Why Funds Who Want to Grow Must Continue With Their Strategic Projects

As an experienced surfer knows, if you wait until the wave is on top of you, then your chance to ride that wave is already gone. The same can be said about when an alternative asset manager innovates and invests in new technologies and projects during periods of low performance like we have seen recently.

As Klaus Schwab Founder and Executive Chairman of the World Economic Forum (“WEF”) noted, “Typically, first-adopters of technology are the ones with the financial means to secure it, and that technology can catapult their continued success increasing the economic gaps.”

He went on to say, “Additionally, the changes might develop so swiftly, that even those who are ahead of the curve in terms of their knowledge and preparation, might not be able to keep up with the ripple effects of the changes.”

Overview of This Paper

We will look at what companies did during the recession of 2008 to identify historical trends. We will also examine recent surveys that suggest where Investors are focused as they evaluate Hedge, Private Equity and other Alternative Asset managers in 2019 and beyond. Finally, we will highlight information from our own client data to explain how our clients followed these trends and share how those funds performed in terms of their own growth or decline.

Our Thesis

The underlying assumption to our work is that the economy and the market will recover and so will the asset managers who possess strong fundamentals. Given this premise, it would be very hard to argue that putting your strategic projects on hold is a good business decision if you want to stay relevant in an increasingly competitive landscape.

We look at surveys performed by EY and KPMG which back what most fund managers already know. Investors are focused on allocating their money to Innovative Funds who have strong cost management approaches in place, and who are leveraging the latest and greatest technologies.

Finally, we speak to the usage of technologies like AI, Big Data and RDP which are indispensable in the 4th industrial revolution and support the conclusion that funds who have not embraced these technologies will lose out to more innovative managers.

Our Recommendation

Based on this evidence, the only possible course of action is that funds must continue to push forward with their strategic and cost management projects undaunted by current fund performances. This is critical to not just to survive, but thrive and grow in the fast-paced and constantly evolving technical golden age we now live in.

Klaus Schwab who coined the term the 4th Industrial Revolution explained that, “Typically, first-adopters of technology are the ones with the financial means to secure it, and that technology can catapult their continued success increasing the economic gaps. Additionally, the changes might develop so swiftly, that even those who are ahead of the curve in terms of their knowledge and preparation, might not be able to keep up with the ripple effects of the changes.”

We believe in this statement Mr. Schwab accurately warns businesses that a pause in innovation can be very costly to their competitive position in the marketplace.

Why a Reactive Response to Poor Fund Performance Can Amplify its Impact

While it is totally understandable that a prudent CFO, CTO or COO will place all projects on hold during periods of uncertainty and poor fund performances, the loss of momentum is far too costly to allow this to happen. This pause will only multiply the impact on your funds’ future performance by handicapping your investment team from performing their jobs at an optimal level.

There appear to be two basic camps on this question. One side argues that companies should double their innovation efforts in recessionary times. In March 2008, American Express CEO Ken Chenault was quoted in Fortune saying, “A difficult economic environment argues for the need to innovate more, not to pull back.” [1]

What we have seen firsthand at the top performing funds is the exact opposite mentality. The top funds never stop working on the most important strategic projects to their business. In fact, what we have witnessed in most cases is when the markets are in question they double down on their investments, because they want to be able to take advantage of the funds who are too scared to make moves and enhance their market dominance.

They know from experience that when others are cautious and holding back, they can seize on opportunities more easily to extend their dominance.

Historical Support for Investing in Disruptive Innovations During Economic Contraction

Supporting the concepts of the 4th industrial revolution, FinServ believes the pace at which new technologies are being offered to funds in our industry is at a pace that we have never seen before. We believe adopting solutions like AI and RDP without delay is essential to succeed during these down periods in performance.

As we researched historical data to support our thesis, we came across many examples and anecdotes that support the idea that innovation during hard times is the best course of action. Here is one example provided in 2001.

The EY study further backs up the case for innovation supporting the idea that tactical short-term fixes are always important, but it should never be prioritized or replace the long-term, strategic investments that fund managers must continue to focus on in a highly competitive marketplace for investors. We’ll explore a few examples of these innovations as it relates to alternative asset managers later.

