Selecting the Right IT Managed Service Provider the FinServ Way

Are you happy with your IT MSP? Many funds are not. Selecting the right IT MSP is not something you should keep putting off. Learn how FinServ helps its clients find the right IT provider for their unique needs.

Managing your IT infrastructure touches every team member and can create significant issues if not handled effectively. From extensive downtime to user frustration having an IT team that does not act as a business partner can hurt your whole fund.

FinServ completed an IT MSP Vendor Selection for one of our Private Equity Fund clients experiencing these exact issues. When the head of the fund could not access his systems during the pandemic, and their service provider had let the problem sit for over 24 hours, the fund decided a change had to be made.

The client was already aware of FinServ’s Vendor Selection methodology, as a few months earlier, we helped them select a new Third-Party Fund Administrator.

FinServ’s Vendor Selection methodology ensures that our clients select the right service provider for their unique requirements. Our comprehensive approach includes three stages of selection.

Phase 1 – Initiate

FinServ works with our client to inventory/collect all essential documentation and support for the new vendor culminating in a detailed set of user requirements. FinServ leverages our functions of an IT MSP to reconcile all possible functions to ensure all possible services are covered. Getting from a long list of vendors to a shortlist based on a detailed Request for Information (“RFI”).

Phase 2 – Assess

At the core of our selection approach, we use a 35-Page RFP including over 320 detailed questions. This level of detail ensures that the vendor provides the services and support in a way that meets each client’s requirements. Every client has their own way of doing business, and this approach ensures that the vendor that best fits that model is selected. The key to this stage is FinServ’s team with unparalleled attention to detail combs through the provider’s documentation and answers. It creates a qualitative and quantitative scoring that investors and auditors call world-class.

Phase 3 – Recommend

In the final stage of our selection process, we use scripted demos, which force each vendor to show, not just tell us, how they address the client’s most complex challenges. It is in this step that the right vendor rises to the top. Most salespeople hate this step because they know that often they want to stretch the truth about their systems. The right vendor can show how it is done to seal the win. In our final step, we conduct comprehensive reference checks that often uncover issues that may not disqualify a vendor but help the client with crucial advice as they move forward with the winner. The final step is a recommendation deck that summarizes all the detailed work, including the cost analysis across the finalist vendors supporting the client’s final selection. Many clients have used this document to show potential investors the quality of diligence in selecting a key service provider.

Beyond the Methodology

The process is key to making the right choice, but more important is ensuring that you focus on the essential areas these service providers offer. Technology is constantly evolving, be sure there is a focus on what is needed today and in the near term to meet your firm goals and requirements.

FinServ makes it our business to always stay on top of the latest requirements from regulatory agencies like the SEC and the latest technologies that the best providers are using.

Your IT Managed Service Provider (“MSP”) typically handles 2 to 3 of the most critical aspects of your business:

1) Cyber-Security & Risk Management

2) Monitoring & Management of IT Infrastructure

And for funds that have chosen not to keep IT resources in-house.

3) Service Desk / Desktop Support for Users / Company

1) Cyber-Security & Risk Management

With the war in Ukraine and the increased likelihood of focused cyber-attacks, there has never been a more critical time for a financial institution to ensure that they have the best possible risk management and cyber security coverage possible.

The offerings from the best IT MSPs have changed drastically over the past few years as the technology for cyber security and risk management has been forced to evolve as quickly as the sophistication of attacks.

The Not So Obvious Requirements Matter Most

One of the nuanced aspects of these services is less about your direct protection and more about how communications about potential IT security issues are raised. Our clients desire to limit the noise created by non-critical communications, so only the most critical issues are escalated for review. Some vendors have more advanced issue monitoring and alert systems that use rules and triggers to raise only the most important messages to clients, limiting “boy who cried wolf” scenarios.

The best vendors also proactively provide webinars and training for your employees to stay on top of the latest attack approaches. A knowledgeable team is your best defense against constantly evolving and changing cyber threats.

2) Monitoring & Management of IT Infrastructure

Has your network ever gone down, leaving you unable to work? Have any of your remote employees ever lost access to your network? Has a crucial executive of your firm ever been frustrated by not getting the IT support they need?

If the answer to those questions was yes, you probably don’t have the right service provider with the proper setup and response management systems. The best IT MSPs have formulated approaches that ensure redundancy and backup of essential systems, so you never have downtime during regular business hours. Similarly, they have all created world-class service systems that support intelligent routing of critical issues with complete status transparency. Essential issues are solved in minutes, not hours or days. When they take longer, your support staff can see real-time updates on 1) who is working on the issue, 2) when it will be resolved, and 3) all the latest activity and communications to the key executive.

3) Service Desk / Desktop Support for Users / Company

If a key executive’s camera is suddenly not working and they have a full day of Zoom or Teams calls ahead, not having someone come to their desk immediately to fix the issue can be a significant problem.

Alternative asset management firms often choose not to hire a CTO or desktop support staff. With predominantly SaaS-based applications, the need for in-house physical support has been dramatically reduced. Many smaller funds prefer to rely on an outsourced IT support person along with a part-time Virtual CTOs (“vCTOs”) to focus on complex technology strategy. Separately, while remote desktop support can work for many issues, in-person physical support is still something many funds require. While many IT MSP Vendors have moved away from offering this service, it is still an essential requirement for many funds.

If you are one of these funds, FinServ has you covered. We know which IT MSPs truly champion this type of support and which vendors only give it lip service. Additionally, If you are unhappy with any existing onsite IT support you are receiving today, we can help you move to a vendor that will cover all of your needs.

Conclusion

The IT MSP Vendor space is filled with many sub-par providers that cannot cover the mission-critical services that alternative asset managers require. In a world where one mistake could cost your firm its reputation or paralyze your operations, it seems crazy to leave this essential operational risk under-serviced and exposed.

There is no one-size-fits-all vendor. Many of the best IT MSPs have focused their services in certain areas, so choosing the right partner that fits your firm’s unique requirements is essential. FinServ’s knowledge of the marketplace and our rigorous selection methodology ensure you get the provider and services your fund requires.

To learn more about FinServ Consulting’s services: info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

The Great Debate: Agile or Waterfall Project Management

Effective Project Management

Effectively managing a project and team(s) is a difficult task that faces increased challenges in a remote environment. Obstacles are exacerbated by the lack of in-person collaboration and the inability to stop by a colleagues desk for a quick and informal update. However, selecting the correct project management methodology can help alleviate numerous issues and ensure that your project is completed successfully.

Agile & Waterfall Methodology Overview

No project management technique is best suited for all situations. The most common methodologies are Waterfall and Agile. Although both approaches are popular and have been around for an extended period of time, specific projects are better suited by one or the other.

The Waterfall methodology is the traditional and sequential approach that is best for projects with a well-known scope likely to experience minimal change. Client input takes place at milestones as the project transitions throughout the various phases. In a Waterfall project management strategy, each phase must be completed prior to transitioning to the following phase. These phases are clearly outlined and define clear objectives that must be accomplished before progressing.

As indicated by the name, an Agile methodology is designed to accommodate change. Its iterative nature focuses on completing certain objectives by the end of a specified time period known as a sprint. Agile methodologies are well suited for projects with unclear initial requirements. The methodology prioritizes the most important aspects of a project and relies on continuous client input throughout the engagement. Deliverables are reviewed by the client and other applicable teams after their corresponding sprint.

Advantages of Each Method

The Waterfall approach’s numerous advantages derive from its structured nature. The first of which, is that it clearly defines all aspects of the project and ultimately increases planning accuracy and detail. Consequently, this approach aligns well with fixed price contracts and government entities. Furthermore, progress can be measured through the completion of each phase as opposed to a product backlog that hasn’t been addressed.

It is less reliant on client input because it is predominantly collected at milestones. This allows the client to take a hands off approach and focus on the day-to-day operations of their business. Finally, successful completion of projects managed with a traditional methodology ensures that all items are addressed and eliminates ambiguity.

One of the greatest advantages to the Agile approach is its flexibility. An Agile approach is particularly useful when the project’s timeline is strained because it prioritizes the most important features. The sprint structure aligns with Time & Materials contracts because sprints are predetermined timeframes that specify workload.

Additionally, constant client interaction augments quality via increased feedback, additional testing, and dynamic user requirements that account for evolving needs. The constant nature of client feedback allows for frequent modification of the product backlog. This is particularly useful for a technical client that wants to get a deeper understanding of the solution. They can work through their use cases and determine if their needs will be better served by an alternative route.

Disadvantages of Each Method

Although each method is effective in its own right, they are not without disadvantages. The Waterfall methodology requires a thorough understanding of business requirements prior to beginning. The Project Manager must have a clear sense of all client needs and initially account for them throughout the various phases. Scenarios where the client is unable to provide a comprehensive overview of the requirements may force the PM to “fill in the gaps” – which is far from ideal.

Another disadvantage associated with the Waterfall approach is the risk of a final deliverable that is not in line with client expectations. Given that the client is less involved in the process, they may be surprised by the end result. However, the traditional approach hedges against this with comprehensive requirements and periodic updates.

