Recent News

The fund administration business is no stranger to the merger mania that has affected other service providers in the financial services industry. In the race to build out the most complete, feature-driven platform, these outsource providers have taken the route of buy (versus build). Recent examples include State Street buying Charles River Development, JP Morgan moving part of their business to Arcesium’s technology platform and SS&C buying Eze Software. These are a few of the more well-known names in the industry, but there are much more. The common denominator in these three cases is that in an effort to build out and expand their product offering, these administrators have chosen to buy a complementary product rather than develop something in-house.

How Did We Get Here?

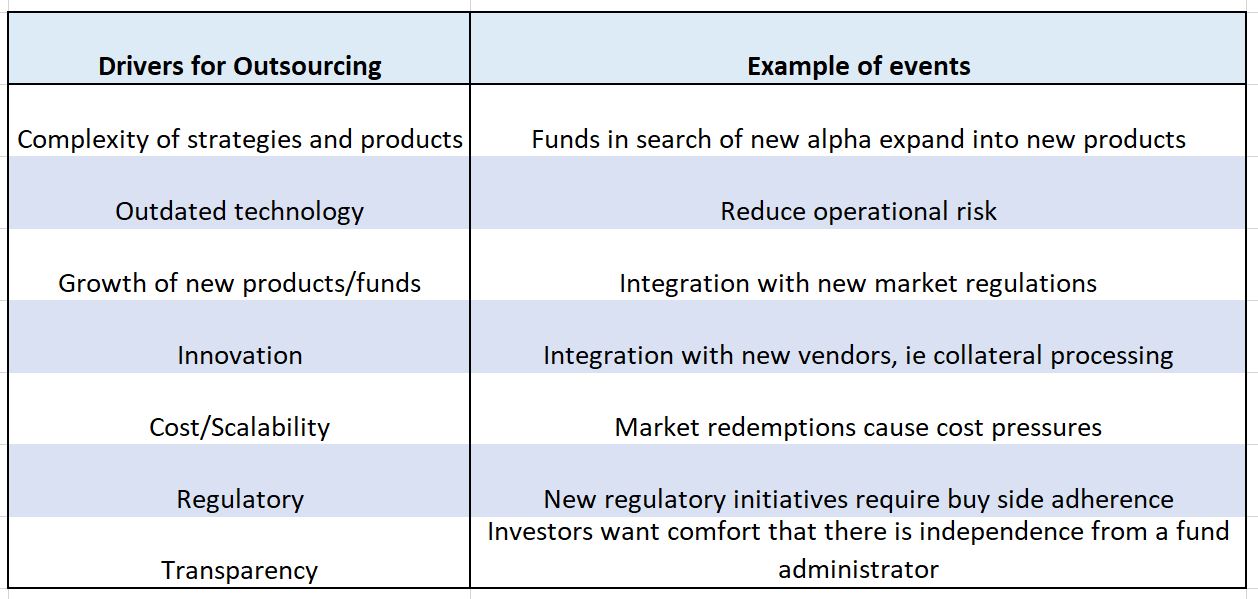

To understand today’s landscape, it’s worthwhile to go back in time just a few years to give some context. As recently as ten years ago, most fund administrators were perfectly happy to strike a NAV and run some basic reconciliations for a hedge fund (and were paid handsomely for it). As the industry went through a transformation, asset managers in search of alpha started to increase the breadth of their trading. With regulation added to the mix, not only did asset managers have to contend with internal and investor reporting, they had to now consider things like FATCA and Form PF. As a result, fund administrators were finding themselves having roles in the front, middle and back office.

A few of the common themes that we’ve come across in our research is that investors have started having an increased appetite for analytics. This is in turn requires their fund administrators to be able to sate their appetite. If the platform has no capability to handle big data or provide business intelligence, they will immediately find themselves at a disadvantage. One reason why JP Morgan moved part of their fund administration business to Arcesium was for its one-stop shop of integration across the technology stack. In this new paradigm, clients would have access to their own technology and an in-place data model, while providing Middle Office services, NAV calculation and investor reporting.