Strategic, long-term actions are more successful in protecting margins

It feels like an intuitive finding, but the data is clear. Those managers who indicated that they were taking strategic, long-term actions are more likely to report that their margins increased in the past two years.

Only 19% of those managers who indicated they were taking tactical, short-term actions increased margins as compared to 62% who indicated margins decreased. This compares to managers who took strategic actions of whom 32% reported margin increases and only 36% who had margin compression.

Margins are influenced based on both top-line revenue growth as well as cost management, all while making necessary investments to support the overall growth of the business. With resources less abundant for most managers, business leaders need to critically analyze their operations and take actions to best prepare the organization for both the current and future landscape. Acknowledging that the industry is being disrupted and taking advantage of newfound opportunities will best position innovative and forward-looking managers to deal with challenges and competition.

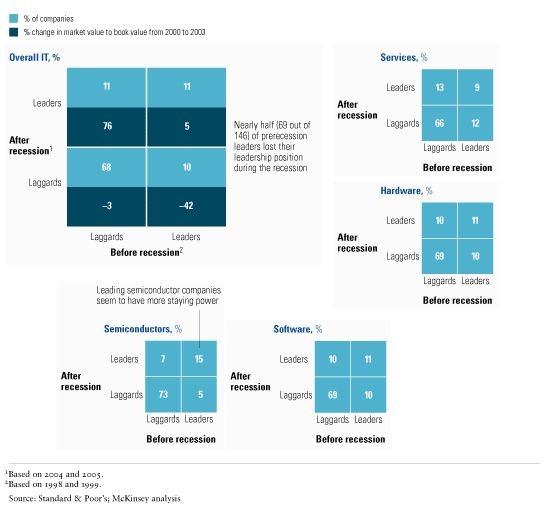

A study performed by McKinsey in the high-tech industry that backs up this point. In their analysis below they reinforce the point made by Klaus Schwab, that if you hesitate you will be left behind, but if you innovate you will surge ahead. The evidence suggests that if you hold back you can very quickly lose your position in the marketplace and go from a leader to a laggard.

“We found, for example, that 69 of the 146 high-tech companies entering the 2000–02 contraction as leaders—47 percent—emerged from it as laggards (Exhibit 3).

Conversely, 13 percent improved their positions during that same period. For example, the last downturn saw several leaders in various subsectors slip, from storage device makers and enterprise software manufacturers to virtualization and consulting-services firms. In contrast, companies such as Foxconn and HCL ascended.

Even companies that remained in the same categories moved to the extremes: Cisco Systems and 3Com, for instance, continued to be a leader and a laggard, respectively, but Cisco’s performance improved while 3Com’s fell further (see sidebar, “Cisco: Exploiting a recession’s dynamics”). With so much change in the sector’s leadership, it’s not surprising that we found that the market-to-book values of leaders and laggards changed significantly—by 40 to 80 percent from prerecession values. The current crisis could exacerbate the sector’s volatility.” [1]

Cisco: Exploiting a recession’s dynamics

While many competitors of Cisco Systems retrenched during the 2000–02 high-tech slide, Cisco invested in the downturn through prudent M&A moves, simultaneously scaling up and streamlining. The company made 16 acquisitions for a total value of almost $15 billion, rounding out its portfolio in areas such as systems design (a large stake in Sigma Systems). It also shed noncore assets, such as a consulting unit in Europe.

Cisco then took decisive steps to increase revenues and cut operating costs. To gain market share, the company reduced prices and shored up customer relationships by allowing deferred payments on purchases. At the same time, it aggressively cut operating expenses by more than $2 billion—in part through redesigning products to use less costly parts and slashing its supplier base by 50 percent to extract bigger discounts from remaining vendors. These actions allowed Cisco to extend its leadership against competitors such as 3Com, which reportedly reduced its headcount by 50 percent (versus Cisco’s 20 percent), froze acquisitions, and divested a valuable asset—Palm—to raise cash. By contrast, Cisco’s cash discipline allowed it to buy back stock even as it stepped up acquisitions. [2]

Another Strong Argument to Invest in Market Downturns

During these market downturns, vendors will offer clients extra incentives to move deals forward, including cost concessions. This is something funds can really leverage, sometimes even locking in long-term preferred rates. Another thing we have seen is when projects are slower at these firms, you are much more likely to get their best talent on your project.

