Navigating the Complex World of Trade Confirmation and Settlement

In the dynamic environment of financial markets, post-trade processing and trade settlement hold immense significance to investors and

financial institutions. Precision and efficiency are imperative for maintaining smooth operations with transactions unfolding rapidly.

Despite impressive technological strides, human errors endure, casting repercussions across the industry. The shift to T+1 and T+0 settlements has intensified challenges, leaving little room for error.

To successfully address these complex challenges, investment firms are actively searching for trustworthy and reputable partners with in-depth expertise in post-trade execution. These partners have the ability to seamlessly navigate the intricate network of transactions and provide unwavering assurance to clients in their post-trade activities.

This blog explores the intricate landscape of trade confirmation and settlement, unravelling the six pivotal steps underpinning these essential processes. Our aim is to demystify the intricacies and shed light on the crucial stages that culminate in the seamless execution of trades within the financial realm.

| Key Stages | Description | Highlights |

| Order Placement | The trade settlement process is initiated with order placement. Fund managers/ clients convey buy or sell orders to their executing brokers, outlining the security, quantity, price, and other pertinent particulars. | Fund Managers use a variety of different OEMS platforms like Eze, Enfusion, Bloomberg AIM, etc., to initiate orders. |

| Trade Execution | Upon receiving the order, the broker assumes the role of an intermediary and initiates the trade execution process on behalf of the client. This critical phase involves translating the client’s order into actual market transactions, where the broker facilitates the buying or selling of the specified securities. | Trades are executed over the FIX network through platforms like NYFIX, and Bloomberg deployed on the executing broker systems for trade execution and matching. |

| Trade Matching | Trade matching constitutes a pivotal phase within the trade confirmation and settlement framework, characterized by the simultaneous electronic input of trade particulars by two distinct sources into a dedicated electronic trade matching platform. This process derives its nomenclature from its fundamental principle: the parity and equality maintained between both participating parties. The electronic trade matching platform serves as an arena where these trade details are systematically compared and validated. Through a series of automated processes and cross-checks, the platform diligently assesses the submitted particulars for congruence, highlighting any disparities or inconsistencies that require resolution. | Various trade matching platforms such as Omgeo’s CTM, MarkitSERV, Traiana, ICE Link, and BTCA facilitate trade matching by connecting counterparties and streamlining the trade confirmation process. |

| Trade Validation | Trade validation is a crucial process involving a final comprehensive check of gathered information. This validation allows potential issues or discrepancies to be proactively identified and corrected before engaging with other entities. This step ensures that accurate and reliable data is communicated, minimizing the risk of errors in subsequent stages of the trade process. By offering an opportunity for rectification, trade validation contributes to the overall efficiency and integrity of the trading system, instilling confidence in all involved parties. It acts as a safeguard, preventing the propagation of erroneous information and promoting seamless trade execution. | DTCC’s GTR, SWIFT’s Accord, MarkitSERV’s TradeServ are a few trade validation systems in the market that cater to different asset classes and trade types. |

| Trade Confirmation | After reaching a consensus among all involved parties, the trade enters the critical phase of trade confirmation. Here, a formal acknowledgment of the trade’s specific details and agreed-upon terms is exchanged. This includes crucial information, such as settlement instructions. Trade confirmation acts as a binding agreement, solidifying the transaction and establishing the groundwork for subsequent processing steps. This process allows potential discrepancies or misunderstandings to be identified and resolved, ensuring a smooth and transparent trade flow. Ultimately, trade confirmation plays a pivotal role in enhancing the efficiency and reliability of the overall trading process, instilling confidence in all stakeholders, and minimizing risks associated with trade execution. | Trade confirmation is a pivotal stage, signifying successful trade execution among parties. Accurate confirmation is especially crucial due to varied settlement cycles:

|

| Trade Clearing and Settlement | Following trade confirmation, the clearing and settlement process is initiated, facilitated by the clearing house. In this stage, the clearing house assumes the counterparty risk, acting as an intermediary to ensure a seamless settlement of the trade. Validating trade details and calculating net obligations it guarantees the availability of funds and securities necessary for settlement. By undertaking this vital role, the clearing house enhances the security and efficiency of the overall clearing and settlement process. This crucial step mitigates potential risks and minimizes the chances of payment or delivery failures, instilling confidence in market participants and fostering a stable trading environment. | The settlement process involves diverse payment methods based on security type and trading venue:

|

Key Stakeholders in the Trade Settlement Lifecycle

| Stakeholders | Roles |

| Executing Brokers | Brokers act as intermediaries, connecting clients to financial markets. They receive and execute trade orders on clients’ behalf. Brokers also participate in trade affirmation, confirming trade specifics per client preferences before proceeding to settlement. |

| Custodians | Custodians safeguard and hold securities in trust for clients. Crucial to settlement, they ensure securities are available for delivery and assist in resolving discrepancies during trade affirmation. Custodians play a vital role in maintaining accuracy and security. |

| Fund Managers | Clients, as investors, utilize brokers to execute buy or sell orders. Initiating trade confirmation and settlement, clients drive the entire sequence through their trade instructions, playing a pivotal role in the process. |

| Clearing House | The clearinghouse acts as an intermediary between buyers and sellers, ensuring accurate trade settlement. Assuming the buyer role to every seller and vice versa minimizes counterparty risk and guarantees trades. This mechanism enhances market stability and safeguards the trading process. |

Navigating Trade Settlement Complexities

Although the trade settlement process aims for efficiency, its complexity arises from various factors. Let’s delve into some of these intricacies and examine why clients frequently rely on external institutions (such as custodian banks and clearinghouses) for assistance in trade settlement:

- Regulatory requirements: Different geographical regions and financial markets adhere to distinct regulatory frameworks for trade settlement. Complying with these regulations adds intricacies that require specialized expertise to navigate effectively.

- International transactions: Cross-border deals introduce additional complexities related to foreign exchange dynamics, tax implications, and adherence to global legal regulations.

- Trade volume and frequency: Institutional investors and traders often handle a high volume of trades. Managing settlement for such a large volume of transactions can be time-consuming and prone to errors.

- Trade types and instruments: Financial markets host a variety of trade types and instruments, including equities, bonds, derivatives, and more. Each instrument’s settlement process possesses unique characteristics, contributing to overall complexities.

- Time sensitivity: Timely settlements are crucial to prevent trade failures or penalties. Ensuring all parties meet deadlines requires efficient communication and execution.

- Risk management: Trade settlement involves counterparty, operational, and market risks. Inadequate risk management could lead to financial losses.

In response to these challenges, investment firms are actively seeking reliable and proficient partners who can confidently manage post-trade execution activities. This is where expert consulting firms come to the forefront, offering comprehensive trade settlement services tailored to the unique requirements of investment firms.

These firms understand the pivotal nature of the settlement process and the financial and reputational consequences of errors. With a team of experienced professionals, cutting-edge technology, and a profound grasp of the financial sector, these firms are well-prepared to handle the complexities and intricacies of trade settlement. Through meticulous attention to detail and stringent quality control, they ensure accurate and efficient processing of each trade, mitigating the risk of errors and reducing potential losses for clients.

| How FinServ Transformed Client Operations: A Short Case Study |

|

In a recent collaboration, FinServ Consulting showcased its commitment to tailoring solutions for a client grappling with extensive trading activities in the APAC markets. Challenge: The client’s struggle with limited local support prompted a custom approach to enhance operations and streamline trade support. Solution: Understanding the client’s precise needs was vital. This led to devising tailored trade support solutions. Documenting the trade settlement process with clear procedures, timelines, and responsibilities established a transparent and structured framework. Our team executed the trade settlement process meticulously per the client’s instructions, swiftly resolving any discrepancies that emerged. During market volatility, vigilant trade monitoring was prioritized to protect the client’s interests from potential adversities. A robust communication channel was established to address crucial concerns promptly. Consistent updates on trade status fostered client reassurance and confidence in our services. Result: This engagement exemplified FinServ Consulting’s client-centric dedication. Personalization, understanding, and transparent communication culminated in empowering the client to navigate APAC market challenges confidently. |

Conclusion:

Trade settlement facilitators play a pivotal role in aiding clients with their trade settlement needs. These facilitators offer an array of services aimed at streamlining and speeding up executing and finalizing trade transactions. Their services typically encompass trade matching, clearance, and settlement. Harnessing cutting-edge technologies and established networks guarantees accuracy, transparency, and security in trade settlements. Clients reap the benefits of minimized operational risks and expedited error-free settlement cycles. Moreover, these facilitators provide valuable insights and reporting, empowering clients to make informed decisions and optimize their trade activities.

