Prepare Your Business for Workday 2024 R1

Workday 2024 R1 was released recently and introduced multiple new payrolls and compensated-related capabilities. These features will have a major impact on the client’s Workday environment, and it is critical that the Workday team researches and tests the new updates in the Preview environment to ensure that their systems remain up-to-date.

Workday typically follows a semi-annual release schedule, with updates rolling out approximately twice a year. The spring update was released on the first weekend of March. The release introduced new features, enhancements, and fixes to the Workday platform to improve user experience, functionality, and overall performance.

These updates are important for Workday customers as they ensure that their systems remain up to date with the latest features and improvements, helping them to stay competitive and efficient in their operations. In this article, we specifically review the new Payroll and Compensation updates introduced by the Workday 2024 R1.

Payroll

Prior Period Tax Adjustments

Prior Period Tax Adjustment Calculator to reduce manual effort. PPTA is accessible through the related action icon of an original completed pay result.

- Select Prior Period Tax Adjustment > Run

PPTA Calculator streamlines the process for retro tax authority adjustments. If multiple pay results need to be adjusted, always start with the earliest completed period first.

PPTA can be used anytime users are retroactively adding, changing, or deleting the following for an employee:

- Primary home or work state

- Tax elections for work or home city

- Local other authority

- County local taxes

- Home school district

- Domicile state

The new Prior Period Tax Adjustment (PPTA) calculator will help to calculate tax and wage differences effortlessly due to retro tax authority changes in completed periods. This provides greater efficiency when adjustment for wages or taxes is needed due to retroactive tax authority changes.

Payroll Insights

Real-time smart tool for reviewing payroll results. It has multi-faceted filtering capabilities:

- Once a pay calculation has been run, the Payroll Insights report will pull predictive pay data.

- Allows easier review of historical payroll results to identify what are true abnormalities and what is not.

- Feedback can then be provided on predicted results to improve accuracy over time.

New Tasks:

- Maintain Payroll Insights Configurations

- Maintain Payroll Insights Custom Tags

New Reports:

- Payroll Insights Results Report

- Historical Payroll Insights Results Report

Payroll Insights provides a real-time prediction and evaluation tool to analyze payroll results based on historical payroll result patterns. This feature helps to reduce the amount of time and effort spent manually reviewing and identifying payroll exceptions.

Payroll Third-Party Payments

Generate and Settle Payments for Deduction Recipients of IWO and Court Orders. Workday can now process payments for IWO and Court Orders:

- When a pay calc is run, Workday generates a payable item for the deduction recipient’s line result.

- A new tab is produced on the pay result “Payroll Third-Party Payments.”

- After payroll is completed, the payable will be available to pull into Settlement Run using the new filter “Payroll Third-Party Payments.”

- Payments can be processed electronically via integration or through the print check feature.

Utilizing the normal payroll processing and settlement methods, Workday can now identify, process, and produce payments to deduction recipients. Previously, customers were required to handle these payments manually outside of the payroll process or rely on third-party vendors to complete them. Customers can now produce these payments internally with Check Printing or utilize their existing bank integrations. This feature is a time and cost-saver for clients currently managing the maintenance of their IWOs.

Compensation

Workday Docs for Compensation Statement Layouts. With Workday Docs, users can now create a custom Compensation Review Statement layout within Workday:

- Workday Docs for Layouts is a visual editing tool for designing, creating, and previewing document layouts for use with custom advanced reports in Workday.

- Users can insert data fields and even apply condition rules to any piece of the layout.

As one of the more highly anticipated updates, users can now completely customize the compensation review statements without the need for any outside reporting tools. Once created, users will be able to make updates to the compensation review statements more easily year over year.

Total Rewards Statement Redesign

Design for Increased Customization. Redesigned Layout:

- Users can now configure section groups that will display on the statement as cards.

- Each section group can include lists, tables, and calculated values.

- Users can arrange the cards on the statement in any order they like.

The updated design of Total Rewards Statements will allow users to customize how they show employees their compensation. This will allow employees to understand their compensation more easily and how it is broken into different components.

Percent-Based Calculated Plans

Manage Complex Percent-Based Compensation Plans. Target Percentage or Ceiling Amount:

- Manage complex percent-based compensation plans to configure and report on a target percentage and a ceiling amount for amount-based calculated plans and process them in Payroll.

Calculated plans can now be included in salary-dependent Primary Compensation basis calculations for workers managed by Basis Total. New display text for Calculated Plans with ceiling calculations or percentage calculations.

Dynamic Plan Type Display

Dynamic Compensation Transactions. Propose Compensation Change:

- Workday 2024R1 makes it easier to assign employees compensation during the Propose Compensation Change process by displaying only the relevant plan types for the employee.

By only seeing what is relevant to a specific employee when processing a Change Job or staffing transaction, the processor can decrease manual error while condensing what it sees and maximizing efficiency.

Grid Profiles for Compensation Review

Grid Configuration Profiles. Grid Profiles & Conditional Calculations:

- There is increased flexibility of grid configurations in compensation reviews. Users can now configure multiple grid configurations for the same compensation review process.

Flexibility within the Compensation Review Grid Configuration allows Planners to view fields that are more relevant to the participants in the process.

Conclusion

The Workday release will have a major impact on your current Workday environment, and new features will enable better user adoption for your team. It is critical that your team thoroughly researches and tests the new updates in your Preview environment.

