic brand is able to innovate and transform the vintage car market with a cutting edge technology like Salesforce Blockchain.”

Per Salesforce’s News Release, Salesforce makes Blockchain more accessible and even more powerful through the following:

- Build Networks with Clicks — Drag and drop ready-to-use modules to build their own blockchain networks with minimal need for writing code.

- Automate Data with Lightning Platform — Make blockchain data actionable through native integration with Salesforce. Layer complex blockchain data on top of existing sales, service or marketing workflows like search queries and process automation. Even more, companies can now run Einstein-powered artificial intelligence algorithms that integrate blockchain data into sales forecasts, predictions and more.

- Engage Partners Easily—Lower the barrier to entry for partners, distributors and intermediaries to leverage Salesforce Blockchain. Companies can now pull in APIs, pre-built apps and integrate any existing blockchains with Salesforce. With an intuitive engagement layer, companies can also easily interact with and add third parties to their blockchain with a few clicks and a simple authentication—creating trust networks.

Lamborghini Salesforce Blockchain Usage

Lamborghini recognized the benefits of Blockchain and how Salesforce enabled them to achieve those desired Blockchain benefits. Using Salesforce Blockchain, they took on the challenge to improve their heritage cars certification process. Heritage cars are previously owned cars that when resold, must go through an extensive and exhaustive process to certify that the car is 100% Lamborghini.

“When a Lamborghini is resold, the vehicle often goes through 800 to 1,000 certification checks that take place at the Lamborghini headquarters in Sant’Agata Bolognese, Italy,” according to a press release published by Salesforce.

The certification process requires that Lamborghini coordinate a vast network of participants – technicians, repair shops, dealerships and more – to verify the provenance and authenticity of the vehicle. To improve the speed and efficiency of the certification process, Lamborghini digitized the process by creating a trusted network among the certification process participants in Salesforce Blockchain.

“Innovation has been at the core of our company since its founding,” said Paolo Gabrielli, Head of After Sales at Automobili Lamborghini. “Salesforce Blockchain will allow us to take our innovation a step further, accelerating the authenticity of our heritage vehicles faster than ever.”

In addition to speeding up the certification process, Salesforce Blockchain has layered on the inherent security of Blockchain into the process. All authentication checks are managed by Lamborghini and its trusted partner network where each partner in the Blockchain has access to the entire database behind the car from parts, service, history and verifications. Full data transparency with decentralized data renders counterfeiting practically impossible.

Usage in the Alternative Asset Management Industry

The quality of early design partners and what Lamborghini has been able to do with Salesforce Blockchain has shown that Salesforce Blockchain is a powerful product that will have practical application to any number of organizations, especially alternative asset managers.

Consider the following questions outlined by Salesforce to think about the potential use case of Blockchain at your organization. (https://www.salesforce.com/blog/2019/05/what-is-blockchain-technology.html)

- Do you want to solve a business problem, rather than an integration problem? Blockchain is at times mistakenly positioned as an integration technology, but that’s not a core strength. If integration’s your goal, you may be better off using an API, Enterprise Service Bus (ESB), or web service.

- Does your business process require inherent irreversibility? This quality is foundational to blockchain, so ask yourself whether it would help you achieve your business objective or hinder it.

- Do you want to transfer objects of value from one party or entity to another? If this is the case, consider whether what you intend to do will benefit from immutability. Also, does it require consensus? If the answer is “yes,” you might benefit from using blockchain.

- Do you want to transfer information across organizational boundaries? If your use case involves some level of managing cross-organizational trust, deploying blockchain can help. It can also be useful if you want to simplify the process between you and upstream or downstream business partners.

- Do you want to target an ecosystem, rather than a few parties? Consider whether the problem you want to solve requires (significantly) more than two participants. If it is just a handful, integration might be the way to go. If you are targeting an ecosystem, blockchain may be the right choice.

- Do you have a clear strategy for engaging and driving adoption with partners? Without their adoption of blockchain, the positive impact to your business will be limited.

With the above questions in mind, a high impact and practical usage of Salesforce Blockchain could be in streamlining the Investor Onboarding process, typically a laborious and inefficient process bound by repetitive tasks and adhering to rules and regulations such as:

- KYC (Know Your Client) Verification – working with multiple parties to review and verify specific pieces of data such as proof of identity, source of funds, legal structure, sanction and watch list screening, etc.

- Client Suitability Verification – working with clients to confirm their suitability for investing in a fund under FINRA Rule 2111 or MiFID II guidelines (i.e. investments are in line with their risk tolerance and ability to bear losses). As client situations can change, investment suitability must be continually reassessed

Bringing the KYC and Client Suitability Verification process into Salesforce Blockchain expedites the process by bringing all parties and the associated reviews together in one trusted network. Once the data is in one network, it can be shared with Salesforce CRM enabling process automation and AI insights into the process. In addition, it also enables a fully transparent review process that is inherently auditable.

Summary

Salesforce Blockchain is a major focus of Salesforce to enable their clients to easily avail themselves of this paradigm changing technology. Salesforce believes in clicks, not code and has brought this model to Blockchain. For the early adopters of Salesforce Blockchain such as Lamborghini, Salesforce Blockchain has shown itself to be an indispensable feature of Salesforce. To prepare for Blockchain, FinServ can help in mapping out your current processes and planning out what can be put into Blockchain. If you would like help with planning or implementing this, or just get more info or a demo on these features, FinServ would love to help. You can reach us at info@finservconsulting.com or give us a call (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Top 5 Most Exciting Features from Dreamforce 2019

As always, Dreamforce was an amazing event where Salesforce announces many exciting new features they are planning to roll out in their software over the next one to two releases. In the past few years, Lightning was the key focus area; however, this year, Salesforce made a strong pivot towards Einstein – their Artificial Intelligence (AI) platform. It is clear that integrating AI and Machine Learning into their platform has now become the main focus of where Salesforce is driving the majority of their new innovations. Therefore, it will be no surprise that many of the items on the list this year relate to Einstein features and functions.

#5 – Einstein Search

Per Salesforce, they are taking the Enterprise Search function in Salesforce to a new level by making it personal, natural, and actionable. One of the most exciting aspects of Einstein Search is that it will provide a personalized search result for each user. Einstein Search leverages both Machine Learning and Data Mining techniques to produce its’ results. Another exciting enhancement to Einstein Search is the ability to use Natural Language to enter a search. I saved the best for last and certainly the most exciting feature of Einstein Search will be the actionable toolbar. This toolbar will allow you to take action on your search results right from the search bar, which will result in a 50% reduction in clicks and page loads for your most frequently-used tasks. Reducing the number of clicks is far and away the number one requirement clients ask us for, so this will be a truly powerful new feature.

Note – This personalize results feature currently requires at least 100 active Sales Cloud licenses. Salesforce is working to remove this restriction.