Agile method drawbacks tend to be associated with one of its strengths, frequent client input. It requires a significant amount of coordination and cooperation across multiple internal and external teams. While this is great in theory, it may be difficult in practice. Clients may not have the resources, interest, or expertise required for the Agile approach’s mandated involvement. This is especially relevant when the client outsources the work as they hired another firm to step away.

The adaptability of the approach leads to many changes in the project’s scope. These changes affect the project’s cost and timeline. Unfortunately, this is not feasible for certain clients and situations. Moreover, low priority items may not get completed within the original time frame due to a focus on high priority items.

Conclusion

In conclusion, both the Waterfall and Agile Project Management methodologies include pros and cons. In an ideal scenario, the project would be completed successfully regardless of the utilized approach. However, certain client types, engagements, and solutions are better suited by one of the two methods. It is critical that you discuss both options with the client and pick the one that they are most comfortable with. Many professionals blend the two techniques to benefit from each’s strengths while minimizing the drawbacks. Recent trends have increased popularity for Agile management, but it is beneficial to gather all available requirements as early as possible.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Securely Share and Work with Files in Salesforce

FinServ has partnered with a firm out of Germany to provide a seamless integration of SharePoint Online right in Salesforce. If you would like to see a demo, please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

The Nightmare Scenario you have to Avoid

Sweat is dripping down your brow and you have a queasy feeling in your stomach, it’s 2 o’clock in the morning and you are desperately trying to reach the person who your Investor Relations team accidentally emailed an investor (NAV) statement with the investor’s social security number in it. If you have shared a sensitive document with the wrong person, you know the sheer terror these moments can bring. We see the most sophisticated financial services companies in the world taken down by these types of mistakes all the time. Even if the email is retrieved the public relations fallout will likely cost you investors or in some extreme instances the shut down of your fund.

Given this risk, it is hard to believe that the majority of funds and other financial services firms are still not integrating their CRM systems with enterprise-level document management systems like SharePoint Online. At FinServ Consulting we work with 40 of the top 100 hedge and private equity funds in the world and very few of these firms currently use enterprise-level document management systems to protect their investor data.

The Quick and Easy way to Use SharePoint Online in Salesforce

Most Salesforce clients abandoned Salesforce Files a long time ago. Due to its lack of user-friendliness and severe limitations, Salesforce Files became one of the least-used features in Salesforce. At the same time, many companies have been moving to cloud-based office suites like Office 365 from Microsoft. With most Office 365 licenses, you get SharePoint Online for free. SharePoint Online is an extremely secure, cloud-based and feature-rich enterprise-level Document Management system.

Has anyone in your firm ever accidentally sent a sensitive document to the wrong client?

SharePoint Online has the ability to stop the recipient from opening that document even if they have already downloaded it onto their computer.

Inserting a Cloud-based Link to a SharePoint Online Document in Email

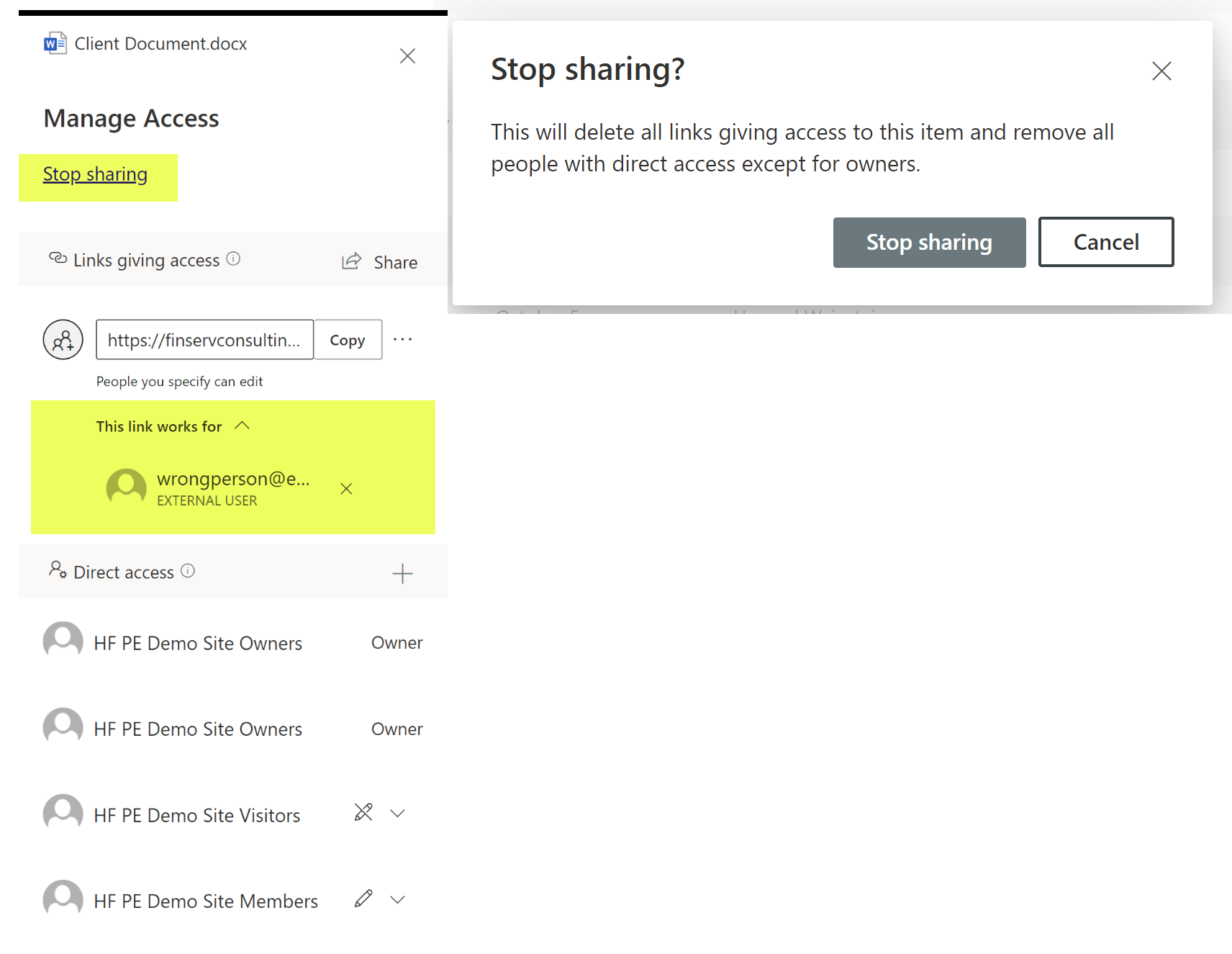

Removing Access Quickly

If you realize you made a mistake, you can stop the person from accessing the document you shared with just a couple of clicks. Even if they downloaded the document onto their hard drive, they will not be able to open the document thanks to Microsoft’s use of dual-key encryption. This means once you take away your side of the key, they can never open the document again.

2 clicks and access to the document is removed

Has anyone in your company ever accidentally or purposely emailed a file to an external recipient with Social Security numbers in it?

SharePoint Online with Outlook / Email integration means that you can stop any email or attachment from being shared if it contains sensitive info with PII (Personally Identifiable Information).

Particularly for highly regulated industries, like Financial Services and Healthcare, the built-in dual-key encryption and information rights management (“IRM”) features that SharePoint Online offers out of the box are “have to have’s”.