Getting the most out of these features will require a thorough understanding of what you are trying to get out of Workday and how Workday will work within your organization. With FinServ, you have a trusted advisor with experience in both Workday and the industry to help you make informed decisions about what functionality to leverage, ensuring that you make the most out of your Workday investment. FinServ has advised both Workday HCM and Financial clients through Major Semiannual releases. In addition to release consultations, FinServ Consulting offers operational assessments and Workday implementations. FinServ has experienced HR and Finance consultants who have worked with clients on vendor selections and implementations of various HR and Finance platforms.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Mastering Data Migration: Strategies, Solutions, and Success

Data migration remains a critical process for alternative asset managers aiming to stay competitive, enhance operational efficiency, and achieve their strategic objectives. In the dynamic world of finance, where data is fundamental for informed decision-making, achieving seamless data migration is essential for alternative asset managers.

In the dynamic world of finance, where data is fundamental for informed decision-making, seamless and accurate data migration is essential for organizations like hedge funds, private equity firms, asset managers, and fund administrators aiming to transition their systems and workflows. With technology progressing rapidly and industry dynamics constantly evolving, the importance of robust systems and workflows cannot be overstated. Data migration emerges as a complex challenge in such a landscape, especially for entities handling intricate financial instruments, detailed investor allocations, and diverse portfolios. Successfully navigating this challenge demands strategic planning and meticulous execution to achieve desired outcomes.

This comprehensive blog post explores the intricacies of data migration tailored for financial firms, specifically hedge funds and fund administrators. Focusing on these firms’ unique landscape, we delve into their challenges, explore best practices for successful migrations, and propose potential solutions to navigate the complexities of transferring financial data seamlessly.

FinServ Consulting draws upon its extensive experience and cultivated expertise forged through partnerships with similar funds and entities. This strategic approach allows the company to successfully support its clients in the dynamic realm of data migration projects.

Challenges in the Data Migration Process:

Data migration is riddled with numerous challenges, especially when grappling with substantial data volumes or transitioning to a new system. This segment will delve into the complex hurdles faced by financial firms during data migration, addressing issues ranging from maintaining data integrity and managing compatibility disparities between source and target systems to mitigating the risks of downtime and disruption.

Data Quality Issues:

The importance of data quality cannot be emphasized enough, considering the significant consequences of incomplete or inaccurate data, duplicate entries, and improperly formatted information.

Accomplishing precise Net Asset Value (NAV) and investor allocations, the primary goals in every data migration project, depends significantly on the completeness and accuracy of the source data. This involves meticulously examining various data components, including trade and open lot files, non-trading and cash activity reports, and financial statements. FinServ Consulting highlights the crucial need to validate data samples for accuracy before migration, emphasizing a proactive approach to identify and rectify any inconsistencies. This ensures the preservation of data integrity throughout the entire migration process.

Disparity between Source and Target Systems:

A critical challenge during data migration arises from compatibility issues between the source and target systems. These systems may operate on distinct platforms or employ diverse data formats, creating obstacles to seamless data transfer.

For example, in the source system, certain asset classes like Collateralized Loan Obligations (CLOs), Loans, and Collateralized Mortgage Obligations (CMOs) might be uniformly treated as Notes or Bonds due to system limitations. However, the target system may support these distinct asset classes, requiring a thoughtful transition that accommodates these variations. In another scenario, the source system might lack an automated method for handling complex investor allocations, resorting to manual management through Excel spreadsheets. Conversely, the target system may feature a sophisticated calculation engine designed for these intricate allocations.

FinServ Consulting excels in crafting migration plans, which include testing and validation of these variations, ensuring a smooth transition that not only addresses system limitations but also effectively leverages the capabilities of the new environment. This tailored approach is essential for mitigating issues arising from differences in asset treatment, automation capabilities, and overall system functionality.

Downtime and Disruption:

Data migration often introduces downtime and disruptions to regular business operations. Throughout the process, systems may experience offline periods, and access to real-time and live data could be restricted, potentially impacting business operations and customer service. Mismanagement of the migration process can exacerbate downtime, leading to errors and potential data loss.

To counter the challenges of potential downtime and disruptions during data migration, FinServ Consulting adopts strategic measures. This includes scheduling migrations during less busy periods, conducting migrations in Quality Assurance (QA) environments, or implementing controlled setups with dummy entities in live production environments. FinServ emphasizes the importance of maintaining regular communication and updates for stakeholders throughout the entire process. This commitment to transparency and collaboration contributes to a smoother and less disruptive data migration experience for financial firms.

FinServ Consulting Recommended Best Practices for Successful Data Migration

FinServ Consulting’s recommended best practices serve as a comprehensive guide for financial firms undertaking data migration. By incorporating these practices into their migration strategy, businesses can navigate the complexities of the process with confidence and achieve successful outcomes.

Creating a Comprehensive Data Migration Strategy:

Formulating a well-defined data migration strategy is crucial for ensuring success in financial firms. This strategy encompasses various elements such as a detailed project timeline, a comprehensive list of deliverables, key milestones, roles and responsibilities, effective communication channels, and contingency measures to address unexpected challenges during the migration.

This involves conducting detailed sessions with the head of operations and accounting to understand how to achieve the end goal effectively. There are several approaches to data migration, each with its advantages and considerations:

- Migrating historical open lots and journal entries true up for all other entities, including cash and non-trading items, up to an agreed-upon Cut-Off Date. This method is the quickest and most cost-efficient solution. However, it may result in the loss of historical Realized P&L or journal entries.