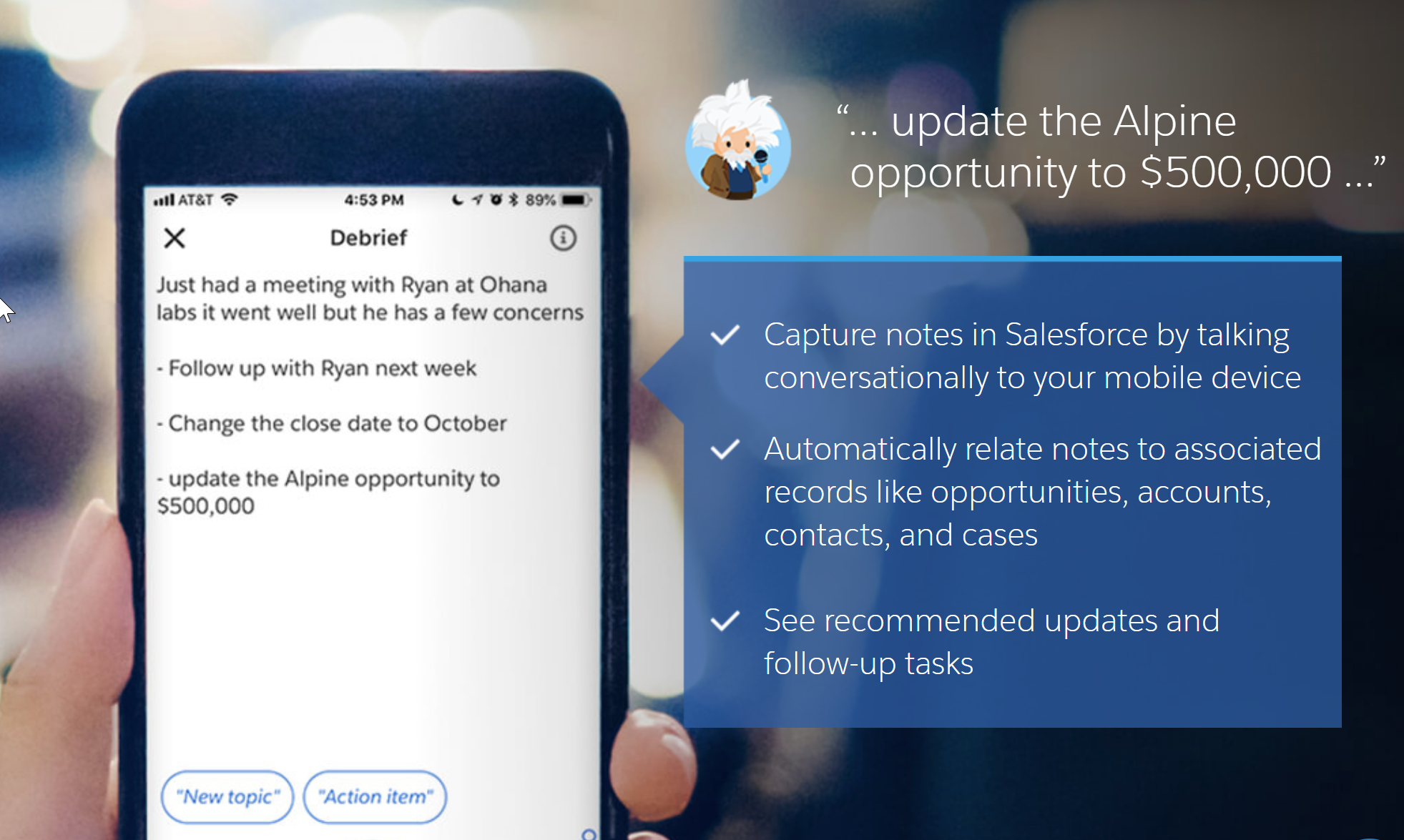

#4 – Einstein Voice

This is a feature that was announced at last year’s Dreamforce with huge excitement and anticipation, but it was never released. We are happy to announce that this key feature is finally ready for beta usage in the upcoming release. Now you will be able to speak into your phone or many other compatible devices like Alexa or Google Dot to enter your info into Salesforce without having to type anything. Some key features that already exist include: Opportunity and Task Updates, Einstein Voice Skills (a new feature we will elaborate on in a future post) and the ability for Einstein to suggest follow ups tasks. You can also receive briefings from many smart devices by simply using natural language like: Give me my daily briefing, or What accounts are at risk? There is no doubt that allowing Sales reps who are on the road to update info and add leads without having to type this in will address the biggest issue people have had with getting data into Salesforce – the need to get key people to enter data. This feature promises to have the biggest impact on timeliness of information and the quality of information in Salesforce.

#3 – Pardot Lightning Email Builder

Salesforce announced a real game changer by leveraging their familiar builder canvas with components on the left, properties on the right, and drag and drop WYSIWG in the center panel so you can create dynamic and powerful emails right in Pardot. Key features include a totally responsive capability right out of the box where moving the email to any device will result in the email scaling perfectly. The Email Builder also includes key features like Hover and Link capability, as well as a Call to Action button and a Survey Provider. The release date for this feature is not set right now, but hopefully Pardot users will see this feature in a release in 2020.