Microsoft PII Warning when Sensitive Data is Detected in a Document

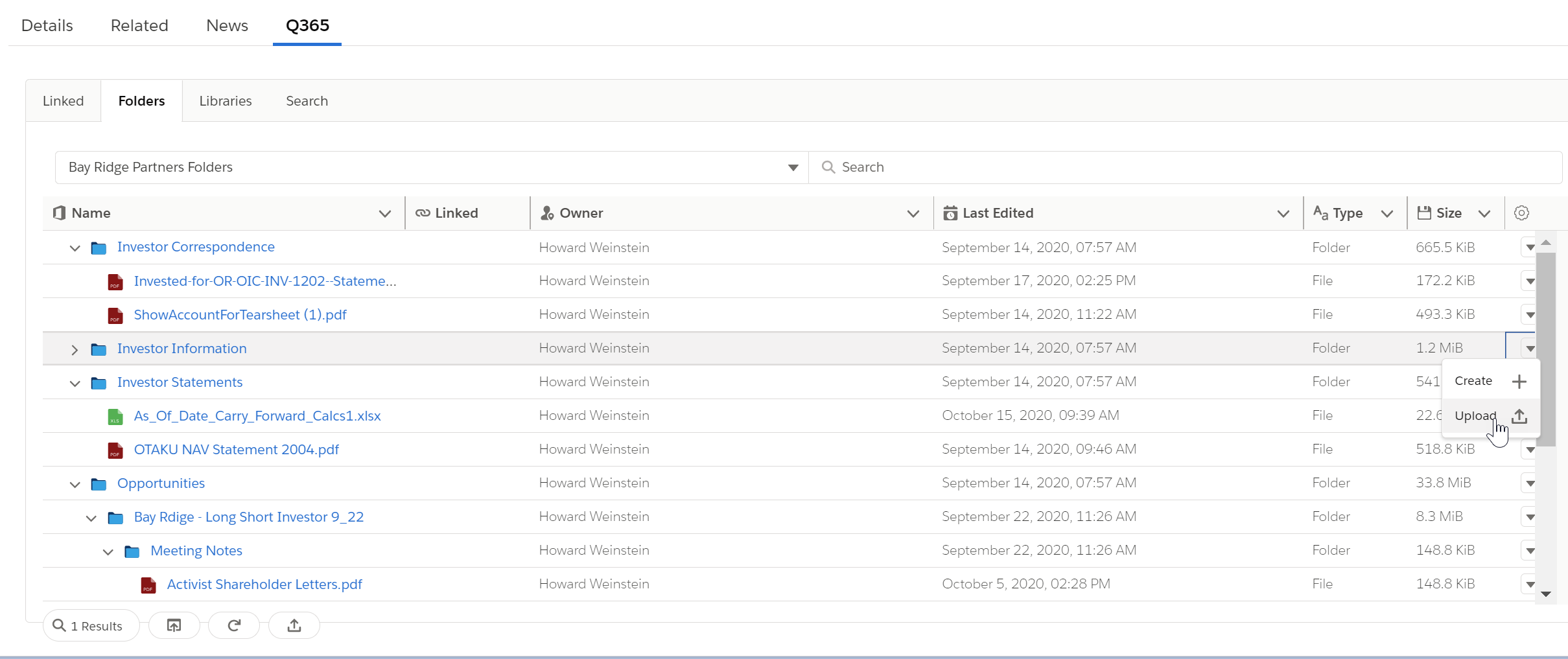

Seamless Integration with our Salesforce App

The application we helped build provides a seamless interface to all of your SharePoint Document Libraries and Files inside the Salesforce Lightning User Interface. The benefits of this application mean that your users will save hundreds of hours they used to spend searching through inconsistent folder structures and names or wading through multiple versions of a file to try to figure out which is the latest version of the file. By automatically linking the Files and Folders to your Salesforce records, you get your data and your files in one combined place to provide optimal efficiency for your team.

Through the application interface you get:

- 1-click to Open just about any kind of file so your team never wastes time with multiple clicks or waiting for a file to download before you can open it

- For Microsoft Office files where you have editor access, it will open up in the Office app in Editor mode

- You can upload files into the document library with 1-click as well

- You can also delete files if you have the correct access with 1-click

- Embedded search available right within the Lightning Component

Investor Relations Use Case

For our Alternative Asset Management clients, we offer the case study of the Investor Relations associate who often spends their day working with investors on questions. The ability to view the investor’s contact record while also looking at the investor’s latest NAV statement or recently updated subscription documents provides a level of efficiency that makes their day-to-day work much easier.

example of Investor Contact record with right sidebar of SharePoint Online Files

How the App Works

Putting the automated component into place is as simple as adding any Lightning Web Component; the interface offers quick and easy checkboxes to turn off and on key features in the application. Once added to any Object Type in Salesforce (standard objects or custom objects are all supported), the interface makes it simple and user-friendly to access your files and folders in seconds.

The quick and easy way to open SharePoint files right in Salesforce!

The application leverages advanced Microsoft technology to provide:

- Automatic creation of preset Folder and Subfolders that are automatically linked to the Salesforce record you just created or updated

- You can use the data in Salesforce to automatically name the Folder; this ensures a consistent naming scheme which will make it easy to find files

- For historical records, we offer automated scripts to create the Folder and Subfolders for all of your existing Salesforce records

Automatically Create a new set of SharePoint Online Folders and Link to your Salesforce Record with no Clicks when you create a New Salesforce Opportunity!

Conclusion

Using an Enterprise-Level Document Management system is a must-have for any company working in a regulated industry like Financial Services or Healthcare. SharePoint Online from Microsoft provides the most cost-effective and robust system in the marketplace. When you combine that with the Salesforce CRM system, you provide your users with a seamless and secure platform to work with customers while ensuring your company’s and your clients documents and data, including PII, remain secure.

The application FinServ has created with our partner provides the level of automation and seamless integration that your users demand and will also ensure they embrace the use of a Document Management system like SharePoint Online.

If you are interested in a demo or would like to purchase the application, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Technology Sets Its Sights on Private Equity

The evolution of technology and its impact across various industries has become widely accepted, particularly for Financial Services. However, Private Equity’s acceptance of new technology has lagged behind other subsectors. Resistance is subsiding as Private Equity Funds are rushing to adopt Client Relationship Management (“CRM”) tools, utilize unstructured data, and transition to the cloud.

Relationship Management

Success within Private Equity is reliant upon strong and enduring relationships that are difficult to manage without the proper infrastructure. Scattered data paired with a lack of centralized oversight can serve as a catalyst for inefficiencies that hinder deal execution and frequency. Efforts to combat the before mentioned issues have given rise to the popularity of CRM systems. Furthermore, numerous CRM solutions can be configured to streamline reporting and eliminate user error.

Although the absence of a CRM system can be detrimental to a firm’s success, a poorly configured system that fails to meet user requirements may be worse. Inadequate systems are generally accompanied by a lacking implementation partner that failed to assess the organization’s needs prior to vendor selection. It is crucial to enlist the services of an experienced implementation partner that has “been there, done that”.

FinServ has successfully implemented CRM solutions for countless Alternative Asset Managers and Financial Institutions. Not only are we a Salesforce Partner, but we also have significant experience with other industry CRMs such as Backstop, Clienteer, and Dynamo. FinServ can walk you through the entirety of the process by gathering business requirements, managing the implementation so you can focus on your business, and tailoring the solution to facilitate your unique procedures.

Data Utilization and Analytics

We are in the golden age of data and organizations are eager to leverage as much of it as possible. Unfortunately, sourcing data from a variety of locations often leads to a lack of uniformity and an assortment of issues. Private Equity firms are implementing robust analytics and data science for Transactional Due Diligence, Post-Investment Value Creation, and more. The application of data science within Transactional Due Diligence is exceptionally groundbreaking as perspective buyers are often subjected to tight timeframes of approximately 6 weeks.

Business Intelligence, Data Science, and Machine Learning allow Private Equity firms to conduct real-time analysis and assess billions of data records in a limited amount of time. Granular post-investment analysis can be attributed to geography, customer type, and more. The segmentation of the data enables a comprehensive understanding of the business. Thus, augmenting the Private Equity firm’s ability to perform the focused improvements that are central to their business model.

Exhaustive analysis of the fund’s overarching portfolio and individual companies hinges upon access to structured data. FinServ has the extensive Business Analysis and Operational Assessment experience that is required for structuring processes and data accordingly. We will partner with your organization to remediate operational issues while integrating innovative technology.

Transitioning to the Cloud

Cloud utilization is rapidly increasing as stigmas against housing data in off-premise locations have eroded. Private Equity firms are realizing the significant benefits provided by transitioning their data to cloud environments, SaaS, and IaaS locations. Migration allows firms to focus on their core competencies rather than hosting data. Cybersecurity is a predominant concern that will be alleviated by outsourcing a portion of the responsibility to an organization that exclusively focuses on housing internal and client data. Safeguarding this sensitive information is required for client safety, firm reputation, and regulations such as GDPR.

One consideration that may be inhibiting your organization’s migration to the cloud is the massive undertaking of doing so. FinServ has honed our data migration expertise through 15+ years of working alongside more than 40 of the world’s top 100 Hedge and Private Equity Funds. Communication is emphasized throughout our engagements and we will partner with your organization to ensure a proper and efficient transition. Furthermore, FinServ will take the opportunity to streamline processes and eliminate bottlenecks that have been hindering your business.

Even though Private Equity has been slower to adopt new technologies than other Alternative Asset Managers, the industry has begun to align with key initiatives offering indisputable benefits. The implementation of superior technologies like CRM systems, Cloud infrastructure, and the utilization of data for advanced analytics supplements competitive advantages and investor returns.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Prepare for the New and Remote Workplace

COVID-19 abruptly forced many financial institutions into a remote staffing model without the slightest inclination of its duration. Barring the infrastructural challenges, many employees have enjoyed the elimination of commuting, comfortable attire, and flexibility. The mandatory adoption of working from home will have significant implications for the daily trips to the office that were once the norm.

An Operational Assessment of your firm’s technology and procedures will identify issues that will be exacerbated by a sustained virtual workplace and provide insight into four verticals: Planning, Security & Controls, Collaboration, and Client Interaction. It is important to perform an exhaustive analysis of your firm’s technology and procedures to identify issues that will be magnified by a remote model.

Planning

The importance of planning is one of the few constants in today’s erratic climate. Many organizations are creating management teams and enlisting the assistance of third-party specialists to navigate these tumultuous times. Creating a specialized team will enable flexibility, establish accountability, guide the implementation of new technologies, and mitigate risks.