- Migrating granular data, including all trades, cash activity, and journal entries. This approach provides a comprehensive solution with access to all historical P&L and ledger entries. However, it can be extremely time-consuming and expensive.

- Migrating open lots while maintaining granularity on cash and non-trading data. This option strikes a balance between the first two approaches. It is less expensive than option 2 and provides more historical data than option 1. Additionally, it can be cost-efficient and significantly quicker than option 2.

By carefully considering these options and aligning them with the organization’s goals and resources, financial firms can devise an effective data migration strategy tailored to their specific needs and objectives.

Ensuring Data Integrity and Systems Compatibility:

Data integrity is a critical consideration in achieving a successful data migration. This involves identifying discrepancies like missing or inaccurate data and creating a comprehensive plan for resolution. Utilizing data profiling tools is advantageous in detecting inconsistencies and determining effective approaches for resolution.

Additionally, verifying compatibility between source and target systems is essential for a seamless migration process. Given potential differences in data structures, formats, and standards, this involves mapping source data to align with the target system, identifying necessary data transformations, and validating data format accuracy.

Leveraging Automated Tools:

Automated tools play a pivotal role in enhancing the efficiency of the data migration process while simultaneously reducing the likelihood of errors. These tools encompass a spectrum of solutions, ranging from quick VBA scripts for data transformation to more comprehensive system-supported tools. Their primary objective is to automate key tasks such as data extraction, transformation, and loading.

For instance, consider a hedge fund with a substantial trading volume leading to a vast history of open lots and transactions. Once the source data formats are established, creating quick Excel macros can significantly expedite the loading process. This automation minimizes the need for manual intervention, resulting in notable time and cost savings while concurrently reducing the risk of errors.

Risk Mitigation and Contingency Planning:

Identifying potential challenges is crucial in data migration, and employing strategies to mitigate risks is essential. Developing comprehensive contingency plans ensures a swift response to unforeseen issues, safeguarding smooth project execution. This involves proactive risk assessment, ongoing monitoring, and agile responses to emerging challenges, all aimed at preserving project success.

It is crucial to have rollback options and restore points established during the data migration process to ensure that the previous accurate version is restored in case of unforeseen issues.

Documentation and Knowledge Transfer:

Creating thorough documentation is pivotal for future reference and ensuring effective knowledge transfer within the organization. This practice guarantees that insights gained during the data migration process are well-documented, facilitating seamless continuity and providing a valuable resource for future efforts.

Post Migration Support:

Establishing feedback loops is crucial for ongoing improvements after data migration. Continuous monitoring for post-migration issues allows for the identification of potential challenges, enabling the organization to address them swiftly. This involves creating mechanisms for gathering feedback to inform iterative enhancements and maintaining vigilant oversight to ensure a successful post-migration phase.

Conclusion

In conclusion, data migration remains a critical process for businesses aiming to stay competitive, enhance operational efficiency, and achieve their strategic objectives. While it presents inherent complexities and challenges, these hurdles can be overcome with the right strategies and considerations. By proactively addressing potential obstacles such as data quality issues and system incompatibility and adhering to best practices like meticulous planning, thorough testing, and vigilant monitoring, businesses can ensure a smooth and successful transition.

At FinServ, we understand the nuances of data migration, particularly within the realm of the asset management industry. Leveraging our deep expertise in diverse data types, workflows, and processes, we provide tailored solutions to meet each client’s unique data migration needs. Our methodologies and frameworks, supported by technical proficiency and a robust project management model, guarantee effective resolutions for data migration challenges. Whether you require a push-start, ongoing support, or leadership in complex migration projects, FinServ stands ready to assist your firm at every stage of the journey. With our assistance, you can confidently navigate the complexities of data migration, ensuring that your migration aligns seamlessly with your objectives and contributes to your overall success.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

Unlocking the Power of Data: Why Hedge and Private Equity Funds Should Embrace Snowflake

Traditional on-premises data warehouses often struggle with handling large datasets, hindering optimal decision-making. By embracing Snowflake, funds can gain a competitive edge by driving superior investment outcomes while keeping their data infrastructure secure.

In today’s rapidly evolving financial landscape, data has become the lifeblood of decision-making for hedge and private equity funds. As the volume, velocity, and variety of data continue to increase, so does the need for a modern, scalable, and agile data management solution. Enter Snowflake – a cloud data platform revolutionizing how organizations manage and analyze their data. In this blog post, we’ll explore why hedge and private equity funds should consider leveraging Snowflake to stay ahead of the curve and drive better investment outcomes. In this post, we have focused on the front-office-related aspects of a fund’s data. Still, the same advantages apply to the investor relations/business development, HR, and middle and back-office operations of your fund.

Scalability and Performance:

Hedge and private equity funds deal with massive amounts of data, from market trends and economic indicators to company financials and portfolio performance. Traditional on-premises data warehouses struggle to handle the scale and complexity of this data, leading to performance bottlenecks and scalability challenges. Snowflake’s cloud-native architecture allows funds to scale their data infrastructure on-demand, ensuring fast and reliable access to critical insights, even as data volumes grow.