At the end of the day, it is all about supply and demand. If you are brave enough to spend money during shakier times, you will no doubt be able to complete your projects, purchase software and other services at a more advantageous cost than when the rest of the market is buying with you.

FinServ’s Client Experience During Periods of Market Turmoil

As a consulting firm who lived through the 2008 financial crisis, we experienced first-hand how our client base reacted to those catastrophic events. We observed how many of our clients put all projects on hold and pulled back on all work immediately. We witnessed far fewer continue with their most strategic projects undaunted by the potential collapse of the markets.

Of course, the current situation is far from the dynamics of the financial crisis, but we are seeing a general pause on existing projects and slowdown in new projects at many investment firms since the middle of 2018.

Without exception, our clients who chose to continue with their projects during the crisis greatly expanded their businesses and exponentially grew their AUM over the following years. We believe this was because they never stopped their projects and kept the momentum in the innovations. This left them in a much better position to take advantage as the markets rebounded.

This was not only investment in projects or software, but also in new hires and training as well. With many funds cutting back, the number of desirable and experienced candidates in positions like fund accounting had a rare instance of supply far surpassing demand, resulting in many key, valuable hires made during that time.

In an industry where the most knowledgeable resources are so hard to find and hire, this was a rare time when finding qualified candidates was far less challenging.

The Current Alternative Asset Management Environment

Over the past several years, it has become increasingly difficult for funds to compete for new investors and achieve superior returns. As this competition continues to increase, funds are searching for the differentiators that will compel investors to choose their funds.

Based on our own experience, the rigorous due diligence process that most investors put fund managers through today presents challenges in two key areas which is backed up by several studies: technical innovation and cost management.

Technical Innovation – Prospective investors have been clear when performing their due diligence to look for funds who are innovators and utilizing the latest and greatest technologies to achieve superior returns and to effectively manage risk.

The days of investors just providing money without scrutinizing the investment process is gone. The survey by EY substantiates the understanding that although investors may not explain why they require this, it is absolutely critical that the funds who want to continue raising capital must be leveraging technologies like AI, RDP, big data and other innovations.

As a professional with over 25 years in consulting, I have worked through many different economic cycles. Often during the downturns, I have seen clients shift their focus toward compliance-related or non-discretionary projects, and away from more strategic or innovative efforts. In fact, this is the opposite of what funds should do based on investor requirements, and below is great evidence for why.

Continuing to prioritize innovation efforts in recessionary periods requires strong senior leadership. The overwhelming tendency is to slash resources, shut down long-term investments and focus on incremental improvements. Taking the wrong actions can sharply inhibit a company’s ability to reach its long-term strategic objectives. Approaching the problem in the right way can allow companies to do more with less and continue to move forward.”1

As FinServ has worked closely with our clients they have shared many stories of the most common and consistent questions asked during the due diligence process. A few years ago, there was a tremendous focus on risk management and controls in key operational processes and a push to ensure external third parties like third party administrator was validating the funds’ financials. Over the past year or so, there has been a significant shift towards understanding a funds technology stack and what new technologies they are utilizing in their investment process and in their operations to effectively support cost management.

The EY study further supported our experience as well.

“Investors believe advanced technology and data in the front office are important … but few have been able to quantify the benefits.

As the industry becomes more familiar with the use cases of artificial intelligence and alternative data, investors are increasingly coming to expect that asset managers will leverage it. Many view these tools as attractive complements to the manager’s existing investment process which can lead to alpha generation … although few investors can actually prove it.

Investors reported that 30% of their 2018 allocations are to managers using next-generation investment tools or data with an expectation that these allocations will grow to over 40% in the next two years. Investors are continuing to trend in the direction of expecting AI or alternative data to be used, and where it is not, managers may need to justify the rationale.