Security

The sensitivity of client data within financial services results in security being a predominant concern. One particular issue is numerous employees accessing company information with wireless networks beyond the organization’s control. The combination of unsecured networks and increased attacks from opportunistic deviants poses significant risk to financial institutions and their clients.

Furthermore, cybersecurity teams’ impeded ability to respond may affect their capacity to remediate issues in a timely fashion. Many teams are accustomed to face-to-face collaboration and/or additional resources that may not be available when working from home. Prevention is the best defense and can be achieved by conducting a detailed assessment of your firms processes and systems.

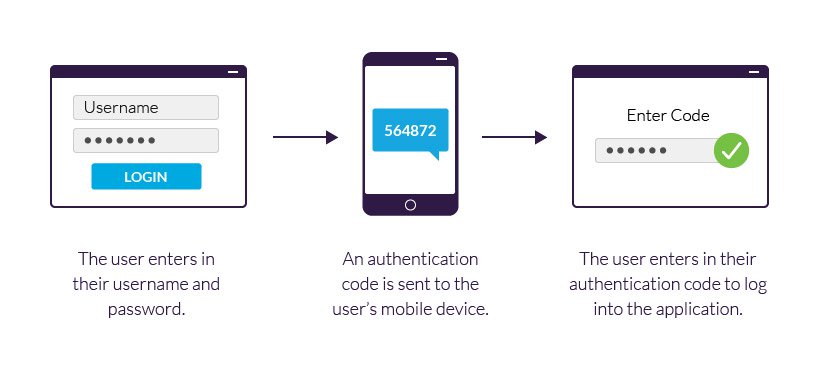

Establishing procedural controls and maximizing the native features of current technology will enable your company to stop attacks before it is too late. An effective defense for eliminating external access to company information can be as simple as utilizing 2 Factor Authentication or modifying a monthly process.

Collaboration

Collaboration is a major concern that inhibited employer’s from implementing a remote workforce prior to the pandemic. The recent success of remote work has assuaged worries and has even led banking heavyweights such as JPM and Barclays to consider the implementation of remote teams and/or rotational models. Rotational models are particularly attractive because they reduce fixed costs while balancing the benefits of in-person and entirely remote staffing models.

The short-term success of a virtual workplace will not persist if institutions fail to align their technology and operations accordingly. Video conferencing has emerged as the predominant medium for establishing virtual connections but has unfortunately been accompanied by a series of growing pains.

The sheer volume of concurrent employees leveraging the video conferencing system often overloads the solution if it was configured for a lower number of users. Additionally, various teams utilizing different platforms may result in access issues. Mass collaboration can be facilitated through the implementation of a uniform video conferencing system such as Microsoft Teams or a sophisticated document management system like SharePoint.

User error caused by a lack of sufficient training and limited employee access contributes to bottlenecks that can be easily avoided by partnering with an experienced implementation partner. Although the days of side-by-side spreadsheet collaboration may be behind us, teamwork can be augmented with the use of platforms such as Microsoft’s SharePoint. Multiple users can simultaneously work on the same file while SharePoint maintains versioning, audit trails, and an assortment of security features that protect sensitive data.

Client Interaction

Successful client interactions are dependent on thorough and frequent communication. The investment industry has recently experienced a level of volatility and uncertainty that makes communication more important than ever. Asset managers and financial institutions must have the necessary operations and technology to efficiently communicate and protect information that has traditionally been delivered in person.

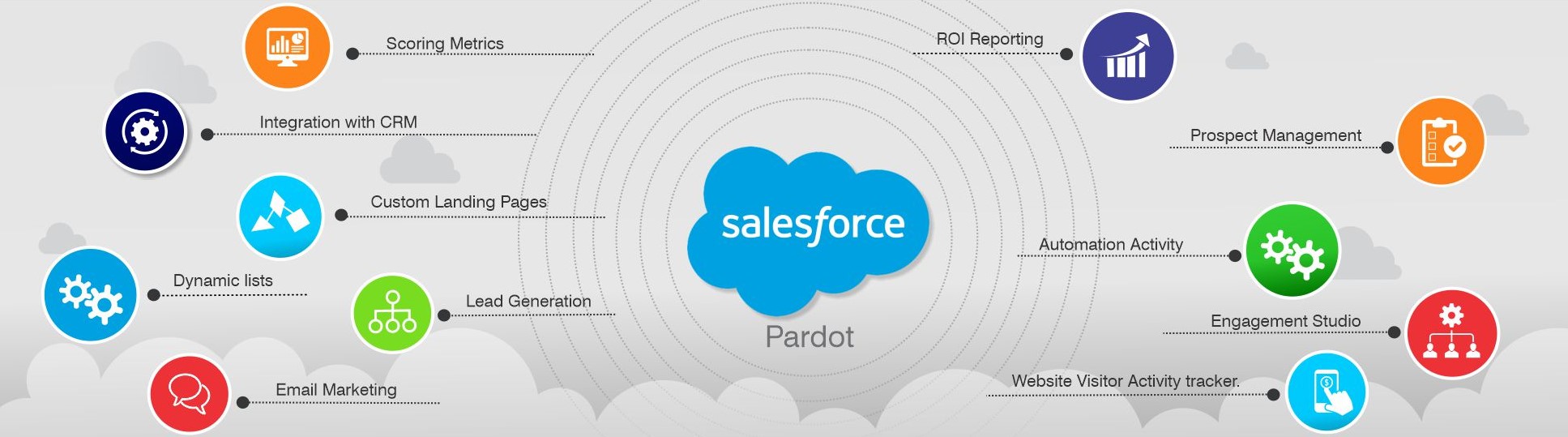

A popular solution for the mass distribution of content among Salesforce users is Pardot. Pardot is a marketing automation tool offered by Salesforce that boosts communications with potential and current investors. Moreover, it is important to evaluate CRM solutions such as Backstop, Clienteer, Dynamo, or Salesforce to ensure that your team is maximizing their functionality.

The unexpected transition to remote work was a daunting task that will have lasting impacts throughout the financial services industry. Organizations must align their processes and technology if they desire a seamless changeover. Technologies such as Microsoft Teams & SharePoint, an Operational Assessment, and a dedicated Management Team are likely required. FinServ has served as a trusted advisor to the world’s leading Asset Managers & Financial Institutions for more than 15 years and is the ideal partner for facilitating this conversion.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Intelligent Business with Power BI

In order to understand the capabilities of Power BI, it is best to start with the fundamentals of Analytics & Business Intelligence (“ABI”) and data visualization. The combination of ABI and data visualization allows Power BI to articulate information in a digestible manner that is supportive of intelligent decision making.

ABI tools are user-friendly data management platforms that emphasize self-service and provide analytical functionality ranging from data preparation to insight generation. Business Intelligence (“BI”) leverages historical information while analytics employs modeling and statistics to anticipate future events. Generally speaking, BI is focused on what happened, and analytics is focused on why it happened.