Agility and Flexibility:

In today’s fast-paced financial markets, agility is key to seizing new opportunities and adapting to changing conditions. Snowflake’s decoupled storage and compute architecture enables hedge and private equity funds to decouple their data storage from compute resources, allowing them to independently scale and optimize each component based on their needs. This flexibility enables funds to quickly spin up new analytics workloads, experiment with new data sources, and iterate on investment strategies without being constrained by their underlying infrastructure.

Security and Compliance:

Data security and compliance are top priorities for hedge and private equity funds, given the sensitive nature of the information they handle. Snowflake provides industry-leading security features, including end-to-end encryption, role-based access controls, and data masking, to protect sensitive data and ensure compliance with regulations such as GDPR, CCPA, and SEC Rule 17a-4. Additionally, Snowflake’s built-in audit trail and governance capabilities provide funds with full visibility into data access and usage, helping them maintain trust and transparency with investors and regulators.

Advanced Analytics and Insights:

In the competitive world of finance, the ability to extract actionable insights from data can be the difference between success and failure. Snowflake’s integration with leading analytics and machine learning tools, such as Tableau, Looker, and DataRobot, empowers hedge and private equity funds to uncover hidden patterns, identify investment opportunities, and optimize portfolio performance. By leveraging Snowflake’s scalable compute resources and support for diverse data types, funds can perform complex analytics tasks, such as risk modeling, scenario analysis, and predictive modeling, with ease.

Cost-Efficiency:

Traditional data warehousing solutions often require significant upfront investment in hardware, software, and maintenance, making them cost-prohibitive for many hedge and private equity funds. In contrast, Snowflake’s pay-as-you-go pricing model allows funds to pay only for the resources they consume, eliminating the need for costly infrastructure investments and providing greater cost predictability and transparency. Additionally, Snowflake’s automatic scaling and resource optimization capabilities help funds minimize wasted resources and optimize their cloud spend, further driving cost-efficiency and ROI.

Conclusion

In conclusion, Snowflake offers hedge and private equity funds a modern, scalable, and agile data platform that can unlock the full potential of their data assets. By embracing Snowflake, funds can gain a competitive edge in the market, drive better investment outcomes, and future-proof their data infrastructure for the challenges ahead. It’s time for hedge and private equity funds to harness the power of Snowflake and take their data capabilities to the next level.

How FinServ Can Help

With close to twenty years of working with the top 100 Hedge and Private Equity funds, FinServ is uniquely positioned to understand the data requirements of your fund from Front to Back-Office and everywhere in between. Our consultants possess the technical skills and industry expertise to help you design and implement an effective Snowflake strategy. Our familiarity with all the other systems you will need to integrate your Snowflake data into makes FinServ the ideal Snowflake Partner to help you unlock the Power of their platform today.

About FinServ Consulting

FinServ Consulting is an independent, experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks, and industry service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle, and back-office. FinServ provides managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience working with the world’s largest and most complex asset management firms and global banks.

The Great Debate: Agile or Waterfall Project Management

Effective Project Management

Effectively managing a project and team(s) is a difficult task that faces increased challenges in a remote environment. Obstacles are exacerbated by the lack of in-person collaboration and the inability to stop by a colleagues desk for a quick and informal update. However, selecting the correct project management methodology can help alleviate numerous issues and ensure that your project is completed successfully.

Agile & Waterfall Methodology Overview

No project management technique is best suited for all situations. The most common methodologies are Waterfall and Agile. Although both approaches are popular and have been around for an extended period of time, specific projects are better suited by one or the other.

The Waterfall methodology is the traditional and sequential approach that is best for projects with a well-known scope likely to experience minimal change. Client input takes place at milestones as the project transitions throughout the various phases. In a Waterfall project management strategy, each phase must be completed prior to transitioning to the following phase. These phases are clearly outlined and define clear objectives that must be accomplished before progressing.

As indicated by the name, an Agile methodology is designed to accommodate change. Its iterative nature focuses on completing certain objectives by the end of a specified time period known as a sprint. Agile methodologies are well suited for projects with unclear initial requirements. The methodology prioritizes the most important aspects of a project and relies on continuous client input throughout the engagement. Deliverables are reviewed by the client and other applicable teams after their corresponding sprint.

Advantages of Each Method

The Waterfall approach’s numerous advantages derive from its structured nature. The first of which, is that it clearly defines all aspects of the project and ultimately increases planning accuracy and detail. Consequently, this approach aligns well with fixed price contracts and government entities. Furthermore, progress can be measured through the completion of each phase as opposed to a product backlog that hasn’t been addressed.

It is less reliant on client input because it is predominantly collected at milestones. This allows the client to take a hands off approach and focus on the day-to-day operations of their business. Finally, successful completion of projects managed with a traditional methodology ensures that all items are addressed and eliminates ambiguity.

One of the greatest advantages to the Agile approach is its flexibility. An Agile approach is particularly useful when the project’s timeline is strained because it prioritizes the most important features. The sprint structure aligns with Time & Materials contracts because sprints are predetermined timeframes that specify workload.

Additionally, constant client interaction augments quality via increased feedback, additional testing, and dynamic user requirements that account for evolving needs. The constant nature of client feedback allows for frequent modification of the product backlog. This is particularly useful for a technical client that wants to get a deeper understanding of the solution. They can work through their use cases and determine if their needs will be better served by an alternative route.