About FinServ’s Middle & Back-Office Services:

Organizations must leverage tailored solutions to meet their unique requirements in the fast-paced and competitive financial services industry. FinServ Consulting stands out as a trusted partner, offering a comprehensive solution suite that empowers portfolio managers, operations teams, and back-office functions. By aligning technology with industry best practices, FinServ Consulting helps organizations drive efficiency, enhance decision-making, and deliver value across the board. Embrace the power of tailored financial services solutions with FinServ Consulting and unlock your organization’s potential.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

Optimizing Middle and Back Office Operations: Empowering Hedge Funds for Success

Fund managers understand that it can be difficult to support and scale their operations team; instead, they are moving to outsourced providers to satisfy critical requirements. The right Managed Services Partner will streamline their middle and back-office operations, allowing them to focus on core business activities and capitalize on service level agreements, which include expanded coverage across multiple time zones.

Hedge funds strive to attain strong investor returns through varied investment approaches. They must establish structured fund management, compliance, and reporting systems to accomplish this goal. This is crucial to satisfy investor demands, maintain competitiveness, mitigate risks, adhere to regulations, uphold transparency, improve efficiency, and prevent regulatory issues.

Efficient middle and back-office operations play a critical role in ensuring seamless operations of the fund, and adherence to regulations, resulting in the generation of accurate and reliable reporting. Systematic middle and back-office operations form the backbone of a well-structured and successful hedge fund by managing the operational aspects that underpin the fund’s activities.

Fund managers understand that it can be difficult to support and scale their operations team; instead, they are moving to outsourced providers to satisfy critical requirements. The right Managed Services Partner will streamline their middle and back-office operations, allowing them to focus on core business activities and capitalize on service level agreements, which include expanded coverage across multiple time zones.

This article explains the advantages of outsourcing middle and back-office functions and how it enables fund managers to enhance their operational efficiency and competitiveness in the market.

Expert Middle & Back Office Support

Outsourcing middle and back-office operations provides hedge funds with the benefit of utilizing a team of skilled professionals equipped with specialized knowledge. By harnessing this expertise, fund managers streamline their processes, improve productivity, and enhance risk management practices.

- Optimizing Hedge Fund Efficiency – Hedge funds employ diverse investment strategies to achieve returns surpassing traditional market benchmarks and align with investor expectations. However, the intricate nature of middle and back-office operations can strain a fund’s resources and time, because it requires meticulous attention to tasks such as trade execution, risk assessment, and regulatory compliance. The shift in focus from operational tasks to more investment-focused tasks allows fund managers to make more informed decisions, adapt quickly to market changes, and seize lucrative opportunities.

- Adaptability – Partnering with a service provider with diverse asset class and accounting expertise equips hedge funds for swift adaptation to market shifts and strategies. This seamless flexibility facilitates scaling in trading new asset classes, bolstering the fund’s ability to navigate market fluctuations and make informed decision-making confidently. Fund managers gain reassurance that their daily middle and back-office operations remain unaffected by altering strategies and trade volumes. Expert service providers adeptly accommodate changes, minimizing implementation time and managing the learning curve effectively.

- Advisory – Choosing the right managed service provider is of utmost importance. A reliable service provider surpasses the responsibility of guaranteeing precise daily middle-office and back-office activities. They proactively collaborate with fund managers to enhance workflows and provide advisory support. This approach involves identifying challenges and offering tailored solutions, like incorporating automated swap settlement and reconciliation processes. This is supported by implementing complex tasks like reconciling performance and financing interest against broker files; and adapting tax lot reconciliations to align with specific client preferences, ensuring accurate Profit and Loss (P&L) and General Ledger Providers play a crucial role in delivering valuable expertise and encouraging the adoption of best practices among their clients. This is achieved through a structured series of workflow assessments that are designed to enhance the efficiency and effectiveness of their client’s operations. The provider’s commitment transcends contractual obligations, validating the decision to outsource by delivering extra value. Such dedication reinforces the partnership and cultivates a successful, efficient, and productive relationship with the hedge fund.

- Utilizing Time-Zone Difference – Asset managers collaborating with overseas outsourcing partners gain access to a dedicated and efficient support team available around the clock, spanning pre-market and early trading hours. The time zone disparity enables hedge funds to receive continuous support and real-time aid, even during their non-working hours. With a local presence in the US office, clients enjoy 24/5 coverage. Moreover, the US-based team collaborates closely with fund managers and operations heads, directly streamlining workflows and executing new strategies. This setup ensures rapid issue resolution and seamless operations, minimizing downtime and maximizing productivity. The presence of a dedicated support team empowers hedge funds to tackle operational challenges and sustain uninterrupted functionality. This dynamic contributes to their overall success and competitiveness within the market.

- Customization and Scalability – It is imperative that outsourcing partners recognize the distinctiveness of each hedge fund and understand the importance of catering to their unique requirements. Consequently, the right partner will offer tailored solutions to accommodate individual needs. This necessitates that the outsourced partners possess functional expertise and a technical understanding of the client’s preferred systems and technology. Customization may include curated portfolio reporting, specialized tax lot services, portfolio re-balancing, manual journal entry setups, handling swap and borrow financing adjustments, and other ad-hoc requirements unique to the fund’s operations. This level of personalized service ensures that the outsourcing partner can efficiently address the fund’s individual demands, providing comprehensive and bespoke support that enhances operational efficiency and accuracy. The ability to cater to such diverse and specific requirements further validates the value of outsourcing for hedge funds seeking a highly adaptable and dedicated partner.

- Risk Mitigation & Better Governance – Efficient outsourcing partners play a pivotal role in assisting hedge funds to navigate risks and enhance governance practices expertly. Their valuable service involves adeptly managing and mitigating operational risks while meticulously monitoring Net Asset Value (NAV) and discrepancies stemming from Fund Administrators’ inputs. This comprehensive process encompasses tasks like calculating dividends, swap accruals, and other non-trading calculations, alongside routine daily and month-end checks. The primary goal is to swiftly identify and rectify potential errors, thus minimizing the chances of financial complexities or regulatory issues emerging during audits. This consistent dedication to compliance and regulatory standards nurtures a deep sense of confidence within hedge funds, highlighting the integrity and professionalism that characterize their partners’ operational approaches.

FinServ Consulting’s Role in the Middle and Back Office Industry

FinServ Consulting’s managed services team provides efficient trade, cash, and position reconciliations, allowing front office and operations teams access to reliable, updated, and error-free information. Accurate positions and NAV data allow portfolio managers and traders to confidently focus on order generation, including sizing and position allocations.

In addition, our service offering includes daily P&L checks, tax lot reporting, swap financing and dividend accrual assistance, hands-on systems entries, and overall guidance with the goal of ensuring efficient month and quarter-end accounting closes. Any discrepancies or differences with fund administrators, prime brokers, and other counterparties are resolved quickly and remediated in real-time.