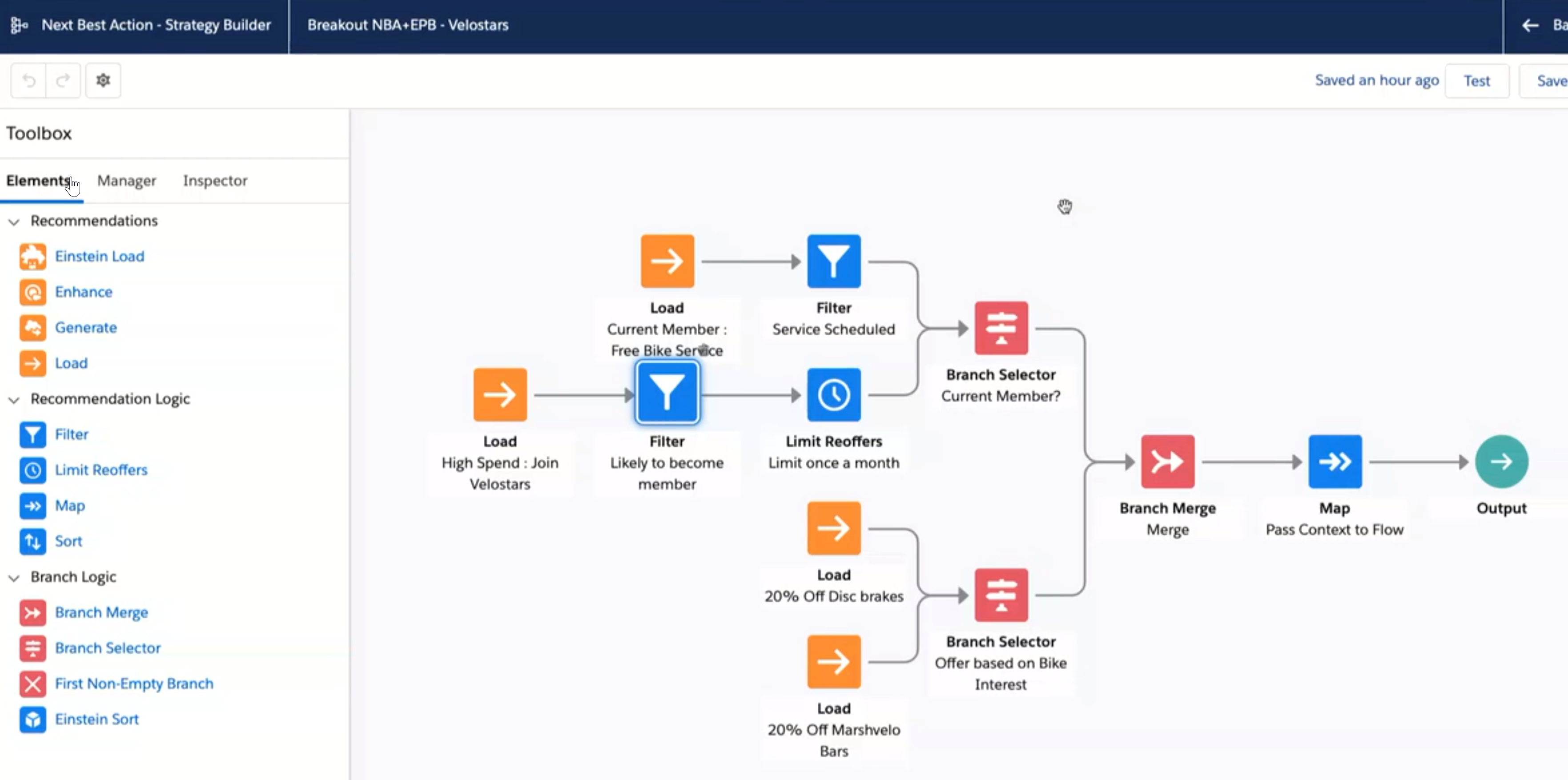

#2 – Einstein Prediction Builder & Next Best Action

Einstein Prediction Builder used to be a paid Service and now it is free and included with Sales Cloud. In a nutshell, Prediction Builder will look at all your historical leads and assess which leads converted using Machine Learning. It will construct a model that will enable you to identify the leads your team creates that have the highest likelihood of closing, which will enable your team to maximize their efficiency in the sales process. Predictions are unique to each company you create; the domain expertise and prediction builder does the rest!

- How much is this deal likely worth?

- How long will it take for this deal to close?

Or

- Is this Lead Going to Convert?

Prediction Builder will support Einstein Next Best Action helping you to cross sell, upsell.

Next Best Action works on getting your insights to work together to create a unified decisioning layer in the form of a recommendation to a Salesperson’s desktop at the right moment and turn that into an action that results in a outcome (closed deal). Next Best Action also integrates to Salesforce Lightning Flow by allowing a customer to link to an automated workflow.

#1 – MyTrailhead

Salesforce is now offering companies the ability to leverage their world class learning platform to provide bespoke training for any company. Imagine a simple and user-friendly interface that will fast-track compliance and other core company-required training because of its’ usability. . With Badges used to incent employees and interactive videos and quizzes to confirm knowledge, the Trailhead platform provides a top-notch environment to ensure key financial services requirements are fully covered by all employees while making it fun and easy to complete.

Uses include:

- Supercharging the Employee Onboarding Process including critical Compliance Training

- Reinforcing the Company Culture

Conclusion

These features, available now or in Beta and some that will be available in 2020, are items your organizations should seriously consider for your Salesforce roadmap in 2020. Each of these features will add great value to key areas like data integrity, compliance, user adoption and user friendliness of your system. If you would like help with planning or implementing these solutions, or just get more info or a demo on these features, FinServ would love to help. You can reach us at info@finservconsulting.com or give us a call (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Artificial Intelligence for Human Resources

Artificial Intelligence – The Next Internet

Today, the term Artificial Intelligence (AI) has gone main stream and has become the focus for the next stage of technological evolution. In 1996, Bill Gates said about the Internet:

“The Internet is a revolution in communications that will change the world significantly. The Internet opens a whole new way to communicate with your friends and find and share information of all types. Microsoft is betting that the Internet will continue to grow in popularity until it is as mainstream as the telephone is today.” –Bill Gates (Time, 16 September 1996).

This sounds awfully familiar to how AI is being described today as to how it will reshape our lives. In the Business.com article “3 Reasons Why AI is Beneficial to Business“, AI is described as:

“Artificial intelligence (AI) is regarded as one of the most impactful technologies in the word today. It is transforming the way the world works by spurring innovation in every sphere of the planet. There are many advantages of AI, from the capability of making any function work faster to improving how the world runs.”

Much like how the Internet was described in its genesis, AI is being described in a similar grandiose fashion where I am not being told anything specific in terms of benefits nor am I being told of the practical usage of AI. For example, how is AI going to exactly make me and my clients work more effectively? Specifically, how will this make the HR space function more efficiently? How can HR utilize AI to add value to their work and to their firm?

Think Small

To identify the areas where AI can help HR immediately, it helps to think small. Find smaller ways to improve your work processes that you can implement with minimal change. Changes that affect multiple groups and the whole organization will run into stiff cultural resistance and incur greater risk. For example, AI has been a trending topic recently in how it can improve the Recruiting process from scheduling to follow ups to candidate interaction. However, we have seen that Recruiting processes can be difficult to change due to ingrained processes, legacy systems, multiple internal and external involved parties, etc. Furthermore, if AI is not implemented correctly for Recruiting, it can potentially lead to employment law violations.

In a notable misstep for AI, Amazon recently disclosed that they abandoned an internal effort to have AI review and process candidate resumes as the AI learned gender bias and showed preference toward male resumes. Reuters reported that:

In effect, Amazon’s system taught itself that male candidates were preferable. It penalized resumes that included the word “women’s,” as in “women’s chess club captain.” (Reuters, Amazon scraps secret AI recruiting tool that showed bias against women)

Effective AI should be thought of as an “add-on” that can enhance your work by taking on mundane tasks, guiding you through tasks, offering advanced data analysis to complement your work, etc. We have selected 3 areas where an AI “add-on” can have a big impact to HR and be implemented quickly.

- Chatbots

- System Training

- Retaining Talent

Chatbots

Chances are that you have already encountered many of these Chatbots on your daily websites from shopping sites to your utility provider’s site. The Chatbot AI prompts you to ask questions which they then answer without an actual representative interacting with you. Well, this is coming to the workplace as well and HR is in a prime position to benefit.

On the popular collaboration and messaging app, Slack, the add-on, Niles, can listen and learn from your questions. For example, you can ask Niles, how much would it cost to switch from the Low to High Medical plans or how many vacation days can I carry over? Niles can answer these questions freeing up your time for more complex tasks. And what if Niles does not know the answer? Well, you would have to give Niles the right answer and Niles would learn from this.

