The evolution of technology and its impact across various industries has become widely accepted, particularly for Financial Services. However, Private Equity’s acceptance of new technology has lagged behind other subsectors. Resistance is subsiding as Private Equity Funds are rushing to adopt Client Relationship Management (“CRM”) tools, utilize unstructured data, and transition to the cloud.

Relationship Management

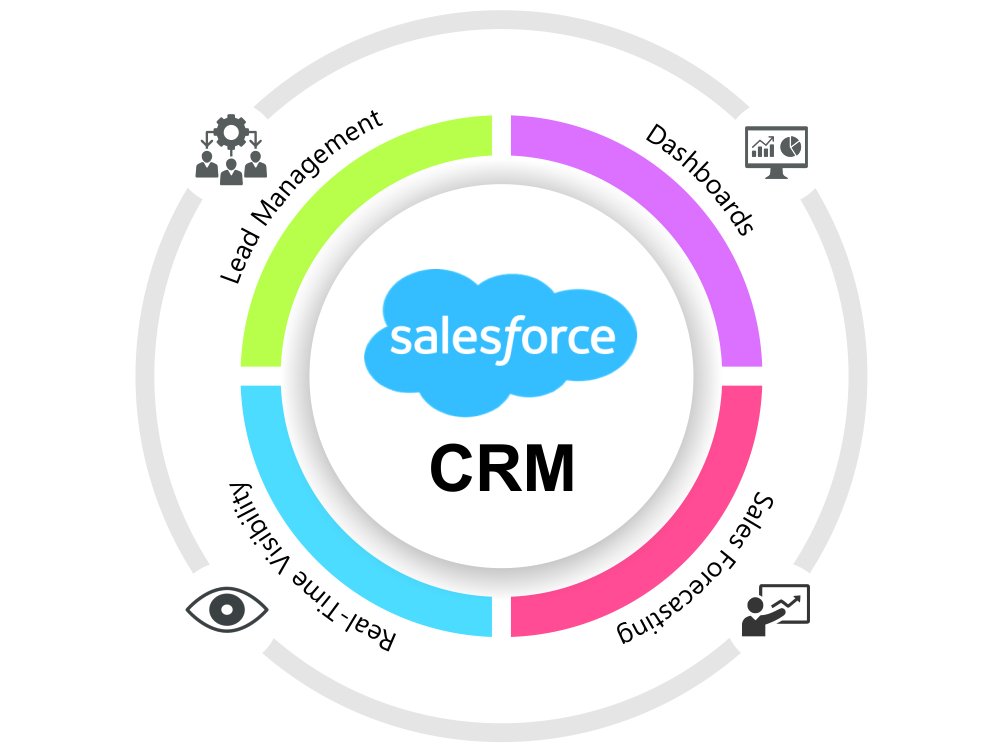

Success within Private Equity is reliant upon strong and enduring relationships that are difficult to manage without the proper infrastructure. Scattered data paired with a lack of centralized oversight can serve as a catalyst for inefficiencies that hinder deal execution and frequency. Efforts to combat the before mentioned issues have given rise to the popularity of CRM systems. Furthermore, numerous CRM solutions can be configured to streamline reporting and eliminate user error.

Although the absence of a CRM system can be detrimental to a firm’s success, a poorly configured system that fails to meet user requirements may be worse. Inadequate systems are generally accompanied by a lacking implementation partner that failed to assess the organization’s needs prior to vendor selection. It is crucial to enlist the services of an experienced implementation partner that has “been there, done that”.

FinServ has successfully implemented CRM solutions for countless Alternative Asset Managers and Financial Institutions. Not only are we a Salesforce Partner, but we also have significant experience with other industry CRMs such as Backstop, Clienteer, and Dynamo. FinServ can walk you through the entirety of the process by gathering business requirements, managing the implementation so you can focus on your business, and tailoring the solution to facilitate your unique procedures.

Data Utilization and Analytics

We are in the golden age of data and organizations are eager to leverage as much of it as possible. Unfortunately, sourcing data from a variety of locations often leads to a lack of uniformity and an assortment of issues. Private Equity firms are implementing robust analytics and data science for Transactional Due Diligence, Post-Investment Value Creation, and more. The application of data science within Transactional Due Diligence is exceptionally groundbreaking as perspective buyers are often subjected to tight timeframes of approximately 6 weeks.

Business Intelligence, Data Science, and Machine Learning allow Private Equity firms to conduct real-time analysis and assess billions of data records in a limited amount of time. Granular post-investment analysis can be attributed to geography, customer type, and more. The segmentation of the data enables a comprehensive understanding of the business. Thus, augmenting the Private Equity firm’s ability to perform the focused improvements that are central to their business model.

Exhaustive analysis of the fund’s overarching portfolio and individual companies hinges upon access to structured data. FinServ has the extensive Business Analysis and Operational Assessment experience that is required for structuring processes and data accordingly. We will partner with your organization to remediate operational issues while integrating innovative technology.

Transitioning to the Cloud

Cloud utilization is rapidly increasing as stigmas against housing data in off-premise locations have eroded. Private Equity firms are realizing the significant benefits provided by transitioning their data to cloud environments, SaaS, and IaaS locations. Migration allows firms to focus on their core competencies rather than hosting data. Cybersecurity is a predominant concern that will be alleviated by outsourcing a portion of the responsibility to an organization that exclusively focuses on housing internal and client data. Safeguarding this sensitive information is required for client safety, firm reputation, and regulations such as GDPR.

One consideration that may be inhibiting your organization’s migration to the cloud is the massive undertaking of doing so. FinServ has honed our data migration expertise through 15+ years of working alongside more than 40 of the world’s top 100 Hedge and Private Equity Funds. Communication is emphasized throughout our engagements and we will partner with your organization to ensure a proper and efficient transition. Furthermore, FinServ will take the opportunity to streamline processes and eliminate bottlenecks that have been hindering your business.

Even though Private Equity has been slower to adopt new technologies than other Alternative Asset Managers, the industry has begun to align with key initiatives offering indisputable benefits. The implementation of superior technologies like CRM systems, Cloud infrastructure, and the utilization of data for advanced analytics supplements competitive advantages and investor returns.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.