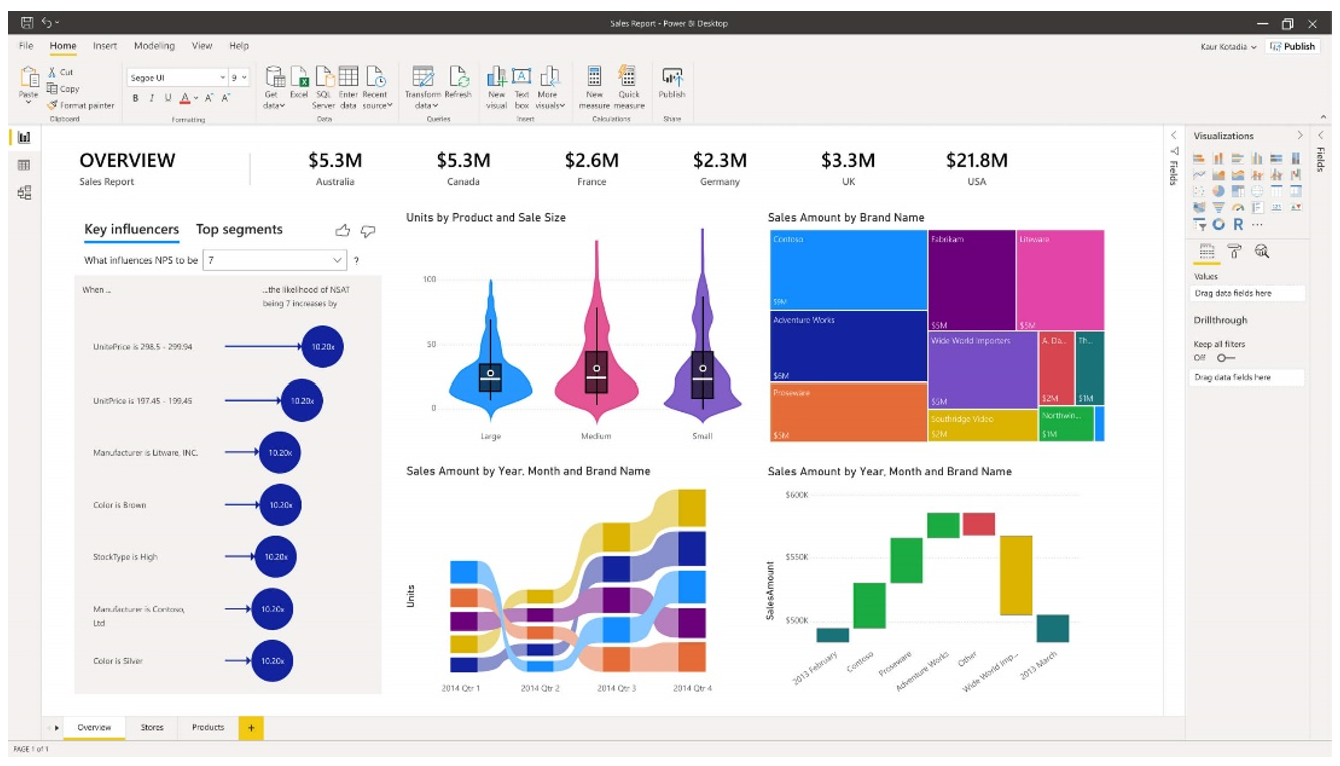

Data visualization is the presentation of information through graphical mediums like charts, diagrams, dashboards, and more. Dashboards are an amalgamation of components designed to inform stakeholders in an aesthetically pleasing manner like the sales dashboard below. The goal is to provide an informative platform that is far easier to comprehend than traditional resources such as a spreadsheet with thousands of rows.

Power BI and Its Key Features

Power BI is a business intelligence solution that enables companies to draw organizational insights by using data visualizations, performing analytics, connecting to hundreds of data sources, and embedding content into external applications & websites. An additional benefit enjoyed by users on the Windows platform is its seamless integration with the Microsoft suite. In summation, Power BI allows users to connect, prepare, model, and visualize data.

Power BI incorporates numerous features (illustrated above) that assist in the analysis and comprehension of a business. Three particularly impressive features included in Power BI’s repertoire are Natural Language Generation (“NLG”), Automated Insights, and Advanced Analytics. NLG uses artificial intelligence to automatically produce rich text descriptions detailing outputs. Automated Insights are conceived from advanced algorithms and are a great way to initiate analysis on large data sets. While the initial analysis generated from Power BI can provide direction for additional research and evaluation, other factors may be sufficiently analyzed within Power BI without the need for further investigation. Advanced Analytics can be performed with Power BI’s internal ABI platform and/or by integrating with external models. Azure Machine Learning Studio’s drag and drop interface can be combined with SQL and R to conduct predictive analytics on data sets.

Subscription Options and Functionality

The three versions of Power BI are Desktop, Pro, and Premium. Desktop, the lowest-tiered option, can be downloaded from the Microsoft Store for free. It includes the core data visualization and analysis features; data preparation, reports, dashboards, connection to over 50 data sources, and the ability to export in various formats.

Pro includes all of Desktop’s functionality and can be purchased as a standalone product for an annual subscription of $10 per user license per month or as part of the Microsoft Office 365 Enterprise E5 suite. The enhancements differentiating Pro primarily fall under collaboration and the distribution of content. For example, users can share their insights by embedding visuals within applications such as SharePoint and MS Teams. Furthermore, users can leverage peer-to-peer sharing to distribute their work to external stakeholders with Power BI Pro licenses.

Premium, the most advanced offering, comes at a hefty annual subscription that breaks down to a monthly price of $4,995 per dedicated cloud compute and storage resource. Some distinguishing characteristics that amplify data analysis include enterprise level BI, cloud & on-premise reporting, dedicated cloud computing, and big data analytics. Other features that are included in Power BI Premium are increased storage, higher refresh rates, and a larger data capacity. Premium grants enterprise-wide access and is best suited for large organizations with significant business intelligence requirements.

Implementing Power BI in Financial Services

Power BI has countless applications for alternative asset managers and other financial services companies that span the front, middle, and back office. One of Power BI’s most popular functions is financial management and reporting. QuickBooks Online customers can utilize a preconfigured Content Pack that allows them to quickly construct financial statement dashboards. Users are immediately provided with functionality that comprises customer rankings, profitability trends, and various financial ratios.

Implementing and tracking KPI’s with Power BI allows investment managers to accurately evaluate operations. Best practice is to have KPIs spanning the front, middle, and back office because an unidentified issue in any of the three areas can be detrimental. A few prevalent KPIs are Investment Management Fee Revenue as a Percentage of AUM, Trade Settlements per Back Office Employee, Subscriptions vs. Redemptions, and Trade Error Rate by Asset Class.

Business intelligence can be applied to portfolio management by connecting Power BI to the underlying data sources detailing investments. For instance, asset allocation reports and dashboards allow fund managers to interpret the distribution of funds relatively easily. Another prominent application of Power BI is treasury & liquidity management because data visualizations can be developed to provide detailed breakdowns of cash management, FX hedge balances, and more.

Conclusion

Power BI is a powerful ABI platform that augments a business’s ability to consume data through the creation of interactive reports and dashboards. Business intelligence can be constructed to support any business function with enough data. More importantly, it can be configured to the firm’s unique needs and has the ability to adapt with dynamic business requirements.

FinServ has acquired deep industry and technological expertise through the completion of over 600 engagements at more than 40 of the top 100 Hedge and Private Equity Funds. FinServ can configure Power BI to accurately monitor operations, identify the correct KPIs, properly document business processes, and seamlessly integrate new technologies with existing infrastructure.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Salesforce Spring 20 – The Top 5 Features to Deploy in your Company Today

As with most Salesforce releases, the Spring 20 release which came out for most Salesforce users last week is full of some great new enhancements and features to the system. In this article we will highlight a few of the items we think will be most useful to Asset Managers and Financial Services companies. If you would like more insight into these updates and how to implement them please feel free to contact us at info@finservconsulting.com or by completing our Salesforce inquiry form

# – 1. Lightning Extensions for Google Chrome Browser

Click here to access extension for Google Chrome

This first feature applies to anyone who uses the Google Chrome Browser only. Now you can install a Google Extension called the Lightning Extension that provides 3 new features. The most useful of these new features is the Component Customization feature which will allow your users to toggle on and off sections of their Page Layout. If there is a section that is never used or if the user wants a streamlined view, they can now quickly make any section invisible on their screen and can toggle it back on if needed.