FinServ Consulting places significant emphasis on five critical service areas, enabling the delivery of quality reconciliations and back-office reporting. This is achievable due to FinServ’s extensive expertise in various aspects of hedge fund operations and a deep understanding of systems and technology.

| Critical Service Areas | Description | Examples |

| Shadow Accounting Essential | Shadow accounting is a vital service deployed to authenticate the accuracy of fund administration books. Maintaining parallel accounts enables thorough monitoring and verification of fund transactions and positions. This approach promptly identifies and addresses potential discrepancies in Profit & Loss (P&L) calculations at month end. Additionally, shadow accounting helps mitigate reconciliation challenges arising from diverse lot liquidation methodologies used by different parties. |

|

| Daily Reconciliation | Managed service providers conduct daily reconciliations of client data against each prime broker, regardless of trade volume. This daily scrutiny is crucial for T+1 settlement, ensuring accurate and timely data. By maintaining consistent reconciliations, FinServ Consulting minimizes discrepancies and offers hedge funds a real-time portfolio view at the start of each trading day, providing a performance advantage. |

|

| Swaps and Borrow Management | Outsourcing swap financing and borrow accrual processes enables thorough validation of swap or borrow agreements with prime brokers, focusing on financing rates and payment frequencies. This ensures robust reconciliations, preventing potential data reconciliation gaps that may arise if solely left to the fund administrator. |

|

| Tax Lot Management | Accurate tax management for share sales requires precise modelling of different lots due to varying tax implications. However, many fund administrators lack the capability for complex tax lot management. Outsourcing to tax experts who understand tax laws and can generate ad hoc reports and tax reconciliations helps avoid issues, especially during a fund administrator change, ensuring data consistency and accurate accounting. |

|

| Cash, Collateral and Margin Management | Accurate cash balance alignment with prime brokers and comprehensive recording of activities involving brokers, ISDA counterparties, and banks is crucial. As these activities are not always recorded in real-time, specialized tools and support are necessary for cash actions. Outsourcing these functions can ensure accurate reconciliations and proper accounting, preventing discrepancies over time and maintaining financial integrity. |

|

Conclusion

Outsourcing middle and back-office operations offers hedge funds a strategic advantage by allowing them to focus on their core business, access to specialized expertise, utilize time zone differences for non-working hours support, receive prompt responses, and benefit from tailored solutions. It enhances risk management practices, improves operational efficiency, and ensures better governance, ultimately supporting hedge funds in their pursuit of excellence in the highly competitive financial landscape.

About FinServ’s Middle & Back-Office Services:

Organizations must leverage tailored solutions to meet their unique requirements in the fast-paced and competitive financial services industry. FinServ Consulting stands out as a trusted partner, offering a comprehensive solution suite that empowers portfolio managers, operations teams, and back-office functions. By aligning technology with industry best practices, FinServ Consulting helps organizations drive efficiency, enhance decision-making, and deliver value across the board. Embrace the power of tailored financial services solutions with FinServ Consulting and unlock your organization’s potential.

To learn more about FinServ Consulting’s customized financial services solutions, visit our website at https://www.finservconsulting.com.

How Private Equity Firms Can Benefit from Using Task Management Software

Private Equity firms have complex internal operations and continue to rely too heavily on spreadsheets, email, and disparate application software to track their internal operations. Adopting a task management system can streamline the workflows across multiple teams and provide greater visibility of each team’s performance. Greater transparency ensures that any bottlenecks can be easily identified and addressed, strengthening organizational transparency and efficiency.

Private Equity (PE) firms’ operational efficiency is critical in determining their success, especially against shifting market conditions. PE firms typically have complex inter-departmental processes managed through Excel spreadsheets, email communications, and other disparate applications. While Excel and Outlook are essential tools, an Enterprise Task Management system is far more effective in organizing tasks, providing a centralized place to see the status of critical path items, and creating an optimal Private Equity foundation for your overall success.

FinServ has spent 18 years working with our clients to enhance their business processes. In the past few years, we have focused on assisting our Private Equity clients in Private Equity in leveraging task management software to address some critical areas of their operations. From this experience, we have gained great insight into how a PE firm’s internal operations can be classified into six main stages and how task management tools can optimize their operations on a day-to-day basis:

| Private Equity Operation | Operation Description | |

| 1 | Fundraising | The IR team performs many tasks with prospective investors during the fundraising process. Timely responses to Investor inquiries are critical. Often the requests can be quite complex and involve several departments in the fund. Ensuring each task is laid out for the IR and other team members and ensuring they can mark the tasks complete ensures that all steps are handled efficiently. In contrast, key senior members can easily check in on the status of any prospect in real time. |

| 2 | Deal Sourcing | As a PE Fund sources deals, they will repeat the same steps with each deal collecting and sharing critical documents through that process. Leveraging a task management tool with linkages to a document management system like SharePoint ensures that Deal Team members can efficiently review and approve critical documents while staying current with the latest activities in the deal sourcing flow. A system automatically notifies key deal team members and related departments as specific critical milestone tasks are met is essential to successfully closing a deal. |

| 3 | Deal Management | As the deal progresses through the latter stages of the flow, the operations, legal, tax, and cash management teams need to play a part in getting the deal to the close date. Ensuring that every deal has a consistent list of tasks and that the person responsible is always tagged to the task and reminded when they need to perform their role ensures that every deal can be handled effectively and efficiently. |

| 4 | Portfolio Management | Effective portfolio management is crucial for PE firms to monitor their investments carefully and ensure high returns for their investors. Typically, PE firms rely on spreadsheets and ad-hoc communications to track essential tasks such as entity management, compliance, etc., which can be error-prone. The task management tools can streamline the tasks, track the entity setup and compliance obligations, and implement a uniform workflow approach across different regulatory jurisdictions. This simplifies compliance, mitigates risk, and saves time. |

| 5 | Reporting | PE firms must prepare reports for multiple stakeholders, I.e., internal executives, investors, regulators, etc. To prepare comprehensive reports, internal coordination between the deal execution, investor relations, fund accounting, and cash management teams is required. The task management tool can serve as a central platform for teams to coordinate their tasks and share documents via the integration with SharePoint etc. Additionally, a task management system can produce graphics and visualizations on multiple metrics, providing valuable insights about a workflow’s progress and resource planning. |

| 6 | Accounting & Reconciliations | Typically, PE firms use multiple accounting software for reconciliation processes and record maintenance. The reconciliations occur weekly, monthly, and quarterly to ensure that all systems are accurate. In large PE firms, different teams are often responsible for managing specific systems. Often funds use many de-centralized methods to communicate about these critical tasks. Valuable energy and time are wasted trying to find the latest email or DM related to a task. Using a centralized reconciliation project in a Task Management system, users can streamline the tracking processes involving multiple systems, break down workflows into smaller tasks, assign those to specific team members, and set due dates. This provides one place to see the status of all reconciliation work. |

Through our work with several Private Equity clients, we have found that the success of implementing an Enterprise Task Management system comes down to a few critical success factors.

- Ease of Use & Implementation – Sophisticated workflow tools can provide great automation to operations. However, these tools are highly complex and take many months to implement. They often require very technical resources to set up and code solutions. Task management tools offer a simple, intuitive setup that results in implementing a solution in days or weeks, allowing users to see results quickly.

- Super Users Drive Adoption – Business users can quickly learn how to set up their projects in a Task Management tool, becoming early adopters who share their successes with other groups. Users have set up issue-tracking projects that have quickly spread to several other departments when they share their success stories.

- Cross-Departmental Collaboration – One client was struggling with the coordination of onboarding employees between their HR and IT departments. The HR team leveraged the Task Management tool to share the new hire process with the IT team. The IT team created its project, which tracked each detailed step of setting up a new employee, including communications with external parties. The new process resulted in a streamlined process where every new employee gets what they need to succeed, resulting in a great first impression of a process often filled with issues at many other firms.

- White-Glove Support – Even if a system is simple to implement, it does not mean every user can handle it independently. Our firm focuses on providing users with all the support they require, including helping them to model their project if desired and providing them with helpful best practice approaches to everyday task management items. When a client has a question about how to do something in the system or something is not working the way they expect, we respond immediately, ensuring they maintain their enthusiasm for the system. Eventually, the users become self-sufficient, but early on, we make sure they have a large degree of handle holding and support.