System Training

As more and more HR departments implement HCM systems, there comes a learning curve to learn how to use the system. For the most part, users have been trained through on-site sessions and user guides. But how much knowledge does the user really retain after the training is complete – not enough to complete the task seamlessly. User guides have issues as well in terms of finding and using the correct guide and their overall static nature. You can always ask your HRIS Administrator for help but that depends on if they are available and it may take time away from their other tasks as well. AI in System Training is designed to overlay on top of the system for a seamless experience and interact with you as you do your task. This on-screen experience is on demand and contextual.

WalkMe, a digital adoption platform, offers AI training that sits on top of the Workday UI. It can guide you step by step to complete your tasks and this becomes really powerful when taking the context into account. For example, you are no longer following just the steps to transfer an employee from the New York office to the London office. WalkMe would recognize the context that you are performing the office move task in – the employee is transferring, not just moving. You could be prompted to perform related tasks such as updating a home address, converting salary to the local UK salary or updating the retirement benefits. And if you have never done these steps or forgot how to do them? WalkMe has got you covered..

Retaining Talent

When employees leave, it causes strain on the organization’s employees and the organization itself. Employee morale can suffer. The organization can encounter the adverse effects from lost industry and institutional knowledge and the necessity to kick off recruiting a replacement. Recruiting itself is arduous and time consuming and there is no guarantee that the replacement is a good fit for the organization. But what if you could potentially prevent this or at least be prepared when someone inevitably leaves? AI can scan and analyze employee behavior and cues and identify those at risk for leaving. With this knowledge, potential issues can addressed before they become issues and the transition plan becomes a proactive exercise rather than a reactive exercise.

Veriato, a user behavior analytics and employee monitoring software company, offers AI platforms designed to identify employees that may be leaving. By tracking the employee’s behavior from their computer activity, tone in emails, keystrokes, internet browsing, etc., a baseline is created for that employee. The AI can monitor and detect deviations to the baseline that would indicate if an employee might be leaving. For example, the AI may detect a change in tone to a negative tone regarding the company in emails or disengagement from work through reduced work activity.

Summary

AI is being touted as the next great solution much like the Internet was in its early days. To take advantage of AI now, start small and practical. Small improvements can be implemented quickly with less organizational resistance and risk. The benefits of AI will be realized quicker and will help you present tangible benefits as supporting arguments for implementing AI with a larger organizational impact. FinServ has helped many of our clients evaluate their current processes, implement process efficiencies and select technology that best fits the organization. For help in evaluating where AI can benefit you and implementing it, contact FinServ at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Top 5 Ways to Automate Data Entry in Salesforce

The Challenges with Data Entry

One of the biggest complaints we hear from our clients is that users don’t enter their data properly (or at all). It’s astounding that even though technology is making exponential leaps, this same core issue remains.

Fortunately, Salesforce has many tools available that require little or no effort to implement and will make it much easier for your users to get their data into Salesforce.

Here is a list of the top 5 ways FinServ has leveraged the tools in Salesforce to make it easier for users to provide the vital data your business requires. Most of these items are very easy and you can implement on your own, but we are always happy to put them in place for you if you need assistance.

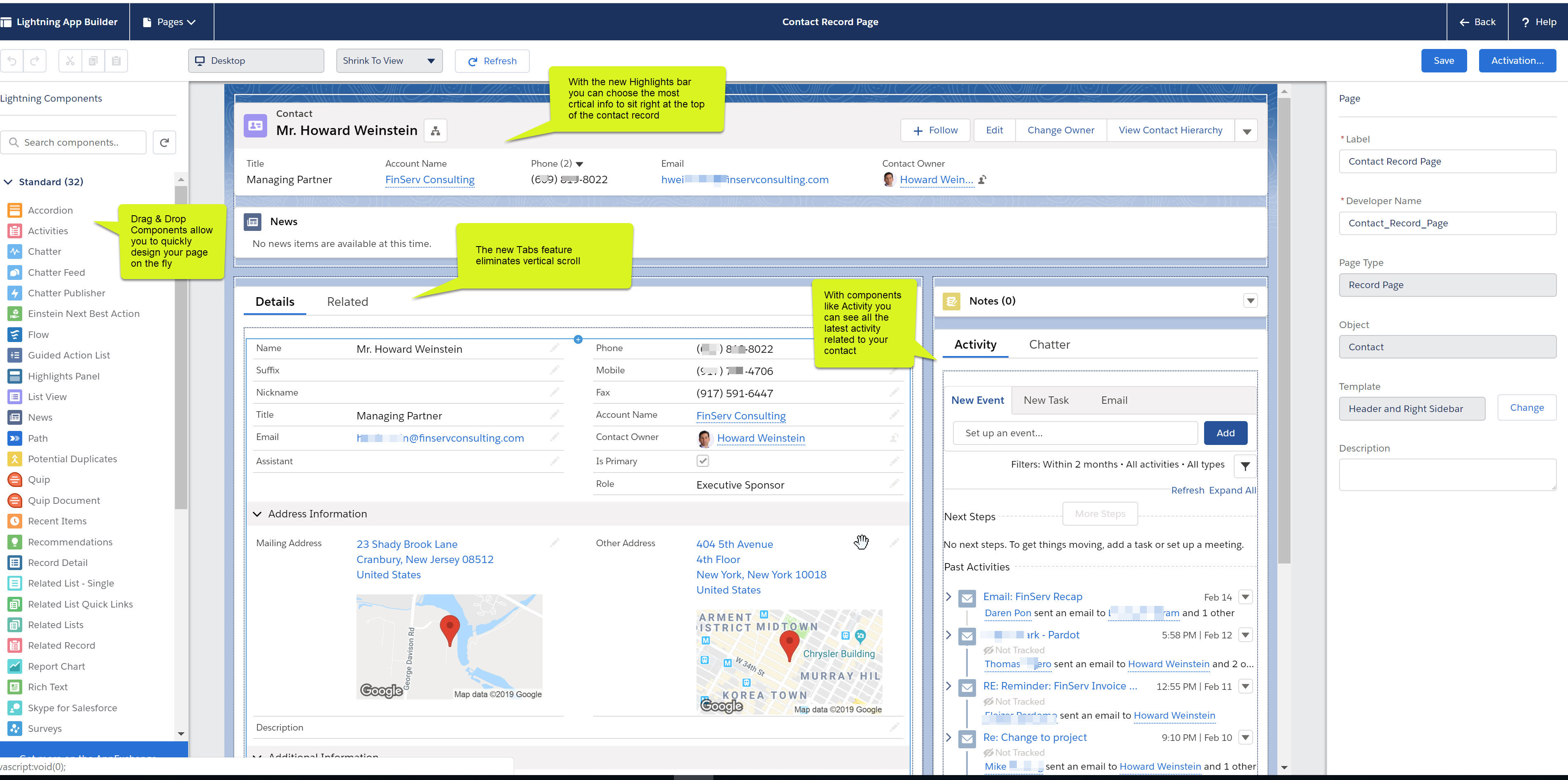

- Create an Appealing Data Entry Screen – Lightning Page Layouts

When Salesforce introduced the Lightning Page builder, they provided an easy to use Drag & Drop interface to customize the layout of your key record pages. With the addition of Tabs & Accordion views, the amount of information a user can access on the screen grew exponentially. In addition, the look and feel of the new Lightning Experience is far more aesthetically pleasing, which has been shown to enhance the user experience with all applications.