Those managers who are not embracing these techniques need to ask if they and their investors are comfortable with the status quo or if there are potential benefits.” [1]

3 At the tipping point: Disruption and the pace of change in the alternative asset management industry, 2018 Global Alternative Fund Survey

https://www.ey.com/us/en/industries/financial-services/asset-management/ey-2018-global-alternative-fund-survey

- Cost Management – At the same time, investors continue to add pressures to funds to be much more effective at managing their own operating costs. Investors want assurance from the funds that their operations are efficient. Again, investors are being more intrusive in this area, insisting that funds demonstrate a focus in technologies like AI, Robotic Process Automation (“RPA”) to meet this expectation.

The McKinsey study backed up this same focus on investment in the business operations:

“The companies in our study managed their sales, general, and administrative (SG&A) expenses in a much different way than anything else we investigated. Controlling operating expenses is critical for all companies, but leading ones that maintained their positions in the 2000–02 recession actually increased their SG&A costs by 6 percent more, in absolute dollar terms, than leaders that lost their positions (Exhibit 4). Some leaders that maintained their leadership also raised overall headcounts by 2 percent; fallen leaders cut them by 8 percent. The growth in SG&A expenses and employees took place even as sales for most leaders declined by 5 percent. A leading software firm, for instance, increased its advertising expenditures from $1.23 billion in 2000 to $1.36 billion in 2001 as the market softened. And SAP ramped up sales and marketing spending by 19 percent in 2001, although it cut administrative expenses by 8 percent. In contrast, a software competitor that slipped somewhat cut approximately 2,000 sales and marketing employees.” [1]

Who is Implementing These New Technologies

As a consulting firm that services the Hedge and Private Equity Fund markets, we have seen that the two alternative asset management approaches have different levels of systems requirements, as well as experience levels of investing in technologies.

Hedge funds tend to have far more complex needs, demonstrating a propensity to invest in and adopt new technologies well ahead of most private equity firms. However, we have seen over the past several years that many of our private equity clients are beginning to push into the newer technologies like AI and big data at an increasing rate.

The Private Equity Story

A KPMG paper which focused mostly on digitization technologies correctly points out that while Private Equity firms have been slow to adopting new technologies, they do have just as much, if not more to gain from investing in them.

This is because Private Equity firms can not only apply the solutions to their own investment process, but also to their portfolio companies, thus offering a huge return in terms of efficiency by leveraging the same technologies. Applying these technologies to their portfolio company reporting requirements also aids in the transparency for their investors. Investors preferred private equity firms who utilized advanced technologies to report performance on their investments as they saw this as evidence of a strong set of fund operations and effective controls. Additionally, investors looked very favorably on fund managers who brought the latest technologies to their investment portfolio to enhance their investments value and efficiency as well.

KPMG’s analysis corroborates this finding with the following charts.

As suggested by KPMG, innovation should not be limited to the front office and the investing process in general, but instead should be spread out across the front, middle, and the back office as the chart below depicts.

This backs up the point we made earlier that potential investors are also very interested in cost containment and want to see evidence that the funds are using technology to make their operations as cost effective and efficient as possible.

Private equity firms are applying technologies to the onboarding of new portfolio companies, which makes the processing of the portfolio company’s financials more efficient and antiquates a manually intensive process that was often subject to data entry errors.

The Hedge Fund Story

A survey by EY reveals that the most innovative hedge funds have already been delving into artificial intelligence and big data for some time now.

“Artificial intelligence and machine learning are more often being used by managers across asset classes and investment strategies to make actual investment decisions. Automation of various facets of the investment process is being embraced, and managers who are able to complement their operations with these tools are gaining significant competitive advantages.” 2

The impact of artificial intelligence on front-office models is significant

In the past year, we saw 300% growth in the use of artificial intelligence (AI) in the front office among hedge fund managers and 100% growth in the proportion that expect to use AI in the near future. Quantitative managers have been on the forefront of this technology for years, but managers of all strategies have been building capabilities and taking advantage of next generation trading systems and tools.

Hedge funds have embraced these capabilities more quickly as their investment strategy of analyzing large volumes of securities and economic data lends itself more to leveraging software and machine learning as part of the trade analysis and execution process. Further, hedge fund managers are more likely to have been further along on the technology continuum. Over their life cycle, most were able to forgo basic tools such as spreadsheets Excel and have been using off-the-shelf and proprietary technology.