The Task Management Tool Marketplace and Deciding What Tool is Right for Your Firm

Different types of task management software tools are available in the marketplace. While some are free and relatively simple, others need to be bought and can be deployed firmwide. We have found that the best Task Management tools provide these core capabilities:

| Functionality | Description | PE Usage Example |

| Rules Automation | The ability to create simple if-then scenarios in the tool will support things like notifying someone when a task is overdue or moving completed tasks to an archive. | Notices for Deal Closing Funding Requirements |

| Forms | The ability to leverage forms for projects like IT Tickets or issue trackers creates a detailed request or item with key characteristics. | PE Data Issues Tracker |

| Automation for Recurring Tasks | The ability to set a Task or a set of Tasks to recur on a set periodic basis either by a specific date or when all the previous tasks have been completed. | Fund Accounting Quarterly Reporting Requirements |

| Auto Updates to Due Dates |

The ability to automatically update due dates on tasks when one key date changes. | Deal Closing workflow |

| Advanced Security Controls |

The ability to set access to a project or a set of tasks. The ability allows edit access to a subset of fields by user role. | HR Hiring / Onboarding project |

| Integration with Key 3rd Party Applications & APIs |

The ability to integrate with email/calendar to track key tasks or to feed tasks from a received email. The ability to integrate task updates with Teams or other DM systems. Integration with SharePoint Online or other document management systems to link documents to tasks while maintaining the core security of sensitive documents. The ability to leverage an API to pull data from external systems and update the tasks in the Task Management system. |

Investor ad-hoc reporting requests Investor GDPR PII document tracking Credit Facility Management |

Outside of the key benefits from our extensive work in this area, we have found that there are three main benefits of using task management software for a PE firm:

Greater Transparency:

Given that PE firms receive information from various sources – third-party vendors, market data providers, disparate internal systems, and ad-hoc data dumps – it is essential to translate all the relevant information into clearly defined workflows in a task management system. The structured workflow enhances operational efficiencies and provides greater transparency, which is especially important when multiple tasks require inter-departmental cooperation, e.g., when a deal closes, in addition to the Deal Execution team, Tax, Legal, Valuation, and Cash Management teams, etc., need to be notified. Different teams can track their combined workflow and easily compare each other’s progress in the task management system.

Task management systems can also accommodate the underlying dynamics of a workflow by providing capabilities such as approval tasks, dependencies, etc. For example, if the post-deal closing workflow cannot be started until a deal is closed, the workflow can be structured for the post-closing workflow to be triggered only after a deal is closed. Similarly, approval tasks can be created so that unless a task has been approved, the user cannot progress to the following task. Typically, these are ‘soft blocks’ that can be overridden but are crucial in preserving the workflow structure.

Greater Integration:

Private Equity firms use multiple tools to track their operations. For example, many PE firms track the Deal from inception to its funding in Salesforce or other CRM systems.

Most of the clients we have implemented task management systems used to track this info in their email systems which could have been more efficient and decentralized. After our implementation, the task management tools connect with different software, such as Salesforce, to ensure the Deal information flows automatically into a central place where all deals and statuses are tracked. When a Deal is funded, it flows into the task management system in a pre-defined workflow and alerts the relevant teams to complete the assigned tasks.

Where email can come in handy is to notify a person when they have something important to take care of in the task management system. Task management systems provide more intelligent connectivity with email communications. Through their built-in integrations with Outlook, Gmail, etc., emails can provide detailed information from the task management system and link the user directly to the task they must act upon.

Some PE teams, like Investor Relations, constantly receive emails from investors and prospects. Many task management tools allow emails to be forwarded to a specific project. They can intelligently scrape critical information from the email to automatically create a task for the IR team to act upon. By providing the ability to translate emails directly into tasks, the task management systems significantly reduce the manual effort required to distill the information into actionable items and assign it to individuals as needed.

Task management tools can also integrate with file-sharing software such as SharePoint Online. Private equity internal operations rely heavily on spreadsheets housed in a central location, e.g., SharePoint. Task management software can integrate with SharePoint, allowing users to attach their files, located in SharePoint, to the workflow as needed. Users can easily be redirected to the SharePoint file through the task management software whenever they need to access the files while completing their tasks. Task management tools can maintain the same privacy rights as SharePoint, thus protecting the security of sensitive documents.

Greater Reporting:

Practical task management tools report essential metrics in real-time, allowing users to draw insights about any workflow’s progress. For example, a task management system can produce graphics and visualizations on multiple metrics, such as the number of tasks completed, the number of tasks assigned to a specific user, etc. This allows an executive to quickly see projects or processes in trouble or critical staff members whose workload is too heavy.

Teams can use these reports to easily track the overall project’s progress and gauge individual members’ performance. For example, through sorting and filtering capabilities, the task management systems allow the users to filter the tasks by an assignee and check if they have completed them on time. Additionally, if a task remains incomplete beyond the due date, it will be highlighted, and the assignee will be notified accordingly.

Moreover, these reports can easily be exported from the system. Flexible reporting options allow users to customize the reports according to their needs. This provides a quick and effective way to fully understand the workflow’s progress and ensure that delays can be identified promptly.

Conclusion

Private Equity firms have complex internal operations and continue to rely too heavily on spreadsheets, email, and disparate application software to track their internal operations. These methods could be more inefficient and error-prone, and valuable energy and time are often spent searching for the data to verify its accuracy.

Adopting a task management system can streamline the workflows across multiple teams and provide greater visibility of each team’s performance. Centralizing all tasks in one system makes it easy for line-level staff or senior executives to get the information they require quickly. Greater transparency ensures that any bottlenecks can be easily identified and addressed, strengthening organizational transparency and efficiency.

About FinServ Consulting

With over 18 years of working with the top Private Equity funds in the industry, FinServ has the technical and business expertise to help your fund select and implement the best task management system for your requirements. Contact us to find out how quick and easy it can be to streamline your fund with FinServ’s industry and task management experts.

How Asset Management Firms Can Optimize their Workday Support

When building your support team or enhancing it, it is essential to look for certain key characteristics. These characteristics are attributes of individuals who know Workday in and out and how the industry operates. These attributes are crucial in creating a support team that can efficiently handle any Workday request.

Whether you are implementing Workday for the first time or are an existing Workday user, proper support is needed to ensure your Workday experience is a success. To realize the system’s full potential and adequately support your business users, Workday must be supported by resources capable of taking on many tasks. These tasks can vary from answering how-to questions, troubleshooting issues, administering recurring events, updating calendar/schedule periods, liaising with Workday, and analyzing/deploying Workday release features.

When building your support team or enhancing it, it is essential to look for the following key characteristics. These characteristics are attributes of individuals who know Workday in and out and how the industry operates. These attributes will result in a support team that can efficiently handle any Workday request.

- Resources with Industry Experience – Support personnel with experience in the industry are more efficient than newer resources without the requisite background. In addition, these resources can understand and diagnose issues quickly and accurately as they have been through similar situations before.

- Less Specialization – Resources knowledgeable in multiple Workday modules provide more comprehensive solutions to issues. In addition, cross-module expertise enables these resources to know what components are related, how they impact each other, and what is part of any total solution.

- Documentation Skills – Resources that know how to create well-written documentation provide value beyond configuring Workday. The documentation they produce will be invaluable to retaining institutional and contextual knowledge, mitigate against staff turnover, and provide a knowledge base for others to leverage.

Resources with Industry Experience

It is important not to fixate only on what resources know in Workday. Knowing the ins and outs of the industry is just as valuable. This knowledge is gained only through experience and provides a perspective on how things are supposed to work regardless of the kind of system.

For example, it is quite common for terminating employees at Asset Managers to be subject to a Garden Leave policy where the terminated worker is essentially paid not to work for a set amount of time after their termination. Workday does not come pre-configured with the means to put someone on Garden Leave; it will be up to your firm to configure this. Resources with experience administering and using Garden Leaves will know how to configure it properly. In Workday, the easy part is setting up the Garden Leave itself so that the terminations could go on leave and not terminate until the end of their Leave. However, there are additional considerations to review regarding whether Garden Leave terminations should be included in active headcount, where they should sit in your organization, or whether they should be visible to employees outside of HR. Support resources knowledgeable about Garden Leaves would know how to configure Workday optimally, focusing on the pitfalls to look out for and specific reporting requirements.

This is just one specific example; however, with so many moving pieces for a feature commonly used by Asset Managers, it is critical to vet resources on their knowledge of Workday and how they have applied Workday to meet HR policies at other firms in the same industry.