When you combine this new tool with updates to your Page Layout, you can maximize how efficiently your users can access the data they need to update.

If you have not already upgraded to Lightning, you need to do this immediately. Not only will Salesforce be moving all customers over to Lightning by the end of 2020, but the improvements to the User Interface alone justify making the update because they make data entry so much easier.

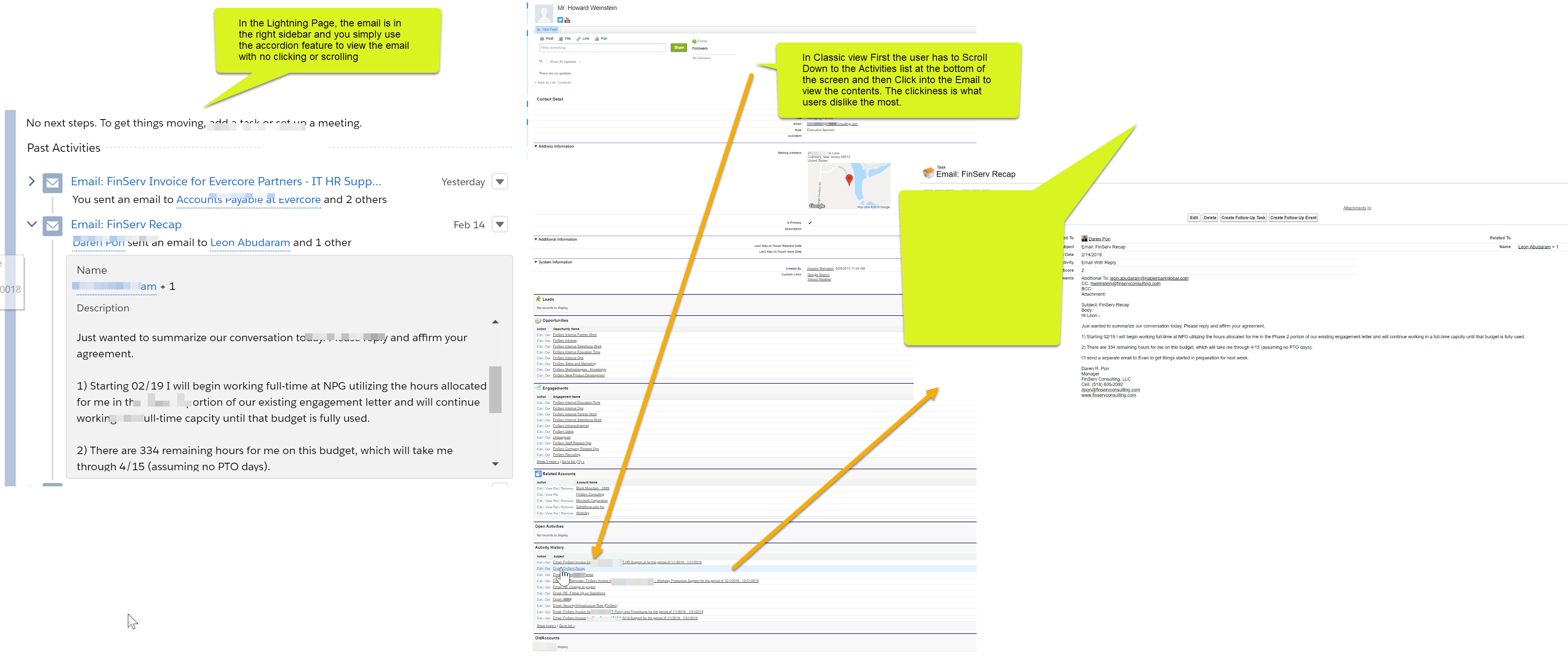

With the move from Classic to Lightning, Salesforce eliminated the “Vertical Scroll of Death,” which is what Salesforce users referred to as the endless vertical scrolling required to view your data in Salesforce Classic (see screenshots below for comparison of Classic to Lightning layouts).

There is a ton of great out-of-the-box Components that will save you time which your users will love; here is a list of the ones we have found to be the most useful:

Tabs – Replace the need to scroll by adding tabs to your page. You can then add other components into your tabs like Related Lists.

Related List Single – We find this one most useful, especially when you have one item related to your record and you want to place it somewhere prominent. A great example of this are files related to your contact you have saved.

Recent Items – Provide users with the last items they interacted with, as these may need updates.

Related Record – Provide users with records that are related to the current one, again making it easy for them to update information.

(Below is an example of a Contact profile in the Lightning UI, you can see that the Activity can be placed conveniently to the right sidebar to maximize the usefulness of the screen, and tabs are used to provide access to related lists with no scrolling required)

(The screenshot below shows on the left the Contact record in the Lightning UI. Email activity is easy to access and can be viewed with no clicking or scrolling. On the right the classic view which requires both scrolling and multiple clicks to access the same information)

- Provide an Intelligent, Interactive Data Entry Experience to Users – Automated Workflow

One of the lesser used, but most useful features in Salesforce is its workflow tools. In the Spring ’19 Release, Salesforce rolled out its new Flow Builder which provides a more user-friendly interface compared to the old Cloud Flow Designer.