Use of big data continues to proliferate

The majority of hedge funds either use or are evaluating “next-gen” data for use cases in their investing — a material increase from two years ago. During 2018, only 30% of hedge fund managers did not expect to use next-gen data in their investment process, a decline from almost 50% who made that statement just two years ago. The explosion in the volume of data that is available and the number of market participants utilizing it have begun to change how many hedge funds think of this information. For many firms in the industry, what next-gen data was a few years ago is now just data.

As a consulting firm with very deep expertise in ERP systems and business expertise in fund accounting and other back office areas, we have been helping our clients from our inception to implement the latest applications and technologies to automate manual, recurring and error prone processes.

The speed at which new technologies have been introduced and adopted by the hedge fund industry in just the past two to three years has been astounding. This is in no small part due to key players like Workday who have begun to dominate the ERP / Financials marketplace with a SAAS-based solution that many hedge funds are implementing.

Now that Workday and other vendors are linking their applications to AI offerings, the cost and effort required for even small fund managers to leverage these technologies in areas of their business other than the front office is even more compelling. This is further backed up by the EY survey:

Hedge fund managers lead in using robotics and AI in the middle and back office.

There has been significant growth in the proportion of hedge fund managers that leverage robotics to perform routine, repetitive tasks in the middle and back office. In 2017, just 10% of hedge fund managers reported that they had invest in robotics or AI. This year a third of hedge managers have implemented robotics and 1 in 10 is utilizing AI.

The benefits are significant. Technology is able to confirm trades, reconcile positions, automate regulatory reporting filings, etc. Once implemented, the tools can work continuously and limit the amount of manual, low-value work performed by people at the manager, freeing these individuals up to perform more value-add activities. The tools and technology are no longer the “wave of the future” so much as the current reality and one of the most impactful means in which managers can scale their operations to support growth and product diversification.

A Warning to Laggard Private Equity Managers

The EY study found some alarming observations in the likelihood of PE funds embracing these new technologies overall. Given the historical use of systems by PE funds, this is not surprising. However, given the increased competition for investors it is shocking that most PE funds seem determined to keep their heads stuck in the sand when it comes to AI.

74% of private equity managers do not expect to use AI. But only 40% of hedge fund managers still hold that expectation.

Conclusion

It seems clear that despite many experiencing weaker performance over the past year, there is only one option for any fund who wants to continue to not only survive, but thrive in the ever more competitive alternative asset management marketplace.

The evidence we have provided in this analysis compels managers to avoid any hesitation on moving forward with key strategic projects. Doing so will inevitably position them at a distinct disadvantage compared to other funds who will be only too happy to take their investors.

Investors are far more savvy and demanding than ever in our industry’s history, and that trend shows no signs of abatement. In fact, we expect that the demands for funds to be more transparent and efficient through technological innovations will only grow exponentially as the 4th industrial revolution takes hold.

Size is no longer a guarantee of leadership in the future, as our historical analysis has shown. It is quite easy to go from a leader to a laggard in increasingly shorter periods of time as the speed of innovation outpaces companies’ ability to adapt.

The words of Klaus Schwab should be a constant reminder to innovate at all costs:

“It used to be that the big used to eat the small, now it is the fast eat the slow and I’m seeing it everyday.”

[1] Innovating During A Recession, By Scott D. Anthony and Leslie Feinzaig, July 8, 2008

https://www.forbes.com/2008/07/08/recession-innovation-retailing_leadership_clayton_in_sa_0708claytonchristensen_inl.html#3b48f53d4757

[2] Article McKinsey Quarterly March 2009 High tech: Finding opportunity in the downturn, By Andrew Cheung, Eric Kutcher, and Dilip Wagle

https://www.mckinsey.com/business-functions/organization/our-insights/high-tech-finding-opportunity-in-the-downturn

[3] At the tipping point: Disruption and the pace of change in the alternative asset management industry, 2018 Global Alternative Fund Survey

https://www.ey.com/us/en/industries/financial-services/asset-management/ey-2018-global-alternative-fund-survey

[4] The Digital Transformation Imperative – Why Private Equity Firms Must Digitally Transform to Compete, By Gavin Geminder, and Jeff Kollin

https://assets.kpmg/content/dam/kpmg/us/pdf/2018/05/737580-nss-pe-digital-transformation-whitepaper-v18.pdf

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

FinServ can help you plan for and optimally implement a long term strategy and roadmap to embrace the new technologies of the 4th Industrial Revolution.