Less Specialization

Having less specialization in a specific Workday component may seem counterintuitive, but in our experience, it is quite the opposite. Sure, a specialist in a particular Workday module can expertly configure its module. However, this specialization comes at a cost where they cannot configure other modules or realize the more significant impact a request may have on other areas of Workday.

As a result, a specialist may not be able to implement a comprehensive solution. Or, their lack of knowledge of other Workday components would introduce complexities when handoff and coordination are required between multiple resources.

For example, in Workday Financials, you can set up a Punchout where Workday integrates with a vendor allowing you to purchase items (like office supplies or computer hardware) directly from the vendor, and the order information would flow directly into Financials. Setting this up would involve creating a Purchase Order, matching the invoice, capitalizing the asset (if applicable), and setting up a depreciation schedule. Again, a resource that was knowledgeable in multiple Workday components would be able to advise you on what to watch out for and the best path to implement the solution.

Documentation Skills

The most overlooked attribute when evaluating Workday resources is the mindset and ability to document everything and do it well. Documentation is critical as resolving Workday issues is often an involved process involving researching the subject, implementing the solution, and testing multiple scenarios. Furthermore, many types of problems and projects repeat themselves (i.e., an employee thinks their Time Off Balance is incorrect, Performance Cycles happen twice a year, annual Open Enrollment, and new time off plans). Documentation can prevent having to research and resolve the same issues more than once.

Proper and well-written documentation will preserve the work done, allowing you to retain institutional knowledge, lessen the impact of any resource turnover, and enable work to be done more efficiently. The team will spend less time re-examining common issues, attempting to understand past decisions, and more time resolving the actual problem.

Retaining knowledge of your existing setup is particularly relevant across the alternative investment client base, where firms often devise complex allocation rules to determine the true profitability of each business line. These rules result in a ‘fully-loaded’ P&L by business line and can be used in some cases to determine the compensation of portfolio managers, traders, or other essential employees associated with the business. In some cases, firms will want access to this P&L but not have it truly posted in the general ledger and instead use it for reporting purposes. This necessitates customized reporting that may exclude or include these allocations depending upon the view of the person running the report. When troubleshooting or modifying these reports, it may take a resource that is unfamiliar with the setup much longer and may lead them to recommend modifications that are not appropriate. It may also require lengthy explanations from the business that is not the best use of time and could otherwise be avoided.

Conclusion

Successfully supporting Workday is not easy, as there are many types of users to deal with and a wide array of issues to resolve. Therefore, selecting the proper staff to support Workday is in your best interest. Your support personnel must be capable of working with multiple Workday components, documenting solutions and decisions well, and having knowledge of the business to create solutions that fit within the industry. By recognizing and evaluating resources against these critical traits, you will be well-positioned to field the right Workday support team for your organization.

FinServ’s long history servicing the world’s top Alternative Asset Managers, combined with our deep Workday expertise, make us a natural option to help you find a world-class Workday support team.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

How FinServ Helps Funds Optimize Their Operations

Operational assessments provide an opportunity for asset managers to objectively evaluate current operational structures with an eye toward improving operations. Today’s environment — characterized by hybrid work structures and new strategies focused on investments in cryptocurrencies and other alternative assets – means that managers need to initiate these assessments to ensure that existing systems and processes are aligned with long-term operational goals.

There are many reasons for an asset management company to undertake an operational assessment. The most common are that firms grow assets under management, change or add the types of assets traded, expand the range of strategies and/or funds it manages and have a more complex investor base with different requirements for shareholders. All these changes mean systems and processes set up at the beginning of the firm’s life cycle may no longer be fit for purpose.

FinServ Consulting leverages all its experience and expertise gained in working with similar funds or businesses to help support its clients in this exercise. This has given the company unique insights into how assessments can be conducted and what asset management firms will gain from the process.

Identifying Problem Areas

The first step in the process is to look at and analyze an investment firm’s full operations and processes to identify inefficiencies that are holding back the growth of the firm. This process can also reassure investors that the firm is doing everything it can to use its resources effectively while at the same time having processes and controls in place to ensure that operations from front to back office are running smoothly and are fit for the present as well as the future.

The assessments can highlight a variety of areas where firms may want to make changes. This strategic initiative looks at how technology is being used, whether service providers deliver in the most effective way and if teams are structured for optimal efficiency. The review can expose bottlenecks, suggest areas where best practice can be implemented and show how to streamline a business. Ultimately, a target operating model is defined and presented with a path to get there.

Although operational assessments are routinely conducted by many firms, lately there has been an increase in requests for these evaluations. This is due to several reasons. For example, because of the pandemic, some technology investment has been delayed however, firms have only grown in complexity. Inefficiencies caused by manual processes may be exacerbated as the fund grows its assets under management (AUM).

Many firms still use Excel or have many operations done manually when there are more eloquent automated solutions available. The frequency of this can be a direct result of the infrastructure set up at the beginning of a firm’s life cycle. As it grows, those processes may no longer be adequate, particularly if it has experienced changes in the types of asset classes traded, the size and volume of trades or other factors. These factors mean existing infrastructure is less optimal. The systems used at the start of a business may not be scalable or the most efficient as it grows.

Identifying Where Efficiencies Can Be Made

Once the parameters of the operational assessment are established, everyone involved in a specific process in a fund are interviewed using a set list of questions. This helps identify ways to streamline work – such as trading workflows.

For instance, portfolio managers do not always have all the information they need at their fingertips. There may be a lot of manual work before a trading decision is made. Interviews with portfolio managers, traders, operations, finance, and anyone from the technology side involved in these processes are interviewed to identify areas where there may be ways to update work streams or plan for future expansion.

A list of predetermined questions also gives the conversations a focus and helps identify areas of inefficiency that can be improved.

The resulting list of projects – ways a firm can change processes, technology and even people to be more efficient – can be daunting. These projects can be small or large, complex or simple, easy to implement or difficult.

While it is always up to the firm to decide which projects it wants to tackle in the short or long term, some like to focus on quick wins that may be relatively inexpensive while others put together a program aimed at gradual transformation of processes and procedures.

FinServ Consulting has developed a project impact/effort matrix that helps identify which actions will have the most impact on the business while also judging the difficulty or complexity in implementing these compared with those that are much easier to do but have less overall effect on the business.

This assessment is a snapshot, giving the firm an overview of inefficiencies and what the impact of fixing them will be. Quick wins could include things like reorganization of the folder directory, discontinuing daily reports or giving Bloomberg access to more people. Key improvements that may take longer to implement might include hiring more people, like a tax director, implementing new systems like a portfolio management system (PMS) or a data warehouse.

The addition of new strategies and funds may also put a strain on existing infrastructure. Likewise, the introduction of managed accounts, funds of one or onshore/offshore structures to accommodate a wider range of investors will necessitate different procedures and processes.

Operational due diligence by investors can also identify red flag areas where improvements need to be made.

A Path Forward: Recommendations

At the end of the operational assessment there are usually five to six strategic areas where change is recommended. These range from relatively inexpensive projects to more long-term changes.

The assessment gives a timeline and costs to help firms make decisions on what to tackle first and what it may want to consider in the longer term. It is the firm’s decision what to do next and how.

By using FinServ for this exercise, unlike other consultants, the job does not end at giving the firm recommendations. FinServ is available to help implement all the suggestions, provide assistance in choosing the right technologies, service providers, processes and procedures to ready the firm for present operations as well as for the future.

While the operational assessment does not look at whether and how a firm might go into another business, like loan servicing, the process does look at operations where targeted improvements will make jobs more efficient and scalable. Some growing firms worry that every time they add a new fund or strategy, they will need to hire more persons, adding to the costs and making it difficult to scale the business. For them, outsourcing options and third parties that can assist them and make more staff unnecessary may be better options than adding to the employee list.

Assessments are also made on third party providers, like fund administrators. By looking closely at what a fund administrator provides, they could request more services and gauge whether the amount of money the administrator is charging is close to the costs for similar businesses. The assessments are holistic, looking at all the processes of the entire firm.

Whether the need for an operational assessment is necessitated by operational due diligence by investors, a more complex investor base, firm growth or just a health check after a few years of operations, the process is geared to help tighten processes and procedures, streamline controls, and get the firm to the desired future state where it is capable of being more efficient and making more informed decisions. A fund’s infrastructure should never dictate what trading strategies are permissible or impede a business decision.