Disadvantages of Each Method

Although each method is effective in its own right, they are not without disadvantages. The Waterfall methodology requires a thorough understanding of business requirements prior to beginning. The Project Manager must have a clear sense of all client needs and initially account for them throughout the various phases. Scenarios where the client is unable to provide a comprehensive overview of the requirements may force the PM to “fill in the gaps” – which is far from ideal.

Another disadvantage associated with the Waterfall approach is the risk of a final deliverable that is not in line with client expectations. Given that the client is less involved in the process, they may be surprised by the end result. However, the traditional approach hedges against this with comprehensive requirements and periodic updates.

Agile method drawbacks tend to be associated with one of its strengths, frequent client input. It requires a significant amount of coordination and cooperation across multiple internal and external teams. While this is great in theory, it may be difficult in practice. Clients may not have the resources, interest, or expertise required for the Agile approach’s mandated involvement. This is especially relevant when the client outsources the work as they hired another firm to step away.

The adaptability of the approach leads to many changes in the project’s scope. These changes affect the project’s cost and timeline. Unfortunately, this is not feasible for certain clients and situations. Moreover, low priority items may not get completed within the original time frame due to a focus on high priority items.

Conclusion

In conclusion, both the Waterfall and Agile Project Management methodologies include pros and cons. In an ideal scenario, the project would be completed successfully regardless of the utilized approach. However, certain client types, engagements, and solutions are better suited by one of the two methods. It is critical that you discuss both options with the client and pick the one that they are most comfortable with. Many professionals blend the two techniques to benefit from each’s strengths while minimizing the drawbacks. Recent trends have increased popularity for Agile management, but it is beneficial to gather all available requirements as early as possible.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Technology Sets Its Sights on Private Equity

The evolution of technology and its impact across various industries has become widely accepted, particularly for Financial Services. However, Private Equity’s acceptance of new technology has lagged behind other subsectors. Resistance is subsiding as Private Equity Funds are rushing to adopt Client Relationship Management (“CRM”) tools, utilize unstructured data, and transition to the cloud.

Relationship Management

Success within Private Equity is reliant upon strong and enduring relationships that are difficult to manage without the proper infrastructure. Scattered data paired with a lack of centralized oversight can serve as a catalyst for inefficiencies that hinder deal execution and frequency. Efforts to combat the before mentioned issues have given rise to the popularity of CRM systems. Furthermore, numerous CRM solutions can be configured to streamline reporting and eliminate user error.

Although the absence of a CRM system can be detrimental to a firm’s success, a poorly configured system that fails to meet user requirements may be worse. Inadequate systems are generally accompanied by a lacking implementation partner that failed to assess the organization’s needs prior to vendor selection. It is crucial to enlist the services of an experienced implementation partner that has “been there, done that”.

FinServ has successfully implemented CRM solutions for countless Alternative Asset Managers and Financial Institutions. Not only are we a Salesforce Partner, but we also have significant experience with other industry CRMs such as Backstop, Clienteer, and Dynamo. FinServ can walk you through the entirety of the process by gathering business requirements, managing the implementation so you can focus on your business, and tailoring the solution to facilitate your unique procedures.

Data Utilization and Analytics

We are in the golden age of data and organizations are eager to leverage as much of it as possible. Unfortunately, sourcing data from a variety of locations often leads to a lack of uniformity and an assortment of issues. Private Equity firms are implementing robust analytics and data science for Transactional Due Diligence, Post-Investment Value Creation, and more. The application of data science within Transactional Due Diligence is exceptionally groundbreaking as perspective buyers are often subjected to tight timeframes of approximately 6 weeks.

Business Intelligence, Data Science, and Machine Learning allow Private Equity firms to conduct real-time analysis and assess billions of data records in a limited amount of time. Granular post-investment analysis can be attributed to geography, customer type, and more. The segmentation of the data enables a comprehensive understanding of the business. Thus, augmenting the Private Equity firm’s ability to perform the focused improvements that are central to their business model.

Exhaustive analysis of the fund’s overarching portfolio and individual companies hinges upon access to structured data. FinServ has the extensive Business Analysis and Operational Assessment experience that is required for structuring processes and data accordingly. We will partner with your organization to remediate operational issues while integrating innovative technology.

Transitioning to the Cloud

Cloud utilization is rapidly increasing as stigmas against housing data in off-premise locations have eroded. Private Equity firms are realizing the significant benefits provided by transitioning their data to cloud environments, SaaS, and IaaS locations. Migration allows firms to focus on their core competencies rather than hosting data. Cybersecurity is a predominant concern that will be alleviated by outsourcing a portion of the responsibility to an organization that exclusively focuses on housing internal and client data. Safeguarding this sensitive information is required for client safety, firm reputation, and regulations such as GDPR.

One consideration that may be inhibiting your organization’s migration to the cloud is the massive undertaking of doing so. FinServ has honed our data migration expertise through 15+ years of working alongside more than 40 of the world’s top 100 Hedge and Private Equity Funds. Communication is emphasized throughout our engagements and we will partner with your organization to ensure a proper and efficient transition. Furthermore, FinServ will take the opportunity to streamline processes and eliminate bottlenecks that have been hindering your business.