Is Office 365 Coming to a Hedge Fund Near You?

At the FinServ Consulting CTO Roundtable held this past May, we hosted 12 CTO’s from some of the top hedge hunds in the US. Of those 12 CTO’s, 11 were seriously considering a move to Office 365. The remaining CTO was already on Office 365.

Office 365, and in general cloud based office suites, have long been speculated to be taking over from the traditional MS Office client based applications. However, due to the cautious nature of the financial services industry (especially around email) it seemed like this would never happen at Hedge Funds. Over the past year FinServ has seen this tide significantly turning and Office 365 coupled with Azure AD FS are becoming a hot topic with many CTO’s. Many Hedge Funds are currently contemplating the move to Office 365, but still need to get comfortable with some key aspects of the platform. Here are the main concerns we are hearing from our clients and some of the potential solutions that they are considering.

1. Microsoft’s 99.98 % up-time for email is not good enough. How can I guarantee that our people are never without email?

Answer: As one of our client’s noted 99.98% up time means Microsoft could be down for one day every full year and that is far too much for his firm to tolerate. As of now it seems that the most common choice of a backup email insurance policy amongst our client base is Mimecast. If Microsoft has an outage Mimecast would enable a client to keep their email up and running by acting as a backup email system.

2. Single Sign-On is critical to our firm. We need a secure way to ensure that our employees can access all their applications without having to memorize a number of passwords or be prompted to re-enter passwords just to access Office 365.

Answer: This one can be a lot trickier and the key to the solution seems to be with Azure AD FS as the best solution. While vendors like OKTA claim that they are a superior solution to Azure AD FS the addition of another vendor to layer on top of the Microsoft solution does not seem necessary in this particular instance. The huge advances in capabilities that Microsoft has shown with Azure AD FS combined with its ability to integrate with so many common vendors means that single sign on should be easily attainable through Microsoft alone. The biggest area to focus on is simply ensuring that your AD FS setup for your users and groups is clean and well-organized prior to migration. There are many tools available from Microsoft that aid in ensuring that your AD FS is in good working shape to supoprt the move to Office 365.

3. How strong is Microsoft on Mobile Device Management (“MDM”)? If someone leaves our firm or if the device is lost or stolen can I wipe from a device the information related to our firm?

Answer: The short answer is a definitive yes. Microsoft, if configured, can allow you to totally manage your user’s devices so that you can selectively wipe only certain portions of the user’s device. You can use Azure AD FS as your source of inventory for all devices, which can control enrollment into Intune, access to Office 365 and connections to corporate resources.

4. We have heard a lot about SharePoint Online being a major new piece of Microsoft’s overall strategy for collaboration, but what are its real capabilities and how secure is it?

Answer: This is certainly a loaded question, and there are many topics to cover when a client asks this question. First, it is key to ensure that the client understands what SharePoint Online is, and how it works with One Drive for Business. While SharePoint Online offers Document Libraries and many other great features, for teamwork and collaboration, the One Drive for Business Sync Client is one of the major behind the scenes critical components of this solution. Microsoft has been rapidly enhancing this solution to ensure that it is secure enough to enforce key security standards, so that the financial services industry can finally start to embrace the overall solution for document, and file management. Microsoft’s approach to encryption keys is a major part of this solution, as is the ability to lock down access to the One Drive for Business and SharePoint folders by domain. Microsoft’s Data Loss Prevention (“DLP”) features can all be setup through configuration screens on Office 365, but it does need to be performed very carefully in order to ensure that the system is setup without the risk of data loss, or the risk of an employee’s sharing something that goes against your firm’s data sharing policies. The good news is this is all already in the solution and you just need a skilled and experienced partner to help configure this in your Office 365 setup. The bottom line is most if not all Hedge Funds are in the process of looking at, or are moving to Office 365. The compelling cost and resource savings of outsourcing this part of a funds infrastructure is too compelling. With that said, there are many answers that the CTO’s and fund executives want answered especially around security (including data loss prevention and up time) before they take the plunge. FinServ Consulting has partnered with the top experts in the field to gather all the critical answers that will allow our clients to make this move in the most effective and secure way possible.