Even firms that believe they are relatively straight forward as they only do a small number of investments or trades may be challenged by the complexity of regulatory filings, the different types of data needed for a variety of purposes and a complex investor base.

Conclusion

FinServ Consulting, with years of experience working with a wide variety of asset managers, brings its knowledge and expertise to the operational assessment process – and does not leave the client with a list of “to-dos”. It helps in the implementation of the suggestions to create a firm fit for purpose now and in the future.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

FinServ Opens New India Office with Middle & Back Office Outsourcing Offerings

FinServ Expands Global Presence with India Office.

The New Office Enables Better Service to Fund Clients Amid Increased Demand for Support Services & Solutions.

FinServ is pleased to announce the opening of a new office in Mumbai, India. Shaurin Jobalia, who has worked with leading hedge funds and alternate asset management firms globally, will lead a growing team in India, which has more than two decades of collective middle- and back-office experience in fund accounting. The Indian team includes professionals who have previously worked at industry-leading firms such as Enfusion, SS&C Technologies, GlobeOp, Morgan Stanley Fund Services, and Bank of America.

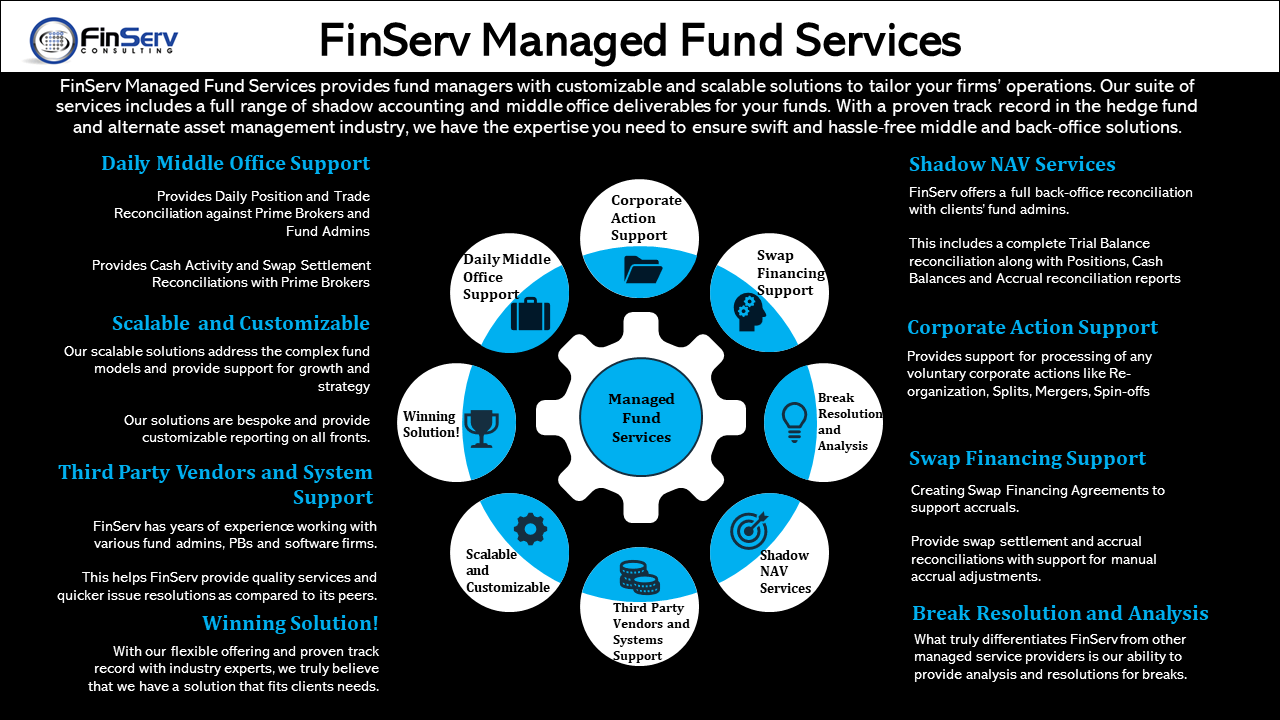

The office will serve funds in a broad range of areas, including:

- Assisting with daily trade positions and cash reconciliations with custodians, prime brokers, and fund administrators.

- Providing break analysis for any issues

- Assisting with corporate actions and swap financing accruals and setup.

- Providing complete shadow NAV with clients’ third-party administrators, including balance sheet and income statement reconciliations.

FinServ’s Managed Services aims to provide fund managers with customizable and scalable solutions to tailor their firms’ operations.

The opening comes at a time when two key trends are converging. First, alternative asset managers are under increased pressure to reduce costs. Fees fell to new lows in 2020 according to Hedge Fund Research, as investors pulled roughly $46 billion from funds. Secondly, COVID-19 has disrupted day-to-day operations and provided a new set of challenges for asset managers in keeping their businesses functioning effectively. A silver lining has emerged, however. The global pandemic has accelerated the use and adoption of remote workers among fund managers. With teams working remotely, managers have leaned on service providers and recognized that they can support operations and technology through outsourcing.

With a team in India, FinServ can meet those requirements and deliver new benefits, such as reduced costs and more flexibility. The FinServ team is unique as they bring systems expertise which allows for detailed analysis and problem solving. In addition, the team is staffed by experienced resources that have a deep understanding of different asset classes. If a fund trades equities, credit or privates, the team brings the appropriate knowledge to assist in the processing. By leveraging the team, funds can efficiently scale their operations by eliminating the need to increase headcount for non-core activities, or job functions. The new India office will support FinServ’s core consulting business across specialized middle and back office managed services, software customization and implementations, industry systems integrations, and bespoke systems development.

At a time when funds are accustomed to receiving what has historically been a commoditized service, FinServ’s team takes it a step further. The teams are well-versed in each client’s unique needs and deliver on those requirements through both a hands-on and customized approach.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