Joan Kehoe, global head of JP Morgan Alternative Investment Services said, ‘we have seen opportunities to streamline and automate this two-way information transfer between those records we keep as an administrator and our clients’ systems, a task that has historically been complex due to different applications, data models, sourcs of information, and timing.’ In this case, we can go back to the buy vs build question that everyone faces. In this case, even a well-capitalized corporation like JP Morgan decided that there was no internal appetite to build all of these integration points. Instead, they went out to the market and found a service provider in Arcesium, which has already built a tried and tested product. Arcesium today manages more than $100bn in AUA (assets under administration) and counts Balyasny, Blackstone Alternative Asset Management and DE Shaw as clients.

The eternal hunt for alpha has also forced fund administrators to adapt to their clients’ trading activities. Being able to handle multi-asset servicing in an automated fashion via the cloud has become a key driver to fund administration expansion. In the past, with relatively small volumes being traded by few clients, administrators could live with manual processes in the short term. In today’s world, increased volumes from multiple clients require automated solutions. When you add to the mix, algorithmic and high frequency clients, automation has become a must-have. When SS&C closed on the purchase of Eze Software in July 2018, industry veterans pointed to Eze’s new cloud platform, Eclipse, as a prime driver for the acquisition.

The world’s largest fund administrator, BNY Mellon, which has $33.1 trillion under custody and/or management, has recently started an initiative to revamp their Middle Office platform. Their decision included a combination of buy and build. They have a proprietary OMS and their derivatives system remains Summit, which is a product from Finastra. There are plans to upgrade their Collateral systems with new messaging software. Their fund accounting system remains Eagle, which they purchased almost twenty years ago.

It should be noted that asset managers have also looked to fund administrators to outsource their back office operations. Back in 2011, Bridgewater Associates made the decision to outsource their back office to BNY Mellon. This involved carving out roughly 200 employees and turning them into BNY Mellon employees, while still employing them out of the same office in Westport, CT.

Integration of the Front, Middle and Back Offices

Like any other industry, added competition causes everyone to become leaner and provide improved, scalable service. One way of doing this is finding and choosing the best-in-breed component for your product.

