Integrating external data feeds from your Administrator can facilitate operations and eliminate many of the daily bottlenecks faced by employees. Investor Relations teams may struggle to adequately communicate key performance and investment data to investors if they are simultaneously juggling numerous information sources. Directly feeding Administrator data into Salesforce will allow them to navigate a singular system while answering critical questions. Moreover, you can finally eliminate your countless excel files and the associated processes that mandate excessive manipulation.

Salesforce boasts impressive reporting and data visualization functionality that will enable your firm to draw deeper insights. The amalgamation of Salesforce Reports, Dashboards, and real time data will allow your organization to create visualizations highlighting key investor and performance metrics. Thus, augmenting personnel’s ability to anticipate client needs and answer their questions. FinServ has developed an assortment of pre-built reports and dashboards that isolate data pertaining to investment strategy, region, fee structure, performance, and more.

How to Integrate Your Data

Salesforce offers three primary tools for uploading data into Salesforce: Data Import Wizard, Data Loader, and dataloader.io. Each tool is applicable in its own right with differing use cases and functionality. The Data Import Wizard does not require installation and can easily be found by performing a quick search within Setup. Once you open the Data Import Wizard, it is as simple as selecting your CSV file and mapping the fields via the Salesforce Interface. Although the Data Import Wizard is a useful tool for basic uploads, it’s record count is limited to 50,000 and it cannot export data. The Data Import Wizard can be leveraged for both Custom Objects and Standard Objects such as Accounts, Contacts, Campaign Members, Leads, and Solutions.

Data Loader is a more robust data integration solution than Data Import Wizard. It is an external client application and therefore requires installation. The Data Loader facilitates the importation of 5,000 to 5 million records and is inclusive of both data exportation and deletion functionality. Users can specify configurations with the user interface or command-line interface. More advanced users can use the command-line interface to automate their data processing needs. However, the command-line interface is limited to Windows users and uses the Salesforce Object Query Language.

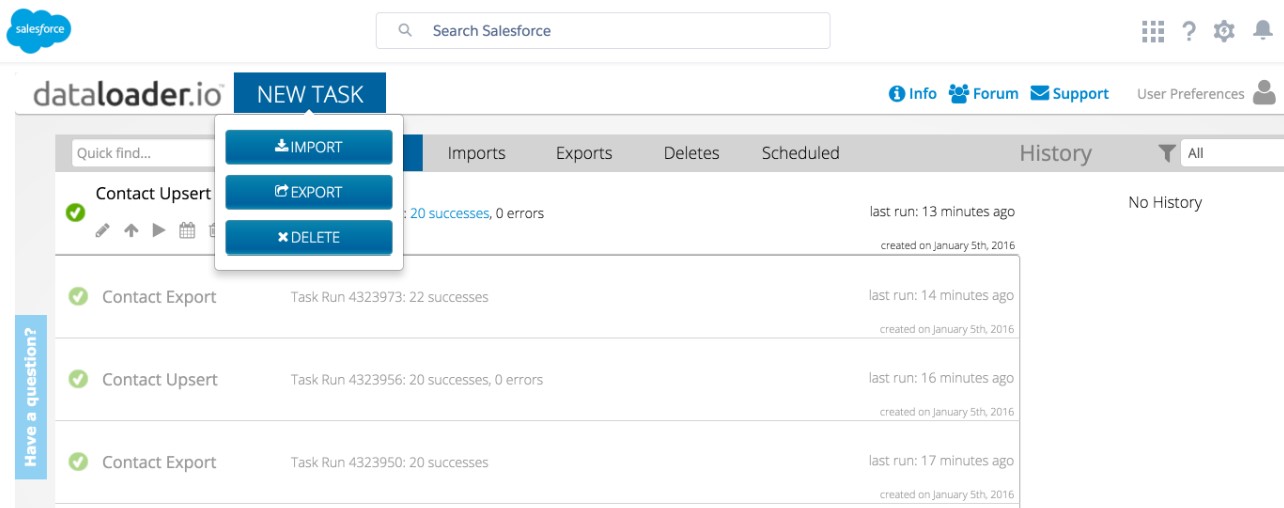

The final and most developed option is the cloud based MuleSoft solution known as dataloader.io. Similar to Data Loader, dataloader.io boasts importing, exporting, deleting, and scheduling capabilities. However, it can pull data from a variety of sources such as Box, Dropbox, FTP and SFTP repositories. Data Loader’s functionality is dependent on the package offering (Pricing Information) and has 3 editions that are priced at $0, $99, or $299 per month per user. The number of records, file size, and related objects ranges from 10,000, 10MB, and 1,000 to Unlimited, 100MB, and 100,000 per month.

How FinServ Can Help

FinServ’s completion of hundreds of projects spanning the Back, Middle and Front Offices for more than 40 of the top 100 Alternative Asset Mangers has enabled an expertise in industry processes, technological solutions, database management, and more. Additionally, FinServ has a deep understanding of the granular details associated with constructing a customized data model that fulfills your funds operational needs. FinServ is an accomplished integration partner due to countless experiences with Administrators and other Third-Party Data Sources.

Identifying the correct data may appear intuitive, but it is a common pain point throughout the industry. FinServ will host sessions with your various teams to identify and document their requirements. Thus, enabling the structured categorization of necessary and superfluous data. Directly integrating data into Salesforce allows for the elimination of unnecessary calculations that often mandate reconciliation. Subsequently reducing strain on your infrastructure and employees to allow for concentration on value rather than performing endless maintenance.

FinServ’s role extends well beyond the traditional tasks associated with integrating your data feeds. Business processes optimization and the identification of enhancements will originate from more than 15 years of experience within the Alternative Asset Management industry. FinServ will consolidate systems, document procedures, ensure successful implementations, and redesign processes to construct a simple and efficient approach that supports both your business and personnel.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.