To learn more about FinServ’s Office 365 and Microsoft related services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

6.5 Proven Tips for Selecting the Right Third Party Administrator

The market landscape for Third Party Administrators (TPA’s) is changing rapidly and many Hedge Funds and Private Equity firms are struggling to make sense of these changes. The major players in the marketplace are consolidating, but new Fund Administration options are appearing almost everyday. The current state of the market makes selecting the right TPA for your fund more difficult than ever.

Funds are wise to utilize a structured approach when evaluating the market for TPAs. A structured approach helps ensure that you select the best service provider to fit your firm’s unique strategy, product mix and approach to operations. Utilizing a consultant can help make certain that your Administrator selection project occurs on time and within budget.

FinServ Consulting’s Third Party Administrator selection services have already helped numerous leading Alternative Asset Managers select the right Third Party Administrator to support their growth. FinServ’s team has spent more than 200 hours analyzing the marketplace in over 20 different performance categories around functional, technical and regulatory requirements. FinServ’s experience working with Funds and TPAs has led to an industry leading perspective on the TPA Market. FinServ understands the complexities of the marketplace and can help provide guidance on how to select the best TPA for your firm. FinServ’s team places emphasis on the following best practices for considering a new Fund Administrator.

(1) Understand your Firm’s Unique Complexity

The first step in selecting the right Administrator is to understand what makes your firm unique. The right Administrator will be able to understand and even help resolve this complexity. Does your firm have both Private Equity and Hedge Fund structures? Do your investors have certain reporting requirements? Does your IT team have extremely rigid security concerns? It is imperative to ensure that the TPA your firm selects is well equipped to handle your unique operational challenges. It is also important to consider the future strategic direction of your fund. Some Administrators cannot service certain fund structures like 40ACT or UCITS funds, and will be unable to support future growth in these areas. Understanding your firm’s current objectives and future direction is crucial to selecting the right administrator.

(2) Define Key TPA Capabilities in Working Sessions

Holistically understanding your firm’s operations is also an important step in selecting the right administrator. Different functions within a fund have unique perspectives on what is important; so it is crucial to involve all stakeholder groups in the process. Furthermore, clients who operate in different geographic regions can have unique requirements that should be incorporated (i.e. specific regulatory requirements or an understanding of the local culture and methods of operation). FinServ’s methodology includes conducting workshops with different operational areas in the firm to drive the requirements that form the basis of the Request for Proposal (RFP). Creating working groups allows you to ensure that all requirements are captured, and every department feels they are part of the selection process. This inclusion drives ownership and buy in for the vendor that is ultimately selected.

(3) Spend Time on the Request For Proposal

The RFP is an extremely important document that breaks down a fund’s requirements into key areas for the vendors to focus on. The RFP will organize your firm’s key processes into well-defined technical and functional requirements. A quality RFP presents your fund’s information in a manner that will elicit meaningful vendor responses to address your key challenges. The information requested from the Administrators in the RFP will include details on the Administrator’s organization, client base, capabilities, service levels, pricing, conversion methodology, and operating model. The RFP should be a comprehensive document that serves as a basis of comparison for all of the vendors. Vendor responses should be evaluated both qualitatively and quantitatively to narrow the already short vendor list to 2-3 finalists that can be further drilled down upon.

(4) Create Quantitative Scoring on the RFP

Often selecting a vendor can become a very emotional decision. You may like the salesperson or the team, but buying based on emotions can often lead to the wrong choice. In order to separate the emotional aspect of the sales process, funds are wise to leverage a quantitative approach to balance their qualitative assessment. Utilizing quantitative scoring on the RFP allows you to compare vendors across the various dimensions that are important to your organization. The different requirements from the RFP should be prioritized and ranked, and each vendor’s response should be evaluated. Hard metrics (i.e. processing times) are preferable, but where hard metrics do not exist, vendors should be rated on a 1-5 scale indicating their strengths and weaknesses in the area.

