Transition from the once world-renowned London Interbank Offer Rate (LIBOR) to an Alternative Reference Rate (ARR) is slated for completion by year-end 2021. The push to guide the world economy from LIBOR to the Secured Overnight Financing Rate (SOFR) was triggered by a series of scandals that highlighted LIBOR’s reliance on “Expert Judgement” rather than market transactions. LIBOR serves as the benchmark rate for more than $350 trillion financial products worldwide with $200 trillion in assets tied to USD LIBOR alone.

What is LIBOR, and How is it Used?

LIBOR is published daily by the Intercontinental Exchange (NYSE: ICE) and denominated in five currencies across the world. It is the benchmark interest rate for major global banks extending short-term loans to one another on the international interbank market while serving as the benchmark rate for variable lending assets such as adjustable rate mortgages and other consumer loans. In addition to loans, it is used as the base rate for FRNs (floating rate notes) that use “LIBOR + X” to determine yield. Other financial instruments that frequently use LIBOR as the underlying rate include forward rate agreements, interest rate swaps, CDs, syndicated loans, and various collateralized obligations.

LIBOR’s Shortcomings

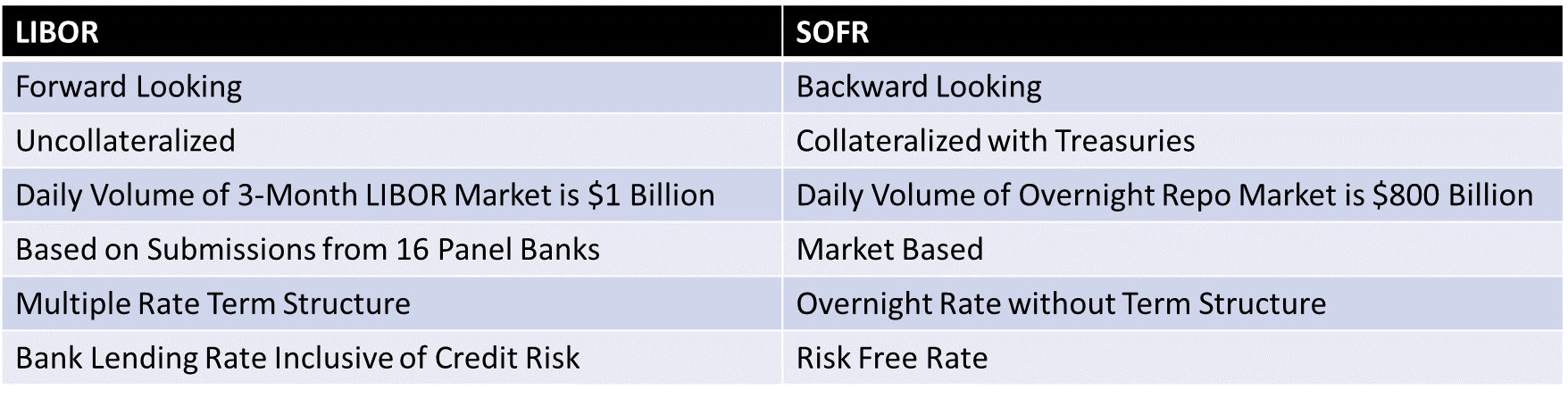

The primary shortcoming exhibited by LIBOR is its dependence on “Expert Judgement” rather than an active market. The rate submitted by each of the 16 panel banks is the cost at which the bank believes it could finance itself. LIBOR’s significantly low trading volume is illustrated by its most active tenure’s (3-month) daily transaction value of approximately $1 billion. Consequently, less than 30% of LIBOR rate submissions are derived from actual transactions.

What is SOFR, and How will it Alleviate LIBOR’s Issues?

SOFR is the cost of borrowing overnight cash collateralized by Treasuries. It is the proposed Alternative Reference Rate for USD LIBOR and is posted each business day by the New York Fed around 8:00am. SOFR is dictated by the daily exchange of $800 billion in overnight Treasury repo transactions. This greatly reduces its susceptibility to manipulation as the rate is determined by market activity rather than the submissions from the 16 panel banks.

SOFR’s Shortcomings

Although ARRC has deemed SOFR as the USD LIBOR replacement, it is not a flawless solution. SOFR lacks LIBOR’s credit component and termed structure. LIBOR is produced for multiple time periods (3-month, 6-month, etc.) and SOFR is a single overnight rate; thus, posing an issue when borrowing funds at various time intervals. SOFR’s volatility is another predominant issue that was illustrated by a spike in September of 2019 when it jumped to 5.25% while some individual transactions reached as high as 10%. The issue was severe enough to warrant Fed intervention.

Managing the Move – FinServ Can Ensure Success

$35 trillion of the $200 trillion in assets tied to USD LIBOR are scheduled to expire after 2021. These legacy assets with varying fallback language present complexities when analyzing the impact of the transition and extracting LIBOR terms from ISDA contracts. Exposure to LIBOR assets can be identified through the utilization of technological systems such as Natural Language Processing (NLP) or a manual process; but it will likely prove ineffective to solely allocate human resources to the task. FinServ can spearhead the combined application of NLP technology and manual oversight to restructure legacy assets referencing LIBOR.

Regulators advise the appointment of a Senior Manager in conjunction with the establishment of a steering committee to oversee the changeover. The transition is a laborious process that will require the complete dedication of numerous individuals and a detailed roadmap for measuring progress. FinServ can oversee interactions with internal and external stakeholders while providing onsite white glove service tailored towards walking your company through this vital transformation.

FinServ’s comprehensive project management approach is inclusive of issue management, scope management, executive level presentations, and comprehensive weekly status reports. A mere 20% of financial institutions have a mature LIBOR transition plan for the impending 2021 year-end deadline. It is critical to create a thorough LIBOR Roadmap and begin immediately.

An extensive review of your business is vital for the identification of LIBOR dependent practices. Additionally, an in-depth analysis of your current state will likely identify opportunities for enhancement. Formal documentation of modified and/or new processes is crucial for training personnel while simultaneously serving as a resource for resolving issues faced in day-to-day operations. Allow FinServ to apply our business and technological expertise to create documentation that employees lack the time to adequately produce.

Summary

It is not necessary to embark on the journey from LIBOR to SOFR alone. Nor is it always feasible to allocate employees with various other responsibilities to this initiative. The move from LIBOR to SOFR is quickly approaching and it is best to make the necessary adjustments sooner rather than later. FinServ is an industry leader that has the expertise, experience, and resources required for a successful transition. To further continue the conversation or to discuss more of FinServ’s capabilities, please contact FinServ at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.