Even though Private Equity has been slower to adopt new technologies than other Alternative Asset Managers, the industry has begun to align with key initiatives offering indisputable benefits. The implementation of superior technologies like CRM systems, Cloud infrastructure, and the utilization of data for advanced analytics supplements competitive advantages and investor returns.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Cybersecurity Protection with Salesforce Shield

Salesforce recently introduced a cybersecurity focused offering that builds on the already formidable security capabilities of the world’s leading customer relationship management platform. With Salesforce Shield, organizations can institute better internal cybersecurity practices by developing clearer oversight of employee’s daily activities and stronger protection of their valuable data. Salesforce Shield expands on the class leading security infrastructure of Salesforce across the three key service areas of:

- Platform Encryption

- Event Monitoring

- Field Auditing

Salesforce Shields’s focus on these three services allows for a more nuanced utilization of privacy functionalities and clearer oversight into the firm’s cyber activities. Of course, administrators of standard Salesforce environments could always customize their firm wide security settings through a variety of restrictions, permissions, and requirements across the platform. However, with Salesforce Shield, administrators have exponentially deeper control and granularity when establishing and maintaining their firm’s online security. This article will provide an overview of each Salesforce Shield’s services, as well as the key factors management should consider when implementing the technology.

Platform Encryption

A standard Salesforce subscription only allows for the encryption of custom fields that are less than 175 characters, which is likely insufficient for many firms that maintain large amounts of customer data. For the first time, Salesforce Shield brings encryption to a wider range of custom and standard fields, including sensitive information such as Account Names, Addresses, Phone Numbers, and Emails. Platform Encryption with Shield allows users to natively encrypt their most sensitive data such as personally identifiable information (PII), confidential, or proprietary data, while meeting internal and external compliance regulations. Salesforce Shield also allows users to adopt the latest encryption innovations, such as Bring Your Own Keys (BYOK), which allow users to provide their own tenant secret, generate their own Hardware Security Module (HSM), and ultimately increase their control over the encryption processes.

Implementation Considerations:

1) Identify Encryption Needs

-

- Firms need to first identify their unique encryption needs. Encrypting every piece of data that a firm has online would slowdown workflows, leading to inefficiencies that provide little returned value. Firms should identify and evaluate the potential channels and methods of attack they face, while also classify the data types that they would like to protect. At the same time, firms can specify which fields are the truly “must encrypt” elements and evaluate the business functionality changes that may come with encrypting this information.

2) Apply Field Level Encryption

-

- Because encryption can be assigned at the field level across different users, firms need to decide which fields would be accessible by different users. Shield allows firms to grant permissions to certain fields only for authorized users, while also applying encryption to these fields for an added level of security. Once these capabilities have been properly vetted, users can begin testing how their business processes would work with this newly encrypted data.

3) Define Key Management Strategy

-

- Shield enables firms to take on greater ownership over their encryption key management strategy. For an effective implementation of Salesforce Shield, firms should identify who can manage the encryption keys and define the protocols for backing up, rotating, and archiving keys.

4) Maintain Organization’s Encryption Policy

-

- Platform encryption requires strong policy and procedure documentation to guarantee its effectiveness. Establishing the lifecycle of keys and periodic data backups ensures that the data your firm has today is securely maintained in the future as well. Meanwhile, periodic reviews of encryption protocols ensure that these established policies remain effective as data grows and new fields are added. Regular reviews of data encryption protocols are a critical aspect of continued data security and data effectiveness with Salesforce Shield.

Event Monitoring

Salesforce Shield allows firms to have even clearer oversight of critical business performance and user behavior data. Firms using Salesforce Shield have a deeper understanding of the underlying performance, security, and individual usage of data stored in their Salesforce ecosystem. With Event Monitoring, managers can drill deeper into their event log files in order to visualize time relevant performance and security metrics. This allows managers to understand employee behavior within Salesforce, ensuring that they are securely utilizing the platform to its fullest potential, and overseeing the storage of their sensitive data. Managers would find these capabilities especially valuable during audits, when regulators can easily drill down to see what changes were made within Salesforce, by which users, at what time. Shield allows for this Event Monitoring capability on over 40 different event types across different user activities, all of which can be displayed across 16 pre-built dashboards.

Implementation Considerations:

1) Capture Read-Only Event Log Files

-

- With more than 40 event types able to be captured using Salesforce Shield, firms should first review the current list to see which would bring value to their organization. Event logs can store the granular details of how specific users are utilizing the firm’s data, as well as the corresponding timing and location of these action. Therefore, understanding what data to be capturing as well as the means of capturing this data is critical part of a successful Salesforce Shield implementation.

2) Visualize the Data to Identify Critical Insights

-

- The ability to directly transfer Salesforce insights into any business intelligence or data visualization tool, such as PowerBI (click here for an earlier FinServ post on Power BI), allows managers to quickly visualize trends and develop actionable strategies. Users can also build Data Loss Prevention or Adoption & Performance dashboards with Einstein Analytics or bring this data into any of the 16 prebuilt dashboards with the Einstein Event Monitoring Analytics tool included with Shield. Additional visualizations capabilities can also be found in pre-built apps via Salesforce’s AppExchange and data can still be exported to CSV files for additional analysis and visualization methods.

3) Take Action

-

- Identifying gaps in security policies and procedures, modifying governance policies, and setting up access controls as well as transaction security measure are all early management considerations for an effective implementation of the Event Monitoring service. This will support firms in driving initiatives to increase user adoption, automating workflows, and improving the overall performance of their Salesforce environment.

