Companies are realizing that there is a significant amount of actionable business information in their unstructured data. Consolidating, accessing, and analyzing unstructured data is increasingly becoming an important factor in optimizing and analyzing business processes.

Are your firm’s deal documents simplifying or complicating the due diligence process? Imagine having the ability to seamlessly compile information from different sources, gain top level perspective from your firm’s combined intelligence, and ensure your process for managing knowledge and intellectual property is streamlined, enforced, and compliant. An Enterprise Content Management (“ECM”) system can give your firm the ability to gather, synthesize, and analyze information in real-time while helping to reduce complexity and increase productivity across your organization.

FinServ has found that many Alternative Asset Managers struggle to properly manage their deal documents. Managing information can be a difficult endeavor, especially when a team spans across different functions and locations, or when deal teams are frequently traveling and working remotely. An unstructured document management process frequently causes inefficiencies throughout an organization and can result in missed opportunities or poor decisions. Some of the most common issues we see at our clients include:

- Version control issues, due to multiple iterations and a high number of authors or collaborators

- An inability to identify and analyze key data trends across your deal documentation

- Issues retrieving past due diligence documents, for reference in future deals

- Compliance/Audit issues resulting from unorganized folders and unclear document management structures

- Security issues related to managing remote or mobile access to documents

- A loss of documentation due to an employee’s departure from the firm

Enterprise Content Management systems are becoming increasingly prevalent in the Alternatives industry and a strong document management process can be a major competitive advantage for a growing Asset Management firm.

A 2016 study of ECM applications by Nucleus Research found that investing in an ECM system has an average return of 750%; however, FinServ’s experience indicates that the potential return is even higher for Alternative Asset Managers.

An ECM system can simplify your process for managing documentation and ensure the right people are viewing the right files at the right time. Automating document management processes enables your firm to more effectively allocate resources and manage productivity. Many asset management firms are already leveraging ECM systems to improve their operations, chiefly through the creation of integrated workflows, customized dashboards, and enhanced reporting capabilities.

Integrated Workflows

Developing defined workflows around key document processes can help improve data retention by automating tasks and increasing standardization across your firm. Unfortunately, most funds rely on email, and unorganized folders to manage their documentation which leads to significant issues with data quality. A recent report from The Association for Information and Image Management found that 28% of organizations have been criticized in the last 3 years by their auditors for poor records. An ECM system can help your firm secure the underlying processes around managing your data by creating workflows that define the entire process from end to end.

A strong workflow allows firms to manage any documentation received and determine who will need to review which pieces. This can be accomplished by creating permission-based roles, as well as folder and subfolders for different types of documents. Defined workflows can alert staff members when specific documents require their attention and ensure that nothing gets through the cracks. Other features of a strong integrated workflow include:

- Check-in/check-out and document locking, to coordinate the simultaneous editing of a document

- Version control, so users can see how the current document came to be, and how it differs from the versions that came before it

- Roll-back, to “activate” a prior version in case of an error or issue

- Audit trail, to permit the reconstruction of who did what to a document during the course of its life in the system

Creating a strong document management workflow can help improve efficiency across your organization. However, implementing a workflow requires a change of behavior across your organization. FinServ has found that the most effective way to introduce a new ECM tool is on a business process basis. When you target key processes first it enhances adoption and also creates a large ROI. Some key processes that can be targeted first are:

- Collecting data from portfolio companies and deal teams

- Deal tracking and origination

- Expediting Investor Reporting processes (generating quarterly reports, K-1s, and other mailings)

- Building regulatory/audit workflows (FAS 157, reviewing financing agreements, sourcing agreements and other commercial contracts)

- Fundraising and marketing

- Other complex multistep processes.

Luckily, creating integrated workflows does not involve training your people on new technology: most ECM systems can integrate with the Microsoft Office suite for an intuitive user experience, and to help ensure higher compliance rates with the new workflows. ECM systems facilitate the creation of key business process workflows that can help your firm save time and money.