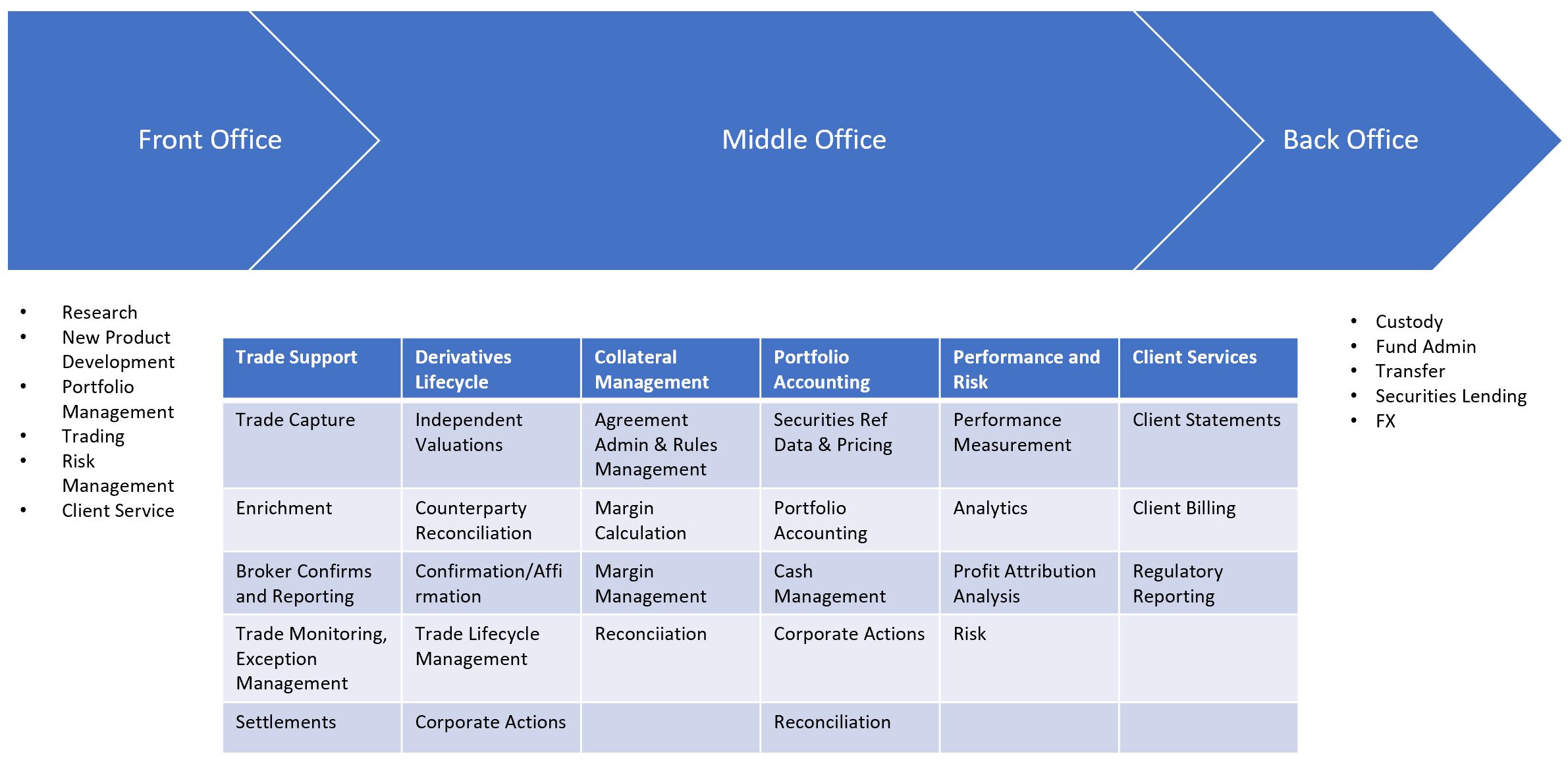

When you take a look at the chart of Front-to-Middle-to-Back Office activities, you can see that the Middle Office function has a lot of opportunities by which fund administrators can improve and scale their offering. This area has traditionally been the driver of the mergers we mentioned in the beginning. When State Street bought Charles River Development, it was for their award-winning trade capture/order management offering. They likely looked at competitors like Blackrock, who for years, have had their own OMS system in Aladdin. Lou Maiuri, the head of State Street Global Markets accurately summed it up when he said, ‘the reality is building things internally, starting this from scratch organically, it’s a long journey.” Acquiring another market-leading vendor also ensures that your existing client base is much more likely to continue buying your services.

But, this can be a double-edged sword. When there is opportunity for integration among all the different Middle Office functions, there is also ripe opportunity for things to go wrong. If you can imagine each vertical (ie Trade Support, Derivatives, Collateral, Accounting, Risk and Client Services) coming from a separate module or vendor, there could be up to 6 different disparate systems in the Middle Office! Imagine what could go wrong as a fund administrator attempts to ensure data flows automatically between the six systems. Some of the pain points we’ve seen is: 1. keeping a golden source of trade data as it goes through the trade lifecycle; 2. ensuring that Collateral is kept up-to-date in the Derivatives system and 3. ensuring reference data is persisted throughout the Middle Office.

As much as you can expect each vendor to have integration points upstream and downstream, fund administrators have realized the best way to mitigate data risk is to own your platform and the data that comes with it. Past market surveys that we’ve seen have noted that the three most important factors in selecting a fund administrator are: technology ease of use, technology ease of integration and willingness to customize. What better way to ensure your technology is easy to use and integrate than having control of the product and the platform, in-house?

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.