Field Audit Trail

As companies continue to generate and track massive quantities of data, having an effective IT governance strategy in place becomes more and more critical. Salesforce Shield Audit Trail allows users to track the history of various data fields in their Salesforce ecosystem in a far more robust manner. While the field history feature included with a standard Salesforce subscription allows users to track 20 fields for 18 months, Salesforce Shield Audit Trail allows users to track 60 fields per object for 10 years. This is a significant asset for firms operating in highly regulated industries such as financial services. Shield allows firms to extend the utilization of their audit trails while remaining compliant with data retention and audit granularity requirements.

Implementation Considerations:

1) Consult Business Units to Understand Retention and Audit Period / Depth

-

- Firms should first identify their data retention and audit period on a per object basis to understand exactly where and how Audit Trails may benefit their business processes. While the maximum possibility is for 10 years and 60 objects, firms should find the ideal balance between complete oversight and operational efficiency. Additionally, firms should consider the unique regulatory guidelines they must adhere to while customizing the service to fit their needs.

2) Set Retention Policies

-

- Firms should determine which fields and objects should be retained for audit purposes. Additionally, identifying when and how long this information should be archived is a crucial step in a successful implementation of Field Audit Trail.

3) Identify Practices for Retrieving and Auditing Data

-

- Finally, firms should develop best practices for obtaining, maintaining, and auditing this data. Steps such as setting up audit dashboards, defining standardized queries, and providing access to auditors in the permissions settings should be taken to ensure consistent and accurate reporting of Field Audit Trails in the future as well.

Security Benefits Over Standard Salesforce

The Platform Encryption, Event Monitoring and Field Audit benefits that Salesforce Shield brings to users, beyond the basic platform capabilities, offer an effective means of protection against a wide range of cybersecurity threats. Firms can now encrypt large amounts of information in standard objects, track and visuzalize a variety of events in pre-built dashboards, and maintain an audit history of dozens of objects for a decade. Salesforce has recognized that as the cybersecurity landscape continues to evolve, robust and innovative solutions are needed to keep their customers ahead of criminal attacks.

FinServ’s Capabilities

When securing your firm’s sensitive data from increasingly sophisticated attacks, it is crucial to partner with industry experts that understand the most effective solutions available. While Salesforce Shield brings a deeper level of sophistication over classic Salesforce security capabilities, sophisticated technology is only part of the complex cybersecurity equation. FinServ can gather the development requirements and implement the detailed policies and procedures to protect your firm for years to come. An effectively led implementation of Salesforce Shield is the best way to ensure that there is lasting security for your organization as cybercrimes grow more sophisticated and prevalent.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.

Intelligent Business with Power BI

In order to understand the capabilities of Power BI, it is best to start with the fundamentals of Analytics & Business Intelligence (“ABI”) and data visualization. The combination of ABI and data visualization allows Power BI to articulate information in a digestible manner that is supportive of intelligent decision making.

ABI tools are user-friendly data management platforms that emphasize self-service and provide analytical functionality ranging from data preparation to insight generation. Business Intelligence (“BI”) leverages historical information while analytics employs modeling and statistics to anticipate future events. Generally speaking, BI is focused on what happened, and analytics is focused on why it happened.