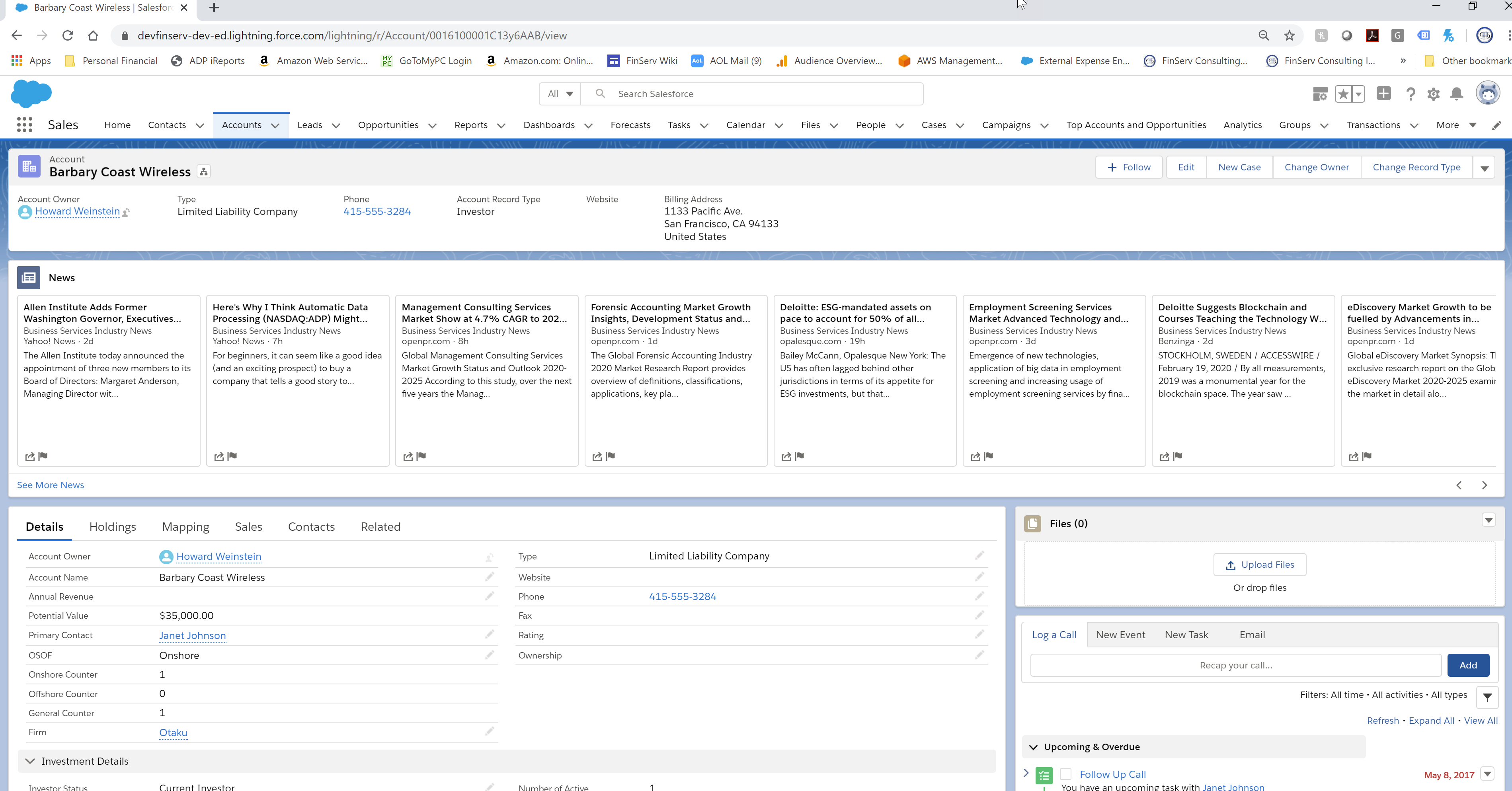

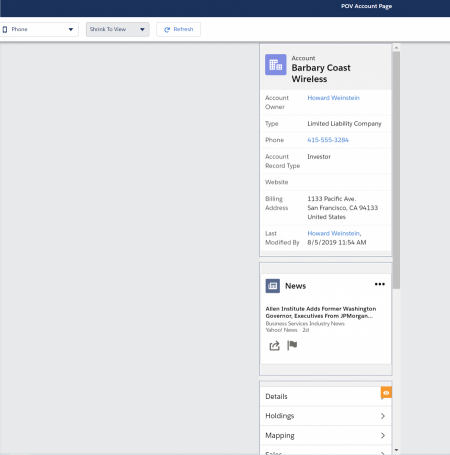

A great example is in the Account Barbary Coast Wireless — we often want to see the latest activity with the client but the File section is taking up the screen so the user can’t quickly see that section right away.

Account Page before enabling new Component Customization

By quickly using the new feature, you see which sections will be hidden (see how its done below)

When you click on the Component Icon the screen will grey out and you will see the components and you can select as shown in the screenshots which ones you have chosen to hide

There are two other less impactful features in this release. One is Dark Mode which is meant to be easier on the eyes when working at night, for instance, and renders the background black. The second is Linkgrabber, which opens every single link you click on in a single browser tab, similar to how the Sales Console works for people who like that feature.

#2 – Lightning App Builder for Mobile

Salesforce has started to push out a real difference maker with their Mobile application, which is increasing the functionality gap between Salesforce and other industry CRM’s like Backstop and Clienteer. For those who have become used to the Lightning Page Builder for the desktop, you will be overjoyed to know that the Page Builder for the Mobile Device has now become General Availability. You can now drag and drop and setup the layout of your pages for your Mobile Device as easy as you would on a desktop. The cherry on top with this feature is the ability to differentiate the layout by device so for smartphones with limited space you can intelligently decide which layouts and features are included in your page setup.

The familiar App Builder with the New Form factor Option to Customize the Layout for any Smart Phone

With the new Phone view you get to see the dynamic layout that the user sees on their smartphone.

You can see that the layout is automatically adapted to your phone screen’s dimensions providing a fully responsive experience that Backstop and Clienteer can’t even dream about.

The Filter by Device lets you decide not to show certain components like graphs that may be too big to effectively be viewed on a mobile device.

The below screenshot shows the intuitive and easy to use filter to exclude large components from the phone options

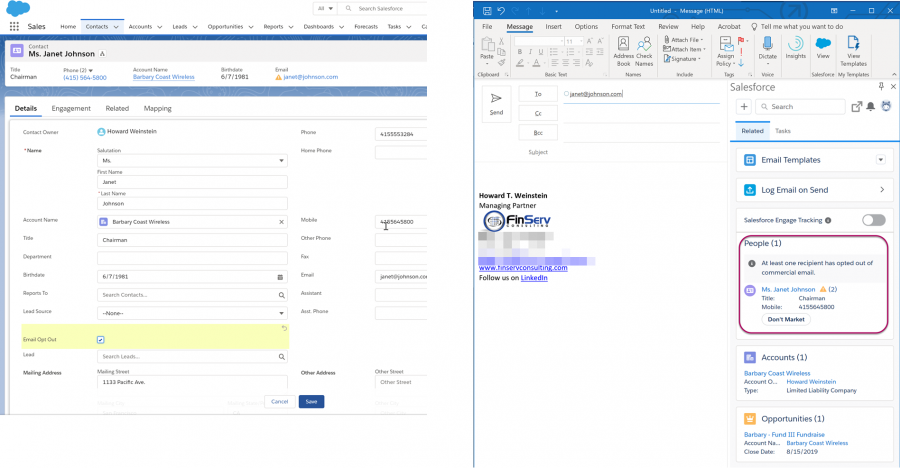

#3 – Email Integration / Opt Out Shown Right in Sidebar

For those who are extensive users of the Lightning Salesforce plugin for Outlook and Gmail, you will love the new feature which highlights when a contact has opted out of emails right in the Salesforce Outlook sidebar.

In the before screenshot below you see Janet Johnson’s contact info showing under People

The first screenshot below shows Janet’s contact record which is updated in Salesforce to indicate that she has opted out of email. You can see in the 2nd screen shot the resulting clear warning — anyone who tries to write Janet an email will see that she has opted out of email. This keeps sensitive investors and investor representatives from getting upset with your sales and marketing teams!

#4 – Report Filtering by Other Fields on the Report

The Spring 20 release has several new features in Reporting. Once of the most useful additions is the ability to add filters to the report that compares other fields on the report.

For example, this can come in very handy if you wanted to compare an Investor’s NAV in an older fund vs. their NAV in a current fund. In my example, the fund has 3 funds and I filtered on the Investor’s whose NAV in Fund III is greater than their NAV in Fund I. The original report had 17 Records but this filtered report just shows the 11 Investors who meet the refined criteria.

The screenshot below shows the user friendly filter screen with the new option to choose the filter type of Field instead of a literal value

#5 – URL Links with Prepopulated Values (not for mobile app)

This next item is one of those features advanced users loved in Classic that was lost in Lightning during the transition. Thankfully, Salesforce has been working diligently to bring back the most popular features to Lightning as Classic is very close to its end of life.

This feature allows you to create a URL link that includes prepopulated values for any field in the object, which will save time when creating a new record. For instance, if your Sales and Marketing teams are at an Investor roadshow and they are meeting new Investors, they will want to create new Contacts quickly since there are often many fields that are always the same entry in a Contact. By creating a clickable URL link to start the new Contact from the Account Page for the Investor, the new Contact can be prepopulated with as many of the fields as you want. Some of these may be placeholder values, while others are real values that never change but previously had to be manually entered or selected.

The syntax to set this up is a bit tricky so we recommend you seek help from us or your IT department if you are not experienced in HTML as you need to create a query string and place the field name and the value you want entered separated by a comma. You use lightning/pageReferenceUtils module to build navigation links that prepopulate a records’ create page with default field values. Prepopulated values can accelerate data entry, improve data consistency, and otherwise make the process of creating a record easier.

How: To construct a custom button or link that launches a new record with prepopulated field values, use this sample formula:

/lightning/o/Account/new?defaultFieldValues=

Name={!URLENCODE(Account.Name)},

OwnerId={!Account.OwnerId},

AccountNumber={!Account.AccountNumber},

NumberOfEmployees=35000,

CustomCheckbox__c={!IF(Account.SomeCheckbox__c, true, false)}

Link to New URL Link Description

Conclusion

As you see there are many exciting features included in Salesforce’s Spring 20 release. FinServ Consulting, a top Salesforce Partner with a focus on the Asset Management sector, ensures our clients take advantage of the most important features and maximize their investment in Salesforce.

If you are interested in any of these features and want help implementing them or just have a question about them, please contact us here or by email at info@finservconsulting.com and we would be happy to help.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Increasing a Fund’s Operational Effectiveness through Cloud-Based Document Management

Introduction

In the world of Private Equity (“PE”), document management is critical because it ensures that the legal parameters for deal documents are followed and guarantees that the details related to specific investments are captured. These documents can be very complicated, often requiring many rounds of review and there are many comments and changes to these agreements before the ultimate terms are finalized. Efficient document management is challenging and often leads to technological and operational issues for our Private Equity clients. The sensitive nature of these documents means that members of deal teams have several security-related priorities in mind when it comes to managing these classified documents. Those priorities include:

| Virtual Access to Files | Accessing the latest version of a file through a secure system and syncing updates back to all users in real-time for seamless collaboration |

| Access Control Options | Reporting, monitoring and modifying the viewing rights of authorized users. |

| Information Rights Management | Limiting the ability to print, forward via email, or copy documents based on the specific security rights of a particular user or a pre-defined group of users who are accessing the document. |

| Time Based Restrictions | Functionality such as removing a user’s access to a document once a deal has concluded, or providing a guest user access to a document that expires in a specified amount of time (e.g. one week’s time). |

In addition to deal teams, many other groups within PE firms can also benefit from the features of a document management system. These systems have proven to provide user friendly and feature rich platforms to support regulatory or business driven requirements. The table below offers some key examples in the alternative asset management industry:

| Stakeholder | Business Need |

| Investor Relations | When working with administrators on items such as investor letters, iterative updates result in numerous versions of drafts.

