Undergoing technological change or implementing a new system is not something to be taken lightly in ordinary market environments, much less during a time of extreme or abnormal market volatility. If your fund or organization is planning to implement a new OMS or replace a legacy OMS, there are several things you should consider.

From a business and investment standpoint, there are the usual key considerations, including: the need for integrated OMS/EMS functionality, whether ease of use important, ability to customize workflows and if there is a desire for extensive client/marketplace connectivity. From an operational perspective, one must also consider other non-functional items like data migration (and how easy it is to implement), the software support model, modularity and future expandability.

The aforementioned list only touches the surface; the overarching themes involve automation, workflows, analytics and decision-support tools. In fact, in a recent Refinitiv/Greenwich Associates paper, traders ranked an EMS as the most impactful technology in the short-term.

OMS vs EMS

In general, hedge funds treat the Portfolio Manager (PM) and Trader workflows as a single unit, whereas traditional asset managers may have additional bifurcation between roles and responsibilities. At a hedge fund where the PM sends orders via email/chat/voice to a trader to execute, they may want a single, integrated OEMS. On the other hand, an asset manager often has multiple PMs who route orders to a centralized trading desk. In this case, the institution may want a solution with specific standalone OMS and EMS functionality, in order to access best-of-breed functionality.

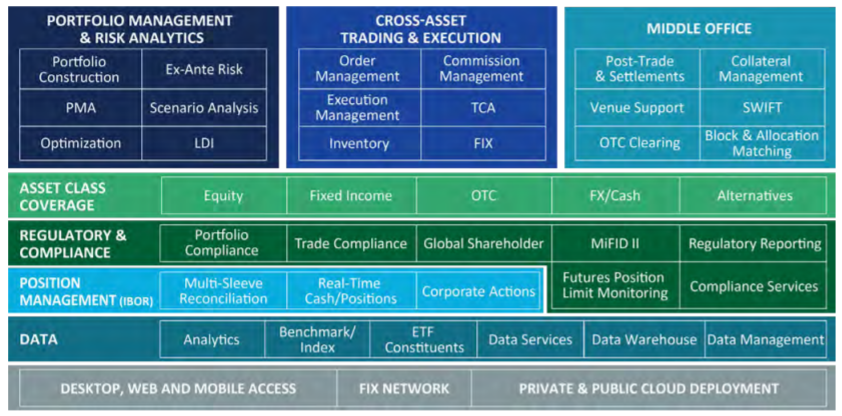

The trend in the marketplace for a while has been OMS vendors integrating additional trading functionality by buying or building EMS solutions. This results in the ability to capture and allocate client orders while also capturing execution details to help the firms comply with regulatory requirements. Additionally, this allows them to market themselves as an all-in-one solution and would insulate the client from having to integrate yet another vendor into their technology stack.

Source: Charles River Development

Ease of Use

Being able to get your operations, back office and front office users onboarded and using the software as quickly as possible can be a heady concern for most clients. In theory, this sounds simple, but many legacy OMS were designed with a single asset class in mind. If your client is now multi-asset, multi-strategy and trading a variety of instruments in volume, it’s even more imperative that a system be easy to use and operate as one cohesive platform.

A modern interface with intuitive workflows can be a competitive advantage especially if the fund’s current OMS platform is antiquated and requires, in a worst case scenario, dual entry or swivel-chairing in order to execute and fill an order. (Swivel chairing involves a PM creating orders/allocations in an OMS and then sending them over to trader for execution in an EMS).

Ease of Customization

A vendor’s product team always has to find the right balance of customization and the notion of a standard offering for the client. However, in this day and age where customizability is king, most vendors are client-driven and willing to bend over backwards for their clients. Enfusion Systems, whose product features weekly upgrades, has marketed their product as being easily customized. In a recent implementation with an asset manager, Enfusion agreed on development of specific functionalities within their platform that would position them well for the changing OEMS marketplace. The client agreed on an OMS implementation, while also using Enfusion’s Services team for reconciliations (the client still kept some functionality in-house, like collateral management).

Client/Marketplace Connectivity

Most multi-strategy funds that trade a wide breadth of products across different asset classes and venues will always be excited at the prospect of having a vendor whose product comes pre-packaged with existing API connectivity to brokers, venues and marketplaces. Many clients have a baseline expectation of connectivity with a full suite of partners across the spectrum of asset classes. If this is not currently in the vendor’s repertoire, the expectation is that connecting to new trading venues and brokers would be trivial.

Data Migration

One of the most underestimated Issues that can be the source of delays for most implementations is data migration. What seems like a simple exercise to port accounting/trading data from the client’s old system to the new system can lay bare a client’s unreconciled data and inconsistencies between trading data and official books and records. Having clean, reconciled source data from the client that can be matched to the client’s custodian or fund administrator sounds simple. In practice, many things can go wrong and be a source of delays. Finding a vendor who has experience successfully migrating trade data, for funds that are similar to their current structure, in a timely manner is the holy grail.

Our Implementation Project with Enfusion and an Asset Manager

FinServ is currently engaged with an institutional asset manager on the implementation of Enfusion’s comprehensive front-to-back trading software product. The asset manager is looking to implement a new front-to-back office system for one of their businesses. Because their current portfolio management system is a legacy product, the product features were outdated and users found the workflows to be inefficient. By implementing a new portfolio and order management system, they would be able to control service levels and more importantly, they would be able to custom develop functionality that match their growing business needs.

After an extensive vendor selection process, the asset manager chose Enfusion Systems. Enfusion was able to make their choice easy due to their cloud-based solution, which provides integrated order and execution management as well as middle office and IBOR services. Although not the focus of this article, the asset manager was also looking to outsource part of their back office to Enfusion’s Services team. Using one vendor for both OMS and back office was one of the key drivers behind their decision. In addition, having a single data model also provided a golden copy for data for all users across all functions. Since the asset manager’s business model involved trading a diverse set of product types and made use of heavy derivatives, Enfusion’s ability to handle multiple asset classes also made sense.

Considerations

Because implementing a new OMS was such a large effort, the timelines for launching and migrating an initial account and eventually the entire business spanned much longer than a year. A decision was made to have a phased approach, where specific sets of strategies and funds would be moved to the new platform in stages.

In order to alleviate some concern that the execution tools, order management workflows and trade compliance functionality would not be replicated completely (due to extensive in-house custom enhancements over the years), Enfusion worked closely with the client to address these items.

From the client’s standpoint, adding a new system would also add additional complexity – additional integration points, extra feeds into and out of their books and records system, the necessity to have Trading operate out of multiple platforms simultaneously, a bifurcation of the client’s Operations team to handle both sets of systems and lastly, having PMs manage portfolios and strategies across multiple systems during the phased implementation.

“Enfusion and FinServ worked side-by-side during this project – we ran implementations, gathered clients’ requirements and dived deep into the use cases. Both parties were truly collaborative and this enabled accountability with the client. FinServ has tremendous project management experience and it was great partnering with them.”

– Brad Flax, VP of Business Development at Enfusion

Summary

If you are interested in learning more about our current and past Enfusion implementations, please reach out to FinServ. Throughout our 15 years of existence, we have proven that our deep industry knowledge combined with our project management and overall best practice methodologies can be an asset to your organization. To further continue the conversation or to discuss more of FinServ’s capabilities, please contact FinServ at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.