One of the recurring challenges new Salesforce clients encounter during their implementations is grappling with how standard Salesforce objects/functions align with their actual business processes. It is one side of the knowledge sharing gap on any new vendor software implementation. The other side of the gap is that technology teams need to get up-to-speed on a client’s business as quickly as possible. This includes a macro understanding of the client’s industry, the specific business processes related to the project, and how any legacy systems work to support client activities today. The faster these gaps close, the better the final solution will be in the end.

The goal of this article is to address the client-side knowledge gap by educating potential Salesforce clients about one of the critical design discussions in any Salesforce implementation: When Should Contacts be Created in Salesforce? To answer that question, the article will provide a quick overview of some core Salesforce basics, along with FinServ’s rationale supporting Contact-Based Leads for Financial Services clients:

- What is the Difference Between a Lead and an Opportunity in Salesforce?

- What are Salesforce Contacts? When are Contacts Created in the Default Salesforce Workflow?

- What is a Contact-Based Lead Approach? Why is it a Better Choice?

Leads Convert into Opportunities

What is the Difference Between a Lead and an Opportunity in Salesforce?

In Salesforce, Leads represent potential deals that have not been fully vetted or “qualified”; they could also be referred to as “unqualified opportunities”. In this case, qualified refers to confirmed interest from a prospect to buy a specific product/service/offering. Leads can come from a variety of sources, such as real-life interactions like meeting someone at an event or when someone fills out a form on a website requesting more information on a specific product/service.

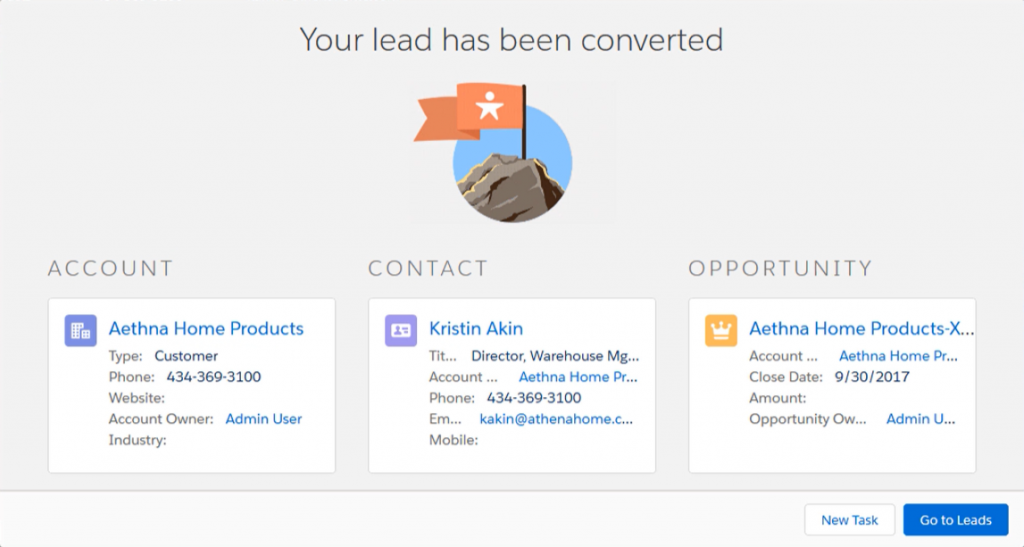

What separates Leads and Opportunities is how realistic the deal is based on confirmed client interest. Opportunities are real, active deals with confirmed, measurable interest from a prospect. When that hurdle is met, Leads are considered qualified and they are “converted” into Salesforce Opportunities. Opportunities are the sales and pending deals that need to be tracked. By creating Opportunities, a “pipeline” of deals is formed, which may be tied to sales forecasting and advanced pipeline reports.

What are Salesforce Contacts? When are Contacts Created in the Default Salesforce Workflow?

Contacts are the golden source of all data related to a person/individual. The set of Contacts in Salesforce is simply a modern-day rolodex. Out-of-the-box Salesforce includes basic datapoints for Contacts one would expect like phone numbers, email addresses, and mailing addresses. When you convert a Lead in Salesforce, the system guides you through the creation of new Accounts, Contacts, and Opportunities, while connecting that data with the information already on the platform.

This default Lead-to-Contact process flow makes sense for a lot of Salesforce clients that are dealing with a high volume of low-quality Leads. An example of this would be a web-based retail store; lots of potential customers might show up through various channel source that need to be filtered and cultivated. Keeping your Leads and Contacts separate help to reduce tracking bad person/individual data from Leads in Salesforce Contacts. The problem with this approach is that Leads are never associated with a Contact until the Lead is qualified and the actual Lead conversion process occurs, which means you lose prospect history. This affects a couple key areas for most of FinServ’s financial services clients:

- Cross-Selling New Products/Services to Existing Clients: Valuable historical information from past interactions on a Contact are never associated with new Leads for the same person/individual. That includes the basics like simple contact information to important details like preferred market strategies and potential commitment amounts for a hedge fund client.

- Re-engaging Old Leads: Even if Leads don’t convert in an isolated sales cycle, most FinServ clients are not dealing with high volume, low-quality. The Leads available are usually curated through existing relationships or through industry service like capital introduction. It is important to curate all this information whenever new Leads are created to avoid face losing valuable details.

What is a Contact-Based Lead Approach? Why is it a Better Choice?

The simple solution to all these issues with vanilla Salesforce is simply to adopt a Contact-Based Lead Approach. This means that users may create Leads from existing Contacts and relate Lead records to Contacts before the Lead conversion process occurs. It’s that easy and it facilitates the ability to handle the above limitations with standard Salesforce, while also supporting common business activities like the ability to track multiple Leads for the same Contact.

The Bottom Line

Adopting Contact-Based Leads is quick solution to solve some of the major limitations of vanilla Salesforce to align the platform with financial services businesses; however, it is a major design decision that is easier to enforce for new implementations. It is always better to measure twice and cut once. FinServ Consulting’s industry expertise and unparalleled track record for financial services clients makes us the right partner to help you make the best decisions to support your business.

To learn more about FinServ Consulting’s services, please contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.