Investor Relations could be better equipped to track and manage the various changes to these letters with the help of a more effective document management system that handles version control in an automated fashion. |

| Compliance | Typically, after a deal is closed, all sensitive deal documents are required to be archived in a library with read-only access for a specified period.

In the past, PE firms maintained physical file rooms for this purpose. Now with the convenience of cloud storage, the creation of virtual file rooms has replaced traditional storage methods. |

| Deal Teams | The process of using Intralinks to create a deal room for documents during a deal phase to share with respective external parties can be significantly simplified.

A cloud-based solution makes it easier to share information with outside stakeholders by granting specific access to folders in a repository without creating duplicate copies of documents that can become out of sync. In addition, the document management systems improves the audit trail by providing full visibility to the access and version history of each document. |

| Legal | The inherent functionality of document management systems including SharePoint Online that supports e-discovery ensures your legal team is compliant with retention policies and any requirements related to possible litigation in the future.

In addition, version control ensures that as your legal team iterates through versions of documents they can maintain all document history and easily compare different versions or revert to an older version if needed. |

| IT | IT departments often bear the responsibility of administering access and security rights within an organization. As such, they must ensure that groups of users in one business area obtain access that is separate from those in another function, whether it be the Deal Team, Legal & Compliance, Outside Directors, Administrative Assistants, Finance & Accounting, and so on.

The features in today’s document management systems have made the creation and maintenance of these individual and group rights far easier and integrated directly with the core security of your whole IT infrastructure. |

| Finance | The Finance departments must interface with all groups within private investment firms. When the financials are finalized, this typically allows the marketing, PR and portfolio managers to proceed with various tasks in their respective groups. If numbers change this can have a cascading impact which can lead to data integrity issues and critical errors.

Document management systems allow Finance to centralize documents and shares their calculations centrally in respective work papers with all other groups, this can eliminate re-work or embarrassing and costly mistakes. |

SharePoint Online from Microsoft

Thankfully, Microsoft has provided the ideal platform with SharePoint Online to address all of these needs and more. Deal teams and their related parties can stay connected whether working on the road, from home, or at the office.

For Private Equity users, the streamlined document management process facilitates collaboration between cross-functional groups, as well as members working in different geographic locations. SharePoint Online can also be accessed through a set of convenient mobile applications, meaning that critical files are never further than one’s smartphone or tablet.

Since SharePoint Online is a cloud-based product included in the Office 365 suite, it is closely integrated with other Microsoft Office applications, allowing users to manage documents and collaborate seamlessly while sharing and protecting sensitive information. The integration of SharePoint Online with other Microsoft Office applications—such as Teams, Excel, Outlook, and the rest of the Office suite of product results in a consistent user experience that simplifies how people interact with content, processes and business data.

People who have not used Microsoft SharePoint recently may not be familiar with how Microsoft has transformed the platform into an Enterprise-level Document Management system. SharePoint now has features and functionality that rival or surpass any Document Management system available in the marketplace. The fact that SharePoint Online is fully integrated with Active Directory and Azure means that your IT staff does not have to do a lot of additional work to fully integrate robust security into your Document Management System setup which has a huge advantage in terms of time to go live on the platform.

SharePoint Benefits

The SharePoint Online platform features many key benefits for users and introduces new functionalities with each release. All organizations strive to increase productivity, and having a tool like SharePoint in place can make all the difference. The features and functionalities offered through this tool directly achieve these efficiencies and help reduce costs. In fact, a 2016 study of ECM (Enterprise Content Management) applications by Nucleus Research found that investing in a system such as SharePoint Online, generates an average return of 750%. Below are some of the key benefits and their direct application to the Private Equity world.

| Feature | Functionality | Application in Private Equity |

| Price Point |

|

|

| Security Feature: Mobile Device Management (MDM) |

|

|

| Versioning |

|

|

| Cloud-Based Platform |

|

|

| Collaboration Tools |

|

|

| Retention Policies |

|

|

Conclusion

Effective document management is critical to Private Equity firms who have a constant stream of time-sensitive deals in their pipeline.

SharePoint Online is an invaluable aid to these firms because it supports necessary functionality with out-of-the-box features such as: collaboration, security, accessibility, and integration with other Office applications. Implementing a Document Management solution is not a simple project and many companies fail in this effort because they are not familiar with the most critical components. An experienced systems integrator like FinServ Consulting will be able to navigate through these challenges and ensure the project is managed successfully.

FinServ understands the Private Equity and alternative asset management industry and from this unique expertise we know how to integrate the most critical industry-related features and functionality of SharePoint Online. SharePoint’s benefits are not limited to the deal team, rather the whole firm can experience increased efficiencies and additional benefits from this impressive platform.

To learn more about FinServ Consulting’s Enterprise Content Management and Document Management expertise, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Enabling the Mobile Workforce in the Alternative Asset Management Industry

It is estimated by the International Data Corporation (IDC) that the number of U.S. mobile workers will rise from 96.2 million in 2015 to 105.4 million in 2020. By the end of 2020, IDC expects mobile workers to account for 72.3% of the total U.S. workforce.

With the technological advancements and proliferation of smartphones and cloud-based applications, the way we work is rapidly changing. The workforce is no longer tethered to the traditional PC or to the confines of a physical office, creating a truly virtual work environment. It is estimated by the International Data Corporation (IDC) that the number of U.S. mobile workers will rise from 96.2 million in 2015 to 105.4 million in 2020. By the end of 2020, IDC expects mobile workers to account for 72.3% of the total U.S. workforce.1

Asset managers are in a great position to take advantage of this trend, as their workforces are especially mobile for several key business reasons. Fund executives and support personnel frequently travel to different financial centers and investor locations to attend investor roadshows, industry events, sales meetings, board meetings, etc. It is critical that these employees have remote access to the firm’s systems, data, and documents in real-time while being updated by coworkers.

The Challenge

While all these leaps in technology are great, the move to the mobile workforce has created a conspicuous weakness in the infrastructure of many of the world’s most influential asset managers. Many funds are only now shifting their focus to cyber security for their mobile devices. As the mobile workforce multiplies, so too will cyber-attacks on the mobile device and on your workforce. With many funds allowing their employees to Bring Their Own Device (“BYOD”) to work, the challenges are even greater.

Cyber criminals target security weak points and the mobile device is a prime target. In 2016 alone, 36,601,939 records were exposed due to a data breach.2 Allowing your team to access your data while working remotely can create a real security issue if your infrastructure is not set up correctly to protect against the most sophisticated hackers. In today’s environment, you need to follow where the work is being done and empower your employees to do so. At the same time, the firm and its investors must be protected at all costs.

Are you willing to risk your fund’s future by putting your investment data, and your client’s data at risk? In 2015, the Global Cost of Cyber Crime was Estimated at $315 billion dollars.3 The monetary damages in the form of actual money stolen or fines levied by the SEC is quantifiable at a point in time and can be managed. The damage to your fund’s reputation is not fully quantifiable, and the fallout would be nearly impossible to manage. Loss of investor faith will cripple your ability to raise new funds and would likely lead to a flood of redemptions. There are two clear opposing issues here:

- The protection of your firm’s data at all costs, and

- The need to ensure that your team can operate as efficiently as possible while they travel.

Consider the scenario where your Head of Investor Relations travels abroad to meet potential investors from a sovereign fund. Is your company secure enough to prevent a data breach or prepared to take action if one of these events occur?

- The employee’s phone with company apps or data is lost or stolen.

- Your company’s email or CRM system is accessed through an insecure or jailbroken phone with a known security vulnerability.

- The employee saves a file attachment received via company email to the hard drive of a PC at a hotel business center and does not delete it.

- The employee accesses company data over public Wi-Fi that is inherently not secure.

Many firms are limiting what their travelling executives can access while they are on the road, or requiring them to remote in through limited access protocols like VPN or Citrix. The main question is, can any fund afford to limit what their Head of Investor Relations can access while they are on the road, at meetings with key investors? Maintaining this productivity could be the difference in securing a new Investor for your fund.

The Solution

The good news is that these and many other threats can be handled with the right security package and many are available in the marketplace. In Gartner’s 2016 Magic Quadrant for Enterprise Mobility Management Suites report, these security packages are recognized as Enterprise Mobility Management (“EMM”) products. EMM products provide a comprehensive security package that secures your firm on all data entry points while enabling employee work mobility.