Dashboards

Documentation is becoming increasingly difficult to manage as content is no longer limited to Excel spreadsheets and Word documents. In the 2016 Magic Quadrant Report for Enterprise Content Management, Gartner predicted that:

By 2019, 70% of all business content will be non-textual, which will require organizations to invest more widely in analytics as part of their content management efforts.

The case for investing in analytics is even stronger for Alternative Asset Management firms, as key transaction documents often combine textual and non-textual information like site plans, photos of real estate, manufacturing specifications or even interviews with your portfolio company’s management team. It is hard to amalgamate unstructured data in a traditional document management workflow, but a major advantage of an ECM system is that it consolidates unstructured data – like spreadsheets, Word documents, emails, and other documents from multiple applications and file systems. Gartner Group estimates that:

80% of business is conducted on unstructured information.

Companies are realizing that there is a significant amount of actionable business information in their unstructured data. Consolidating, accessing, and analyzing unstructured data is increasingly becoming an important factor in optimizing and analyzing business processes. ECM systems are now integrating with Business Intelligence tools to provide integrated dashboards for your team to manage key aspects of their daily work from a single place. Configurable dashboards give each user a tailored real-time view into metrics and trends surrounding deal flow, target company information, and other key business processes. Dashboards allow your management team to pick up on trends before they happen and provide greater transparency into deal pipeline, displaying status, last update, key contacts, and next steps.

ECM systems can also allow your team to customize dashboards to track your deals through various stages from origination to due-diligence and commitment. These dashboards can be customized so Compliance, Investor Relations, and the Investment Team can all monitor the information that is important to them.

However, the real power of Dashboards is to visualize your raw data and supplement your numbers with more qualitative information like commentary from the Portfolio Company Management or key highlights from due diligence reports. In Aug 2016, Harvard Business Review released an article entitled: Private Equity’s New Phase, where Dave Ulrich and Justin Allen discussed a New Phase of Private Equity in which firms utilize non textual data to facilitate organizational change. They found that:

50% of the value of a firm cannot be explained by its financials and that new measures should be used to assess firm value. These measures will include intangibles like strategic clarity, customer connection, brand leverage, and R&D impact and leadership capital around competencies of individual leaders and capabilities of the organization as a whole like culture, talent, accountability, collaboration, and information. PE firms aimed at benefiting from a phase three strategy need to expand their data sources and deepen their ability to sift through both structured and unstructured data in order to find more predictive variables.

A strong ECM system can give your team the ability to sift through large amounts of company data and find these types of actionable insights. Your firm’s data is a competitive advantage, and implementing an ECM system can help you better leverage it.

Reporting Tools

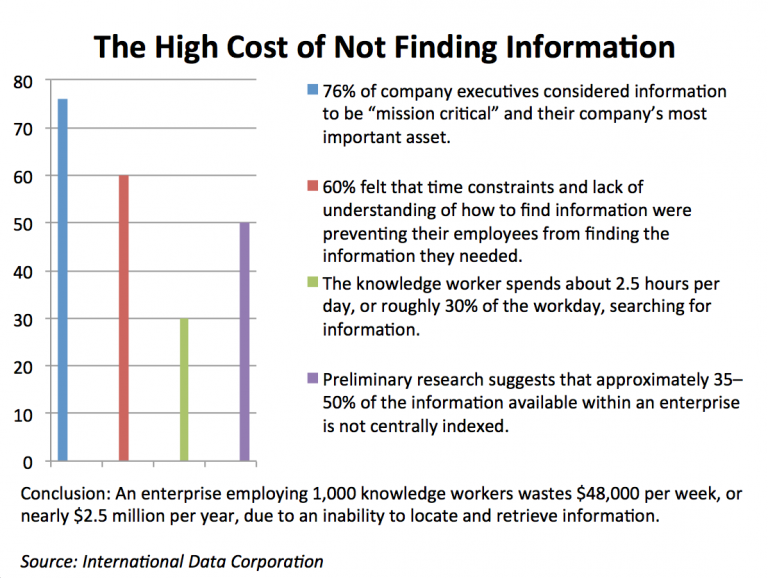

Another advantage of ECM systems is that customized reports can put your data at your employee’s fingertips. A 2013 Report from the International Data Corporation, found that:

“The average knowledge worker spends 2.5 hours per day or 30% of their work week looking for information.”