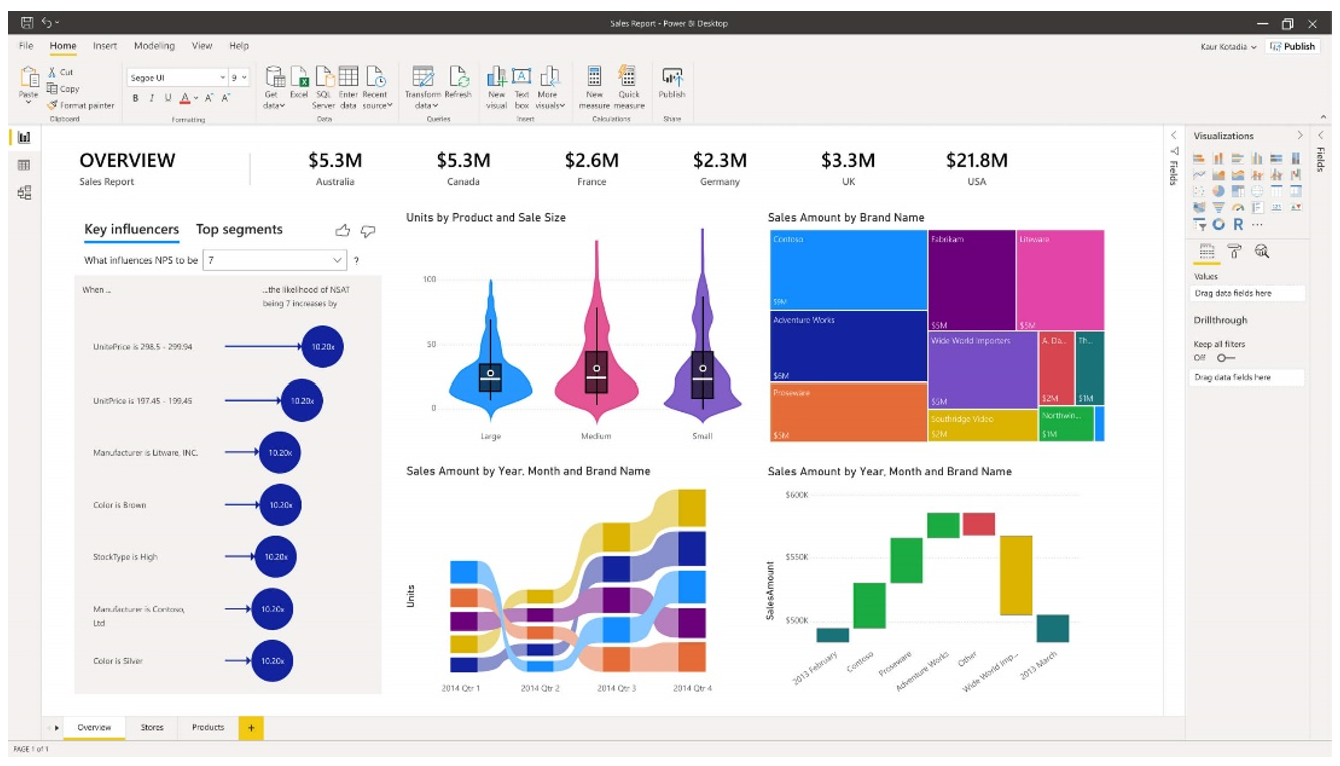

Data visualization is the presentation of information through graphical mediums like charts, diagrams, dashboards, and more. Dashboards are an amalgamation of components designed to inform stakeholders in an aesthetically pleasing manner like the sales dashboard below. The goal is to provide an informative platform that is far easier to comprehend than traditional resources such as a spreadsheet with thousands of rows.

Power BI and Its Key Features

Power BI is a business intelligence solution that enables companies to draw organizational insights by using data visualizations, performing analytics, connecting to hundreds of data sources, and embedding content into external applications & websites. An additional benefit enjoyed by users on the Windows platform is its seamless integration with the Microsoft suite. In summation, Power BI allows users to connect, prepare, model, and visualize data.

Power BI incorporates numerous features (illustrated above) that assist in the analysis and comprehension of a business. Three particularly impressive features included in Power BI’s repertoire are Natural Language Generation (“NLG”), Automated Insights, and Advanced Analytics. NLG uses artificial intelligence to automatically produce rich text descriptions detailing outputs. Automated Insights are conceived from advanced algorithms and are a great way to initiate analysis on large data sets. While the initial analysis generated from Power BI can provide direction for additional research and evaluation, other factors may be sufficiently analyzed within Power BI without the need for further investigation. Advanced Analytics can be performed with Power BI’s internal ABI platform and/or by integrating with external models. Azure Machine Learning Studio’s drag and drop interface can be combined with SQL and R to conduct predictive analytics on data sets.

Subscription Options and Functionality

The three versions of Power BI are Desktop, Pro, and Premium. Desktop, the lowest-tiered option, can be downloaded from the Microsoft Store for free. It includes the core data visualization and analysis features; data preparation, reports, dashboards, connection to over 50 data sources, and the ability to export in various formats.

Pro includes all of Desktop’s functionality and can be purchased as a standalone product for an annual subscription of $10 per user license per month or as part of the Microsoft Office 365 Enterprise E5 suite. The enhancements differentiating Pro primarily fall under collaboration and the distribution of content. For example, users can share their insights by embedding visuals within applications such as SharePoint and MS Teams. Furthermore, users can leverage peer-to-peer sharing to distribute their work to external stakeholders with Power BI Pro licenses.

Premium, the most advanced offering, comes at a hefty annual subscription that breaks down to a monthly price of $4,995 per dedicated cloud compute and storage resource. Some distinguishing characteristics that amplify data analysis include enterprise level BI, cloud & on-premise reporting, dedicated cloud computing, and big data analytics. Other features that are included in Power BI Premium are increased storage, higher refresh rates, and a larger data capacity. Premium grants enterprise-wide access and is best suited for large organizations with significant business intelligence requirements.

Implementing Power BI in Financial Services

Power BI has countless applications for alternative asset managers and other financial services companies that span the front, middle, and back office. One of Power BI’s most popular functions is financial management and reporting. QuickBooks Online customers can utilize a preconfigured Content Pack that allows them to quickly construct financial statement dashboards. Users are immediately provided with functionality that comprises customer rankings, profitability trends, and various financial ratios.

Implementing and tracking KPI’s with Power BI allows investment managers to accurately evaluate operations. Best practice is to have KPIs spanning the front, middle, and back office because an unidentified issue in any of the three areas can be detrimental. A few prevalent KPIs are Investment Management Fee Revenue as a Percentage of AUM, Trade Settlements per Back Office Employee, Subscriptions vs. Redemptions, and Trade Error Rate by Asset Class.

Business intelligence can be applied to portfolio management by connecting Power BI to the underlying data sources detailing investments. For instance, asset allocation reports and dashboards allow fund managers to interpret the distribution of funds relatively easily. Another prominent application of Power BI is treasury & liquidity management because data visualizations can be developed to provide detailed breakdowns of cash management, FX hedge balances, and more.

Conclusion

Power BI is a powerful ABI platform that augments a business’s ability to consume data through the creation of interactive reports and dashboards. Business intelligence can be constructed to support any business function with enough data. More importantly, it can be configured to the firm’s unique needs and has the ability to adapt with dynamic business requirements.

FinServ has acquired deep industry and technological expertise through the completion of over 600 engagements at more than 40 of the top 100 Hedge and Private Equity Funds. FinServ can configure Power BI to accurately monitor operations, identify the correct KPIs, properly document business processes, and seamlessly integrate new technologies with existing infrastructure.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.