Regulation around UMR came about as a response to the financial crisis of 2008-2009. One of the reforms that was recommended was the implementation of margin requirements for non-centrally cleared derivatives. The in-scope OTC derivatives include FX options, NDFs, physical FX forwards, swaptions and hedging trades.

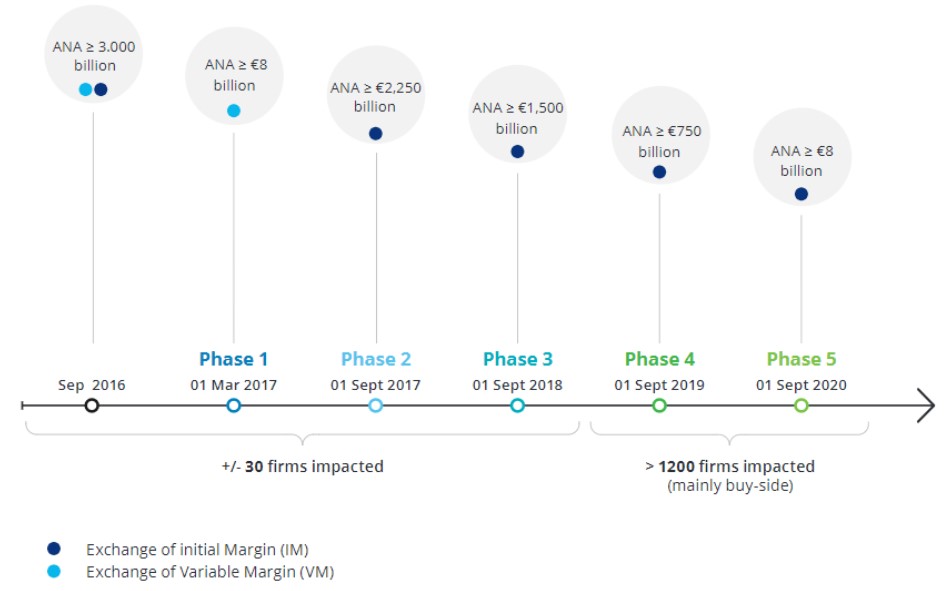

The initial implementation of Variation Margin (VM) requirements was implemented in 2017, while Initial Margin (IM) requirements continue to be phased in until 2021. The new IM rules that are to be put into effect in 2020 and 2021 affect primarily smaller financial organizations, including buy-side participants. Note that UMR has been phased in since September 2016 in the US and March 2017 for remaining market participants.

The initial Phases affected the interdealer market and required execution/negotiation of new CSAs, custodial arrangements, eligible collateral schedules and account control agreements with counterparties/custodians.

The upcoming Phases will affect smaller insurance/banking groups and asset managers, who naturally have less experience with the new rule requirements and likely, fewer resources to help with implementation.

Unlike variation margin, which is based on the market value of trades, initial margin is a risk-based calculation. VM also happens to be a mature concept for most firms; IM, though, is new for most institutional investors because it includes custodians in addition to the trading parties.

Key Dates

Adherence to UMR has been on a phased approach thus far; in 2018, market regulators postponed the last two Phases (4 and 5) by one year. The Phase 4 compliance date was originally September 2018 and was moved to September 2020. The Phase 5 compliance date moved from September 2020 to September 2021.

The phased thresholds for UMR means that, with each Phase, more and more In-Scope Counterparties will be affected and has been the source of some consternation among market participants.

In addition to the notional thresholds, IM is required to be posted between counterparties where there is a consolidated threshold of $50mn USD or $50mn EUR. Thus, if the IM threshold is less than $50mn, no IM needs to be exchanged.

Biggest Challenges

There are four main challenges for market participants when it comes to compliance with UMR:

Solutions

The IM rules consist of the following tasks that need to be completed by a market participant:

- Calculation of regulatory IM

- Collateral segregation and rehypothecation requirements

- Eligibility checks of collateral

- Settling of collateral (on T+1 basis)

- Threshold application (ie 50mn)

Because of this daunting list (many of which are operationally intensive), many participants have sought to outsource their adherence to the new guidelines.

But market solutions have been scarce; there are few all-in-one solutions; rather, a few vendors have capabilities in different facets of UMR

- There were originally two market solutions: Margin Xchange and ISDA create

- As of December 2018, neither had been released to market

- As of September 2019, Margin Xchange ended their product after regulators cut the industry workload by ~90%

- As of January 2019, ISDA create was launched and is free to the buyside

- As of September 2019, 50 firms were on ISDA create; more than 160 other firms are testing the platform ahead of Phases 4 and 5.

Here’s a list of what a ‘typical’ hedge fund needs to do:

- Assess which products are in-scope and calculate notional amounts

- See if the notional threshold is applicable or not

- See if the IM threshold is applicable or not

- Re-negotiate all Credit Support Annexes

- Calculate & Pledge IM and ensure it is held with Custodian Bank

- Ensure no rehypothecation of collateral

- Manage margin requirements: calculation, monitoring, segregation and reconciliation

Calculating IM

Calculation of IM is one of the more cumbersome requirements of the new rules. There are certain vendors who are licensed ISDA initial margin calculation service providers and can help with calculations.

Partial list of vendors who are licensed SIMM service providers

- AcadiaSoft Risk Services Suite

- Bloomberg

- Calypso

- Cassini Systems

- CME

- Clarus Financial

- Lombard Risk

- Murex

- OpenGamma

- Quantile Technologies

- TriOptima

Initial Margin (IM) has to be calculated via one of two methods : the grid method or the SIMM method.

Unfortunately, there is no clear preferred method in that both methods are operationally burdensome. Each method has its pros and cons, which will require each market participant to perform a cost benefit analysis.

Here we will list out some key points for each method.

Grid Methodology – A standardized schedule included by regulators

- Insufficient granularity of tenor buckets and product types

- The grid methodology has a lack of clear guidance from regulators and as a result, inconsistent interpretation. As a result, it hasn’t been widely adopted.

- The methodology seems simple, but results are difficult to compare between counterparties

SIMM Methodology

- Thus far, all entities that have implemented regulatory IM have used SIMM

- Takes into account offsetting risks

- Use of a standardized model allows simpler comparison of margin amounts and results in fewer disputes among participants

- Requires each counterparty to generate sensitivities for every trade – time consuming and requires huge amounts of market data

- The only regulator-approved IM model

Summary

If you are facing any of these issues in complying with the UMR rules, please reach out to FinServ. Throughout our 15 years of existence, we have proven that our deep industry knowledge combined with our project management and overall best practice methodologies can be an asset to your organization. To further continue the conversation or to discuss more of FinServ’s capabilities, please contact FinServ at info@finservconsulting.com or give us a call at (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.