A robust ECM system provides easy access to on-demand reports that allows raw data to be transformed into key business processes. No more searching for information from different sources. Document management systems can streamline the business process by creating access to the required document when needed. Dynamic reporting capabilities support organizations in making faster and more accurate business decisions by leveraging key features such as:

- Data merged from different sources into one report

- Scheduled report delivery to support key business processes (like presenting performance results or portfolio company updates.)

- Integration with 3rd party reporting tools such as Power BI or Tableau

- Policy based reporting (Form PF, FATCA)

Robust reporting functionality can also be used to create on-demand reports customized to particular business challenges. A great example of the power of reporting is in identifying trends in portfolio companies. If your fund wanted to identify international exposure trends across your Portfolio Companies would you be able to automatically pull this information without manually searching through all your due diligence reports? A powerful ECM system would allow your team to quickly search through all your due diligence documentation to identify a list of all countries where your portfolio companies are doing business. The final results can be exported to Excel, or even represented in a presentation-quality report that is linked directly to the inquiry. An ECM system will use reporting to support key business processes and allow your team to better leverage all of your fund’s data. This leads to your employees making more informed decisions and doing so more efficiently.

Conclusion

The market for ECM systems is rapidly growing: Gartner Group estimates the market to grow from USD 28.10 Billion in 2016 to USD 66.27 Billion by 2021. There are many options available and selecting the right option for your organization can be difficult. FinServ has extensive experience navigating these challenges while vetting the marketplace to identify the most appropriate solution for your firm’s unique needs. The greatest challenge to undertaking a vendor selection project is often the availability of key staff. FinServ can provide investment fund best practices, subject matter expertise on the software industry, and the necessary hands-on skillset to ensure the project is implemented successfully without jeopardizing the responsibilities of key staff.

To learn more about FinServ Consulting’s Enterprise Content Management and Document Management expertise, please contact us at info@finservconsulting.com or (646) 603-3799.

References

- “Hybrid ECM: The Future of Enterprise Content Management.” Oracle. N.p., Apr. 2015. Web.

- “Enterprise Content Management Delivers $7.50 for Every Dollar Spent, Up from $6.12 Two Years Ago, Nucleus Research Finds.” Nucleus Research | Return On Investment (ROI). Nucleus Research, n.d. Sep. 2014.

- “Records Management Strategies.” AAIM Market Intelligence, n.d. Web.

- “SMB: Everything You Need to Know about ECM.” AAIM Market Intelligence, 2016. Web.

- Hobart, Karen A., Gavin Tay, and Joe Mariano. “Magic Quadrant for Enterprise Content Management.” Gartner, Oct. 2016. Web.

- “Benefits of a Virtual Data Room for Private Equity Deals.” Benefits of a Virtual Data Room for Private Equity Deals. Secure Docs, June 2015. Web.

- Mulcahy, Ryan. “Business Intelligence Definition and Solutions.” CIO. CIO, Mar. 2007. Web.

- “Street of Walls.” Private Equity New Investment Process. Private Equity Training, n.d. Web.

- Ulrich, David, and Justen Allen. “Private Equity’s New Phase.” Harvard Business Review, Aug. 2016. Web.

About FinServ Consulting

FinServ Consulting is an independent experienced provider of business consulting, systems development, and integration services to alternative asset managers, global banks and their service providers. Founded in 2005, FinServ delivers customized world-class business and IT consulting services for the front, middle and back office, providing managers with optimal and first-class operating environments to support all investment styles and future asset growth. The FinServ team brings a wealth of experience from working with the largest and most complex asset management firms and global banks in the world.