A new set of enterprise level trading systems has been added to the marketplace with much more reasonable price points. Funds that have been holding off on implementing an enterprise-level system to manage their Execution Management (“EMS”), Order Management (“OMS”), Portfolio Management (“PMS”), Fund Accounting and lite Risk requirements should consider re-examining the market for the best options. Despite the lower price point, these applications offer robust core functionality for funds with moderate trade volumes. These systems also offer true straight through processing (“STP”) for many types of equity focused funds. FinServ is seeing an increase in its client base of hedge funds looking towards more cost-effective Portfolio Management platforms.

The majority of these offerings are coming from new software firms in the marketplace. Historically, the biggest challenges of implementing software from startups, or relatively new firms has been a lack of maturity, or the inability to cover certain asset classes. Since many systems were built for one specific fund’s assets or business approach, it often proved far too challenging to take the software that worked well for that one fund and extend its functionality to cover the multiple asset classes and potentially higher volumes that a more complex or larger fund would have. While some of these challenges still exist, and you have to assess each new product independently, many of the latest offerings have passed FinServ’s intensive vendor selection reviews.

Our clients are finding that the cost savings are compelling enough to choose an up and coming software provider over the old stalwart trading platforms that come with a very high price point and here are some typical price point differences we are seeing:

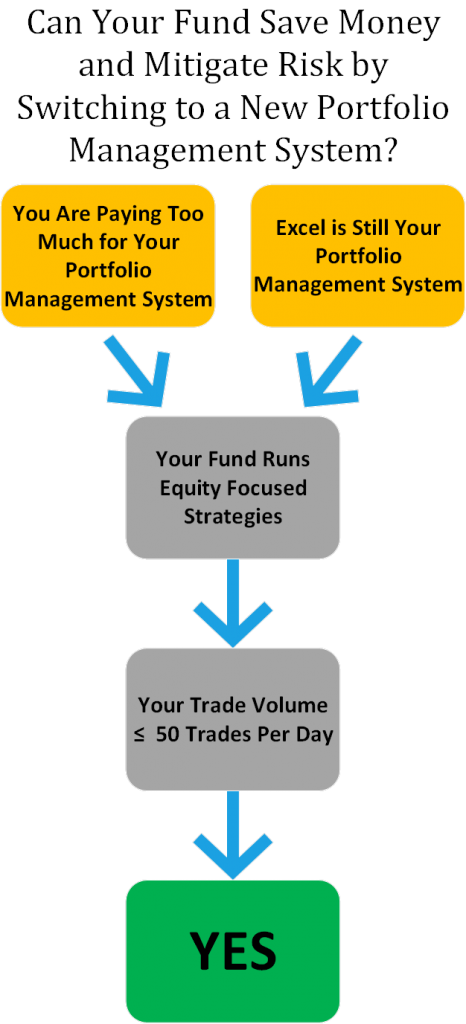

The majority of FinServ’s clients that have a long/short strategy or are lower volume shops, are a good fit for these new solutions. The following topics highlight key areas that will indicate if your fund is a good fit for these systems:

Product Mix – Historically, derivative and hedging, or more exotic asset class support were missing in the newer software choices. Now, the asset class and derivative coverage exist from the majority of these vendors. It is important to note that, as these companies mature, there is some flexibility and patience required, as the asset types are expanded. However, for many of our clients, the cost savings are worth the investment and time required as new functionality is built out.

Trade Volumes – High trading volume shops are not a good fit for these systems because these newer systems cannot currently support the performance demands of the very high transaction flows. However, for funds with trade volumes between 10 and 200+ trades on a weekly basis, who do not trade exotic asset classes, these funds are a good fit for the newer systems in the marketplace.

What is Driving Funds to Require a Portfolio Management System

A number of our clients are anxious to move off Excel, as they see Excel-based systems as a major operational risk. The move is being driven by funds who don’t like to rely on their administrator for reporting that is critical and urgent to their day to day operations. Historically, funds with anything but a very simple mix of asset types did not have many options besides the high cost of systems like SS&C’s Geneva. Now, these funds can choose from a handful of well architected and efficient platforms that can support: Execution Management, Order Management, Portfolio Management, Fund Accounting, lightweight Risk Management & Compliance, as well as Reconciliation functions all under one application.