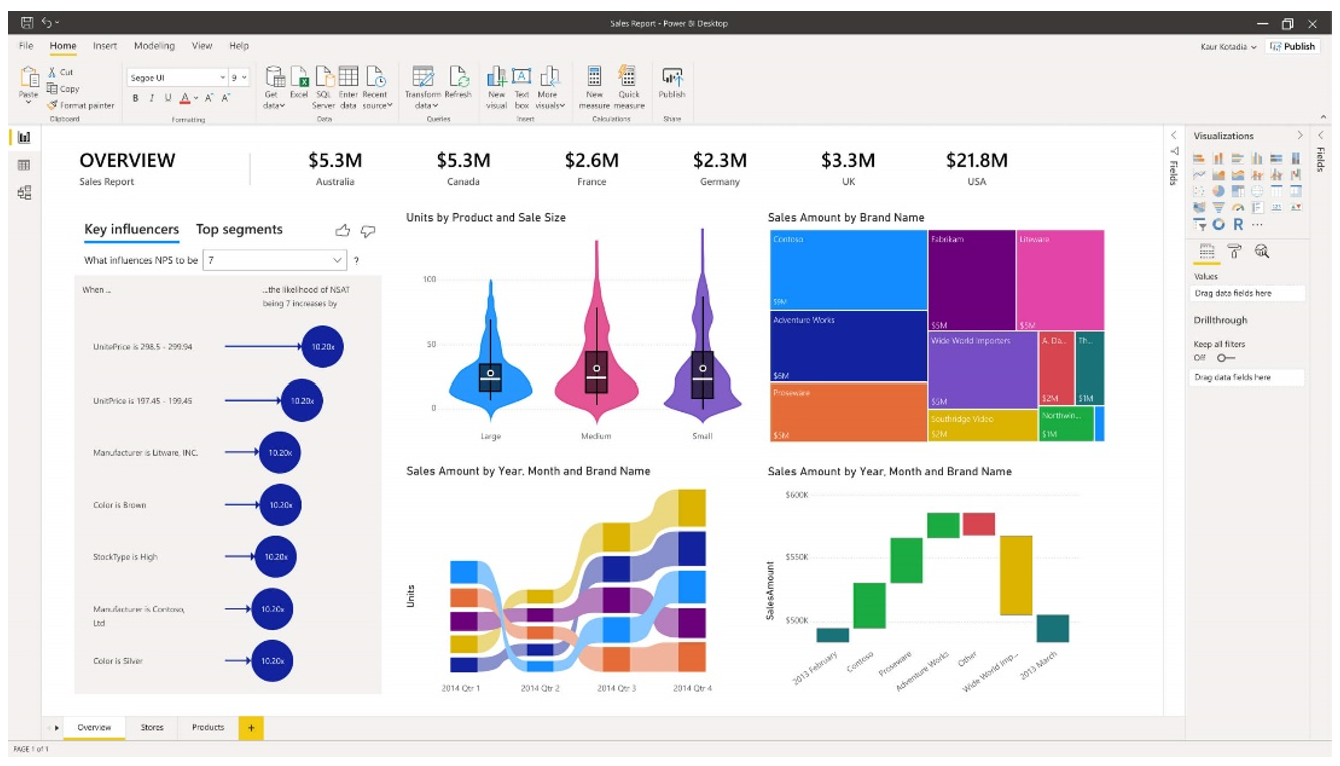

Intelligent Business with Power BI

In order to understand the capabilities of Power BI, it is best to start with the fundamentals of Analytics & Business Intelligence (“ABI”) and data visualization. The combination of ABI and data visualization allows Power BI to articulate information in a digestible manner that is supportive of intelligent decision making.

ABI tools are user-friendly data management platforms that emphasize self-service and provide analytical functionality ranging from data preparation to insight generation. Business Intelligence (“BI”) leverages historical information while analytics employs modeling and statistics to anticipate future events. Generally speaking, BI is focused on what happened, and analytics is focused on why it happened.

Data visualization is the presentation of information through graphical mediums like charts, diagrams, dashboards, and more. Dashboards are an amalgamation of components designed to inform stakeholders in an aesthetically pleasing manner like the sales dashboard below. The goal is to provide an informative platform that is far easier to comprehend than traditional resources such as a spreadsheet with thousands of rows.

Power BI and Its Key Features

Power BI is a business intelligence solution that enables companies to draw organizational insights by using data visualizations, performing analytics, connecting to hundreds of data sources, and embedding content into external applications & websites. An additional benefit enjoyed by users on the Windows platform is its seamless integration with the Microsoft suite. In summation, Power BI allows users to connect, prepare, model, and visualize data.

Power BI incorporates numerous features (illustrated above) that assist in the analysis and comprehension of a business. Three particularly impressive features included in Power BI’s repertoire are Natural Language Generation (“NLG”), Automated Insights, and Advanced Analytics. NLG uses artificial intelligence to automatically produce rich text descriptions detailing outputs. Automated Insights are conceived from advanced algorithms and are a great way to initiate analysis on large data sets. While the initial analysis generated from Power BI can provide direction for additional research and evaluation, other factors may be sufficiently analyzed within Power BI without the need for further investigation. Advanced Analytics can be performed with Power BI’s internal ABI platform and/or by integrating with external models. Azure Machine Learning Studio’s drag and drop interface can be combined with SQL and R to conduct predictive analytics on data sets.

Subscription Options and Functionality

The three versions of Power BI are Desktop, Pro, and Premium. Desktop, the lowest-tiered option, can be downloaded from the Microsoft Store for free. It includes the core data visualization and analysis features; data preparation, reports, dashboards, connection to over 50 data sources, and the ability to export in various formats.

Pro includes all of Desktop’s functionality and can be purchased as a standalone product for an annual subscription of $10 per user license per month or as part of the Microsoft Office 365 Enterprise E5 suite. The enhancements differentiating Pro primarily fall under collaboration and the distribution of content. For example, users can share their insights by embedding visuals within applications such as SharePoint and MS Teams. Furthermore, users can leverage peer-to-peer sharing to distribute their work to external stakeholders with Power BI Pro licenses.

Premium, the most advanced offering, comes at a hefty annual subscription that breaks down to a monthly price of $4,995 per dedicated cloud compute and storage resource. Some distinguishing characteristics that amplify data analysis include enterprise level BI, cloud & on-premise reporting, dedicated cloud computing, and big data analytics. Other features that are included in Power BI Premium are increased storage, higher refresh rates, and a larger data capacity. Premium grants enterprise-wide access and is best suited for large organizations with significant business intelligence requirements.

Implementing Power BI in Financial Services

Power BI has countless applications for alternative asset managers and other financial services companies that span the front, middle, and back office. One of Power BI’s most popular functions is financial management and reporting. QuickBooks Online customers can utilize a preconfigured Content Pack that allows them to quickly construct financial statement dashboards. Users are immediately provided with functionality that comprises customer rankings, profitability trends, and various financial ratios.

Implementing and tracking KPI’s with Power BI allows investment managers to accurately evaluate operations. Best practice is to have KPIs spanning the front, middle, and back office because an unidentified issue in any of the three areas can be detrimental. A few prevalent KPIs are Investment Management Fee Revenue as a Percentage of AUM, Trade Settlements per Back Office Employee, Subscriptions vs. Redemptions, and Trade Error Rate by Asset Class.

Business intelligence can be applied to portfolio management by connecting Power BI to the underlying data sources detailing investments. For instance, asset allocation reports and dashboards allow fund managers to interpret the distribution of funds relatively easily. Another prominent application of Power BI is treasury & liquidity management because data visualizations can be developed to provide detailed breakdowns of cash management, FX hedge balances, and more.

Conclusion

Power BI is a powerful ABI platform that augments a business’s ability to consume data through the creation of interactive reports and dashboards. Business intelligence can be constructed to support any business function with enough data. More importantly, it can be configured to the firm’s unique needs and has the ability to adapt with dynamic business requirements.

FinServ has acquired deep industry and technological expertise through the completion of over 600 engagements at more than 40 of the top 100 Hedge and Private Equity Funds. FinServ can configure Power BI to accurately monitor operations, identify the correct KPIs, properly document business processes, and seamlessly integrate new technologies with existing infrastructure.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Controls Meet Cost Savings: Market Data Expense Management Systems

Global market data spend recently exceeded $30 billion per year1. In an increasingly data-driven investment world, market data spend is only expected to rise, as firms seek out new alpha-generating data sets to enhance returns. Additionally, quantitative investment strategies have never been more in vogue with investors; the literal arms race to find better, more powerful data sets is sometimes merely just a struggle to “Keep Up with the Joneses”.

Market data is a critical component of modern fund management; however, wrangling market data expenses has never been more important due to rising costs and increasing complexity. In this article, FinServ will cover:

- Why is Market Data Expense Management Important?

- What Makes Market Data Expense Management Hard?

- What Technology Solutions are Available?

- Complementary Solutions and Services

- How FinServ Can Help

Why is Market Data Expense Management Important?

Market data is a Top 5 expense at most investment managers, but it is often the #1 headache. Although other expenses like employee compensation, real estate, and general technology spend reach similar (or greater) heights, market data expense management often lacks the same direct and consistent level of stewardship. Everyone wants to decrease market data expenses, even though they tend to be the least understood (e.g. complex contracts, metered services) and it is easy to pass the buck on ownership between technology, finance, operations, and the front-office. Strong, centralized control of the market data management process can help firms save millions by eliminating unused and underutilized services; however, even when market data has an organization’s focus, there are several inherent challenges with managing market data expenses without help.

What Makes Market Data Expense Management Hard?

Market data is incredibly costly and difficult to manage due to its complexity. Market data expense managers are tasked with providing structure to market data programs facing an ever-growing list of responsibilities and related challenges. These include managing a variety of execution-focused priorities, while also driving organizational change via strategic initiatives like optimizing data usage/flow and cutting out unnecessary costs. These activities include:

Expense Allocations & Invoice Reconciliation Controls:

- Market data allocations are usually more complex than vanilla corporate expenses. A single invoice could get allocation to some combination of individuals, groups, departments, and/or strategy (e.g. fund AUM-based allocations).