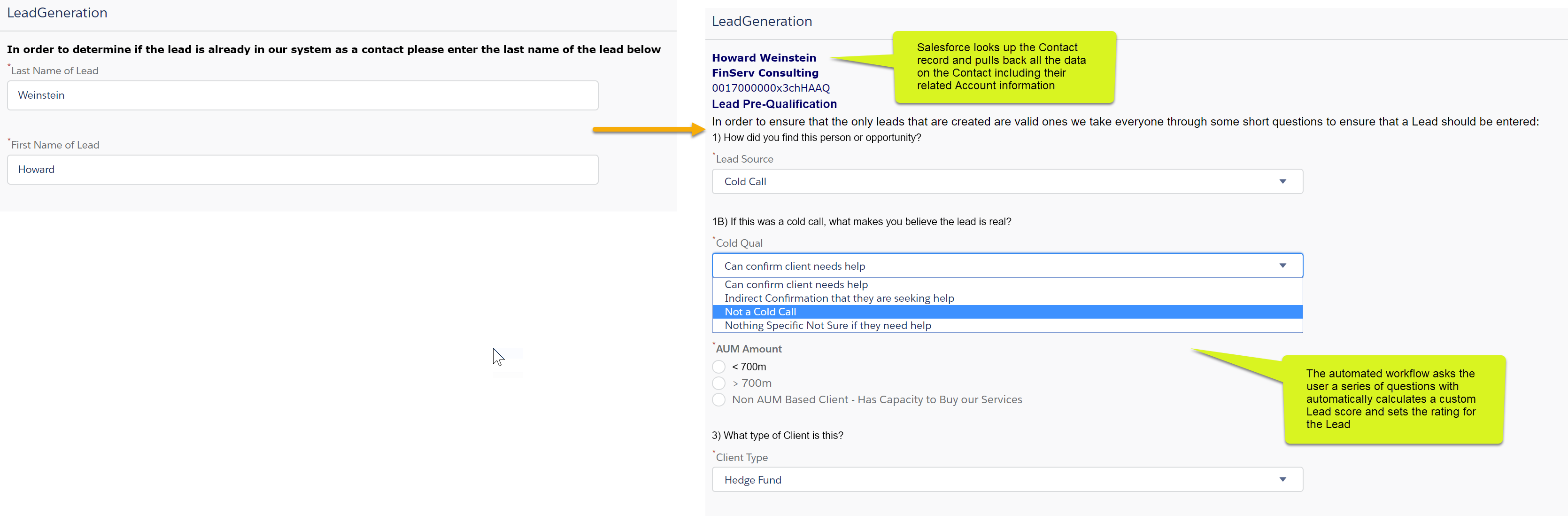

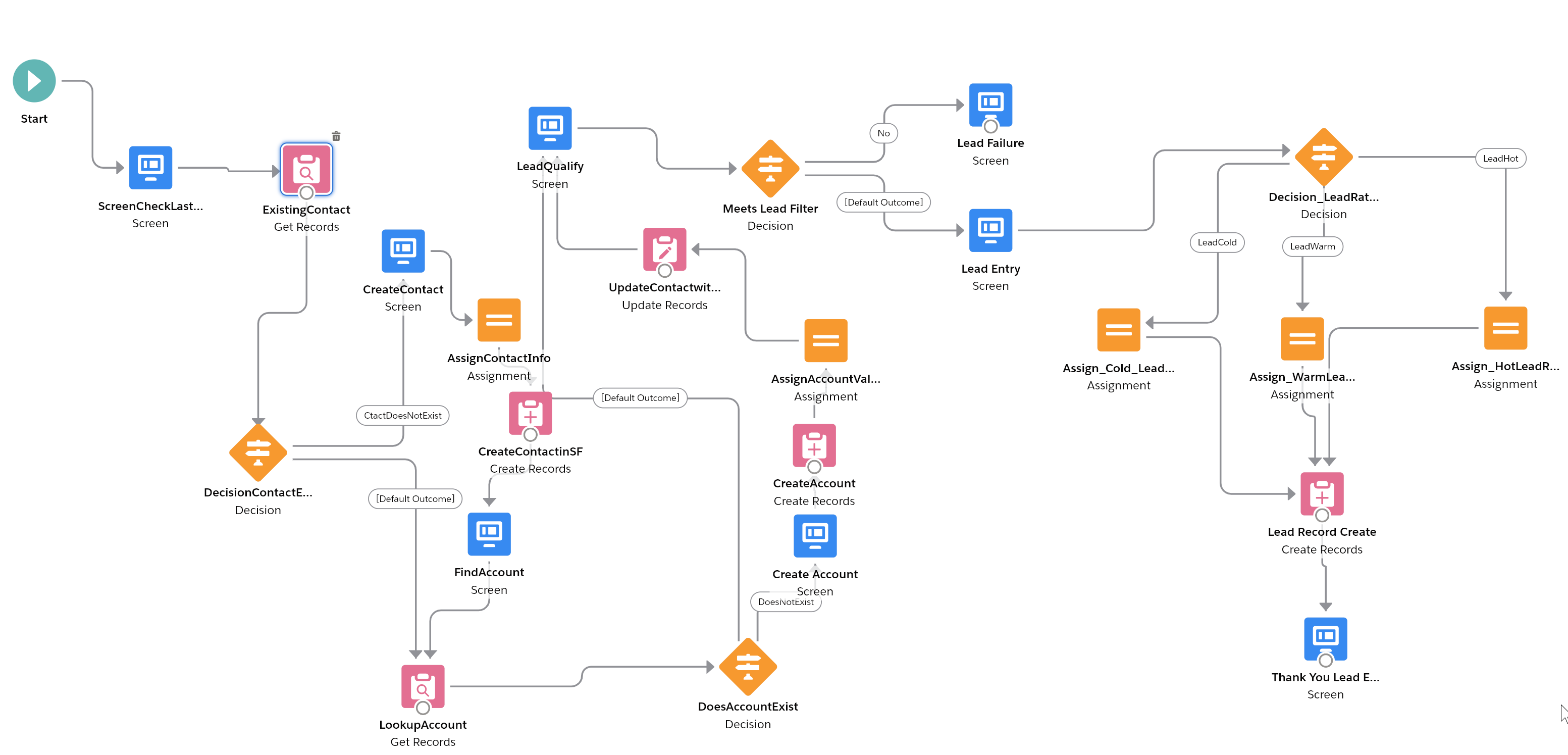

The essence of the new Flow Builder engine works the same way and it is incredibly valuable for data entry. With the Flow Builder, you can create custom wizards and screens for your users to make entering data much more user-friendly (see example below). Additionally, you can use the lookup features in the workflow engine to fill in data for your users or facilitate the selection of values with pre-selected records, pulldowns, and many other easy-to-use features.

(How you can build intelligence into a wizard so that your users answer questions which populates all the sales data for your leads)

At FinServ, we use this capability to provide some additional support to our Sales team when entering a new Lead. Since our lead process is a little unique (we prefer to utilize an existing Account and Contact related to the Lead), we use the Wizard function to determine if that person exists in the system first. If the person does exist, the flow will automatically fill in the contact’s details for the Lead, along with the Contact’s Account information (see example above). If the Contact and/or Account does not exist, the flow takes the user through a series of user-friendly screens, so a new Contact and Account record can be created.

As you can see, the actual workflow below has several steps, decision points, and other features that Salesforce provides with its Flow Builder tools.

All the flow work can be done without any code, through user-friendly screens (see example below) with various options and dialog boxes. More advanced users can combine items using code and Salesforce’s Lightning Components to create very sophisticated user experience.

- Hands-Free Data Entry with Artificial Intelligence – Einstein Voice

We featured Einstein Voice in a previous post, and it is one of the most exciting and best ways to get your busy sales people to enter their data into Salesforce. Your users no longer need to enter their data manually. They can simply speak into their smartphones and Salesforce will use Voice Recognition and Natural Language Interpretation to receive and parse out the message. Salesforce then creates and updates the related records in your Salesforce instance based on the keywords used. Einstein Voice can also notify other team members who have a relationship to the update, alerting them that there is something in the system they need to act on.This is truly the biggest and best thing that has happened in Salesforce for some time and promises to revolutionize data entry.