| Topic | Historical | Current |

| Desire for Real Time Reporting |

|

Even our smaller clients are moving to shadow accounting for multiple reasons:

|

| Meeting Regulatory Requirements |

|

Investor Demands

|

| Reducing Operational Risk |

|

Leveraging a portfolio accounting platform to reduce operational risk by interfacing directly with market data providers, brokers and counterparties

|

| Simplifying Operations & Technical Infrastructure |

|

The new software companies are offering a true straight through processing (“STP”) experience that allows a fund to go from the front to back office with one system. Support true Portfolio Management System capabilities including tagging at the trade and security level for P&L and exposure reporting Pre and Post trade compliance capabilities are now an out of the box feature of most of these systems Key Advantages of 1 system – Front to Back

|

In the following case study FinServ highlights one of our most recent clients who made the move to a new system:

| Case Study – How One Fund Added Shadow Accounting & Automated Reconciliations |

|

A Long / Short Equity shop with over $2B AUM was looking for a shadow accounting solution that would allow for daily reconciliations with its Third Party Administrator’s (“Admin’s”), Prime Broker’s (“PB’s”), and Counterparties and would provide day T+0 reporting to assist with portfolio exposure analysis and same day P/L analytics. The existing process included manual daily reconciliations consisting of logging on to websites, manually transcribing position, market value, and cash balances and comparing these records to the Admin, the street and internal records. This process was error prone, time-consuming and placed a huge reliance on their fund administrator. If new counterparties were added, it compounded the issue and placed an undue burden on the fund accounting and operations staff. The fund began looking for an in-house portfolio accounting solution that would not only allow for a full shadow, but could assist with the reconciliations and reporting requirements. The fund contracted FinServ to assist with the selection. The requirements called for a solution that could be hosted to reduce the burden on the limited internal IT support staff. The system also needed to be capable of supporting asset classes including CDS, CMBX, TRS and several Fixed Income products. In addition, the fund anticipates expanding its asset class to include Bank Debt and other Credit positions in the near future. The system also needed to be integrated with their existing OMS, downstream reporting software and potentially a future treasury, data warehouse and risk application. FinServ documented the existing infrastructure and created future state diagrams depicting the optimal end state. FinServ conducted multiple interviews with the fund operations and accounting staff to understand the key user requirements and current pain points. After a thorough selection, which included a detailed cost analysis, the fund and FinServ selected Enfusion’s Integrata Fund Accounting solution. FinServ and Enfusion took the lead to setup the fund’s structure, load opening balances and connect with the Order Management System (“OMS”). The fund’s admin, prime broker and several counterparties were interfaced directly in the system and reconciliation functionality was established to highlight differences with cash, market value and position data. Financing agreements were established for each unique Swap to automate the daily financing accrual. In addition, Bond interest, Dividend and other automated interest entries were established. An interface with Bloomberg Data License was put in place so prices could be snapped throughout the day. Positions and Cash balances were reconciled with the Fund Admin’s NAV packs. Trade data received from the OMS is reconciled daily. Reconciliation activities which used to take hours each day are now automated. Breaks are identified immediately and remediated. Reporting is now available the same day and includes daily calculations that were previously only accessible at month end. In addition, wash sales and other tax lot reporting is more accessible and allows for more informed trading decisions. Future phases will see Enfusion feeding the OMS with start of day positions and feeding downstream reporting applications which are currently fed by the administrator. Enfusion was the right choice for this fund which is enjoying greater flexibility, increased accuracy and quicker access to data.

|

How FinServ Can Help

An experienced integrator can make a huge difference in your implementation. Pointing out areas like where you can save significant costs with your software provider is just one key area where the right partner will make a massive difference to the success and ultimate cost of your implementation. A partner like FinServ will also make sure you consider all aspects of your business. It is important to not only consider existing needs but also understand where the firm may be headed in the future.

Our clients have found significant benefits in both cost savings and overall operational efficiencies through implementing many of the new Trading Platforms. Even smaller funds now require in-house systems and have a strong desire to eliminate external reporting dependencies. The greatest barrier against undertaking a project of this size and complexity is often the availability of key staff. FinServ has the capability to provide investment fund best practices, subject matter expertise, and a hands-on approach, to ensure your project can be implemented successfully without jeopardizing the daily and monthly responsibilities of key staff.

Strong project management and a tried and true systems integration methodology are also critical to a successful systems implementation. In the past 12 years, FinServ Consulting has saved our client’s millions of dollars by delivering each project we perform, on time and on budget. While the new software companies have strong technologists and architects, they still lack a focus and expertise in core project management and often get distracted trying to manage too many clients at one time. Our clients usually run very lean and having a member of their firm shift all their responsibility to a full-time project is not feasible. By having a consultant who is dedicated to the project and stays on top of all open items including managing the software vendor, we find that projects are completed in a fraction of the time of other implementations where no dedicated consultant is utilized.

Our team can help you determine if you are a good fit for one of these systems and help to estimate the costs and time for your implementation. For more information, please feel free to contact us at info@finservconsulting.com or (646) 603-3799.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.