- This requires a clear understanding of the market data services and solutions currently in use, including an understanding of services purchased. How you pay matters as well; any soft dollar payments should be tightly managed along with appropriate firm compliance officers.

- Due to the volume and complexity of market data vendor invoices, the invoice reconciliation process demands a strong technological solution to facilitate daily market data expense management.

Usage Management:

- Keeping track of actual market data usage is required to get a handle of how to cut unnecessary costs. This includes knowing which applications use specific data, how it’s licensed, and when renewals will occur.

- Market data usage and expense reports are required for the business to make informed decisions related to overall needs. This includes a mechanism to track usage and verify that it is in line with the original business objective.

- Mitigate audit exposure as a firm and remediate any compliance breaches. Understand how the firm’s contracted capabilities compare with actual data usage. Determine if licenses exist for all services utilized across the organization?

Strategic Platform Management:

- Review and implement industry best practices for market data expense management.

- Align the overall strategy with the strategic initiatives of the business and technology teams.

- How may the organization optimize market data consumption across the board to reduce costs?

- How many data vendors are currently used?

- Are any services duplicative/redundant?

- Are there any unused/underutilized services?

- Are there better platforms available for meeting corporate strategy?

What Technology Solutions are Available?

MDSL: Market Data Manager (MDM) and TRG: Financial Information Tracking System (FITS) are two of the leading market data expense management system providers in the financial services and asset management space. The overall landscape has been heavily influenced by private equity merger and acquisition activity. MDSL recently merged with Calero, a telecom expense vendor, and TRG acquired a third player in the market data expense marketplace called Screen: INFOmatch in 2019. Both MDSL and TRG aim to provide structure and clarity to manage firmwide market data, research, software and enterprise subscription spend on subscriptions to market data providers like Bloomberg, Reuters, and FactSet.

- Contract Management and Centralized Inventory: Allows organizations to track, organize, and calculate costs related to market data vendors, contracts, products, and users. Contracts and licensing inventory details may be captured to create a centralized inventory of market data assets for use in invoicing and allocation.

- Compliance Workflow: Compliance approval workflows may be leveraged to review soft and hard dollar eligible costs.

- Invoicing Workflow, Reconciliation, and Allocation: Invoice processing becomes streamlined when matching against structured inventory records. Robust organizational structures may be accommodated to allocate to departments, groups, and/or individual users.

Complementary Solutions and Services

- Managed Services: Both MDSL and TRG offer managed service offerings inclusive of contract maintenance, compliance reviews, and invoice reconciliations. If you are underwater with your current market data expense management process, consider leveraging managed services as part of an initial implementation.

- Usage Monitoring and Control Products: MDSL: Access Compliance Engine (ACE) and TRG ResearchMonitor provide access controls and usage monitoring for subscription services, allowing you to reduce spend on underutilized services and directly ensure compliance with data access contracts/agreements.

How FinServ Can Help

Managing market data expense is often a headache for investment managers, but there are several leading marketplace solutions that help relieve the burden placed on market data managers. FinServ Consulting’s industry expertise and unparalleled track record of service for asset management clients makes us the right partner to help you select the right solution for your organization.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

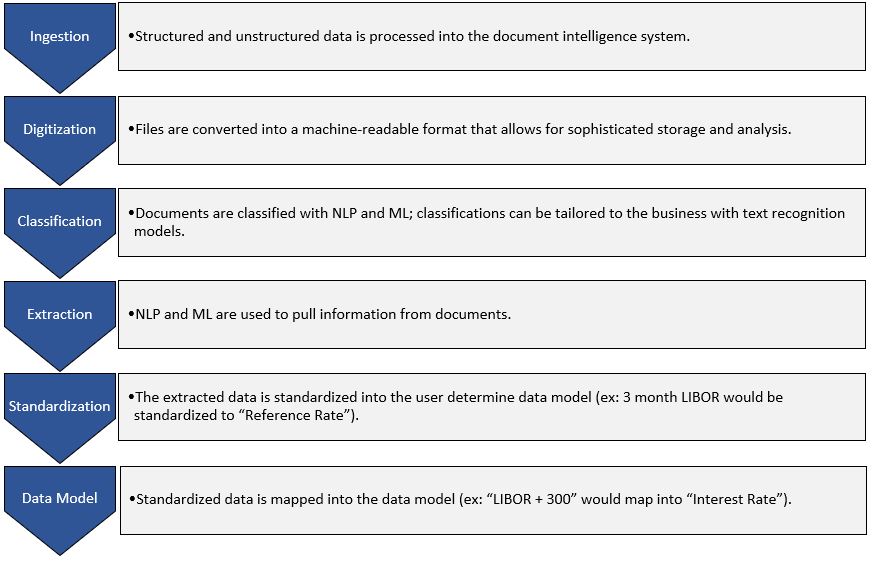

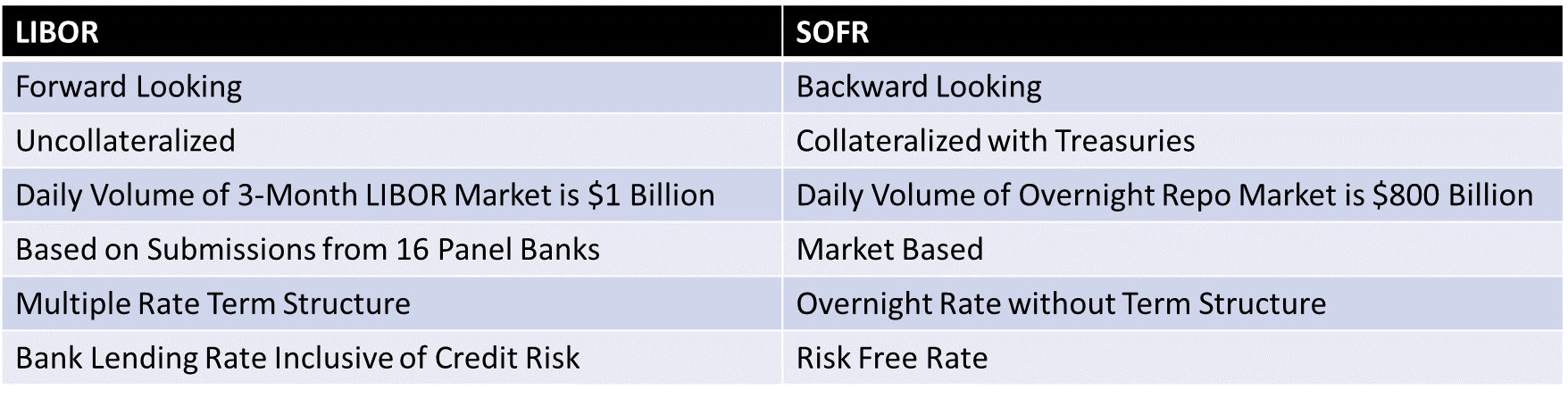

Leverage Document Intelligence to Expedite LIBOR Contract Renegotiations

As previously discussed in SOFR is the New LIBOR, one of the key issues regarding the transition of $35 trillion in USD LIBOR assets to an alternative reference rate is the lack of sufficient fallback language. Inadequate fallback language gives rise to an assortment of complications when attempting to analyze contracts using traditional technologies. Fallback language is the contractual provisions that outline the procedure for transitioning to a new reference rate.

Fallback Language Elements:

Issues with Fallback Language

Numerous issues arise when analyzing the fallback language of assets tied to USD LIBOR. Contracts often fail to designate a benchmark replacement rate and therefore leave managers without a clear resolution plan in the occurrence of a fallback trigger event. Most of the language was designed to alleviate temporary gaps in benchmark rate reporting rather than the permanent termination of LIBOR. Consequently, the appropriate benchmark replacement is unclear.

Compounding the lack of clarity is the absence of a standardized contract structure across various derivatives and cash products. Moreover, many contracts lack the existence of fallback language altogether. The involvement of multiple parties further complicates fallback language negotiations due to a misalignment of priorities. The amalgamation of these issues has hindered firms from storing asset contracts in a sophisticated document repository with search capabilities and often warrants the manual review of individual contracts.

Addressing the Situation