- Empower Their Smartphones – Custom Mobile Experience

If you are not ready to jump fully into AI with Einstein Voice, Salesforce offers the ability to customize your smartphone and tablet experience with the same features described in the Lightning Page Layouts section. You can customize the Navigation experience for your users by deciding what items they see in the Salesforce App, as well as the order of those items.You can arrange your global actions for all your users, placing the most important items that you want your users to perform at the top, like creating new leads or logging a sales call. Compact layouts allow you to put the most important information for a record at the top, so users can access the key information they need quickly, like a phone number for a contact. For smartphones, this feature is a must.

(The compact layouts for the mobile users are both visually appealing and huge time savers when editing data on the road)

(The screenshot below shows a sophisticated app page that was custom built for a mobile phone, even leveraging the phone’s camera to allow the user to insert a photo into the record)

- Setting Tickler Notices and Reminders for your Salespeople – Time-Based Workflow & Rules

This may be a more sensitive one, because not all users like to be reminded to update their data, but it is a great way to ensure the information in your system does not become stale.

For instance, you can set up a rule so that once a lead is generated, if the lead has not been updated after 10 days, Salesforce automatically sends a reminder to the person who opened the lead.

In our experience, this has been the number one way to ensure that key records get updated. This approach can be applied to any record type in Salesforce, and there are an infinite number of ways to implement rules that can become very sophisticated.

Again, this solution requires no code, since you simply use Salesforce’s user-friendly features including: Classic Email Templates, Email Alerts, and Workflow Rules & Tasks.

Conclusion

These are just a few of the amazing tools Salesforce offers to make the drudgery of data entry so much easier for users. FinServ implements these best practice solutions and more for our clients, whom benefit from far improved user group satisfaction and exponentially better data quality. This in turn leads to greater Salesforce platform adoption and stronger ROI on existing Salesforce technology investments. If you would like help with solving your data entry issues, FinServ would love to help. You can reach us at info@finservconsulting.com or give us a call (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

What Do the Leading Hedge Funds and Asset Managers Have in Common?

Market volatility, international trade wars, and speculation around the next recession is driving investors to be more wary and conservative with their money. 2018 was certainly not the best year for the alternative asset industry, considering how the average hedge fund lost 2%. Meanwhile, some fund managers would have jumped at a 2% loss. So, how are industry leaders responding to all of this? Investing more in their technology infrastructure and innovation.

There’s Still Time to Invest in AI and Machine Learning

You know those messenger bots that spring up on your screen every time you visit a web page? Or those messages in Facebook messenger when you buy a product or sign up for a course? That’s not just affecting the retail and the consumer products industries. After seeing the success and engagement with these bots, financial services and other service providers are following suit.

Because these bots keep end users engaged, save time, and provide quick support for frequently asked questions, big players like Workday and Salesforce are integrating this type of machine learning behavior in their software based on how we use their products everyday.

Why should you care?

Well, it’s an incredibly smart move. Workday is already leading the pack by building intelligent bots directly into its platform. Very soon, users can ask a question and receive immediate guidance on things like how to edit an expense report, or update his/her time sheet. These small improvements will make a huge impact on user adoption and change management as organizations seek to innovate and optimize their systems infrastructure. Furthermore, employees won’t be asking your IT or Accounting department about how to use core functionality. This frees up the time of your Technology Manager or Finance Director to focus on more strategic initiatives like streamlining your existing systems processes, or providing recommendations to reduce costs across your departments.

Learn Blockchain

If you still think blockchain is just another buzzword, now is the time to start becoming more familiar with it. A decentralized ledger is probably the most disruptive technology we’ve seen since the introduction of email and AOL’s dial-up. With more and more companies investing in blockchain, the use of the public ledger will become a critical component to an organization’s technological infrastructure, especially within the financial services industry. In short, blockchain effectively eliminates the middleman and any associated fees, so that only the seller and buyer are involved in the transaction. This poses a huge risk to brokers, banks, government backers, and any other agent or third-party normally facilitating the transaction and earning fees as a result of it.

JP Morgan and Mastercard have already created their own blockchain networks to streamline payments faster and more securely.

Everything Will Live in the Cloud

If you’re still operating with enormous amounts of hardware, it’s time to rethink that. Yes, we’ve heard time and time again concerns about security within the cloud. However, from our personal experience with implementing cloud solutions, we can attest to the fact that the leading hedge funds and asset managers have made this transition at least a year ago.

Why?

The better question to ask is, why haven’t you? The cost savings are staggering. The dollars you pay for your data centers, servers’ maintenance, and your IT staff can be reinvested in your top talent, Human Resources, and other departments that need it. Not to mention, cloud solutions are extremely reliable, with services available 99.99% of the time. Along with that, so much more productivity and collaboration that can be achieved through the cloud, especially now that the workforce is more mobile than ever.

If you’re not already investing heavily in one of these areas, you’re going to be left behind. 2020 is less than a year away. Let that sink in.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Augmented Client Service with Salesforce Reinvents Customer Expectations