Microsoft Enterprise Mobility Suite

FinServ Consulting has found that Asset Managers are primarily Microsoft-centric in that their infrastructure is Windows based, their productivity suite is Microsoft Office, and their email is on Outlook. With the core systems using Microsoft products, Microsoft’s Enterprise Mobility Suite (“EMS”) security package is a natural fit for these organizations.

Microsoft’s EMS product consists of several components acting together to leverage Microsoft technologies to form a more comprehensive framework (as shown below) to protect your organization’s data while providing employee mobility.4

| Microsoft Solution | Key Features | Description |

| Azure Active Directory Premium |

|

Microsoft’s Mobile Identity Service, with Single Sign-On (SSO) enabled will require you to sign in only once. Once you log into your Windows account, you will be authenticated through to the rest of your applications such as Office, Salesforce, and Dropbox. Remembering or having to create multiple passwords with varying security requirements — like special characters, uppercase letters, numbers, password length — is replaced with 1 secure password to remember. |

| Intune – MDM |

|

Intune Mobile Device Management (MDM) enables your mobile device to work on your company’s network without the need for VPN, Citrix, or other cumbersome remote technologies. MDM ensures that your mobile device is authorized and meets security requirements (e.g. device has not been jail-broken). MDM ensures that if your device is lost or stolen, the device can be wiped (data and applications erased remotely). If a person has left the firm, the wipe can be selective, erasing only company data and leaving personal data (such as personal emails or photos) intact. |

| Intune – MAM | Secure Office Apps on Your Phone or Tablet |

Working on your mobile device will most likely entail needing access to your Microfost Office apps such as Outlook, Word, or Excel. Microsoft’s Intune Mobile Application Management (MAM) is currently the only service that can manage and enable mobile access to Microsoft Office applications. |

| Azure Rights Management Premium |

Secure File Content Information Rights Management (IRM) |

Microsoft’s Information Protection SErvice provide Mobile ocntent management functinonality tha twill protect you and the firm by protecting the files on your divce. |

Conclusion

Microsoft offers a full EMM security platform that will support your organization today and tomorrow. As the mobile workforce continues to transform the way your employees work and interact with your firm’s data, it is critical to keep the mobile workforce productive and secure your firm data. Microsoft’s EMS is a comprehensive security package that offers a tight integration with the Microsoft family of products that competitors cannot match. FinServ is a Microsoft certified partner. To learn more about FinServ Consulting’s Microsoft and Enterprise Mobility Suite expertise, please contact us at info@finservconsulting.com or (646) 603-3799.

References

(1) IDC Forecasts: U.S. Mobile Worker Population to Surpass 105 Million by 2020

(2) Identity Theft Resource Center: Working to Prevent Internal Data Breaches

(3) Financial Times: Asia hacking: Cashing in on cyber crime – Attacks cost Asian companies $81bn last year. The region is even more vulnerable to new scams

(4) Microsoft: Enabling mobile productivity for iOS, OS X, and Android devices at Microsoft

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How to Use Microsoft’s Power BI to Create Powerful Reports & Dashboards with Little or No IT Support

Business users often struggle to produce reports and conduct analysis without the dependency on their IT team. One of the main reasons is because the users depend on IT to provide the data from many different sources or transform the data in a way that makes it easy to use. Most clients we talk to, say they spend a lot of time waiting for reports from their IT team and this can be frustrating at times. The delays are usually because the IT team has an endless list of user requests and systems projects and often understaffed. The end result is that asset manager’s ability to produce timely reports for key operational purposes or investor inquiries is poor. Leveraging Business Intelligence tools is the way to break this ugly cycle, and enhance your fund’s responsiveness to information requests while also enhancing your reporting with rich and powerful analytics, with little or no IT support.

Microsoft saw the marketplace of Business Intelligence, as a natural extension of their ubiquitous office suite and industry leading SQL Server and Access databases. Microsoft’s entry known as Power BI is one of their latest tools they have rolled out in alignment with Office 365, their cloud-based set of office applications. Power BI has both, a cloud-based and desktop version to support business users in producing powerful visual reports and dashboards from just about any type of data source. The real value of Power BI is that it makes 1) Extracting, 2) Transforming, and 3) Visualizing / Sharing Data something that a business user can accomplish with, little or no support from their own IT team

Extracting Data

Power BI has pre-built connectors to highly popular data sources Salesforce.com, Google Analytics, SharePoint, Facebook and many other cloud-based systems. These connectors make pulling data from these sources as easy as running through a set of intuitive wizards. In addition, Power BI allows users to pull data from the world’s number one data application, Excel. In addition to Excel, Power BI can also pull data from just about any standard file type like txt, csv, and xml just to name a few. Power BI can also pull from more traditional data sources like Microsoft Access, SQL Server, MySQL, Oracle, Sybase and many other databases. If Power BI does not have a connector you can always download your data from your source into any of those file types and you are off to the races!

One of the biggest challenges in excel is the limitations related to more than one person using an excel spreadsheet at one time. A common scenario is, that Finance is preparing the Net Asset Value (“NAV”) pack for the investors from data they have received from the administrator. At the same time, Investor Relations is responding to an investor inquiry based on that same data. Historically, one user would have to wait until the other user is out of the excel file if they want to update that spreadsheet causing delays and frustration. Power BI facilitates multiple teams simultaneously using the same data for different purposes while ensuring the integrity of that data remains intact and solves this issue by allowing each team to access the same data at the same time. It does this by allowing each group to perform their own transformations on the underlying data without affecting the underlying source of the data (the feed from the administrator).

Once your data source is established and your data changes, you simply click the refresh button on Power BI’s Main Menu Ribbon and your data is automatically refreshed

Transforming Data

The real magic of Power BI is in its Transformation Capabilities. Just like Excel, Power BI offers the user a very familiar and user-friendly way to update your data. However, the key difference between the way most people use Excel, and how Power BI works, is that when you modify your Data in Power BI, it never forgets what you did or loses the linkage to your original data source. It does this magic by memorizing the steps you took to change your data and each time you update the data from your data source, you simply press refresh and it repeats those same updates you made to the new data. Just like that, you have all your data just how you need it without having to repeat and potentially make a mistake with your modifications.

To illustrate some of the most common data manipulations capable in Power BI, we will work through an example of a typical way, a user would need to modify some data from Excel. In our before picture below, we have a typical pivot table in excel, which may be great for your accountant who only cares about numbers, but your head of Investor Relations, for instance, is likely to need the same information in a much more visual manner. Many of FinServ’s client projects over the years have focused on how accounting and IR can share the same data for different purposes. In Power BI, with just a few commands in a matter of minutes, any novice user can transform Excel-based tabular information into a report-friendly data set that lends itself perfectly to visual reports and analysis. You can see in our after picture below, how Power BI has transformed the data while recording each step that was taken to organize the data:

- The first command we used was the Transpose Table command which is familiar to many excel users it simply flips the columns and rows in a table

- We then used a simple menu choice, Use First Row As Headers on the Power BI Ribbon to make the first row of data the Field Names for our data

- Next, we simply took the 2 Fields that did not have names and used the

- We then used the Fill Down command, another familiar excel command to simply take the values that were in the data to fill in each rows relative value

- Finally, we used one of the cooler Power BI commands to take the Yearly data that was in columns and convert it to a relational data format, with the Unpivot Columns command

Visualizing / Sharing Data

Visualization in Power BI is, taking the dataset you created and applying Powerful Graphics & Charts to make the Information Come Alive with Insights and Meaning. Power BI provides a rich set of options, including various ways to view and interact with your data. The options go from the basic bar and pie charts to cooler and more sophisticated options like Scatter, Geography-based, or even KPI (Key Performance Indicator) charts. Because all the work was done in the transformation step, the Visualization step is a simple matter of dragging the fields onto your chart and the Power BI Engine does the work of creating your charts for you. In fact, if you drag certain types of data onto the Power BI canvas, Power BI in many instances will pick the best chart type for you.

Conclusion

We have really only scratched the surface of what is possible in Power BI. We have not even spoken about all the great integration capabilities Power BI has with the rest of the Office 365 suite such as: Planner, One Drive, SharePoint Online and many more. In future articles, we will go into more industry specific topics and show how specific alternative asset management data can best be leveraged in Power BI. We will also explain how more sophisticated data extractions and visuals can be created all without any programming required.

The bottom line is, with Power BI Microsoft has put a powerful Reporting & Visualization tool in the hands of business users, and given them the ability to Access Data and Transform it into Stunning and Deeply useful Visualizations in a Collaborative environment, greatly reducing the reliance on their IT teams while addressing many of the limitations of Excel spreadsheets.

How FinServ Can Help

FinServ is a Microsoft Cloud Solutions Partner with deep expertise in Power BI . Our team can help you formulate a Power BI project to transform how your organization views and consumes data. For more information, feel free to contact us at info@finservconsulting.com or (646) 603-3799. You can also access this link to fill out your information and we will follow-up with you immediately.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.