Quantitative scoring allows your firm to make an informed decision by objectively evaluating each TPA to provide the best overall picture of which Administrator is right for your firm.

(5) Scripted Vendor Demos

The best way to ensure that a vendor can provide the services they promise is to have them demonstrate their capabilities. Sales demonstrations often focus on specific features that the sales team wants to highlight, almost exclusively focusing on their company’s natural strengths. The FinServ Consulting scripted demos focus exclusively on the functionality important to your firm. FinServ works with funds to identify their most complex operational challenges and break them down to a series of instructions to be performed by potential Administrators. FinServ has found that creating scripted demonstrations on all key requirements is a powerful tool for confirming vendor competence. Scripted demonstrations should outline exactly what you expect to see during the demonstration, and what the criteria for evaluation is. Ideally, the scripts should outline real-world scenarios using your company’s own data. This will allow you to see how each Admin handles specific requirements and allow for a meaningful comparison between the different vendors. It is also prudent to have your operational teams conduct Q&A sessions directly with the various vendors to help each key stakeholder group ensure their specific requirements are met, while building their understanding and comfort level with the process.

(6) Conducting Thorough Reference Checks

Conducting thorough reference checks is one of the most important steps in selecting an Administrator, but it is often the most overlooked. Many firms approach references as a check-the-box exercise, but funds are wise to conduct through reference checks using detailed questions. References are the best way to gauge if the Administrator will be able to perform with regard to the specific circumstances and challenges of your organization. Any administrator you consider should be able to deliver references of clients with a similar AUM and investment strategy. Your firm should ask the provided reference about the Admin’s ability to perform specific requirements as laid out in the RFP. It is also important to ask about their implementation experience, specifically, what their biggest frustrations were during the onboarding process. Asking detailed questions of the references not only uncovers key issues or areas to address with the TPA but will also reveal personal experiences that will help you get the most out of the selected TPA. FinServ has experience conducting thorough reference checks and can help guide your firm through this critical step.

(6.5) The Importance of the Team

The competency of the team supporting your account is absolutely critical, so having the ability to choose your team or have a say in who will be servicing your fund is key. The vendor’s approach to transitioning from their sales team to their onboarding and servicing team should be clear and strong. In our experience, weaker TPAs spend all their time selling and don’t clearly communicate to the onboarding or delivery team what was learned or even promised in the sales process. This means key items are missed in the onboarding process, which ultimately leads to very painful work to address the lack of communication with the TPA. You should specifically ask to involve the vendor’s core service team early in the sales discovery process. You should ask the support team questions related to your specific business challenges and evaluate their responses. Additionally, Admins service funds from different locations, so it is important to get a feel for how your account will be serviced, and who will be responsible for the different tasks. Selecting the right Third Party Administrator is an extremely important decision for Alternative Asset Managers. The market is filled with many options, and it is important to pick the right vendor. Selecting the wrong vendor can easily cost 2-3 times the amount of hiring a consultant to help you select the right TPA. Every fund is different, so it is important to ensure that any Administrator selected supports your unique operational approach. FinServ has worked with all of the top Administrators and has insight into each TPAs’ Front, Middle and Back-Office functionality, as well as their Investor Relations, Financial Reporting, Tax and other ancillary capabilities. FinServ utilizes an industry leading approach that is tailored to your organization’s unique needs. Our team has the expertise necessary to help your firm make sense of the TPA market and select the right vendor to best support your firm’s ambitions.

To learn more about FinServ’s TPA vendor selection methodologies and related services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

7 Signs Excel is A Key Risk to Your Fund

FinServ has helped many clients to reduce the risks of overusing excel to support key parts of their businesses. Is your business too dependent on excel? Here are some key warning signs that you may be at risk.

To learn more about FinServ Consulting’s Office 365 and Systems Automation related services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.