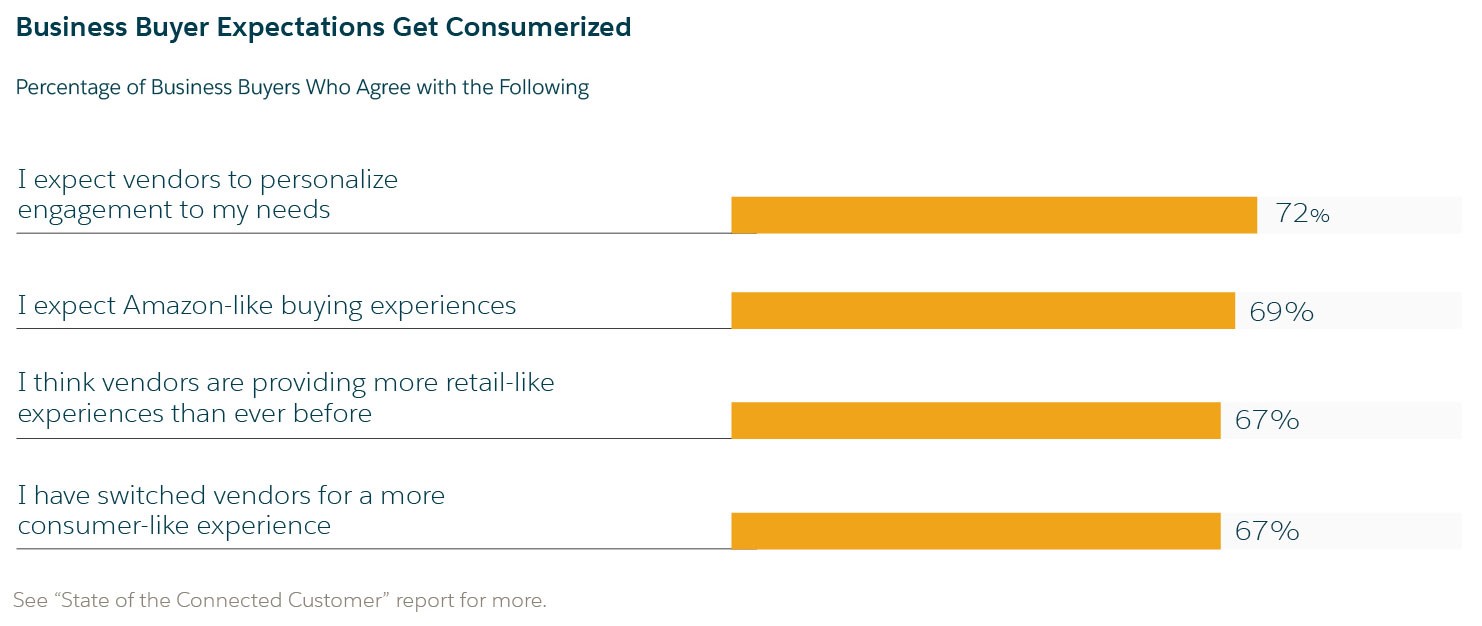

The rapid development of disruptive technology solutions across all industries is raising the expectations of customers at a blistering pace. A firm’s ability to adapt to higher expectations for client service will determine the future winners and losers within already competitive industries like asset management. Salesforce’s “State of the Connected Customer Report” notes that 70% of consumers acknowledge that technology has made it easier than ever to take their business elsewhere in order to find a brand experience that matches their expectations.

Salesforce Service Cloud is a complete customer support platform that complements their sales organization-focused CRM product. Service Cloud allows companies to deliver faster, smarter, and more personalized service to their clients, driving both customer engagement and satisfaction through consistent delivery. Service Cloud achieves this by extending the capabilities of any single client service representative using a set of dedicated tools and technologies:

- Lightning Service Console: The Lightning Service Console delivers a streamlined user interface for client service agents by putting all of the information they need right at their fingertips. This simplifies the agent experience and maximizes productivity.

- Case Management: Improve first contact resolution (FCR) rates by leveraging AI-powered tools to route customer requests to the right person in any support organization. Get a transparent view of all client requests and take action quickly with prewritten response templates in just a few clicks.

- Knowledge Base: Internal knowledge bases and external customer communities help your team share accumulated knowledge with each other and with customers respectively, improving productivity and reducing the burden of frequently asked questions.

Why Should You Care?

Capital expenditure on client support technologies will allow your client service representatives to handle more with less, often in ways that will allow representatives to focus on more challenging and rewarding issue-resolution activities. A Salesforce study on 4,500+ customers identified that Service Cloud achieved:

- 48% faster issue resolution time

- 47% increase in client service representative productivity

- 45% decrease in average call handling time

- 45% decrease in service costs

- 45% increase in customer retention and satisfaction

A specific example of such improvement came from Jeff Dailey, President and CEO of Farmers Insurance. Farmers Insurance was able to realize a 75% overall reduction in loss reporting time after implementing Salesforce Service Cloud:

“We’ve created a claims reporting platform using Salesforce technology with our customers top of mind. The average time for Farmers to take a phone call to report a first notice of loss is approximately 12 minutes. With the Enterprise First Notice of Loss, or EFNOL platform, it can take as little as three minutes from start to finish.”

Submitting an insurance claim is a relatable customer experience that we hope is never necessary, but often inserts itself into everyday life. The event that caused the need to file a claim can often be stressful and challenging, so when the claim submission process is difficult, that only exacerbates the situation. By focusing the customer experience, Jeff Dailey was able to drastically improve one of the key metrics of overall client satisfaction for insurance companies.

The Bottom Line

New technologies like Amazon Alexa and Uber are making life more convenient for everyday retail customers. The limit of those expectations is being further challenged by leaders like Farmers Insurance that are leveraging new client service technology, such as Salesforce Service Cloud, to deliver better client outcomes. Whether you are an industry software technology firm, an outsourced service provider, or an asset management firm looking to get more from your suppliers, FinServ is the partner for you to help you achieve your unique organization goals.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Utilize an Applicant Tracking System to Optimize Recruiting Efforts and Find Top Level Talent

Finding qualified candidates who meet the requirements of the job description and compliment your company’s culture is becoming increasingly harder when you don’t have a system in place to logically work through a plethora of resumes being submitted via various venues. This alone is a difficult task, but even more-so when your firm is competing with others in the market. In some cases, firms do not have the capability to house a recruiting team internally, meaning this process quickly becomes a juggling act with employees’ day-to-day operations. Dealing with a manual recruiting process paired with other work responsibilities is a recipe for stunting your firm’s growth, either by missing out on high-caliber candidates due to lack of time focused on recruiting, or hiring ill-fit candidates by rushing through your candidate pipeline.

An Applicant Tracking System (ATS) can mitigate these risks and help your firm scale at its highest potential by automating your operational workflow and assisting your team with cumbersome tasks, but how?

Handle Larger Applicant Pools

Finding the best fit for your firm is a numbers game. Plain and simple. Not only should the candidate meet your desired skill set, but also should share the same drive and values aligned with your firm’s mantra. The ability to parse through large amounts of resumes in the screening stages ensures the candidates whom are passing through to the next stages are interview-worthy. With an Applicant Tracking System, utilizing pre-screening survey questions will allow you to automatically weed out candidates that do not meet your requirements. Setting this pre-screening questionnaire can also aid in prioritizing candidate interviews based on the score of the questionnaires so that your recruiting time is using their limited time to focus on the top candidates first.

Using Analytics to Your Advantage

Utilizing an Applicant Tracking System’s reporting and analytics functionality can paint a clear picture of your recruiting trends as to what is working. Whether your top candidates are coming from a specific university or have a niche background/skill set, analytics can allow you to focus on those recruiting efforts which are bringing your firm the best talent at all levels. Analytics can aid recruiters to understand when candidates are applying to jobs the most during the year so that they can anticipate the heavy rush and reach out to the business in advance to get the most up to date list of positions needed by the firm.

Creating recurring and one-off reports for management reporting is simplified with the ability to store report templates within the system, which are preset based on your reporting requirements and parameters.

Keep Worthy Candidates in Your Back Pocket

Often, the best candidates are the ones not available. Utilizing the talent pool functionality within an Applicant Tracking System can help your team keep track of those candidates who would be a great fit for the firm, but are not currently available, or your firm does not have availability at the time. Often the recruiting process is building a relationship with candidates so having a built in CRM “customer relationship manager” will help facilitate the tracking and communications with these candidates. These candidates can be bucketed into talent pools based on skill set, experience, or any other criteria desired which makes it easier to locate them and include them in campaigns.

The process ultimately begins with making sure the right system is chosen from the start so that you ultimately minimize your risk and create a smooth implementation and a faster adaption into your overall process. To learn more about FinServ Consulting’s services, please contact us at info@www.finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.